#volatility

65 articles found

Latest

After the market crash on August 18, analyst Andrew Kang adopted a bullish stance. He opened long positions on Bitcoin (BTC), Ethereum (ETH), and Arbitrum (ARB). However, this decision resulted in a significant loss.

Due to his use of extremely high leverage, which reached up to 100x, Kang's positions became vulnerable and were liquidated not once, but as many as fourteen times.

These successive liquidations caused Kang to lose approximately $432,000 in a single day. This incident highlights the risks associated with trading and employing high leverage, especially during periods of intense market volatility.

After the market crash on August 18, analyst Andrew Kang adopted a bullish stance. He opened long positions on Bitcoin (BTC), Ethereum (ETH), and Arbitrum (ARB). However, this decision resulted in a significant loss.

Due to his use of extremely high leverage, which reached up to 100x, Kang's positions became vulnerable and were liquidated not once, but as many as fourteen times.

These successive liquidations caused Kang to lose approximately $432,000 in a single day. This incident highlights the risks associated with trading and employing high leverage, especially during periods of intense market volatility. Arthur Hayes: Armageddon Approaches

Arthur Hayes, renowned cryptocurrency figure and CEO of crypto investment fund Maelstrom, recently shared his insights on the future of Bitcoin. Speaking on the What Bitcoin Did podcast, Hayes predicted significant volatility ahead, triggered by the looming explosion resulting from the US banking crisis and skyrocketing national debt.

Arthur Hayes, renowned cryptocurrency figure and CEO of crypto investment fund Maelstrom, recently shared his insights on the future of Bitcoin. Speaking on the What Bitcoin Did podcast, Hayes predicted significant volatility ahead, triggered by the looming explosion resulting from the US banking crisis and skyrocketing national debt.  Bitmain, the manufacturer of ASIC miners, has rolled out a new protection scheme against market volatility for those buying the S19j XP model.

If there's a downturn of more than 20% in the subsequent three months post-purchase, company ensures compensation at $1.89/T.

Impressively, this offer is available even to current S19j XP owners.

The compensation will be directly credited to the user's account and is usable for any Bitmain product acquisitions.

Bitmain, the manufacturer of ASIC miners, has rolled out a new protection scheme against market volatility for those buying the S19j XP model.

If there's a downturn of more than 20% in the subsequent three months post-purchase, company ensures compensation at $1.89/T.

Impressively, this offer is available even to current S19j XP owners.

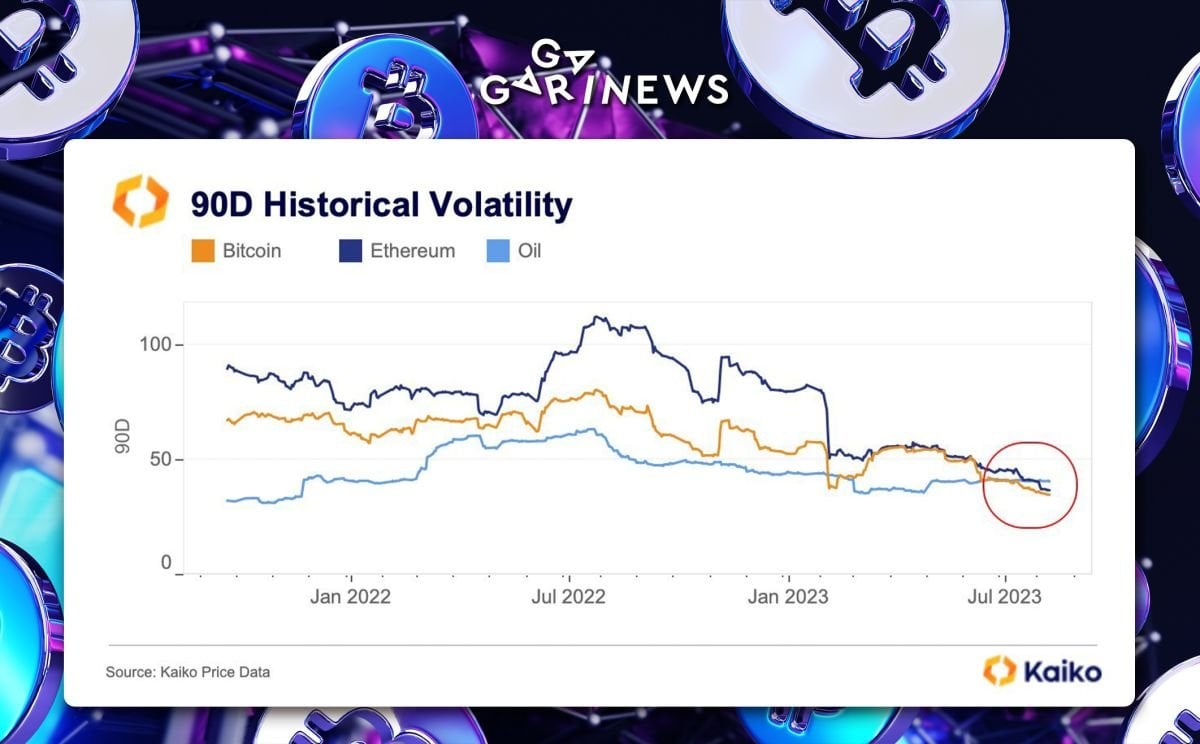

The compensation will be directly credited to the user's account and is usable for any Bitmain product acquisitions.  According to Kaiko, BTC and ETH have recorded their lowest 90-day price volatility compared to oil in many years, a mark last reached in 2016.

Right now, Bitcoin's volatility sits at 35%, Ethereum's at 37%, while oil's is higher at 41%.

Experience tells us that after such periods of quiet , a significant move often follows. Judging by Bitcoin's recent dynamics, it appears such a shift might be kicking off.

According to Kaiko, BTC and ETH have recorded their lowest 90-day price volatility compared to oil in many years, a mark last reached in 2016.

Right now, Bitcoin's volatility sits at 35%, Ethereum's at 37%, while oil's is higher at 41%.

Experience tells us that after such periods of quiet , a significant move often follows. Judging by Bitcoin's recent dynamics, it appears such a shift might be kicking off.