#wallet

204 articles found

Latest

92% of People Have Heard of Cryptocurrency

Consensys, the minds behind the famed Metamask crypto wallet, recently unveiled their report “The State of Web3 perception around the world". This report provides insights into how well cryptocurrency is understood worldwide, the depth of Web3 comprehension, and the public's stance on pivotal aspects like online data privacy and ownership.

Consensys, the minds behind the famed Metamask crypto wallet, recently unveiled their report “The State of Web3 perception around the world". This report provides insights into how well cryptocurrency is understood worldwide, the depth of Web3 comprehension, and the public's stance on pivotal aspects like online data privacy and ownership. Bitcoin laundering suspicions arise over old wallet activity

A Bitcoin wallet, stagnant since 2018 with a hefty 10,000 bitcoins (approximately $260 million), recently caught the attention of blockchain researcher ZachXBT. It's now moving these assets through certain cryptocurrency mixers, raising eyebrows.

A Bitcoin wallet, stagnant since 2018 with a hefty 10,000 bitcoins (approximately $260 million), recently caught the attention of blockchain researcher ZachXBT. It's now moving these assets through certain cryptocurrency mixers, raising eyebrows.  Atomic Wallet has landed in legal hot waters. This development comes after a hacking event that wiped out more than $100 million.

The claimants assert that the developers neither informed the users about the security vulnerability nor contacted law enforcement after the breach.

Many prosperous investors, some having affiliations with Russia, are included in the court case.

Atomic Wallet has landed in legal hot waters. This development comes after a hacking event that wiped out more than $100 million.

The claimants assert that the developers neither informed the users about the security vulnerability nor contacted law enforcement after the breach.

Many prosperous investors, some having affiliations with Russia, are included in the court case.  As per BitInfoCharts, the wallet address bc1q…859v2 received its initial deposit of BTC on March 8. Over the following three and a half months, it amassed 118,000 BTC (nearly $3.1 billion). Speculations quickly spread across X (Twitter), suggesting it might be BlackRock strategically increasing its BTC holdings. However, the wallet belongs to the US-based exchange Gemini. It transferred its funds from an older wallet, which was also among the top BTC holders nearly a year ago. The current top three wallets are as follows: Binance cold wallet — 248,597 BTC.

Bitfinex cold wallet — 178,010 BTC.

Gemini new wallet — 118,300 BTC.

As per BitInfoCharts, the wallet address bc1q…859v2 received its initial deposit of BTC on March 8. Over the following three and a half months, it amassed 118,000 BTC (nearly $3.1 billion). Speculations quickly spread across X (Twitter), suggesting it might be BlackRock strategically increasing its BTC holdings. However, the wallet belongs to the US-based exchange Gemini. It transferred its funds from an older wallet, which was also among the top BTC holders nearly a year ago. The current top three wallets are as follows: Binance cold wallet — 248,597 BTC.

Bitfinex cold wallet — 178,010 BTC.

Gemini new wallet — 118,300 BTC.  Renowned business analyst Adam Cochran recently shared insights concerning Huobi's financial state and its potential insolvency.

Key takeaways from Adam's analysis:

Investigation Underway: Both Huobi and Tron are facing scrutiny, with their staff being questioned by the police.

Unusual Asset Distribution: After Justin Sun's introduction of wrapped USDT (stUSDT), a whopping 98% of user assets intended for Tether bond redemptions ended up in the wallets of Huobi and Justin Sun.

Discrepancy with USDT Balance: Huobi's reported USDT balance is just $63 million, but their users hold a staggering $631 million worth of USDT. Something doesn't add up here.

ETH Holdings in Question: It appears that Huobi is holding all of its users' ETH as stETH, raising eyebrows about their handling of customer assets.

Binance Making Moves: Meanwhile, Binance is actively selling USDT and purchasing DAI, possibly indicating a shift in market dynamics.

Outdated Reserves Page: It's been a whole month since Huobi last updated its reserve page, and discrepancies between the reported figures and wallet balances need clarification.

Renowned business analyst Adam Cochran recently shared insights concerning Huobi's financial state and its potential insolvency.

Key takeaways from Adam's analysis:

Investigation Underway: Both Huobi and Tron are facing scrutiny, with their staff being questioned by the police.

Unusual Asset Distribution: After Justin Sun's introduction of wrapped USDT (stUSDT), a whopping 98% of user assets intended for Tether bond redemptions ended up in the wallets of Huobi and Justin Sun.

