#eth

279 articles found

Latest

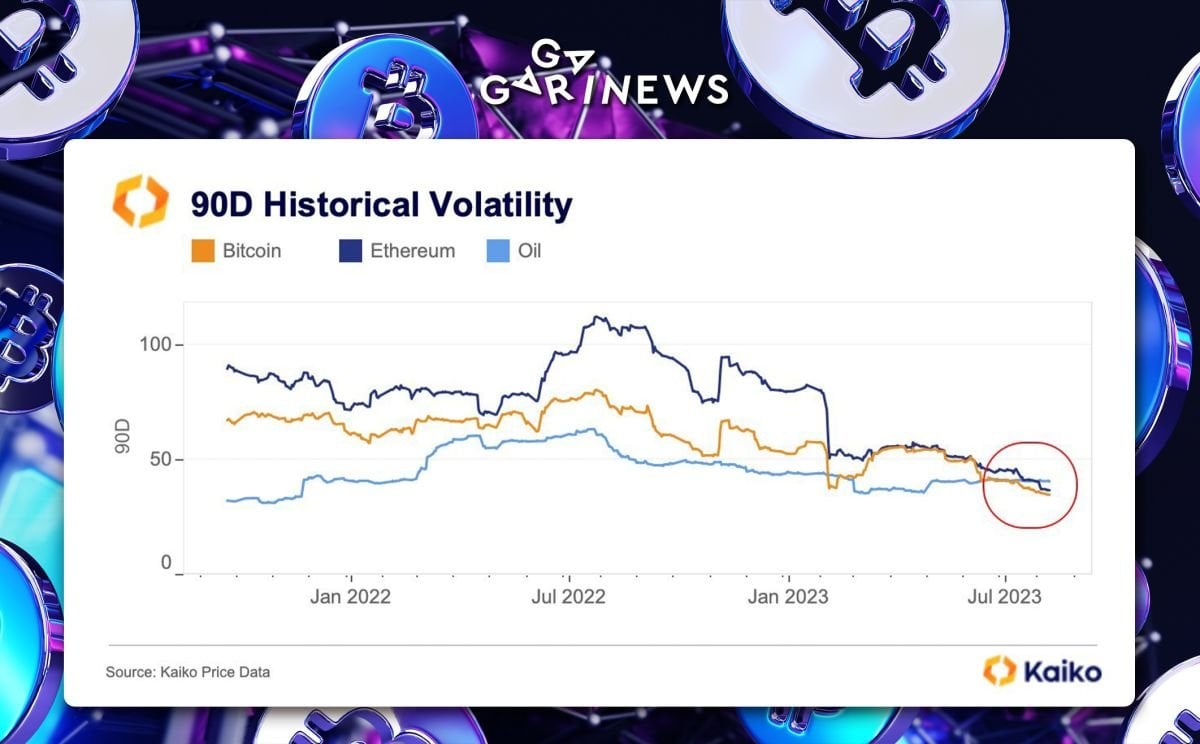

According to Kaiko, BTC and ETH have recorded their lowest 90-day price volatility compared to oil in many years, a mark last reached in 2016.

Right now, Bitcoin's volatility sits at 35%, Ethereum's at 37%, while oil's is higher at 41%.

Experience tells us that after such periods of quiet , a significant move often follows. Judging by Bitcoin's recent dynamics, it appears such a shift might be kicking off.

According to Kaiko, BTC and ETH have recorded their lowest 90-day price volatility compared to oil in many years, a mark last reached in 2016.

Right now, Bitcoin's volatility sits at 35%, Ethereum's at 37%, while oil's is higher at 41%.

Experience tells us that after such periods of quiet , a significant move often follows. Judging by Bitcoin's recent dynamics, it appears such a shift might be kicking off.  In a three-month span beginning in March 2023, the FBI shifted gears in their investigations involving digital currencies. Those efforts have led to the confiscation of an estimated $1.7 million in cryptocurrencies such as BTC, ETH, USDT, XMR, and DAI.

Some of these were traced back to Binance-affiliated wallets. Notably, the Eastern District of Virginia saw the most substantial single seizure of 428.5 ETH.

In a three-month span beginning in March 2023, the FBI shifted gears in their investigations involving digital currencies. Those efforts have led to the confiscation of an estimated $1.7 million in cryptocurrencies such as BTC, ETH, USDT, XMR, and DAI.

Some of these were traced back to Binance-affiliated wallets. Notably, the Eastern District of Virginia saw the most substantial single seizure of 428.5 ETH. Liquity USD (LUSD): A DeFi Stablecoin Review

Liquity USD, or LUSD, is a stablecoin that maintains a 1:1 peg with the US dollar. It's used by the Liquity lending protocol as the primary asset for issuing loans backed by Ethereum (ETH). When LUSD is repaid, the loan is resolved, and the ETH collateral is returned to the owner at its nominal value.

