#coinbase

183 articles found

Latest

This initiative aimed at countering anti-crypto legislation by mobilizing the community.

Coinbase’s long-term plan is focused on cultivating a grassroots movement and building an engaged community that advocates for positive legal changes and crypto-friendly regulations.

This initiative marks the nation’s first ever independent on-chain advocacy organization, driven by and for crypto enthusiasts.

As of now, the initiative boasts 54 161 supporters on its webpage.

This initiative aimed at countering anti-crypto legislation by mobilizing the community.

Coinbase’s long-term plan is focused on cultivating a grassroots movement and building an engaged community that advocates for positive legal changes and crypto-friendly regulations.

This initiative marks the nation’s first ever independent on-chain advocacy organization, driven by and for crypto enthusiasts.

As of now, the initiative boasts 54 161 supporters on its webpage.  Coinbase, the cryptocurrency exchange, has joined forces with Peoples Trust Company. This collaboration facilitates access to the Interac e-Transfers system, streamlining deposit and withdrawal processes for its Canadian user base.

What's more, they're gifting users a one-month free gateway into the Coinbase One subscription. This means no trade-related fees, amplified staking profits, and swift client support.

"Canada is well positioned to be a global leader in the cryptoeconomy thanks to the high levels of crypto awareness, a passionate local tech ecosystem, and the progress towards a strong regulatory framework," voiced Nana Murugesan, the International Development VP at Coinbase.

Coinbase, the cryptocurrency exchange, has joined forces with Peoples Trust Company. This collaboration facilitates access to the Interac e-Transfers system, streamlining deposit and withdrawal processes for its Canadian user base.

What's more, they're gifting users a one-month free gateway into the Coinbase One subscription. This means no trade-related fees, amplified staking profits, and swift client support.

"Canada is well positioned to be a global leader in the cryptoeconomy thanks to the high levels of crypto awareness, a passionate local tech ecosystem, and the progress towards a strong regulatory framework," voiced Nana Murugesan, the International Development VP at Coinbase. Bittrex US's Alleged Bankruptcy: A Blow to the SEC

Instead of targeting market giants like Binance or Coinbase, the US Securities and Exchange Commission (SEC) directed its attention towards Bittrex, a smaller-scale crypto exchange. The aftermath of this conflict provides significant insights for the wider market.

Instead of targeting market giants like Binance or Coinbase, the US Securities and Exchange Commission (SEC) directed its attention towards Bittrex, a smaller-scale crypto exchange. The aftermath of this conflict provides significant insights for the wider market.  During its second-quarter 2023 earnings call on August 3, Coinbase’s Chief Legal Officer, Paul Grewal, expressed confidence that the exchange would win the court case, stating, “We do think we can win. We expect to win.”

In terms of their financial performance:

Coinbase reported a net loss of $97 million on $708 million in revenue for the second quarter of 2023.

Trading volume fell by 37%, and operating expenses were down nearly 50% year over year, partly due to a 30% reduction in headcount.

During its second-quarter 2023 earnings call on August 3, Coinbase’s Chief Legal Officer, Paul Grewal, expressed confidence that the exchange would win the court case, stating, “We do think we can win. We expect to win.”

In terms of their financial performance:

Coinbase reported a net loss of $97 million on $708 million in revenue for the second quarter of 2023.

Trading volume fell by 37%, and operating expenses were down nearly 50% year over year, partly due to a 30% reduction in headcount.  According to Coinbase CEO Brian Armstrong, the SEC requested the exchange to halt trading in all cryptocurrencies except bitcoin before filing a lawsuit against the platform in June.

“We really didn’t have a choice at that point. Delisting every asset other than bitcoin, which, by the way, is not what the law says, would have essentially meant the end of the crypto industry in the US,” said Armstrong.

According to Coinbase CEO Brian Armstrong, the SEC requested the exchange to halt trading in all cryptocurrencies except bitcoin before filing a lawsuit against the platform in June.

“We really didn’t have a choice at that point. Delisting every asset other than bitcoin, which, by the way, is not what the law says, would have essentially meant the end of the crypto industry in the US,” said Armstrong.  The lawsuit between the U.S Securities and Exchange Commission (SEC) and cryptocurrency exchange Coinbase is moving forward as the date for initial arguments has been confirmed. Coinbase's chief legal officer, Paul Grewal, revealed on Twitter that New York judge Katherine Polk Failla had approved the joint request from both parties to proceed with hearings.

Coinbase has until August 4, 2023, to submit its initial brief and additional supporting documents by August 11. The SEC's opposition brief is due on or before October 10, with Coinbase's reply by October 24 or sooner.

