#interest

122 articles found

Latest

Their economists anticipate a reduction in interest rates by late June next year, following a gradual quarterly decrease pattern.

“The cuts in our forecast are driven by the desire to normalize the funds rate from a restrictive level once inflation is closer to the target,” says Jan Hatzius, a senior economist at Goldman.

Goldman forecasts rate cuts in Q2 2024, expecting 25 basis point reductions per quarter with pace uncertainties.

“We expect the funds rate to eventually stabilize at 3-3.25%,” say their economists.

Their economists anticipate a reduction in interest rates by late June next year, following a gradual quarterly decrease pattern.

“The cuts in our forecast are driven by the desire to normalize the funds rate from a restrictive level once inflation is closer to the target,” says Jan Hatzius, a senior economist at Goldman.

Goldman forecasts rate cuts in Q2 2024, expecting 25 basis point reductions per quarter with pace uncertainties.

“We expect the funds rate to eventually stabilize at 3-3.25%,” say their economists.  Private banks in South Korea, Hana Bank and Woori Bank, have taken a keen interest in tokenized deposits, commonly known as Deposit Certificates or CDs.

CDs offer an alternative rooted in blockchain technology, serving as an equivalent to private stablecoins and Central Bank Digital Currencies (CBDCs).

Presently, it's being viewed as a potential substitute for customary notes and deposits without disrupting the existing banking system.

Private banks in South Korea, Hana Bank and Woori Bank, have taken a keen interest in tokenized deposits, commonly known as Deposit Certificates or CDs.

CDs offer an alternative rooted in blockchain technology, serving as an equivalent to private stablecoins and Central Bank Digital Currencies (CBDCs).

Presently, it's being viewed as a potential substitute for customary notes and deposits without disrupting the existing banking system. The CEO of BlackRock foresees Bitcoin’s dominance!

Larry Fink has expressed his positive outlook on cryptocurrencies and their potential to democratize global investing. In an interview with CNBC’s ‘Squawk on the Street’ on July 14, Fink revealed that an increasing number of BlackRock’s clients are showing interest in digital assets.

Larry Fink has expressed his positive outlook on cryptocurrencies and their potential to democratize global investing. In an interview with CNBC’s ‘Squawk on the Street’ on July 14, Fink revealed that an increasing number of BlackRock’s clients are showing interest in digital assets. Cryptocurrencies Trapped by High Interest Rates

Analytical company Nansen has issued a report examining the impact of inflation on both the traditional and cryptocurrency markets. Their experts forecast global growth following the conclusion of the era marked by interest rate hikes and the implementation of transparent regulation.

Analytical company Nansen has issued a report examining the impact of inflation on both the traditional and cryptocurrency markets. Their experts forecast global growth following the conclusion of the era marked by interest rate hikes and the implementation of transparent regulation. FXS Token Buyback Proposal Gets Founder's Nod

Cryptocurrency research firm, Ouroboros Capital, has proposed a more dynamic token buyback strategy that has piqued the interest of Frax Finance's founder, Sam Kazemian. The proposal aims to better leverage price fluctuations in the Frax Share (FXS) token to optimize the efficiency of the current buyback and burn campaign.

Cryptocurrency research firm, Ouroboros Capital, has proposed a more dynamic token buyback strategy that has piqued the interest of Frax Finance's founder, Sam Kazemian. The proposal aims to better leverage price fluctuations in the Frax Share (FXS) token to optimize the efficiency of the current buyback and burn campaign. Vitalik Buterin: Overcoming AI Risks Will Be a Challenge

A thought-provoking online discussion centered on humanity's future amidst the rapid development of artificial intelligence took place in Montenegro. The conversation that sparked the most interest was between Vitalik Buterin and Nate Soares, the founder of the Machine Intelligence Research Institute.

A thought-provoking online discussion centered on humanity's future amidst the rapid development of artificial intelligence took place in Montenegro. The conversation that sparked the most interest was between Vitalik Buterin and Nate Soares, the founder of the Machine Intelligence Research Institute.  The NFTFi market is witnessing a significant revival, with the Blur Blend NFT collateralized lending platform playing a crucial role. Following its launch, the total value of loans on the network has surpassed $67 million, reaching a six-month record, according to data from Dune Analytics.

Currently, Blur Blend dominates the NFTFi market, accounting for a staggering 75% of the total volume of all loans in the sector. This resurgence has prompted renewed interest in the potential of NFT-backed lending and its applications within the broader blockchain and crypto ecosystem.

