#SEC

328 articles found

Latest

U.S., U.K., and European investment firms are increasingly appointing senior executives for digital asset strategies. Amberdata's recent report reveals that 24% of asset management firms have embraced a digital assets strategy, with another 13% aiming to do so within two years. The study, which surveyed 60 investment professionals, found that nearly half (48%) incorporate digital assets in their portfolios. Despite regulatory challenges, Amberdata anticipates a positive shift in the coming years, especially with Ripple's recent legal win against the SEC.

U.S., U.K., and European investment firms are increasingly appointing senior executives for digital asset strategies. Amberdata's recent report reveals that 24% of asset management firms have embraced a digital assets strategy, with another 13% aiming to do so within two years. The study, which surveyed 60 investment professionals, found that nearly half (48%) incorporate digital assets in their portfolios. Despite regulatory challenges, Amberdata anticipates a positive shift in the coming years, especially with Ripple's recent legal win against the SEC.  Facing a court decision that sided with the SEC's classification of LBRY Credits tokens as securities, the crypto startup LBRY is poised to appeal.

Taking a leaf out of Ripple's book, they're looking to challenge the $111,614 fine and the bar on issuing tokens.

Facing a court decision that sided with the SEC's classification of LBRY Credits tokens as securities, the crypto startup LBRY is poised to appeal.

Taking a leaf out of Ripple's book, they're looking to challenge the $111,614 fine and the bar on issuing tokens.  The U.S. Securities and Exchange Commission has received permission from a U.S. judge to request assistance from the South Korean government in questioning Daniel Shin, co-founder of Terraform Labs.

Officials plan to question Shin in connection with their own lawsuit against Do Kwon and to obtain documents related to Chai Corporation, a secondary company that was also used in the illegal scheme.

The U.S. Securities and Exchange Commission has received permission from a U.S. judge to request assistance from the South Korean government in questioning Daniel Shin, co-founder of Terraform Labs.

Officials plan to question Shin in connection with their own lawsuit against Do Kwon and to obtain documents related to Chai Corporation, a secondary company that was also used in the illegal scheme.  Grayscale Investments is gearing up for a potential positive outcome in its lawsuit with the SEC, as it begins hiring for its ETF team. The firm is on the lookout for a "Senior Associate, ETFs" to bolster its ETF business development.

This move comes as the crypto community eagerly awaits a court decision on Grayscale's proposal to convert its GBTC fund into a spot bitcoin ETF.

The outcome could set a precedent for other asset managers seeking approvals for spot bitcoin funds, influencing the future of crypto ETFs.

Grayscale Investments is gearing up for a potential positive outcome in its lawsuit with the SEC, as it begins hiring for its ETF team. The firm is on the lookout for a "Senior Associate, ETFs" to bolster its ETF business development.

This move comes as the crypto community eagerly awaits a court decision on Grayscale's proposal to convert its GBTC fund into a spot bitcoin ETF.

The outcome could set a precedent for other asset managers seeking approvals for spot bitcoin funds, influencing the future of crypto ETFs. NFTs: Are They Securities? The SEC Weighs In

For a while, the NFT landscape went largely unnoticed by the U.S. Securities and Exchange Commission (SEC). However, as the summer of 2023 drew to a close, with Gary Gensler at the helm, the SEC felt an urgent need to address and regulate the growing non-fungible token market.

For a while, the NFT landscape went largely unnoticed by the U.S. Securities and Exchange Commission (SEC). However, as the summer of 2023 drew to a close, with Gary Gensler at the helm, the SEC felt an urgent need to address and regulate the growing non-fungible token market.  On August 30, Judge Katherine Polk Failla delivered a significant ruling on a case brought forth by Uniswap users who alleged they lost funds due to scam tokens on the platform. She stated that ETH and Bitcoin qualify as crypto commodities, a pivotal factor in her decision to close the Uniswap case.J udge was not persuaded by arguments suggesting Uniswap token sales were subject to the Exchange Act. Failla is also the judge overseeing the SEC’s case against Coinbase.

