#exchange

704 articles found

Latest

KRAKEN CTO: Current macro environment hinders new technologies

Vishnu Patankar, the new Chief Technology Officer (CTO) of cryptocurrency exchange Kraken, shared his insights on the current status and future potential of blockchain, cryptocurrencies, and artificial intelligence in an interview with the company's official blog.

Vishnu Patankar, the new Chief Technology Officer (CTO) of cryptocurrency exchange Kraken, shared his insights on the current status and future potential of blockchain, cryptocurrencies, and artificial intelligence in an interview with the company's official blog. Binance Investigated by OSC Despite Canadian Departure

The Ontario Securities Commission (OSC) is not letting Binance off the hook despite the cryptocurrency exchange's decision to exit the Canadian market. Just weeks after Binance's announcement that it was pulling out of Canada due to disagreements with new regulatory rules, the OSC revealed its ongoing investigation into the platform's conduct in the country.

The Ontario Securities Commission (OSC) is not letting Binance off the hook despite the cryptocurrency exchange's decision to exit the Canadian market. Just weeks after Binance's announcement that it was pulling out of Canada due to disagreements with new regulatory rules, the OSC revealed its ongoing investigation into the platform's conduct in the country. DeFi Not Beyond Regulatory Scope, CFTC Chair Declares

In a recent discussion on Bloomberg's Odd Lots podcast, Rostin Behnam, the Chair of the Commodity Futures Trading Commission (CFTC), underscored that decentralized crypto exchanges would be regulated, either by the CFTC or the Securities and Exchange Commission. This applies even if they're built on "self-effectuating" protocols that are merely code.

In a recent discussion on Bloomberg's Odd Lots podcast, Rostin Behnam, the Chair of the Commodity Futures Trading Commission (CFTC), underscored that decentralized crypto exchanges would be regulated, either by the CFTC or the Securities and Exchange Commission. This applies even if they're built on "self-effectuating" protocols that are merely code. Ripple is one step closer to defeating the SEC

A significant legal development has unfolded in the ongoing legal tussle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC). A request from the SEC to keep internal records about a key speech made by former director William Hinman confidential has been rejected by the courts. This move has been welcomed by both Ripple and the broader cryptocurrency community.

A significant legal development has unfolded in the ongoing legal tussle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC). A request from the SEC to keep internal records about a key speech made by former director William Hinman confidential has been rejected by the courts. This move has been welcomed by both Ripple and the broader cryptocurrency community. SEC Seeks Court Order to Freeze Binance US Assets

In a recent development, the U.S. Securities and Exchange Commission (SEC) has requested a court to issue a temporary restraining order to immobilize assets connected to Binance.US. The request, filed in the D.C. District Court, seeks approval to freeze assets linked to BAM Management US Holdings and BAM Trading Services, the entities that hold and operate Binance.US.

In a recent development, the U.S. Securities and Exchange Commission (SEC) has requested a court to issue a temporary restraining order to immobilize assets connected to Binance.US. The request, filed in the D.C. District Court, seeks approval to freeze assets linked to BAM Management US Holdings and BAM Trading Services, the entities that hold and operate Binance.US. Introducing WhiteBIT Token on Bitfinex!

The reach of WhiteBIT Token is expanding across top-tier global crypto platforms. After an intriguing announcement, WhiteBIT crypto exchange has revealed the next platform where WBT trading will commence — Bitfinex, an exchange for professional traders and institutions.

