#SEC

328 articles found

Latest

US House Financial Services Committee members, led by Chair Patrick McHenry, are seeking clarity from the SEC and FINRA about how Prometheum secured a special purpose broker-dealer (SPBD) license.

They're probing if the SEC used Prometheum as a model firm to support Gary Gensler's stance that existing laws suffice for crypto regulation in the U.S.

Despite Prometheum's claims of being pivotal for regulated digital asset offerings, the lawmakers pointed out that the firm hasn't served any customers yet. Also they raised concerns about potential ties between Prometheum and the Chinese Communist Party.

The committee has requested related documents and communication records by Aug. 22.

US House Financial Services Committee members, led by Chair Patrick McHenry, are seeking clarity from the SEC and FINRA about how Prometheum secured a special purpose broker-dealer (SPBD) license.

They're probing if the SEC used Prometheum as a model firm to support Gary Gensler's stance that existing laws suffice for crypto regulation in the U.S.

Despite Prometheum's claims of being pivotal for regulated digital asset offerings, the lawmakers pointed out that the firm hasn't served any customers yet. Also they raised concerns about potential ties between Prometheum and the Chinese Communist Party.

The committee has requested related documents and communication records by Aug. 22.  John Reed Stark, ex-chief of the SEC's Office of Internet Enforcement, believes the current SEC won't approve a Bitcoin spot ETF due to various reasons.

However, Stark suggests that if a Republican wins the 2024 presidential election, the SEC might ease its crypto-enforcement and be more open to a Bitcoin spot ETF.

He also speculates that SEC chair Gary Gensler might resign, potentially paving the way for Hester Peirce, known as "Crypto Mom", to take a leading role.

John Reed Stark, ex-chief of the SEC's Office of Internet Enforcement, believes the current SEC won't approve a Bitcoin spot ETF due to various reasons.

However, Stark suggests that if a Republican wins the 2024 presidential election, the SEC might ease its crypto-enforcement and be more open to a Bitcoin spot ETF.

He also speculates that SEC chair Gary Gensler might resign, potentially paving the way for Hester Peirce, known as "Crypto Mom", to take a leading role. Bittrex US's Alleged Bankruptcy: A Blow to the SEC

Instead of targeting market giants like Binance or Coinbase, the US Securities and Exchange Commission (SEC) directed its attention towards Bittrex, a smaller-scale crypto exchange. The aftermath of this conflict provides significant insights for the wider market.

Instead of targeting market giants like Binance or Coinbase, the US Securities and Exchange Commission (SEC) directed its attention towards Bittrex, a smaller-scale crypto exchange. The aftermath of this conflict provides significant insights for the wider market.  US District Judge Analisa Torres in New York had previously indicated that XRP sales to sophisticated investors fulfilled the criteria for an investment contract under federal securities law

However, this characterization didn’t extend to programmatic investors, which pertains to the general public buying crypto through exchanges.

US District Judge Analisa Torres in New York had previously indicated that XRP sales to sophisticated investors fulfilled the criteria for an investment contract under federal securities law

However, this characterization didn’t extend to programmatic investors, which pertains to the general public buying crypto through exchanges.  She now believes that the SEC may approve multiple spot-Bitcoin ETFs simultaneously, instead of approving them one by one.

This comes after her earlier expectation that her firm would be among the first to receive approval for a Bitcoin ETF.

Bloomberg ETF analyst James Seyffart also shares the same opinion, stating that the path of least resistance for regulators is to approve multiple spot bitcoin ETFs at once or possibly all of them together.

She now believes that the SEC may approve multiple spot-Bitcoin ETFs simultaneously, instead of approving them one by one.

This comes after her earlier expectation that her firm would be among the first to receive approval for a Bitcoin ETF.

Bloomberg ETF analyst James Seyffart also shares the same opinion, stating that the path of least resistance for regulators is to approve multiple spot bitcoin ETFs at once or possibly all of them together.  During its second-quarter 2023 earnings call on August 3, Coinbase’s Chief Legal Officer, Paul Grewal, expressed confidence that the exchange would win the court case, stating, “We do think we can win. We expect to win.”