Discrepancy with USDT Balance: Huobi's reported USDT balance is just $63 million, but their users hold a staggering $631 million worth of USDT. Something doesn't add up here.

ETH Holdings in Question: It appears that Huobi is holding all of its users' ETH as stETH, raising eyebrows about their handling of customer assets.

Binance Making Moves: Meanwhile, Binance is actively selling USDT and purchasing DAI, possibly indicating a shift in market dynamics.

Outdated Reserves Page: It's been a whole month since Huobi last updated its reserve page, and discrepancies between the reported figures and wallet balances need clarification.  A Twitter debate has erupted, speculating that Sam Bankman-Fried (SBF) might be involved with the BALD memcoin rugpull.

Blockchain analysts delved into the developer’s on-chain history and discovered a connection between the wallet address deploying the BALD token and ETH funding from wallets linked to FTX and Alameda Research.

An anonymous DeFi commentator suggested that this link might indicate SBF’s attempt to recover some losses.

Data editors found that the same wallet address had made numerous transfers (400) to blacklisted USDT addresses and appeared to have strong connections with Alameda Research.

A Twitter debate has erupted, speculating that Sam Bankman-Fried (SBF) might be involved with the BALD memcoin rugpull.

Blockchain analysts delved into the developer’s on-chain history and discovered a connection between the wallet address deploying the BALD token and ETH funding from wallets linked to FTX and Alameda Research.

An anonymous DeFi commentator suggested that this link might indicate SBF’s attempt to recover some losses.

Data editors found that the same wallet address had made numerous transfers (400) to blacklisted USDT addresses and appeared to have strong connections with Alameda Research.  Arkham Intel Exchange has acknowledged two on-chain investigators with approximately 9,519 ARKM (valued at ~$5,000) for information on Do Kwon & Terra's wallet holdings.

This new data suggests a potential inconsistency in Terra's previous declaration of possessing a single Luna Foundation Guard wallet.

Arkham Intel Exchange has acknowledged two on-chain investigators with approximately 9,519 ARKM (valued at ~$5,000) for information on Do Kwon & Terra's wallet holdings.

This new data suggests a potential inconsistency in Terra's previous declaration of possessing a single Luna Foundation Guard wallet.  The FBI has sounded the alarm bells: Lazarus Group and APT38, North Korean hacker collectives, could potentially sell off stolen cryptocurrency amassing $40 million, potentially affecting Bitcoin's valuation.

Through their investigative work, the agency has identified nearly 1580 BTC across six distinct Bitcoin addresses. The stolen assets are reportedly from Alphapo, CoinsPaid, and Atomic Wallet.

In aiding market monitoring, the FBI has disclosed the associated wallet addresses, urging vigilance on any transactions involving them.

The FBI has sounded the alarm bells: Lazarus Group and APT38, North Korean hacker collectives, could potentially sell off stolen cryptocurrency amassing $40 million, potentially affecting Bitcoin's valuation.

Through their investigative work, the agency has identified nearly 1580 BTC across six distinct Bitcoin addresses. The stolen assets are reportedly from Alphapo, CoinsPaid, and Atomic Wallet.

In aiding market monitoring, the FBI has disclosed the associated wallet addresses, urging vigilance on any transactions involving them.  After detecting phishing attempts, Terra (LUNA) has temporarily frozen its primary domain, Terra․money. The company's directive? Avoid sites with this domain until they say otherwise.

While the team has ramped up protection for the Station Wallet, a word of caution: avoid the desktop and mobile apps for a bit. But if you're a fan of the Station Chrome extension, the latest version is good to go.

After detecting phishing attempts, Terra (LUNA) has temporarily frozen its primary domain, Terra․money. The company's directive? Avoid sites with this domain until they say otherwise.

