#USDT

98 articles found

Latest

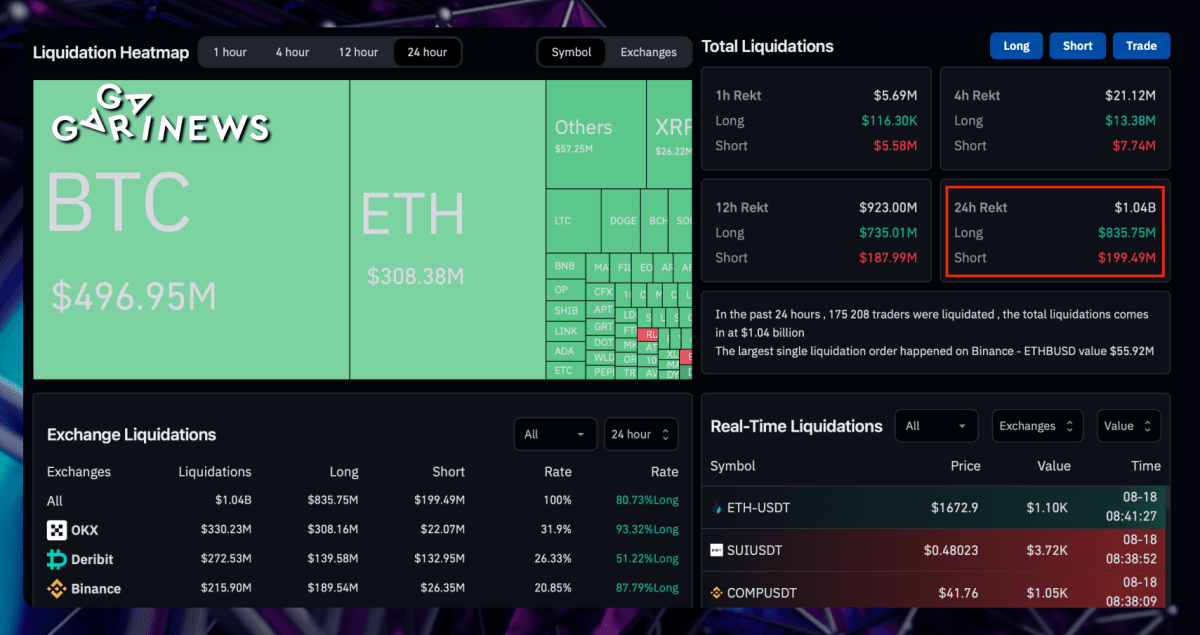

Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.

Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.  In a three-month span beginning in March 2023, the FBI shifted gears in their investigations involving digital currencies. Those efforts have led to the confiscation of an estimated $1.7 million in cryptocurrencies such as BTC, ETH, USDT, XMR, and DAI.

Some of these were traced back to Binance-affiliated wallets. Notably, the Eastern District of Virginia saw the most substantial single seizure of 428.5 ETH.

In a three-month span beginning in March 2023, the FBI shifted gears in their investigations involving digital currencies. Those efforts have led to the confiscation of an estimated $1.7 million in cryptocurrencies such as BTC, ETH, USDT, XMR, and DAI.

Some of these were traced back to Binance-affiliated wallets. Notably, the Eastern District of Virginia saw the most substantial single seizure of 428.5 ETH.  Identifying a crucial flaw in HackenProof's system, the hacker known as blazezaria was rewarded $1 million, with payouts over the course of a year.

He then pledged to allocate 10% from each disbursement to a Ukrainian fund aiding the AFU. The initial contribution of 8290 USDT has been successfully executed.

Identifying a crucial flaw in HackenProof's system, the hacker known as blazezaria was rewarded $1 million, with payouts over the course of a year.

He then pledged to allocate 10% from each disbursement to a Ukrainian fund aiding the AFU. The initial contribution of 8290 USDT has been successfully executed.  Renowned business analyst Adam Cochran recently shared insights concerning Huobi's financial state and its potential insolvency.

Key takeaways from Adam's analysis:

Investigation Underway: Both Huobi and Tron are facing scrutiny, with their staff being questioned by the police.

Unusual Asset Distribution: After Justin Sun's introduction of wrapped USDT (stUSDT), a whopping 98% of user assets intended for Tether bond redemptions ended up in the wallets of Huobi and Justin Sun.

Discrepancy with USDT Balance: Huobi's reported USDT balance is just $63 million, but their users hold a staggering $631 million worth of USDT. Something doesn't add up here.

ETH Holdings in Question: It appears that Huobi is holding all of its users' ETH as stETH, raising eyebrows about their handling of customer assets.

Binance Making Moves: Meanwhile, Binance is actively selling USDT and purchasing DAI, possibly indicating a shift in market dynamics.

Outdated Reserves Page: It's been a whole month since Huobi last updated its reserve page, and discrepancies between the reported figures and wallet balances need clarification.

Renowned business analyst Adam Cochran recently shared insights concerning Huobi's financial state and its potential insolvency.