In terms of their financial performance:

Coinbase reported a net loss of $97 million on $708 million in revenue for the second quarter of 2023.

Trading volume fell by 37%, and operating expenses were down nearly 50% year over year, partly due to a 30% reduction in headcount.

During its second-quarter 2023 earnings call on August 3, Coinbase’s Chief Legal Officer, Paul Grewal, expressed confidence that the exchange would win the court case, stating, “We do think we can win. We expect to win.”

In terms of their financial performance:

Coinbase reported a net loss of $97 million on $708 million in revenue for the second quarter of 2023.

Trading volume fell by 37%, and operating expenses were down nearly 50% year over year, partly due to a 30% reduction in headcount.  Terraform Labs was looking to the positive verdict in the "SEC versus Ripple" litigation as a precedent for its own safeguard against allegations from the U.S. Securities and Exchange Commission. Yet, Judge Jed Rakoff has dashed such hopes.

The crux of the matter is a substantial divergence in the judge's view concerning the Howey Test, which assesses whether an asset is a security. Terraform Labs' token purchases were clearly carried out by users with profit expectations - a paramount criterion for securities. Therefore, it renders the precise method of purchase irrelevant.

The dichotomy between the two judges' decisions underscores the persisting uncertainty in the landscape of cryptocurrency regulations.

Terraform Labs was looking to the positive verdict in the "SEC versus Ripple" litigation as a precedent for its own safeguard against allegations from the U.S. Securities and Exchange Commission. Yet, Judge Jed Rakoff has dashed such hopes.

The crux of the matter is a substantial divergence in the judge's view concerning the Howey Test, which assesses whether an asset is a security. Terraform Labs' token purchases were clearly carried out by users with profit expectations - a paramount criterion for securities. Therefore, it renders the precise method of purchase irrelevant.

The dichotomy between the two judges' decisions underscores the persisting uncertainty in the landscape of cryptocurrency regulations.  The SEC has filed a lawsuit against famous internet marketer Richard Schueler, also known as Richard Heart, along with his crypto projects Hex, PulseChain, and PulseX.

They allege that Schueler conducted three unregistered securities offerings starting in 2019, raising more than $1 billion from investors.

Furthermore, the SEC accused Heart of defrauding his investors by misusing their funds for personal expenses and goods.

The SEC has filed a lawsuit against famous internet marketer Richard Schueler, also known as Richard Heart, along with his crypto projects Hex, PulseChain, and PulseX.

They allege that Schueler conducted three unregistered securities offerings starting in 2019, raising more than $1 billion from investors.

Furthermore, the SEC accused Heart of defrauding his investors by misusing their funds for personal expenses and goods. Gary Gensler: The Antihero of Our Time

SEC Chair Gary Gensler is a figure of contempt for crypto enthusiasts in America and globally. The subject of many ruthless memes and vitriolic tweets, he commands significant attention. However, one should not underestimate Gensler: the crypto industry is up against one of the most brilliant financiers of our time.

SEC Chair Gary Gensler is a figure of contempt for crypto enthusiasts in America and globally. The subject of many ruthless memes and vitriolic tweets, he commands significant attention. However, one should not underestimate Gensler: the crypto industry is up against one of the most brilliant financiers of our time.  The United States House panel has approved two bills that could provide regulatory clarity for crypto firms, addressing the jurisdictional differences between the U.S. securities and commodities regulators.

The Republican bill introduces a process for firms to certify with the SEC that their projects are decentralized, enabling them to register digital assets as digital commodities with the CFTC.

The bipartisan Blockchain Regulatory Certainty Act aims to remove hurdles and requirements for “blockchain developers and service providers” such as miners, multisignature service providers, and decentralized finance platforms.

Congressmen praised the passing of these bills as a “huge win” for the United States.

The United States House panel has approved two bills that could provide regulatory clarity for crypto firms, addressing the jurisdictional differences between the U.S. securities and commodities regulators.

