#coinbase

183 articles found

Latest

Coinbase Steps Back from FTX Europe Acquisition

After the bankruptcy of FTX in 2022, Coinbase expressed interest in acquiring its subsidiary, FTX Europe, with the intention of bolstering their global cryptocurrency derivatives footprint. This consideration was rekindled in September 2023, as reported by Fortune.

After the bankruptcy of FTX in 2022, Coinbase expressed interest in acquiring its subsidiary, FTX Europe, with the intention of bolstering their global cryptocurrency derivatives footprint. This consideration was rekindled in September 2023, as reported by Fortune.  Coinbase's blockchain, Base, has set a new daily transaction record, reaching 1.88 million transactions. This achievement surpasses its previous high of 1.41 million transactions, established shortly after its launch in August. Notably, this number surpasses the combined daily transactions of both Optimism and Arbitrum, which totaled 878,000 transactions.

Coinbase's blockchain, Base, has set a new daily transaction record, reaching 1.88 million transactions. This achievement surpasses its previous high of 1.41 million transactions, established shortly after its launch in August. Notably, this number surpasses the combined daily transactions of both Optimism and Arbitrum, which totaled 878,000 transactions.  On August 30, Judge Katherine Polk Failla delivered a significant ruling on a case brought forth by Uniswap users who alleged they lost funds due to scam tokens on the platform. She stated that ETH and Bitcoin qualify as crypto commodities, a pivotal factor in her decision to close the Uniswap case.J udge was not persuaded by arguments suggesting Uniswap token sales were subject to the Exchange Act. Failla is also the judge overseeing the SEC’s case against Coinbase.

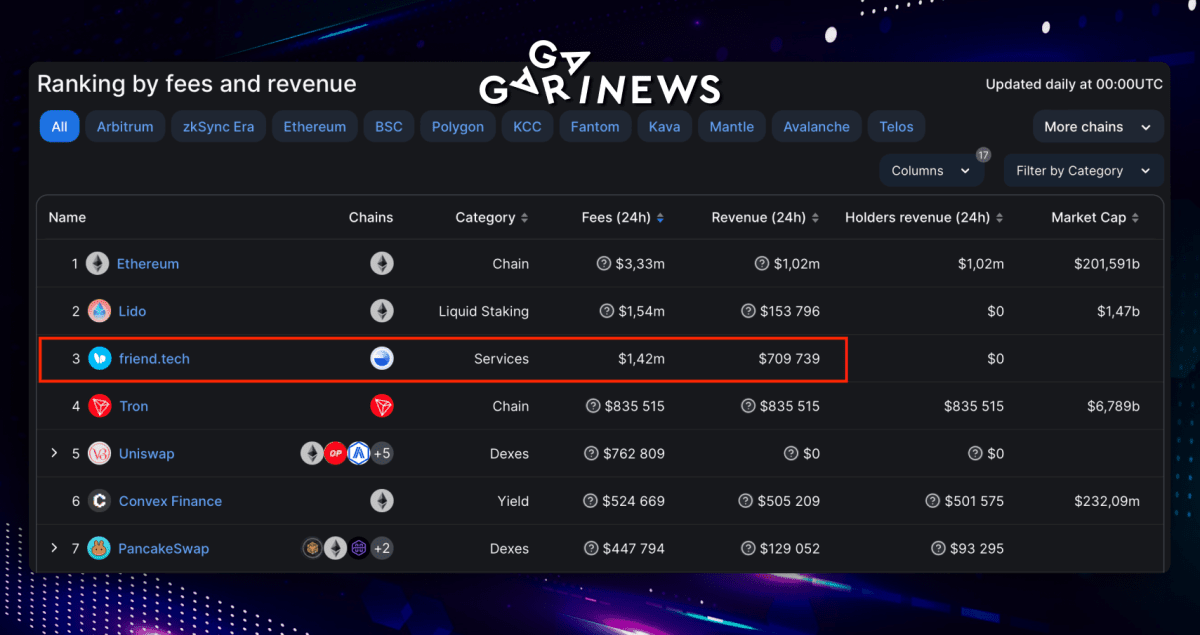

On August 30, Judge Katherine Polk Failla delivered a significant ruling on a case brought forth by Uniswap users who alleged they lost funds due to scam tokens on the platform. She stated that ETH and Bitcoin qualify as crypto commodities, a pivotal factor in her decision to close the Uniswap case.J udge was not persuaded by arguments suggesting Uniswap token sales were subject to the Exchange Act. Failla is also the judge overseeing the SEC’s case against Coinbase.  Social app friend.tech has recorded protocol fees amounting to more than $1.42 million within the past 24 hours, positioning it among the top three crypto projects in terms of user-paid fees. It now stands as the third-highest project for user-paid fees, following Ethereum and Lido Finance, according to data from DeFiLlama. Built on Coinbase’s Base Layer 2 chain, friend.tech is a social app that integrates with X (Twitter). It allows users to trade tokenized shares linked to each other’s profiles. Shareholders enjoy exclusive content access and private chat rooms in X.