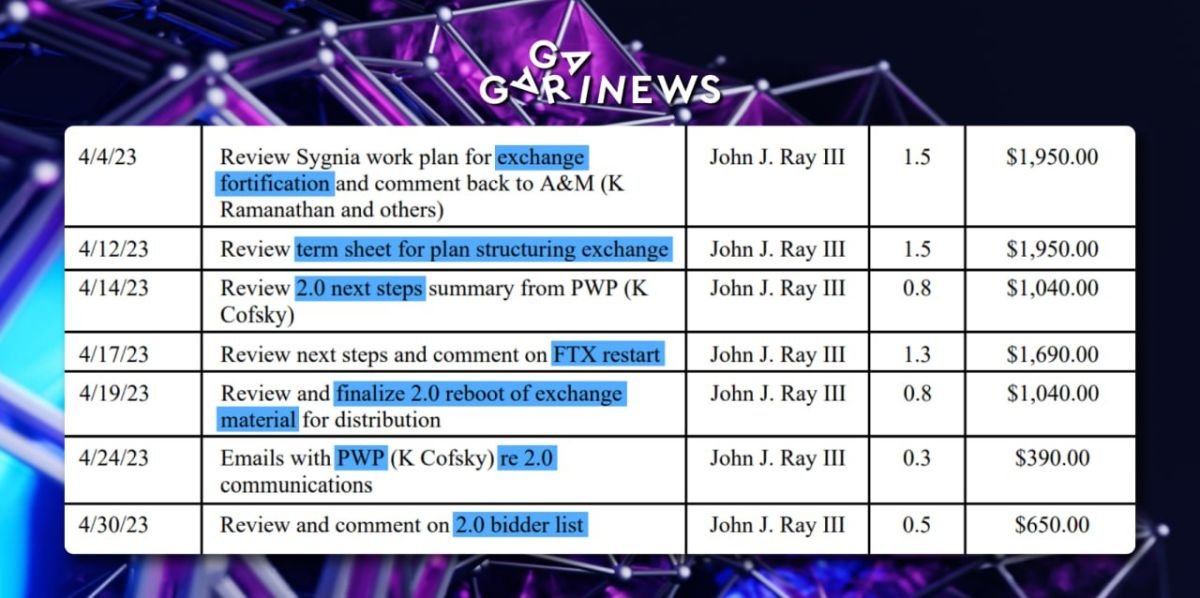

The reach of WhiteBIT Token is expanding across top-tier global crypto platforms. After an intriguing announcement, WhiteBIT crypto exchange has revealed the next platform where WBT trading will commence — Bitfinex, an exchange for professional traders and institutions.  John Ray III, the newly appointed CEO of the beleaguered FTX exchange, has dropped some hints that a potential revival of the exchange may be in the works. Ray, who took over the reins to navigate FTX's bankruptcy proceedings, indicated earlier this year that a resurgence was not off the table.

Recent billing reports reveal intriguing developments - Ray spent 6.7 hours working on aspects related to "2.0," thought to signify the possible relaunch of the exchange as FTX 2.0.

As of now, tangible evidence supporting the exchange's resurrection is scant, with only theoretical remarks and internal plans to go by. However, Ray hasn't entirely dismissed the prospect, stating in January, "Everything is on the table. If there's a feasible way forward, we'll not only explore it, we'll undertake it."

In a conversation in April, FTX's chief lawyer, Andy Dietderich, floated the idea that the crypto exchange could potentially spring back into operation. Such a move would demand substantial capital infusion and could even provide customers with stakes in the future exchange. However, Dietderich clarified that this is merely one of numerous possibilities and nothing has been finalized yet.

Venture Capital firm Tribe Capital has reportedly shown interest in spearheading a funding round to reboot the exchange.

John Ray III, the newly appointed CEO of the beleaguered FTX exchange, has dropped some hints that a potential revival of the exchange may be in the works. Ray, who took over the reins to navigate FTX's bankruptcy proceedings, indicated earlier this year that a resurgence was not off the table.

Recent billing reports reveal intriguing developments - Ray spent 6.7 hours working on aspects related to "2.0," thought to signify the possible relaunch of the exchange as FTX 2.0.

As of now, tangible evidence supporting the exchange's resurrection is scant, with only theoretical remarks and internal plans to go by. However, Ray hasn't entirely dismissed the prospect, stating in January, "Everything is on the table. If there's a feasible way forward, we'll not only explore it, we'll undertake it."

In a conversation in April, FTX's chief lawyer, Andy Dietderich, floated the idea that the crypto exchange could potentially spring back into operation. Such a move would demand substantial capital infusion and could even provide customers with stakes in the future exchange. However, Dietderich clarified that this is merely one of numerous possibilities and nothing has been finalized yet.

Venture Capital firm Tribe Capital has reportedly shown interest in spearheading a funding round to reboot the exchange. How WhiteBIT curbs Russia's attempts to bypass sanctions — Nosov

In an exclusive interview with the online publication "Focus," WhiteBIT founder and CEO elaborated on the transparency and openness of the exchange, their investments in crypto education, and Ukraine's potential to become one of Europe's leading digital hubs.

In an exclusive interview with the online publication "Focus," WhiteBIT founder and CEO elaborated on the transparency and openness of the exchange, their investments in crypto education, and Ukraine's potential to become one of Europe's leading digital hubs. Money in Harmony: Are Stablecoins the Solution or the Problem?

The Bank for International Settlements (BIS) has delved into an analysis to determine if stablecoins and tokenized deposits can sustain the concept of monetary unity, which is vital to maintaining the stability of the exchange rate between private and central bank currencies.

The Bank for International Settlements (BIS) has delved into an analysis to determine if stablecoins and tokenized deposits can sustain the concept of monetary unity, which is vital to maintaining the stability of the exchange rate between private and central bank currencies.