The Republican bill introduces a process for firms to certify with the SEC that their projects are decentralized, enabling them to register digital assets as digital commodities with the CFTC.

The bipartisan Blockchain Regulatory Certainty Act aims to remove hurdles and requirements for “blockchain developers and service providers” such as miners, multisignature service providers, and decentralized finance platforms.

Congressmen praised the passing of these bills as a “huge win” for the United States.  Amid the unresolved dispute between Coinbase and the SEC, a number of esteemed legal academics have weighed in, penning a court statement in support of the cryptocurrency exchange.

Their stance is clear: an asset should only be deemed an investment contract if it promises profits, earnings, or assets from investments. Scholars assert that the court must strictly follow this legal definition, otherwise, it may jeopardize belief in existing securities laws.

Amid the unresolved dispute between Coinbase and the SEC, a number of esteemed legal academics have weighed in, penning a court statement in support of the cryptocurrency exchange.

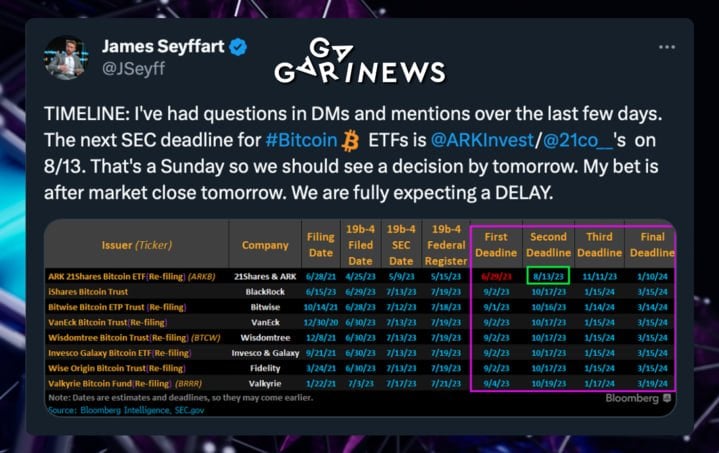

Their stance is clear: an asset should only be deemed an investment contract if it promises profits, earnings, or assets from investments. Scholars assert that the court must strictly follow this legal definition, otherwise, it may jeopardize belief in existing securities laws.  This Sunday (August 13) marks the first deadline for the SEC to weigh in on ARK 21Shares' Bitcoin ETF application.

Weekend deadlines are tricky, but some analysts suggest the decision could drop today.

Analyst James Seyffart puts the odds of approval at less than 5%.

Keep an eye out for the next milestone: BlackRock's Bitcoin ETF deadline is September 2.

This Sunday (August 13) marks the first deadline for the SEC to weigh in on ARK 21Shares' Bitcoin ETF application.

Weekend deadlines are tricky, but some analysts suggest the decision could drop today.

Analyst James Seyffart puts the odds of approval at less than 5%.

Keep an eye out for the next milestone: BlackRock's Bitcoin ETF deadline is September 2.  The U.S. Securities and Exchange Commission (SEC) has leveled charges against 11 Wall Street companies, alleging violations in the handling and retention of electronic communications.

The cumulative fines have reached $289 million, with Wells Fargo and its subsidiaries contributing the largest amount of $125 million.These companies are now obligated to seek the expertise of independent consultants for policy checks.

The U.S. Securities and Exchange Commission (SEC) has leveled charges against 11 Wall Street companies, alleging violations in the handling and retention of electronic communications.

The cumulative fines have reached $289 million, with Wells Fargo and its subsidiaries contributing the largest amount of $125 million.These companies are now obligated to seek the expertise of independent consultants for policy checks.  The founder of CryptoLaw, John Deaton, argues that certain crypto enthusiasts might be overly buoyant about how XRP's price would respond to the court's verdict in the SEC dispute.

XRP has indeed grown by a whopping 85% this year, but Deaton asserts that a fresh peak price would likely coincide with Bitcoin's bull run.