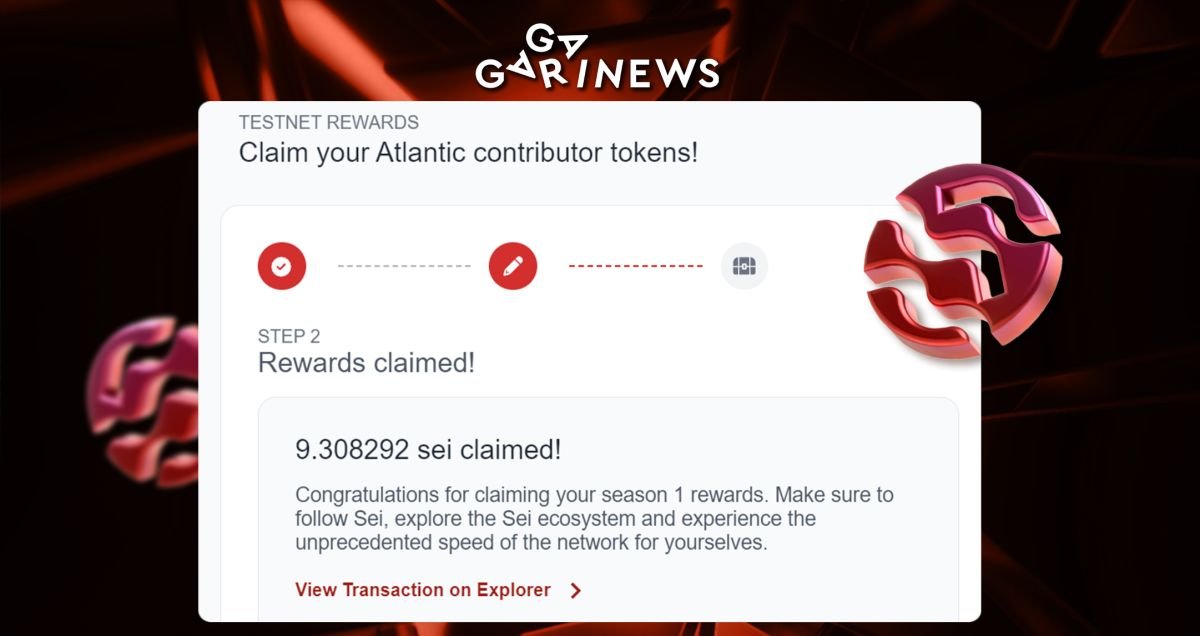

While the team has ramped up protection for the Station Wallet, a word of caution: avoid the desktop and mobile apps for a bit. But if you're a fan of the Station Chrome extension, the latest version is good to go.  The Sei team has initiated token claims for those who participated in the testnet early on. However, the meager bonuses received have left many reevaluating their decision to engage in future airdrops, especially for Tier-2 or Tier-3 projects.

Rewards were disappointingly scant, with most individuals earning only a nominal amount for blockchain testing.

The SEI token price decreased by 20%, possibly attributed to either the overnight downturn in the crypto market or the airdrop itself.

P.S.:To claim your tokens, the Compass wallet is essential, and some regions might require a VPN.

The Sei team has initiated token claims for those who participated in the testnet early on. However, the meager bonuses received have left many reevaluating their decision to engage in future airdrops, especially for Tier-2 or Tier-3 projects.

Rewards were disappointingly scant, with most individuals earning only a nominal amount for blockchain testing.

The SEI token price decreased by 20%, possibly attributed to either the overnight downturn in the crypto market or the airdrop itself.

P.S.:To claim your tokens, the Compass wallet is essential, and some regions might require a VPN.  Following a probe by the Twitter user OnchainPenguin, a dubious $9.5 million transaction was tied to a fresh acquisition proposal.

The inflow to Hodlnaut's wallet was 2221 times higher than the average. Insights from OnchainPenguin pinpoint this account as the source of rewards to OPNX’s leadership.

It seems that Hodlnaut's funds were in some way supporting OPNX's functional outlays,and the trading platform's chiefs might be on a mission to save the virtual currencies FLEX and OX. There's a looming risk that these tokens could nosedive in value if Hodlnaut opts to liquidate its possessions to repay its lenders.

Following a probe by the Twitter user OnchainPenguin, a dubious $9.5 million transaction was tied to a fresh acquisition proposal.

The inflow to Hodlnaut's wallet was 2221 times higher than the average. Insights from OnchainPenguin pinpoint this account as the source of rewards to OPNX’s leadership.

It seems that Hodlnaut's funds were in some way supporting OPNX's functional outlays,and the trading platform's chiefs might be on a mission to save the virtual currencies FLEX and OX. There's a looming risk that these tokens could nosedive in value if Hodlnaut opts to liquidate its possessions to repay its lenders.  A former top trader on Binance sent 2,500 ETH (worth nearly $5 million) to a dead wallet address.

In a surprising comment on his last year's unfortunate trade, he said, "Cannot be happier. Being ultimately bankrupt is the best thing that can happen to me. Anyway, number has no meaning in another dimension. Now is the defining moment."