Key takeaways from Adam's analysis:

Investigation Underway: Both Huobi and Tron are facing scrutiny, with their staff being questioned by the police.

Unusual Asset Distribution: After Justin Sun's introduction of wrapped USDT (stUSDT), a whopping 98% of user assets intended for Tether bond redemptions ended up in the wallets of Huobi and Justin Sun.

Discrepancy with USDT Balance: Huobi's reported USDT balance is just $63 million, but their users hold a staggering $631 million worth of USDT. Something doesn't add up here.

ETH Holdings in Question: It appears that Huobi is holding all of its users' ETH as stETH, raising eyebrows about their handling of customer assets.

Binance Making Moves: Meanwhile, Binance is actively selling USDT and purchasing DAI, possibly indicating a shift in market dynamics.

Outdated Reserves Page: It's been a whole month since Huobi last updated its reserve page, and discrepancies between the reported figures and wallet balances need clarification.  A user fell victim to a 'Zero Transfer Phishing' scam, losing $20 million USDT. These malicious parties imitated a few characters in the wallet address to deceive the unsuspecting victim. Fortunately, Tether reacted swiftly and froze the assets in just 50 minutes.Always stay vigilant when copying wallet addresses from transaction records.Scammers create custom smart contracts to generate look-alike addresses and dupe potential victims.

Correct Address: 0xa7B4BAC8f0f9692e56750aEFB5f6cB5516E90570

Phishing Address: 0xa7Bf48749D2E4aA29e3209879956b9bAa9E90570

A user fell victim to a 'Zero Transfer Phishing' scam, losing $20 million USDT. These malicious parties imitated a few characters in the wallet address to deceive the unsuspecting victim. Fortunately, Tether reacted swiftly and froze the assets in just 50 minutes.Always stay vigilant when copying wallet addresses from transaction records.Scammers create custom smart contracts to generate look-alike addresses and dupe potential victims.

Correct Address: 0xa7B4BAC8f0f9692e56750aEFB5f6cB5516E90570

Phishing Address: 0xa7Bf48749D2E4aA29e3209879956b9bAa9E90570  In a pivotal ruling on July 25, Judge Philip Jeyaretnam of the Singapore High Court declared cryptocurrency as personal property, placing it on par with fiat money. Judge Jeyaretnam's elucidation is notable for the legal status of digital assets.

It was stemmed from a case where ByBit accused its former employee, Ho Kai Xin, of illicitly transferring approximately 4.2 million USDT from the company's coffers to personal accounts. The court mandated Ho to return the funds to cryptocurrency exchange.

In a pivotal ruling on July 25, Judge Philip Jeyaretnam of the Singapore High Court declared cryptocurrency as personal property, placing it on par with fiat money. Judge Jeyaretnam's elucidation is notable for the legal status of digital assets.

It was stemmed from a case where ByBit accused its former employee, Ho Kai Xin, of illicitly transferring approximately 4.2 million USDT from the company's coffers to personal accounts. The court mandated Ho to return the funds to cryptocurrency exchange.  The issuer of USDT has resolved to end support for Kusama, Bitcoin Cash SLP, and Omni Layer. This move follows an in-depth analysis of the functionality, safety, and stability of these particular blockchains.

Notably, Omni Layer, Tether's first transport layer since its inception in 2014, was instrumental during its early days. However, it has witnessed a decline in popularity due to rising competitive solutions.

Though minting of USDT on the aforesaid platforms will be terminated, the redemption process will stay in place for a duration extending at least a year.

The issuer of USDT has resolved to end support for Kusama, Bitcoin Cash SLP, and Omni Layer. This move follows an in-depth analysis of the functionality, safety, and stability of these particular blockchains.

Notably, Omni Layer, Tether's first transport layer since its inception in 2014, was instrumental during its early days. However, it has witnessed a decline in popularity due to rising competitive solutions.

Though minting of USDT on the aforesaid platforms will be terminated, the redemption process will stay in place for a duration extending at least a year.  Company’s CTO Paolo Ardoino has shared his excitement about a mobile app designed to facilitate international purchases settlements B2B, B2C and C2C based on USDT and XAUT payments.

Notably, the app will also incorporate support for Bitcoin Lightning.

Paolo stated that he envisions this app as the future of trade finance.

Having personally reviewed the code, his experience as a developer has left him genuinely impressed. Currently, the app is in its testing stages, with more specifics yet to be unveiled.

Company’s CTO Paolo Ardoino has shared his excitement about a mobile app designed to facilitate international purchases settlements B2B, B2C and C2C based on USDT and XAUT payments.

Notably, the app will also incorporate support for Bitcoin Lightning.

Paolo stated that he envisions this app as the future of trade finance.

Having personally reviewed the code, his experience as a developer has left him genuinely impressed. Currently, the app is in its testing stages, with more specifics yet to be unveiled.  Brian Armstrong has expressed his belief that Binance has transferred some of their USDC assets to a different stablecoin, according to anonymous sources in Cointelegraph.