Liquity USD, or LUSD, is a stablecoin that maintains a 1:1 peg with the US dollar. It's used by the Liquity lending protocol as the primary asset for issuing loans backed by Ethereum (ETH). When LUSD is repaid, the loan is resolved, and the ETH collateral is returned to the owner at its nominal value.  Hayden Adams, the founder of Uniswap Labs, has dismissed a developer known by the pseudonym AzFlin following allegations of creating a FrensTech meme coin and then withdrawing liquidity shortly after its launch.

Preliminary damages are estimated at 14 wETH, equivalent to approximately $25,830. Adams stressed that the company does not condone such actions and, therefore, felt compelled to respond accordingly.

The developer denies the accusations of fraud and describes the situation as FUD. According to him, he only withdrew 1 ETH from the liquidity pool, which he had initially provided from his own funds.

Hayden Adams, the founder of Uniswap Labs, has dismissed a developer known by the pseudonym AzFlin following allegations of creating a FrensTech meme coin and then withdrawing liquidity shortly after its launch.

Preliminary damages are estimated at 14 wETH, equivalent to approximately $25,830. Adams stressed that the company does not condone such actions and, therefore, felt compelled to respond accordingly.

The developer denies the accusations of fraud and describes the situation as FUD. According to him, he only withdrew 1 ETH from the liquidity pool, which he had initially provided from his own funds.  The Masterpiece collection of 8 NFTs presents a fusion of renowned artworks and creations by emerging artists, all integrated with the iconic Coca-Cola bottle.

Timeless masterpieces such as “The Scream” by Edvard Munch, “Girl with a Pearl Earring” by Johannes Vermeer and “Bedroom in Arles” by Van Gogh harmonize with contemporary works by promising talents.

Mint value: 0.011 - 0.014 ETH

The Masterpiece collection of 8 NFTs presents a fusion of renowned artworks and creations by emerging artists, all integrated with the iconic Coca-Cola bottle.

Timeless masterpieces such as “The Scream” by Edvard Munch, “Girl with a Pearl Earring” by Johannes Vermeer and “Bedroom in Arles” by Van Gogh harmonize with contemporary works by promising talents.

Mint value: 0.011 - 0.014 ETH  After nd4.eth's dramatic incineration of 2500 ETH valued in the millions 15 days prior, the anonymous figure continues to confound the crypto community.

This unidentified actor has recently transferred 3 NFTs from top-tier collections BAYC, MAYC, and BAKC to a burn address, with an aggregate value exceeding $88,000.

A deliberate obliteration of digital wealth rages on!

After nd4.eth's dramatic incineration of 2500 ETH valued in the millions 15 days prior, the anonymous figure continues to confound the crypto community.

This unidentified actor has recently transferred 3 NFTs from top-tier collections BAYC, MAYC, and BAKC to a burn address, with an aggregate value exceeding $88,000.

A deliberate obliteration of digital wealth rages on!  A former top trader on Binance sent 2,500 ETH (worth nearly $5 million) to a dead wallet address.

In a surprising comment on his last year's unfortunate trade, he said, "Cannot be happier. Being ultimately bankrupt is the best thing that can happen to me. Anyway, number has no meaning in another dimension. Now is the defining moment."

Other users describe him as a rather eccentric individual with a significant fortune.

What could have led him to take this intriguing step?

A former top trader on Binance sent 2,500 ETH (worth nearly $5 million) to a dead wallet address.

In a surprising comment on his last year's unfortunate trade, he said, "Cannot be happier. Being ultimately bankrupt is the best thing that can happen to me. Anyway, number has no meaning in another dimension. Now is the defining moment."

Other users describe him as a rather eccentric individual with a significant fortune.

What could have led him to take this intriguing step?  The team behind the largest token on the Base blockchain, Bald, has withdrawn a substantial amount of liquidity from LeetSwap, removing 7,000 ETH and 142 million BALD tokens in a significant transaction.

The price of BALD has plummeted to as low as $0.015, experiencing a decline of over 84%.

In the past few days, BALD had seen a gain of over 30,000%, even without having an official website or active presence on social media.

The team behind the largest token on the Base blockchain, Bald, has withdrawn a substantial amount of liquidity from LeetSwap, removing 7,000 ETH and 142 million BALD tokens in a significant transaction.

The price of BALD has plummeted to as low as $0.015, experiencing a decline of over 84%.

In the past few days, BALD had seen a gain of over 30,000%, even without having an official website or active presence on social media.  RocketSwap, a DEX on the Base Layer 2 network, suffered a hack, losing 471 ETH ($862,000). The team identified lapses, including offline signatures during launchpad deployment and storing private keys on the server.

While some accused the team of a potential rug pull, RocketSwap blames a third-party hacker who brute-forced a server to extract private keys.

Post-hack, the hacker moved assets to Ethereum, creating a meme token, "LoveRCKT", which saw a brief price surge on Uniswap before plummeting.

RocketSwap, a DEX on the Base Layer 2 network, suffered a hack, losing 471 ETH ($862,000). The team identified lapses, including offline signatures during launchpad deployment and storing private keys on the server.