Social app friend.tech has recorded protocol fees amounting to more than $1.42 million within the past 24 hours, positioning it among the top three crypto projects in terms of user-paid fees. It now stands as the third-highest project for user-paid fees, following Ethereum and Lido Finance, according to data from DeFiLlama. Built on Coinbase’s Base Layer 2 chain, friend.tech is a social app that integrates with X (Twitter). It allows users to trade tokenized shares linked to each other’s profiles. Shareholders enjoy exclusive content access and private chat rooms in X.  FTX's portfolio liquidation is unlikely to shake the market significantly, as noted by Coinbase in their latest weekly report.

They cited multiple reasons supporting this claim.

1. Weekly Sell Limits: Initially, liquidations are capped at $50 million per week for digital assets. This limit will gradually increase to $100 million in subsequent weeks. Any permanent increase to a maximum limit of $200 million requires approval from two committees representing FTX debtors.

2. Insider-Affiliated Tokens: Stricter controls govern the sale of “insider-affiliated” tokens, necessitating a 10-day advance notice to the same committees.

3. Locked Holdings: A significant portion of FTX’s SOL holdings, along with some other tokens, are locked until approximately 2025 due to token vesting schedules, limiting their availability for sale.

4. Hedging Measures: FTX has the option to hedge its sales of BTC, ETH, and other debtor-identified assets through an investment advisor, contingent on prior committee approval. These precautions ensure a measured and controlled approach to asset liquidation.

FTX's portfolio liquidation is unlikely to shake the market significantly, as noted by Coinbase in their latest weekly report.

They cited multiple reasons supporting this claim.

1. Weekly Sell Limits: Initially, liquidations are capped at $50 million per week for digital assets. This limit will gradually increase to $100 million in subsequent weeks. Any permanent increase to a maximum limit of $200 million requires approval from two committees representing FTX debtors.

2. Insider-Affiliated Tokens: Stricter controls govern the sale of “insider-affiliated” tokens, necessitating a 10-day advance notice to the same committees.

3. Locked Holdings: A significant portion of FTX’s SOL holdings, along with some other tokens, are locked until approximately 2025 due to token vesting schedules, limiting their availability for sale.

4. Hedging Measures: FTX has the option to hedge its sales of BTC, ETH, and other debtor-identified assets through an investment advisor, contingent on prior committee approval. These precautions ensure a measured and controlled approach to asset liquidation.  Coinbase and Circle, five years after jointly launching USDC, are evolving their partnership. Coinbase is acquiring an equity stake in Circle, emphasizing their shared vision for the financial future. To further its reach, USDC will launch on six new blockchains between September and October, expanding its multi-chain presence to 15. With clearer global stablecoin regulations, Circle will assume all governance, including smart contract management. The Centre Consortium, initially governing USDC, will dissolve.

Coinbase and Circle, five years after jointly launching USDC, are evolving their partnership. Coinbase is acquiring an equity stake in Circle, emphasizing their shared vision for the financial future. To further its reach, USDC will launch on six new blockchains between September and October, expanding its multi-chain presence to 15. With clearer global stablecoin regulations, Circle will assume all governance, including smart contract management. The Centre Consortium, initially governing USDC, will dissolve.  Base, engineered on OP Stack as a second layer network, has managed to surpass Arbitrum and Optimism in the number of daily transactions this week. Data from The Block highlighted that on August 15, Base's moving average reached 610,000 transactions, while the counts for Arbitrum and Optimism stood at 576,000 and 597,000, respectively. Although Optimism currently holds a slight lead, overall, the networks are closely competing.

Base, engineered on OP Stack as a second layer network, has managed to surpass Arbitrum and Optimism in the number of daily transactions this week. Data from The Block highlighted that on August 15, Base's moving average reached 610,000 transactions, while the counts for Arbitrum and Optimism stood at 576,000 and 597,000, respectively. Although Optimism currently holds a slight lead, overall, the networks are closely competing.  Coinbase has obtained regulatory approval from the National Futures Association (NFA), a CFTC-designated self-regulatory organization.

This approval allows Coinbase to function as a Futures Commission Merchant (FCM) and provide eligible US customers with access to crypto futures through its platforms.

With this approval, Coinbase becomes the first crypto-native platform to offer a combined solution featuring traditional spot crypto trading and regulated, leveraged crypto futures for their US verified customers.

Coinbase has obtained regulatory approval from the National Futures Association (NFA), a CFTC-designated self-regulatory organization.

This approval allows Coinbase to function as a Futures Commission Merchant (FCM) and provide eligible US customers with access to crypto futures through its platforms.

With this approval, Coinbase becomes the first crypto-native platform to offer a combined solution featuring traditional spot crypto trading and regulated, leveraged crypto futures for their US verified customers.