Other users describe him as a rather eccentric individual with a significant fortune.

What could have led him to take this intriguing step?

A former top trader on Binance sent 2,500 ETH (worth nearly $5 million) to a dead wallet address.

In a surprising comment on his last year's unfortunate trade, he said, "Cannot be happier. Being ultimately bankrupt is the best thing that can happen to me. Anyway, number has no meaning in another dimension. Now is the defining moment."

Other users describe him as a rather eccentric individual with a significant fortune.

What could have led him to take this intriguing step?  In a lawsuit filed in San Francisco, crypto influencer Joel Dietz claims that Consensys stole his idea for a browser-based crypto wallet similar to MetaMask.

Dietz alleges that he created the intellectual property that eventually became MetaMask under a project called Vapor in late 2014.

He hired a person named Davis in 2015 to help with coding Vapor, but Dietz accuses Davis of betraying him and collaborating with Consensys instead.

Consensys denies Dietz’s claims, stating that he falsely marketed himself as the founder of MetaMask to deceive investors.

In a lawsuit filed in San Francisco, crypto influencer Joel Dietz claims that Consensys stole his idea for a browser-based crypto wallet similar to MetaMask.

Dietz alleges that he created the intellectual property that eventually became MetaMask under a project called Vapor in late 2014.

He hired a person named Davis in 2015 to help with coding Vapor, but Dietz accuses Davis of betraying him and collaborating with Consensys instead.

Consensys denies Dietz’s claims, stating that he falsely marketed himself as the founder of MetaMask to deceive investors.  A user fell victim to a 'Zero Transfer Phishing' scam, losing $20 million USDT. These malicious parties imitated a few characters in the wallet address to deceive the unsuspecting victim. Fortunately, Tether reacted swiftly and froze the assets in just 50 minutes.Always stay vigilant when copying wallet addresses from transaction records.Scammers create custom smart contracts to generate look-alike addresses and dupe potential victims.

Correct Address: 0xa7B4BAC8f0f9692e56750aEFB5f6cB5516E90570

Phishing Address: 0xa7Bf48749D2E4aA29e3209879956b9bAa9E90570

A user fell victim to a 'Zero Transfer Phishing' scam, losing $20 million USDT. These malicious parties imitated a few characters in the wallet address to deceive the unsuspecting victim. Fortunately, Tether reacted swiftly and froze the assets in just 50 minutes.Always stay vigilant when copying wallet addresses from transaction records.Scammers create custom smart contracts to generate look-alike addresses and dupe potential victims.

Correct Address: 0xa7B4BAC8f0f9692e56750aEFB5f6cB5516E90570

Phishing Address: 0xa7Bf48749D2E4aA29e3209879956b9bAa9E90570  The Sui Foundation has cut ties with decentralized exchange MovEx due to a contract breach involving the illicit movement of SUI tokens.

MovEx had received 2.5 million SUI tokens (around $1.6 million) for their work on the DeepBook exchange product, under an agreement involving a staged release of the tokens. MovEx, however, broke this agreement by making three transactions of 625,000 SUI to three different wallets without the Sui Foundation's consent or awareness.

Following the breach, MovEx's total SUI allotment has been moved to a custodial wallet to ensure the release adheres to the contractual schedule.

The Sui Foundation has cut ties with decentralized exchange MovEx due to a contract breach involving the illicit movement of SUI tokens.

MovEx had received 2.5 million SUI tokens (around $1.6 million) for their work on the DeepBook exchange product, under an agreement involving a staged release of the tokens. MovEx, however, broke this agreement by making three transactions of 625,000 SUI to three different wallets without the Sui Foundation's consent or awareness.

Following the breach, MovEx's total SUI allotment has been moved to a custodial wallet to ensure the release adheres to the contractual schedule. Hardware Wallets with a Credit Card Form Factor

A number of hardware wallet manufacturers have adopted a unique approach. If they can't compete with the functional prowess of market leaders such as Ledger and Trezor, they can distinguish themselves in another area - the form factor. The convenience of a credit card-sized wallet over bulkier alternatives holds appeal for many.

A number of hardware wallet manufacturers have adopted a unique approach. If they can't compete with the functional prowess of market leaders such as Ledger and Trezor, they can distinguish themselves in another area - the form factor. The convenience of a credit card-sized wallet over bulkier alternatives holds appeal for many.