#ripple

109 articles found

Latest

A federal judge denied the U.S. Securities and Exchange Commission's (SEC) request for an appeal against Ripple, asserting that the regulator did not demonstrate significant reasons to justify disagreements in opinions. However, he has set a court hearing date for April 2024 to address certain issues in the case.

A federal judge denied the U.S. Securities and Exchange Commission's (SEC) request for an appeal against Ripple, asserting that the regulator did not demonstrate significant reasons to justify disagreements in opinions. However, he has set a court hearing date for April 2024 to address certain issues in the case.  U.S., U.K., and European investment firms are increasingly appointing senior executives for digital asset strategies. Amberdata's recent report reveals that 24% of asset management firms have embraced a digital assets strategy, with another 13% aiming to do so within two years. The study, which surveyed 60 investment professionals, found that nearly half (48%) incorporate digital assets in their portfolios. Despite regulatory challenges, Amberdata anticipates a positive shift in the coming years, especially with Ripple's recent legal win against the SEC.

U.S., U.K., and European investment firms are increasingly appointing senior executives for digital asset strategies. Amberdata's recent report reveals that 24% of asset management firms have embraced a digital assets strategy, with another 13% aiming to do so within two years. The study, which surveyed 60 investment professionals, found that nearly half (48%) incorporate digital assets in their portfolios. Despite regulatory challenges, Amberdata anticipates a positive shift in the coming years, especially with Ripple's recent legal win against the SEC.  Facing a court decision that sided with the SEC's classification of LBRY Credits tokens as securities, the crypto startup LBRY is poised to appeal.

Taking a leaf out of Ripple's book, they're looking to challenge the $111,614 fine and the bar on issuing tokens.

Facing a court decision that sided with the SEC's classification of LBRY Credits tokens as securities, the crypto startup LBRY is poised to appeal.

Taking a leaf out of Ripple's book, they're looking to challenge the $111,614 fine and the bar on issuing tokens.  The current market landscape marks an unprecedented decline in liquidity, according to Bloomberg Intelligence's senior macro strategist, Mike McGlone.

If this pattern holds throughout 2023, he warns of a potential sharp descent in Bitcoin prices, which would ripple through Ethereum, XRP, and the general cryptocurrency domain.

“What should be early indications of recessionary times? The best indication should be bitcoin and that’s where I’m looking for the bleeding occasion from bitcoin and it’s still kind of showing what I expected.”

“Picture December: Recession looms, Fed hesitates on easing due to inflation,” said McGlone.

The current market landscape marks an unprecedented decline in liquidity, according to Bloomberg Intelligence's senior macro strategist, Mike McGlone.

If this pattern holds throughout 2023, he warns of a potential sharp descent in Bitcoin prices, which would ripple through Ethereum, XRP, and the general cryptocurrency domain.

“What should be early indications of recessionary times? The best indication should be bitcoin and that’s where I’m looking for the bleeding occasion from bitcoin and it’s still kind of showing what I expected.”