On August 30, Judge Katherine Polk Failla delivered a significant ruling on a case brought forth by Uniswap users who alleged they lost funds due to scam tokens on the platform. She stated that ETH and Bitcoin qualify as crypto commodities, a pivotal factor in her decision to close the Uniswap case.J udge was not persuaded by arguments suggesting Uniswap token sales were subject to the Exchange Act. Failla is also the judge overseeing the SEC’s case against Coinbase.  Victory in court against the SEC enables Grayscale to transform its Bitcoin Trust (GBTC) into an ETF. This development sent Bitcoin soaring past the $27,000 milestone.

Within a 45-day period, the SEC can petition for a rehearing. Once this time elapses, the court will deliver a final mandate specifying the future course of action.

Victory in court against the SEC enables Grayscale to transform its Bitcoin Trust (GBTC) into an ETF. This development sent Bitcoin soaring past the $27,000 milestone.

Within a 45-day period, the SEC can petition for a rehearing. Once this time elapses, the court will deliver a final mandate specifying the future course of action.  European crypto-related exchange-traded products (ETPs) experienced a boost in net inflows during June and July, breaking a nearly three-month trend of global ETP outflows.

Europe-based ETPs saw inflows of €150 million in June and €60 million in July.

The trend change might be attributed to BlackRock's spot bitcoin ETF application. However, recent data indicates a downturn in August, possibly due to the SEC's delay in deciding.

European crypto-related exchange-traded products (ETPs) experienced a boost in net inflows during June and July, breaking a nearly three-month trend of global ETP outflows.

Europe-based ETPs saw inflows of €150 million in June and €60 million in July.

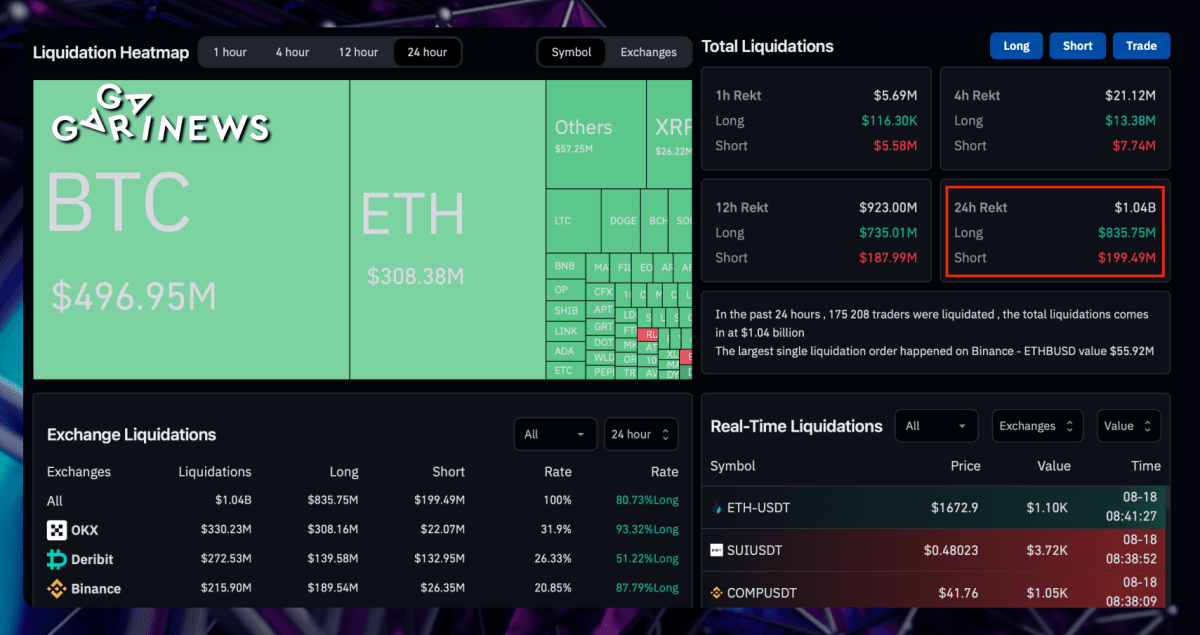

The trend change might be attributed to BlackRock's spot bitcoin ETF application. However, recent data indicates a downturn in August, possibly due to the SEC's delay in deciding.  Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.

