#bloomberg

49 articles found

Latest

July 23 marked the debut of spot Ethereum ETFs in the U.S. trading markets. According to data from a Bloomberg terminal screenshot shared by analyst James Seyffart, the total net inflows amounted to approximately $106.8 million, with the overall trading volume surpassing $1.11 billion.

July 23 marked the debut of spot Ethereum ETFs in the U.S. trading markets. According to data from a Bloomberg terminal screenshot shared by analyst James Seyffart, the total net inflows amounted to approximately $106.8 million, with the overall trading volume surpassing $1.11 billion.  Bloomberg's senior ETF analyst, Eric Balchunas, has revealed that the SEC asked applicants to submit their final S-1 form documents by Wednesday, along with a request for effectiveness on Monday. This suggests that the launch could happen on Tuesday, July 23.

Bloomberg's senior ETF analyst, Eric Balchunas, has revealed that the SEC asked applicants to submit their final S-1 form documents by Wednesday, along with a request for effectiveness on Monday. This suggests that the launch could happen on Tuesday, July 23.  Bloomberg sources report that Apple won't be paying OpenAI for using its artificial intelligence features (ChatGPT) in its products, at least at the start of their collaboration. Apple believes that the value of embedding OpenAI’s technology into millions of its devices outweighs monetary payments.

Bloomberg sources report that Apple won't be paying OpenAI for using its artificial intelligence features (ChatGPT) in its products, at least at the start of their collaboration. Apple believes that the value of embedding OpenAI’s technology into millions of its devices outweighs monetary payments.  OpenAI, an artificial intelligence research and deployment company, has rebutted Elon Musk's claims of prioritizing profit maximization and violating their agreement on creating artificial general intelligence (AGI). This revelation stems from an internal memo obtained by Bloomberg.

OpenAI, an artificial intelligence research and deployment company, has rebutted Elon Musk's claims of prioritizing profit maximization and violating their agreement on creating artificial general intelligence (AGI). This revelation stems from an internal memo obtained by Bloomberg.  The U.S. Department of Justice has leveled charges against three American individuals for committing fraud through SIM card swaps. Bloomberg reports that among the companies affected was the cryptocurrency exchange FTX, which suffered a loss of over $400 million in client assets in the aftermath of its bankruptcy announcement.

The U.S. Department of Justice has leveled charges against three American individuals for committing fraud through SIM card swaps. Bloomberg reports that among the companies affected was the cryptocurrency exchange FTX, which suffered a loss of over $400 million in client assets in the aftermath of its bankruptcy announcement.  Eric Balchunas from Bloomberg, a seasoned ETF Analyst, estimates a 90% chance of the first Ether Futures ETF receiving approval come early October.

According to him, Valkyrie Funds is set to lead with its application, with a series of affirmative decisions expected to follow.

“The spot ETF remains in limbo,” Balchunas points out.

Eric Balchunas from Bloomberg, a seasoned ETF Analyst, estimates a 90% chance of the first Ether Futures ETF receiving approval come early October.

According to him, Valkyrie Funds is set to lead with its application, with a series of affirmative decisions expected to follow.