The lawsuit between the U.S Securities and Exchange Commission (SEC) and cryptocurrency exchange Coinbase is moving forward as the date for initial arguments has been confirmed. Coinbase's chief legal officer, Paul Grewal, revealed on Twitter that New York judge Katherine Polk Failla had approved the joint request from both parties to proceed with hearings.

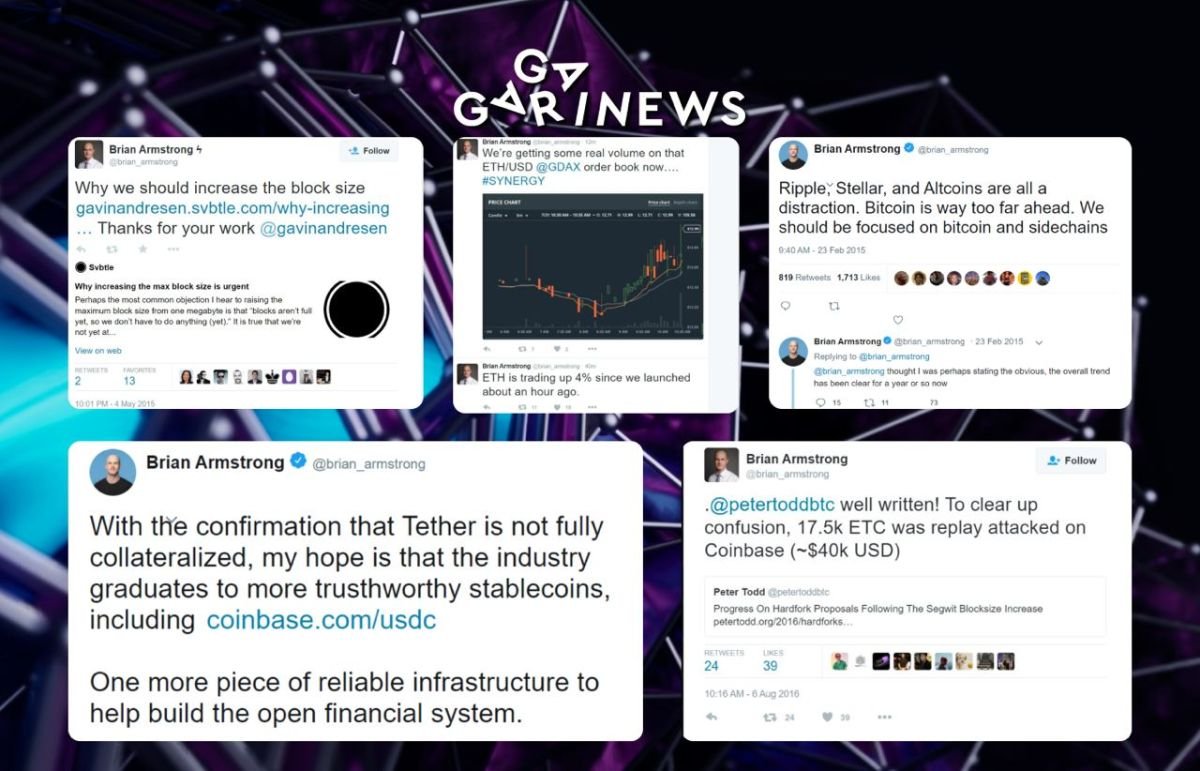

Coinbase has until August 4, 2023, to submit its initial brief and additional supporting documents by August 11. The SEC's opposition brief is due on or before October 10, with Coinbase's reply by October 24 or sooner.  Coinbase CEO Brian Armstrong has recently deleted a substantial number of his tweets from the years 2015 to 2018. Additionally, the digital archive of the World Wide Web, known as the WayBackMachine, has also removed its archive of his tweets.

These tweets from that period covered a range of topics, including Brian expressing his support for increasing Bitcoin’s block size, referring to altcoins as distractions, discussing “replay attacks” on Coinbase, highlighting Ethereum’s price surge after its listing on Coinbase, questioning the full collateralization of Tether, and endorsing USDC, among other things.

As a result of the deletions, these tweets now only exist in the form of screenshots that were captured and shared by others during that time.

Coinbase CEO Brian Armstrong has recently deleted a substantial number of his tweets from the years 2015 to 2018. Additionally, the digital archive of the World Wide Web, known as the WayBackMachine, has also removed its archive of his tweets.

These tweets from that period covered a range of topics, including Brian expressing his support for increasing Bitcoin’s block size, referring to altcoins as distractions, discussing “replay attacks” on Coinbase, highlighting Ethereum’s price surge after its listing on Coinbase, questioning the full collateralization of Tether, and endorsing USDC, among other things.

