#bitcoin

1076 articles found

Latest

John Reed Stark, ex-chief of the SEC's Office of Internet Enforcement, believes the current SEC won't approve a Bitcoin spot ETF due to various reasons.

However, Stark suggests that if a Republican wins the 2024 presidential election, the SEC might ease its crypto-enforcement and be more open to a Bitcoin spot ETF.

He also speculates that SEC chair Gary Gensler might resign, potentially paving the way for Hester Peirce, known as "Crypto Mom", to take a leading role.

John Reed Stark, ex-chief of the SEC's Office of Internet Enforcement, believes the current SEC won't approve a Bitcoin spot ETF due to various reasons.

However, Stark suggests that if a Republican wins the 2024 presidential election, the SEC might ease its crypto-enforcement and be more open to a Bitcoin spot ETF.

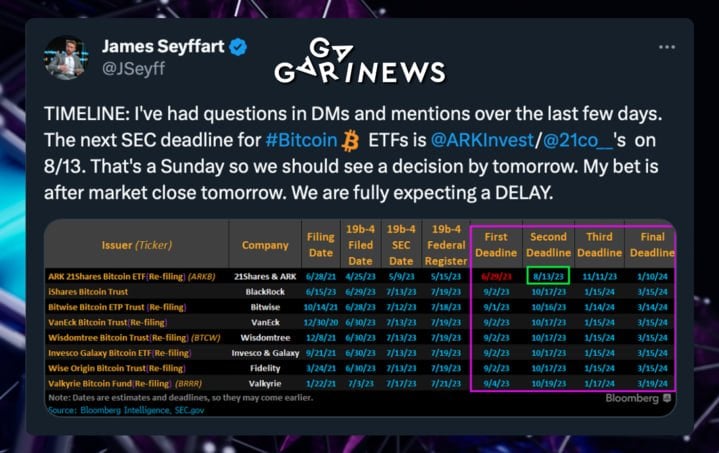

He also speculates that SEC chair Gary Gensler might resign, potentially paving the way for Hester Peirce, known as "Crypto Mom", to take a leading role.  This Sunday (August 13) marks the first deadline for the SEC to weigh in on ARK 21Shares' Bitcoin ETF application.

Weekend deadlines are tricky, but some analysts suggest the decision could drop today.

Analyst James Seyffart puts the odds of approval at less than 5%.

Keep an eye out for the next milestone: BlackRock's Bitcoin ETF deadline is September 2.

This Sunday (August 13) marks the first deadline for the SEC to weigh in on ARK 21Shares' Bitcoin ETF application.

Weekend deadlines are tricky, but some analysts suggest the decision could drop today.

Analyst James Seyffart puts the odds of approval at less than 5%.

Keep an eye out for the next milestone: BlackRock's Bitcoin ETF deadline is September 2.  "Simply put, no. Bitcoin raises concerns among both local and European regulators. Our primary business demands our focus, and it wouldn't be rational to jeopardize it by engaging with a high-risk asset like Bitcoin," says Mykhailo Rohalskyi.

He believes that cryptocurrency lacks advantages over fiat money, apart from the potential to sidestep local currency regulations.

Speaking on Ukraine's crypto landscape, the Monobank co-founder added:

"I'm skeptical about the widespread acceptance of cryptocurrencies in our country. The approach of the National Bank of Ukraine to crypto regulation remains uncertain."

"Simply put, no. Bitcoin raises concerns among both local and European regulators. Our primary business demands our focus, and it wouldn't be rational to jeopardize it by engaging with a high-risk asset like Bitcoin," says Mykhailo Rohalskyi.

He believes that cryptocurrency lacks advantages over fiat money, apart from the potential to sidestep local currency regulations.

Speaking on Ukraine's crypto landscape, the Monobank co-founder added:

"I'm skeptical about the widespread acceptance of cryptocurrencies in our country. The approach of the National Bank of Ukraine to crypto regulation remains uncertain."  Company’s CTO Paolo Ardoino has shared his excitement about a mobile app designed to facilitate international purchases settlements B2B, B2C and C2C based on USDT and XAUT payments.

Notably, the app will also incorporate support for Bitcoin Lightning.

Paolo stated that he envisions this app as the future of trade finance.

Having personally reviewed the code, his experience as a developer has left him genuinely impressed. Currently, the app is in its testing stages, with more specifics yet to be unveiled.

Company’s CTO Paolo Ardoino has shared his excitement about a mobile app designed to facilitate international purchases settlements B2B, B2C and C2C based on USDT and XAUT payments.

Notably, the app will also incorporate support for Bitcoin Lightning.

Paolo stated that he envisions this app as the future of trade finance.

Having personally reviewed the code, his experience as a developer has left him genuinely impressed. Currently, the app is in its testing stages, with more specifics yet to be unveiled.  Bitdeer Technologies Group, based in Singapore, has successfully set up an avant-garde bitcoin mining facility in Gedu, Bhutan – a nation recently recognized for its crypto investments.

As the facility approaches the end of its trial run, many of its mining units are already in operation. Reflecting on the progress, Bitdeer's CEO, Linghui Kong remarked:

"We made significant strides on both the operational and infrastructure fronts during July."

Bitdeer Technologies Group, based in Singapore, has successfully set up an avant-garde bitcoin mining facility in Gedu, Bhutan – a nation recently recognized for its crypto investments.