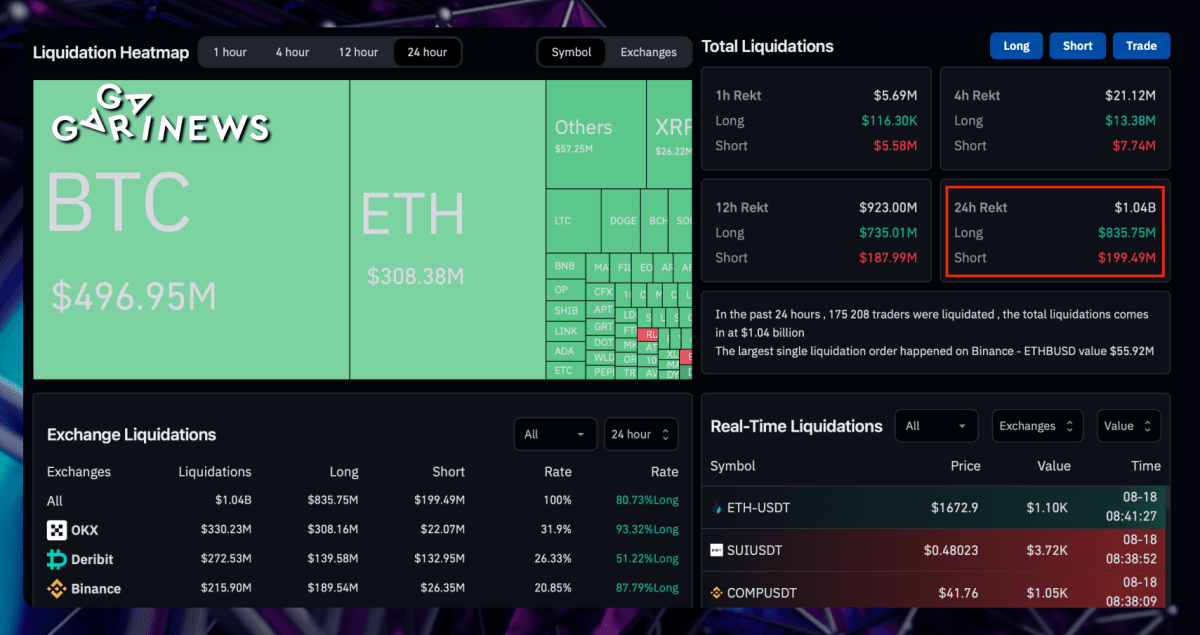

“The spot ETF remains in limbo,” Balchunas points out.  Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.

Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%. Trump Fears Ceding Crypto Market Leadership to China

As cryptocurrencies continue to dominate the US election discourse, Donald Trump discussed the implications for the crypto market in a detailed interview with Bloomberg Businessweek, touching on topics like cryptocurrencies, NFTs, and the chip industry.

As cryptocurrencies continue to dominate the US election discourse, Donald Trump discussed the implications for the crypto market in a detailed interview with Bloomberg Businessweek, touching on topics like cryptocurrencies, NFTs, and the chip industry.  Bloomberg reports that Standard Chartered, a multinational financial corporation, is developing its own platform for trading Bitcoin (BTC) and Ethereum (ETH). This new division will operate as part of the bank's global banking sector, with its management hub based in London.

Bloomberg reports that Standard Chartered, a multinational financial corporation, is developing its own platform for trading Bitcoin (BTC) and Ethereum (ETH). This new division will operate as part of the bank's global banking sector, with its management hub based in London.  In a move by the bankrupt exchange FTX, between 25 to 30 million SOL tokens have been sold to Galaxy Trading and Pantera Capital for $64 each, according to anonymous sources cited by Bloomberg. This transaction is valued between $1.6 to $1.92 billion, though the exact date of the sale remains undisclosed.

In a move by the bankrupt exchange FTX, between 25 to 30 million SOL tokens have been sold to Galaxy Trading and Pantera Capital for $64 each, according to anonymous sources cited by Bloomberg. This transaction is valued between $1.6 to $1.92 billion, though the exact date of the sale remains undisclosed.  Eric Balchunas, the Senior ETF analyst at Bloomberg, has scaled back his optimism regarding the approval of a spot Ethereum ETF, now assessing the chances at 35% by the May deadline. He emphasizes, however, that approval remains a possibility, especially looking ahead to the longer term.

Eric Balchunas, the Senior ETF analyst at Bloomberg, has scaled back his optimism regarding the approval of a spot Ethereum ETF, now assessing the chances at 35% by the May deadline. He emphasizes, however, that approval remains a possibility, especially looking ahead to the longer term.  Bloomberg reports that Changpeng Zhao (CZ), the ex-CEO of the crypto exchange Binance, saw his fortune grow by almost $25 billion in 2023. His financial growth surpassed that of other crypto industry billionaires, including Coinbase's CEO Brian Armstrong and the Winklevoss twins.

Bloomberg reports that Changpeng Zhao (CZ), the ex-CEO of the crypto exchange Binance, saw his fortune grow by almost $25 billion in 2023. His financial growth surpassed that of other crypto industry billionaires, including Coinbase's CEO Brian Armstrong and the Winklevoss twins.  The current market landscape marks an unprecedented decline in liquidity, according to Bloomberg Intelligence's senior macro strategist, Mike McGlone.

If this pattern holds throughout 2023, he warns of a potential sharp descent in Bitcoin prices, which would ripple through Ethereum, XRP, and the general cryptocurrency domain.

“What should be early indications of recessionary times? The best indication should be bitcoin and that’s where I’m looking for the bleeding occasion from bitcoin and it’s still kind of showing what I expected.”

“Picture December: Recession looms, Fed hesitates on easing due to inflation,” said McGlone.

The current market landscape marks an unprecedented decline in liquidity, according to Bloomberg Intelligence's senior macro strategist, Mike McGlone.

If this pattern holds throughout 2023, he warns of a potential sharp descent in Bitcoin prices, which would ripple through Ethereum, XRP, and the general cryptocurrency domain.

“What should be early indications of recessionary times? The best indication should be bitcoin and that’s where I’m looking for the bleeding occasion from bitcoin and it’s still kind of showing what I expected.”

“Picture December: Recession looms, Fed hesitates on easing due to inflation,” said McGlone.