"Until Bitcoin breaks it’s ATH, I don’t expect anything else to," he shared.

The founder of CryptoLaw, John Deaton, argues that certain crypto enthusiasts might be overly buoyant about how XRP's price would respond to the court's verdict in the SEC dispute.

XRP has indeed grown by a whopping 85% this year, but Deaton asserts that a fresh peak price would likely coincide with Bitcoin's bull run.

"Until Bitcoin breaks it’s ATH, I don’t expect anything else to," he shared.  Both Coinbase and the SEC have denied reports claiming that the regulator requested the exchange to halt trading in all cryptocurrencies other than Bitcoin.

A Coinbase spokesperson has clarified to Blockworks that the supposed recommendation was an inaccurate representation of the facts.

The interview published by the Financial Times earlier lacks important context regarding the conversations between Coinbase and the SEC.

Both Coinbase and the SEC have denied reports claiming that the regulator requested the exchange to halt trading in all cryptocurrencies other than Bitcoin.

A Coinbase spokesperson has clarified to Blockworks that the supposed recommendation was an inaccurate representation of the facts.

The interview published by the Financial Times earlier lacks important context regarding the conversations between Coinbase and the SEC.  According to Coinbase CEO Brian Armstrong, the SEC requested the exchange to halt trading in all cryptocurrencies except bitcoin before filing a lawsuit against the platform in June.

“We really didn’t have a choice at that point. Delisting every asset other than bitcoin, which, by the way, is not what the law says, would have essentially meant the end of the crypto industry in the US,” said Armstrong.

According to Coinbase CEO Brian Armstrong, the SEC requested the exchange to halt trading in all cryptocurrencies except bitcoin before filing a lawsuit against the platform in June.

“We really didn’t have a choice at that point. Delisting every asset other than bitcoin, which, by the way, is not what the law says, would have essentially meant the end of the crypto industry in the US,” said Armstrong.  Grayscale Investments has warned the US Securities and Exchange Commission (SEC) that granting approval to certain spot Bitcoin ETF proposals ahead of others could create an "unfairly discriminatory and prejudicial first-mover advantage".

The company's comments follow BlackRock's recent application to launch a spot Bitcoin ETF, which reignited hopes and triggered similar filings from other firms. Grayscale had previously attempted to convert its Bitcoin Trust (GBTC) to an ETF but was denied by the SEC.

The firm now supports the simultaneous approval of all proposed spot Bitcoin ETFs to maintain a level playing field.

Grayscale Investments has warned the US Securities and Exchange Commission (SEC) that granting approval to certain spot Bitcoin ETF proposals ahead of others could create an "unfairly discriminatory and prejudicial first-mover advantage".

The company's comments follow BlackRock's recent application to launch a spot Bitcoin ETF, which reignited hopes and triggered similar filings from other firms. Grayscale had previously attempted to convert its Bitcoin Trust (GBTC) to an ETF but was denied by the SEC.

The firm now supports the simultaneous approval of all proposed spot Bitcoin ETFs to maintain a level playing field.  The lawsuit between the U.S Securities and Exchange Commission (SEC) and cryptocurrency exchange Coinbase is moving forward as the date for initial arguments has been confirmed. Coinbase's chief legal officer, Paul Grewal, revealed on Twitter that New York judge Katherine Polk Failla had approved the joint request from both parties to proceed with hearings.

Coinbase has until August 4, 2023, to submit its initial brief and additional supporting documents by August 11. The SEC's opposition brief is due on or before October 10, with Coinbase's reply by October 24 or sooner.

The lawsuit between the U.S Securities and Exchange Commission (SEC) and cryptocurrency exchange Coinbase is moving forward as the date for initial arguments has been confirmed. Coinbase's chief legal officer, Paul Grewal, revealed on Twitter that New York judge Katherine Polk Failla had approved the joint request from both parties to proceed with hearings.

Coinbase has until August 4, 2023, to submit its initial brief and additional supporting documents by August 11. The SEC's opposition brief is due on or before October 10, with Coinbase's reply by October 24 or sooner.