As a result of the deletions, these tweets now only exist in the form of screenshots that were captured and shared by others during that time.  On Friday, Fidelity Investments and several other firms submitted revised applications for spot Bitcoin exchange-traded funds (ETFs) after the US Securities and Exchange Commission (SEC) deemed the initial filings inadequate.

The companies, including Invesco, VanEck, 21Shares, and WisdomTree, are part of a group of eight firms aiming to launch the first wave of US spot Bitcoin ETFs.

BlackRock kickstarted the trend with its unexpected filing in mid-June.

In the latest filings, all five firms indicated that Coinbase Global Inc. will provide market surveillance for their ETFs, a detail that was missing from their previous applications.

On Friday, Fidelity Investments and several other firms submitted revised applications for spot Bitcoin exchange-traded funds (ETFs) after the US Securities and Exchange Commission (SEC) deemed the initial filings inadequate.

The companies, including Invesco, VanEck, 21Shares, and WisdomTree, are part of a group of eight firms aiming to launch the first wave of US spot Bitcoin ETFs.

BlackRock kickstarted the trend with its unexpected filing in mid-June.

In the latest filings, all five firms indicated that Coinbase Global Inc. will provide market surveillance for their ETFs, a detail that was missing from their previous applications.  Jesse Pollak, Coinbase protocols lead, has clarified the "permissionless" nature of Coinbase’s Layer 2 blockchain, Base, on X (formerly Twitter).

Responding to Gnosis founder Martin Köppelmann's concerns about Base’s centralization, Pollak emphasized that Coinbase doesn't have unilateral control over contracts or the ability to freeze funds on the network.

Despite being the sole operator of Base's sequencer, Pollak insists that the platform aims to be open, permissionless, and decentralized.

Jesse Pollak, Coinbase protocols lead, has clarified the "permissionless" nature of Coinbase’s Layer 2 blockchain, Base, on X (formerly Twitter).

Responding to Gnosis founder Martin Köppelmann's concerns about Base’s centralization, Pollak emphasized that Coinbase doesn't have unilateral control over contracts or the ability to freeze funds on the network.

Despite being the sole operator of Base's sequencer, Pollak insists that the platform aims to be open, permissionless, and decentralized.  Amid the unresolved dispute between Coinbase and the SEC, a number of esteemed legal academics have weighed in, penning a court statement in support of the cryptocurrency exchange.

Their stance is clear: an asset should only be deemed an investment contract if it promises profits, earnings, or assets from investments. Scholars assert that the court must strictly follow this legal definition, otherwise, it may jeopardize belief in existing securities laws.

Amid the unresolved dispute between Coinbase and the SEC, a number of esteemed legal academics have weighed in, penning a court statement in support of the cryptocurrency exchange.

Their stance is clear: an asset should only be deemed an investment contract if it promises profits, earnings, or assets from investments. Scholars assert that the court must strictly follow this legal definition, otherwise, it may jeopardize belief in existing securities laws.  The TVL of Coinbase's blockchain has surged to $146 million following its mainnet launch, surpassing StarkNet's TVL of $112 million.

What's particularly striking is that roughly 87% of Base's TVL is held in ETH.

However, the network's throughput still has room for improvement, with its TPS standing at roughly 5.81.

For comparison, here are the TPS figures of other L2 solutions:

Optimism — 6.88

Arbitrum One — 7.26

zkSync Er — 10.72

The TVL of Coinbase's blockchain has surged to $146 million following its mainnet launch, surpassing StarkNet's TVL of $112 million.

What's particularly striking is that roughly 87% of Base's TVL is held in ETH.

However, the network's throughput still has room for improvement, with its TPS standing at roughly 5.81.

For comparison, here are the TPS figures of other L2 solutions:

Optimism — 6.88

Arbitrum One — 7.26

zkSync Er — 10.72  Both Coinbase and the SEC have denied reports claiming that the regulator requested the exchange to halt trading in all cryptocurrencies other than Bitcoin.

A Coinbase spokesperson has clarified to Blockworks that the supposed recommendation was an inaccurate representation of the facts.

The interview published by the Financial Times earlier lacks important context regarding the conversations between Coinbase and the SEC.

Both Coinbase and the SEC have denied reports claiming that the regulator requested the exchange to halt trading in all cryptocurrencies other than Bitcoin.

A Coinbase spokesperson has clarified to Blockworks that the supposed recommendation was an inaccurate representation of the facts.