To learn more about the NFTFi space and how it could become a new trend in 2023, read the full article on the website.

The NFTFi market is witnessing a significant revival, with the Blur Blend NFT collateralized lending platform playing a crucial role. Following its launch, the total value of loans on the network has surpassed $67 million, reaching a six-month record, according to data from Dune Analytics.

Currently, Blur Blend dominates the NFTFi market, accounting for a staggering 75% of the total volume of all loans in the sector. This resurgence has prompted renewed interest in the potential of NFT-backed lending and its applications within the broader blockchain and crypto ecosystem.

To learn more about the NFTFi space and how it could become a new trend in 2023, read the full article on the website.  In a creative twist to raise cryptocurrency awareness and honor Satoshi Nakamoto, the creator of Bitcoin, an eyewitness to a tornado leveraged their unique footage of the extreme weather event. The individual agreed to share their video with NBC News on the condition that the news outlet mentioned Satoshi Nakamoto in the related story.

The tornado eyewitness, a cryptocurrency enthusiast, recognized the opportunity to garner attention for the decentralized digital currency and its mysterious creator. By weaving Satoshi's name into a mainstream news story, the witness aimed to pique the interest of viewers unfamiliar with the world of cryptocurrencies and possibly contribute to mass adoption.

NBC News, eager to obtain the dramatic tornado footage, agreed to the unusual request, resulting in a surge of curiosity surrounding Satoshi Nakamoto and Bitcoin. Unconventional approaches can sometimes lead to a broader public understanding and engagement in the crypto world.

In a creative twist to raise cryptocurrency awareness and honor Satoshi Nakamoto, the creator of Bitcoin, an eyewitness to a tornado leveraged their unique footage of the extreme weather event. The individual agreed to share their video with NBC News on the condition that the news outlet mentioned Satoshi Nakamoto in the related story.

The tornado eyewitness, a cryptocurrency enthusiast, recognized the opportunity to garner attention for the decentralized digital currency and its mysterious creator. By weaving Satoshi's name into a mainstream news story, the witness aimed to pique the interest of viewers unfamiliar with the world of cryptocurrencies and possibly contribute to mass adoption.

NBC News, eager to obtain the dramatic tornado footage, agreed to the unusual request, resulting in a surge of curiosity surrounding Satoshi Nakamoto and Bitcoin. Unconventional approaches can sometimes lead to a broader public understanding and engagement in the crypto world. ESMA to Initiate Consultations on Crypto Rules in EU

The European Securities and Markets Authority (ESMA), the European Union's securities market regulator, has announced a consultation set for July regarding new regulations for handling complaints and conflict of interest issues that cryptocurrency companies within the bloc would need to comply with.

The European Securities and Markets Authority (ESMA), the European Union's securities market regulator, has announced a consultation set for July regarding new regulations for handling complaints and conflict of interest issues that cryptocurrency companies within the bloc would need to comply with. Tether Expands Presence in Georgia with CityPay.io Investment

Tether announced an investment in CityPay.io, a leading payment processing company in Georgia. With over 600 locations, including shops, hotels, and restaurants, CityPay.io offers seamless payment solutions to customers. This move signifies Tether’s commitment to enhancing the payment industry in Georgia and its growing interest in the country’s crypto-friendly environment.