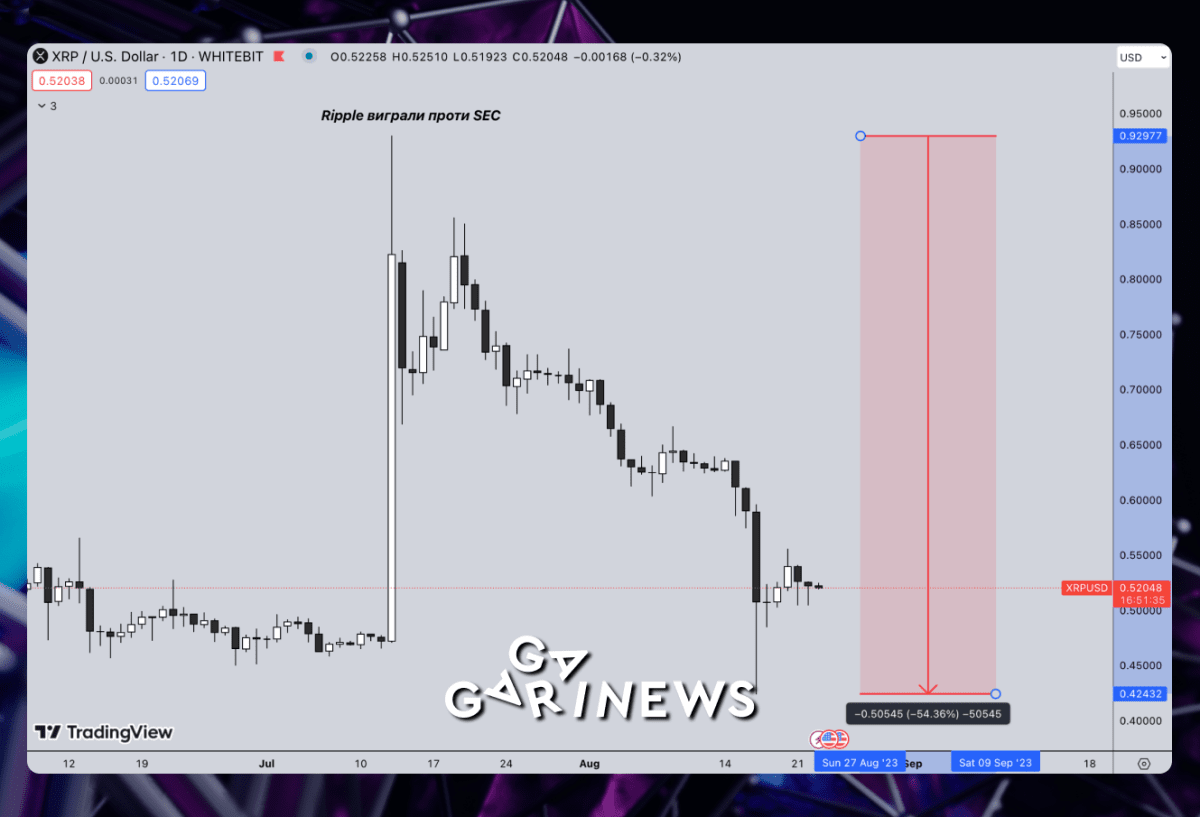

“Picture December: Recession looms, Fed hesitates on easing due to inflation,” said McGlone.  The founder of CryptoLaw, John Deaton, argues that certain crypto enthusiasts might be overly buoyant about how XRP's price would respond to the court's verdict in the SEC dispute.

XRP has indeed grown by a whopping 85% this year, but Deaton asserts that a fresh peak price would likely coincide with Bitcoin's bull run.

"Until Bitcoin breaks it’s ATH, I don’t expect anything else to," he shared.

The founder of CryptoLaw, John Deaton, argues that certain crypto enthusiasts might be overly buoyant about how XRP's price would respond to the court's verdict in the SEC dispute.

XRP has indeed grown by a whopping 85% this year, but Deaton asserts that a fresh peak price would likely coincide with Bitcoin's bull run.

"Until Bitcoin breaks it’s ATH, I don’t expect anything else to," he shared.  Terraform Labs was looking to the positive verdict in the "SEC versus Ripple" litigation as a precedent for its own safeguard against allegations from the U.S. Securities and Exchange Commission. Yet, Judge Jed Rakoff has dashed such hopes.

The crux of the matter is a substantial divergence in the judge's view concerning the Howey Test, which assesses whether an asset is a security. Terraform Labs' token purchases were clearly carried out by users with profit expectations - a paramount criterion for securities. Therefore, it renders the precise method of purchase irrelevant.

The dichotomy between the two judges' decisions underscores the persisting uncertainty in the landscape of cryptocurrency regulations.

Terraform Labs was looking to the positive verdict in the "SEC versus Ripple" litigation as a precedent for its own safeguard against allegations from the U.S. Securities and Exchange Commission. Yet, Judge Jed Rakoff has dashed such hopes.

The crux of the matter is a substantial divergence in the judge's view concerning the Howey Test, which assesses whether an asset is a security. Terraform Labs' token purchases were clearly carried out by users with profit expectations - a paramount criterion for securities. Therefore, it renders the precise method of purchase irrelevant.

The dichotomy between the two judges' decisions underscores the persisting uncertainty in the landscape of cryptocurrency regulations.  Ripple contends that there is no justification for the SEC to appeal its partial loss while the case remains unresolved.

Ripple’s legal team has presented three primary arguments in response to the SEC’s appeal request:

Аn appeal requires a pure question of law and that the SEC’s request raises no new legal issues that need to be reviewed.

SEC’s argument that the court ruled incorrectly on the matter is not sufficient.

An immediate appeal will not advance the termination litigation proceedings.

Ripple contends that there is no justification for the SEC to appeal its partial loss while the case remains unresolved.

Ripple’s legal team has presented three primary arguments in response to the SEC’s appeal request:

Аn appeal requires a pure question of law and that the SEC’s request raises no new legal issues that need to be reviewed.

SEC’s argument that the court ruled incorrectly on the matter is not sufficient.

An immediate appeal will not advance the termination litigation proceedings.  Following the Bank for International Settlements' official announcement on August 9th, Ripple has been included in a task force targeting the enhancement and facilitation of cross-border payments.

The core task is to fine-tune international payments by increasing the accessibility of payment systems and nurturing the links between them, encompassing API consolidation.

Following the Bank for International Settlements' official announcement on August 9th, Ripple has been included in a task force targeting the enhancement and facilitation of cross-border payments.

The core task is to fine-tune international payments by increasing the accessibility of payment systems and nurturing the links between them, encompassing API consolidation.