The interview published by the Financial Times earlier lacks important context regarding the conversations between Coinbase and the SEC.  Brian Armstrong has publicly urged US residents to actively support the 21st Century Financial Innovation and Technology Bill, which promises to bring much-needed clarity to cryptocurrency regulation.

Armstrong emphasized that it is ordinary Americans who can have a decisive impact on the outcome of the vote by sending an email to their representatives asking them to support the bill.

In a more detailed statement, Coinbase added that the bill, in addition to protecting consumer rights and enhancing national security, has the potential to spur job creation in the US.

Brian Armstrong has publicly urged US residents to actively support the 21st Century Financial Innovation and Technology Bill, which promises to bring much-needed clarity to cryptocurrency regulation.

Armstrong emphasized that it is ordinary Americans who can have a decisive impact on the outcome of the vote by sending an email to their representatives asking them to support the bill.

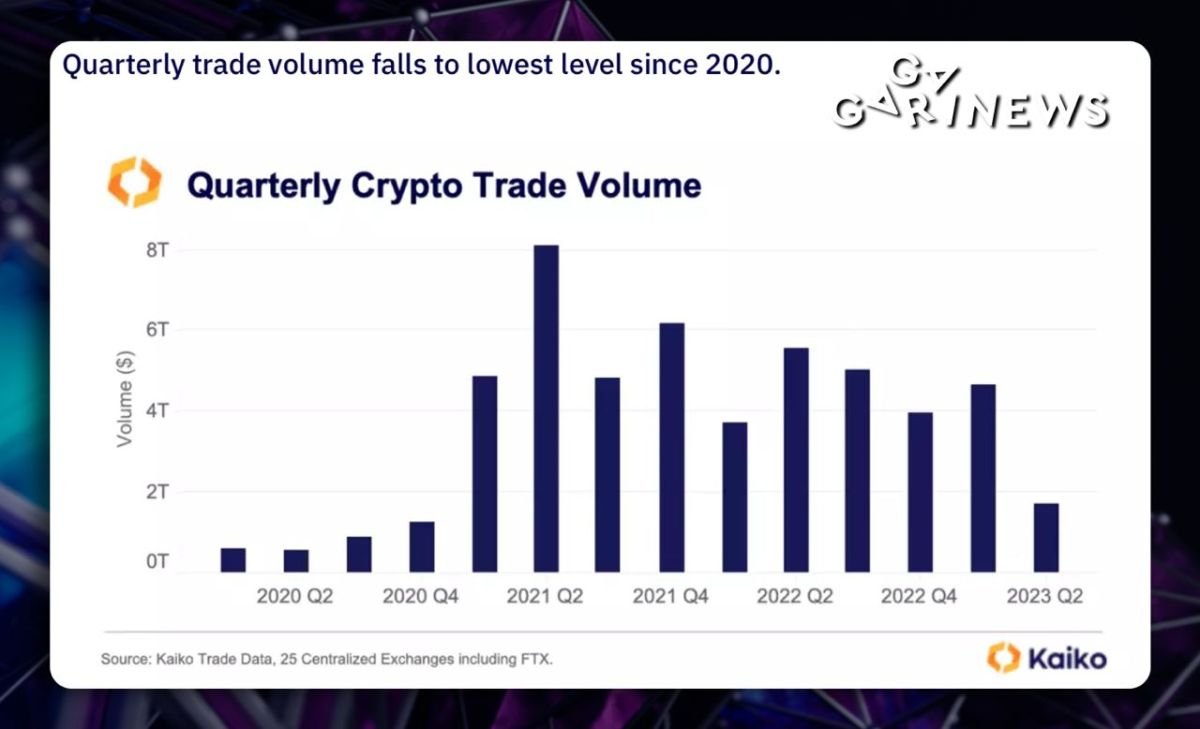

In a more detailed statement, Coinbase added that the bill, in addition to protecting consumer rights and enhancing national security, has the potential to spur job creation in the US.  Despite the ongoing rally in June, spot trade volumes in Q2 experienced a substantial decline, reaching their lowest level since 2020, according to Kaiko.

Binance saw the most significant drop in trading activity, with volumes plunging by nearly 70%.

Other exchanges such as Coinbase, Kraken, OKX, and Huobi also witnessed a decline of over 50% in trade volumes.

Despite the ongoing rally in June, spot trade volumes in Q2 experienced a substantial decline, reaching their lowest level since 2020, according to Kaiko.

Binance saw the most significant drop in trading activity, with volumes plunging by nearly 70%.

Other exchanges such as Coinbase, Kraken, OKX, and Huobi also witnessed a decline of over 50% in trade volumes.