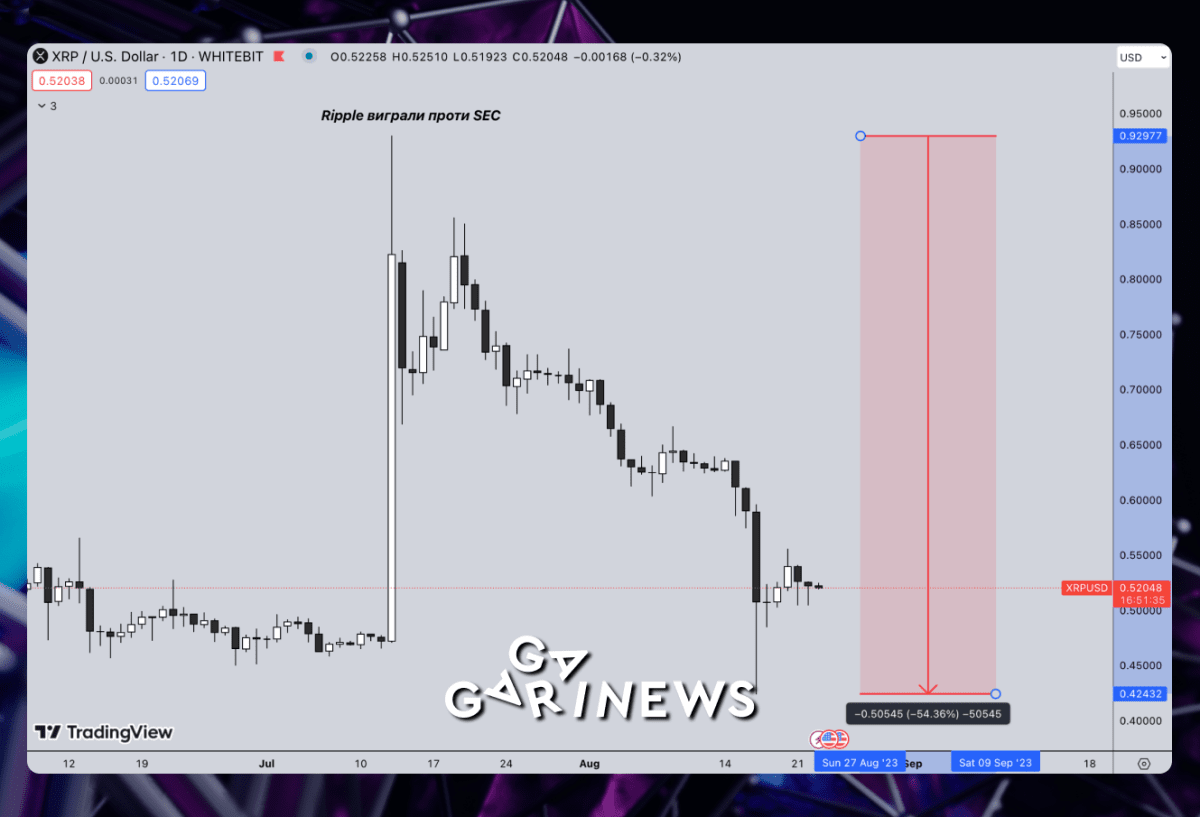

Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.  Ripple contends that there is no justification for the SEC to appeal its partial loss while the case remains unresolved.

Ripple’s legal team has presented three primary arguments in response to the SEC’s appeal request:

Аn appeal requires a pure question of law and that the SEC’s request raises no new legal issues that need to be reviewed.

SEC’s argument that the court ruled incorrectly on the matter is not sufficient.

An immediate appeal will not advance the termination litigation proceedings.

Ripple contends that there is no justification for the SEC to appeal its partial loss while the case remains unresolved.

Ripple’s legal team has presented three primary arguments in response to the SEC’s appeal request:

Аn appeal requires a pure question of law and that the SEC’s request raises no new legal issues that need to be reviewed.

SEC’s argument that the court ruled incorrectly on the matter is not sufficient.

An immediate appeal will not advance the termination litigation proceedings.