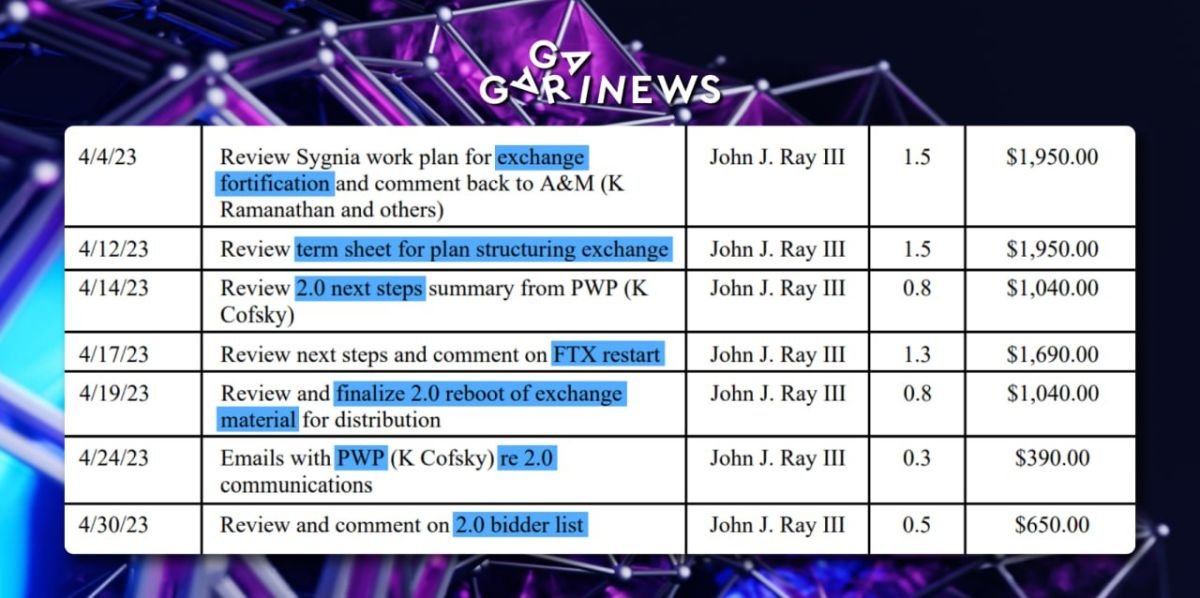

Tether announced an investment in CityPay.io, a leading payment processing company in Georgia. With over 600 locations, including shops, hotels, and restaurants, CityPay.io offers seamless payment solutions to customers. This move signifies Tether’s commitment to enhancing the payment industry in Georgia and its growing interest in the country’s crypto-friendly environment.  John Ray III, the newly appointed CEO of the beleaguered FTX exchange, has dropped some hints that a potential revival of the exchange may be in the works. Ray, who took over the reins to navigate FTX's bankruptcy proceedings, indicated earlier this year that a resurgence was not off the table.

Recent billing reports reveal intriguing developments - Ray spent 6.7 hours working on aspects related to "2.0," thought to signify the possible relaunch of the exchange as FTX 2.0.

As of now, tangible evidence supporting the exchange's resurrection is scant, with only theoretical remarks and internal plans to go by. However, Ray hasn't entirely dismissed the prospect, stating in January, "Everything is on the table. If there's a feasible way forward, we'll not only explore it, we'll undertake it."

In a conversation in April, FTX's chief lawyer, Andy Dietderich, floated the idea that the crypto exchange could potentially spring back into operation. Such a move would demand substantial capital infusion and could even provide customers with stakes in the future exchange. However, Dietderich clarified that this is merely one of numerous possibilities and nothing has been finalized yet.

Venture Capital firm Tribe Capital has reportedly shown interest in spearheading a funding round to reboot the exchange.

John Ray III, the newly appointed CEO of the beleaguered FTX exchange, has dropped some hints that a potential revival of the exchange may be in the works. Ray, who took over the reins to navigate FTX's bankruptcy proceedings, indicated earlier this year that a resurgence was not off the table.

Recent billing reports reveal intriguing developments - Ray spent 6.7 hours working on aspects related to "2.0," thought to signify the possible relaunch of the exchange as FTX 2.0.

As of now, tangible evidence supporting the exchange's resurrection is scant, with only theoretical remarks and internal plans to go by. However, Ray hasn't entirely dismissed the prospect, stating in January, "Everything is on the table. If there's a feasible way forward, we'll not only explore it, we'll undertake it."

In a conversation in April, FTX's chief lawyer, Andy Dietderich, floated the idea that the crypto exchange could potentially spring back into operation. Such a move would demand substantial capital infusion and could even provide customers with stakes in the future exchange. However, Dietderich clarified that this is merely one of numerous possibilities and nothing has been finalized yet.

Venture Capital firm Tribe Capital has reportedly shown interest in spearheading a funding round to reboot the exchange. Crypto Deposits: The Alternative to Traditional Banking

Fiat currencies are prone to constant devaluation and inflation. The interest rates on bank deposits are no longer sufficient to cover the rate of depreciation of such means of payment. Nonetheless, investing in crypto deposits is a popular tool that provides high returns.

Fiat currencies are prone to constant devaluation and inflation. The interest rates on bank deposits are no longer sufficient to cover the rate of depreciation of such means of payment. Nonetheless, investing in crypto deposits is a popular tool that provides high returns.