NotChaseColeman, an analyst, highlights that Binance and Justin Sun are strategically moving from USDT to USDC to secure USD, which will then be invested in FDUSD and TUSD (assets controlled by the company).

Adam Cochran, a name we're familiar with, weighed in, drawing attention to the activities associated with Binance addresses. He observed:

“Even with banks open in Asia and Europe and US coming online, USDT peg is off by the deepest sustained amount since the FTX fall out. Selling pressure once again coming in from the Binance.”

Adam thinks the uncertainty surrounding USDT is at an all-time high, and the Curve Finance and Uniswap platforms are overrun with USDT.

He was optimistic about a more promising USDT horizon today, but that seems to be deferred.

BTC has touched the 28,710 threshold. Indeed, Mondays have their unique trials.

Brian Armstrong has expressed his belief that Binance has transferred some of their USDC assets to a different stablecoin, according to anonymous sources in Cointelegraph.

NotChaseColeman, an analyst, highlights that Binance and Justin Sun are strategically moving from USDT to USDC to secure USD, which will then be invested in FDUSD and TUSD (assets controlled by the company).

Adam Cochran, a name we're familiar with, weighed in, drawing attention to the activities associated with Binance addresses. He observed:

“Even with banks open in Asia and Europe and US coming online, USDT peg is off by the deepest sustained amount since the FTX fall out. Selling pressure once again coming in from the Binance.”

Adam thinks the uncertainty surrounding USDT is at an all-time high, and the Curve Finance and Uniswap platforms are overrun with USDT.

He was optimistic about a more promising USDT horizon today, but that seems to be deferred.

BTC has touched the 28,710 threshold. Indeed, Mondays have their unique trials.  The CEO of Binance has repeatedly aired his distrust of USDT, dubbing it a "black box" due to its lack of transparency in audits and reports.

Also, Binance listed a new stablecoin, FDUSD, on July 26th, that has seen a rapid rise in capitalization. They are in the process of designing their own algorithmic stablecoin and are open to listing more USDT equivalents on their exchange.

Meanwhile, Tether's CTO has hinted at CZ's involvement in market manipulation in the stablecoin sector, mentioning a 10 basis point USDT depeg on July 28th.

"Isn't it interesting that USDt is being pressured down (slightly, within 10bps, just to push market makers to react), and USDc, the main competitor that you would expect being gaining from the situation, is redeemed heavily nevertheless, while suddenly a competitor born 2 days ago is getting it all? Exactly! It feels definitely organic and not manipulative at all. Some people never learn."

For the record, the Twitter account of First Digital Labs (FDUSD) has a mere 585 followers.

It's intriguing to watch the outcome of this power struggle. Is this just the tip of the iceberg?

Fingers crossed, this won't escalate into a challenge for a bout in the octagon, as seems to be a popular move among billionaires...

The CEO of Binance has repeatedly aired his distrust of USDT, dubbing it a "black box" due to its lack of transparency in audits and reports.

Also, Binance listed a new stablecoin, FDUSD, on July 26th, that has seen a rapid rise in capitalization. They are in the process of designing their own algorithmic stablecoin and are open to listing more USDT equivalents on their exchange.

Meanwhile, Tether's CTO has hinted at CZ's involvement in market manipulation in the stablecoin sector, mentioning a 10 basis point USDT depeg on July 28th.

"Isn't it interesting that USDt is being pressured down (slightly, within 10bps, just to push market makers to react), and USDc, the main competitor that you would expect being gaining from the situation, is redeemed heavily nevertheless, while suddenly a competitor born 2 days ago is getting it all? Exactly! It feels definitely organic and not manipulative at all. Some people never learn."

For the record, the Twitter account of First Digital Labs (FDUSD) has a mere 585 followers.

It's intriguing to watch the outcome of this power struggle. Is this just the tip of the iceberg?

Fingers crossed, this won't escalate into a challenge for a bout in the octagon, as seems to be a popular move among billionaires...  A Twitter debate has erupted, speculating that Sam Bankman-Fried (SBF) might be involved with the BALD memcoin rugpull.

Blockchain analysts delved into the developer’s on-chain history and discovered a connection between the wallet address deploying the BALD token and ETH funding from wallets linked to FTX and Alameda Research.

An anonymous DeFi commentator suggested that this link might indicate SBF’s attempt to recover some losses.

Data editors found that the same wallet address had made numerous transfers (400) to blacklisted USDT addresses and appeared to have strong connections with Alameda Research.

A Twitter debate has erupted, speculating that Sam Bankman-Fried (SBF) might be involved with the BALD memcoin rugpull.

Blockchain analysts delved into the developer’s on-chain history and discovered a connection between the wallet address deploying the BALD token and ETH funding from wallets linked to FTX and Alameda Research.

An anonymous DeFi commentator suggested that this link might indicate SBF’s attempt to recover some losses.

Data editors found that the same wallet address had made numerous transfers (400) to blacklisted USDT addresses and appeared to have strong connections with Alameda Research.