While some accused the team of a potential rug pull, RocketSwap blames a third-party hacker who brute-forced a server to extract private keys.

Post-hack, the hacker moved assets to Ethereum, creating a meme token, "LoveRCKT", which saw a brief price surge on Uniswap before plummeting.  The BALD project’s scammer team managed to relocate 7000 ETH ($13 million) from Base network into Ethereum.

Not stopping there, they sent 2100 ETH (around $4 million) to the Kraken exchange, possibly gearing up for a grand withdrawal.

Want the full story on this crafty meme coin scam? Read all about it in our detailed article!

The BALD project’s scammer team managed to relocate 7000 ETH ($13 million) from Base network into Ethereum.

Not stopping there, they sent 2100 ETH (around $4 million) to the Kraken exchange, possibly gearing up for a grand withdrawal.

Want the full story on this crafty meme coin scam? Read all about it in our detailed article!  The TVL of Coinbase's blockchain has surged to $146 million following its mainnet launch, surpassing StarkNet's TVL of $112 million.

What's particularly striking is that roughly 87% of Base's TVL is held in ETH.

However, the network's throughput still has room for improvement, with its TPS standing at roughly 5.81.

For comparison, here are the TPS figures of other L2 solutions:

Optimism — 6.88

Arbitrum One — 7.26

zkSync Er — 10.72

The TVL of Coinbase's blockchain has surged to $146 million following its mainnet launch, surpassing StarkNet's TVL of $112 million.

What's particularly striking is that roughly 87% of Base's TVL is held in ETH.

However, the network's throughput still has room for improvement, with its TPS standing at roughly 5.81.

For comparison, here are the TPS figures of other L2 solutions:

Optimism — 6.88

Arbitrum One — 7.26

zkSync Er — 10.72  Renowned business analyst Adam Cochran recently shared insights concerning Huobi's financial state and its potential insolvency.

Key takeaways from Adam's analysis:

Investigation Underway: Both Huobi and Tron are facing scrutiny, with their staff being questioned by the police.

Unusual Asset Distribution: After Justin Sun's introduction of wrapped USDT (stUSDT), a whopping 98% of user assets intended for Tether bond redemptions ended up in the wallets of Huobi and Justin Sun.

Discrepancy with USDT Balance: Huobi's reported USDT balance is just $63 million, but their users hold a staggering $631 million worth of USDT. Something doesn't add up here.

ETH Holdings in Question: It appears that Huobi is holding all of its users' ETH as stETH, raising eyebrows about their handling of customer assets.

Binance Making Moves: Meanwhile, Binance is actively selling USDT and purchasing DAI, possibly indicating a shift in market dynamics.

Outdated Reserves Page: It's been a whole month since Huobi last updated its reserve page, and discrepancies between the reported figures and wallet balances need clarification.

Renowned business analyst Adam Cochran recently shared insights concerning Huobi's financial state and its potential insolvency.

Key takeaways from Adam's analysis:

Investigation Underway: Both Huobi and Tron are facing scrutiny, with their staff being questioned by the police.

Unusual Asset Distribution: After Justin Sun's introduction of wrapped USDT (stUSDT), a whopping 98% of user assets intended for Tether bond redemptions ended up in the wallets of Huobi and Justin Sun.

Discrepancy with USDT Balance: Huobi's reported USDT balance is just $63 million, but their users hold a staggering $631 million worth of USDT. Something doesn't add up here.

ETH Holdings in Question: It appears that Huobi is holding all of its users' ETH as stETH, raising eyebrows about their handling of customer assets.

Binance Making Moves: Meanwhile, Binance is actively selling USDT and purchasing DAI, possibly indicating a shift in market dynamics.

Outdated Reserves Page: It's been a whole month since Huobi last updated its reserve page, and discrepancies between the reported figures and wallet balances need clarification.  A Twitter debate has erupted, speculating that Sam Bankman-Fried (SBF) might be involved with the BALD memcoin rugpull.

Blockchain analysts delved into the developer’s on-chain history and discovered a connection between the wallet address deploying the BALD token and ETH funding from wallets linked to FTX and Alameda Research.

An anonymous DeFi commentator suggested that this link might indicate SBF’s attempt to recover some losses.

Data editors found that the same wallet address had made numerous transfers (400) to blacklisted USDT addresses and appeared to have strong connections with Alameda Research.

A Twitter debate has erupted, speculating that Sam Bankman-Fried (SBF) might be involved with the BALD memcoin rugpull.

Blockchain analysts delved into the developer’s on-chain history and discovered a connection between the wallet address deploying the BALD token and ETH funding from wallets linked to FTX and Alameda Research.

An anonymous DeFi commentator suggested that this link might indicate SBF’s attempt to recover some losses.

Data editors found that the same wallet address had made numerous transfers (400) to blacklisted USDT addresses and appeared to have strong connections with Alameda Research.