As the facility approaches the end of its trial run, many of its mining units are already in operation. Reflecting on the progress, Bitdeer's CEO, Linghui Kong remarked:

"We made significant strides on both the operational and infrastructure fronts during July."  She now believes that the SEC may approve multiple spot-Bitcoin ETFs simultaneously, instead of approving them one by one.

This comes after her earlier expectation that her firm would be among the first to receive approval for a Bitcoin ETF.

Bloomberg ETF analyst James Seyffart also shares the same opinion, stating that the path of least resistance for regulators is to approve multiple spot bitcoin ETFs at once or possibly all of them together.

She now believes that the SEC may approve multiple spot-Bitcoin ETFs simultaneously, instead of approving them one by one.

This comes after her earlier expectation that her firm would be among the first to receive approval for a Bitcoin ETF.

Bloomberg ETF analyst James Seyffart also shares the same opinion, stating that the path of least resistance for regulators is to approve multiple spot bitcoin ETFs at once or possibly all of them together.  Kevin Kelly, Delphi Digital's co-founder, suggests the crypto market is entering a new cycle. He highlights the consistency in crypto market timings, from peak-to-trough bottoms to recovery durations.

Using Bitcoin as a reference, Kelly describes a typical cycle: a new all-time high, an 80% drawdown, a recovery to the previous high in two years, and a rally to a new peak. This cycle aligns with broader business cycles.

Kelly also draws parallels between Bitcoin's price peaks and the ISM Manufacturing Index.

Despite potential short-term setbacks, Kelly remains optimistic about the market's outlook for the next 12-18 months.

Kevin Kelly, Delphi Digital's co-founder, suggests the crypto market is entering a new cycle. He highlights the consistency in crypto market timings, from peak-to-trough bottoms to recovery durations.

Using Bitcoin as a reference, Kelly describes a typical cycle: a new all-time high, an 80% drawdown, a recovery to the previous high in two years, and a rally to a new peak. This cycle aligns with broader business cycles.

Kelly also draws parallels between Bitcoin's price peaks and the ISM Manufacturing Index.

Despite potential short-term setbacks, Kelly remains optimistic about the market's outlook for the next 12-18 months.  acobi Asset Management Lists Europe’s First Spot Bitcoin ETF on Euronext Amsterdam Exchange.

“It is exciting to see Europe moving ahead of the US in opening up Bitcoin investing for institutional investors who want safe, secure access to the benefits of digital assets,” says the company’s CEO, Martin Bednall.

Well, now it’s the USA’s turn!

acobi Asset Management Lists Europe’s First Spot Bitcoin ETF on Euronext Amsterdam Exchange.

“It is exciting to see Europe moving ahead of the US in opening up Bitcoin investing for institutional investors who want safe, secure access to the benefits of digital assets,” says the company’s CEO, Martin Bednall.

Well, now it’s the USA’s turn!  In the Argentine primary elections, Javier Milei, a candidate who supports Bitcoin and vehemently opposes the Central Bank, has garnered most of the votes.

He's not shy about criticizing the Central Bank, dubbing it a conduit for politicians to exploit Argentinians via inflation.

Milei is convinced that the salvation lies in Bitcoin, which can instill privacy back into finances.

Simultaneously, Bitcoin has hit a fresh historical maximum value when measured in Argentine peso.

In the Argentine primary elections, Javier Milei, a candidate who supports Bitcoin and vehemently opposes the Central Bank, has garnered most of the votes.

He's not shy about criticizing the Central Bank, dubbing it a conduit for politicians to exploit Argentinians via inflation.

Milei is convinced that the salvation lies in Bitcoin, which can instill privacy back into finances.

Simultaneously, Bitcoin has hit a fresh historical maximum value when measured in Argentine peso.  Carlyle Group co-founder David Rubenstein, in an interview with Bloomberg, expressed his regret for missing the opportunity to invest in Bitcoin when a single coin was worth just $100.

Not one to dwell on past mistakes, David's currently pouring capital into companies making crypto trading accessible for everyone.

Sound familiar? David's story echoes in many of us.

Carlyle Group co-founder David Rubenstein, in an interview with Bloomberg, expressed his regret for missing the opportunity to invest in Bitcoin when a single coin was worth just $100.

Not one to dwell on past mistakes, David's currently pouring capital into companies making crypto trading accessible for everyone.

Sound familiar? David's story echoes in many of us.  The Professor, having made an ill-advised Bitcoin investment, is saddled with a huge debt. To resolve this financial mess, he's drawn to the explosive trend of Bitcoin mining.

The storyline takes the crew to Doge City in search of the valuable mineral thallium, a crucial element for today's mining chips.

Even the legendary animated series couldn't resist the allure of Bitcoin!

The Professor, having made an ill-advised Bitcoin investment, is saddled with a huge debt. To resolve this financial mess, he's drawn to the explosive trend of Bitcoin mining.

The storyline takes the crew to Doge City in search of the valuable mineral thallium, a crucial element for today's mining chips.

Even the legendary animated series couldn't resist the allure of Bitcoin!  The founder of CryptoLaw, John Deaton, argues that certain crypto enthusiasts might be overly buoyant about how XRP's price would respond to the court's verdict in the SEC dispute.

XRP has indeed grown by a whopping 85% this year, but Deaton asserts that a fresh peak price would likely coincide with Bitcoin's bull run.

"Until Bitcoin breaks it’s ATH, I don’t expect anything else to," he shared.

The founder of CryptoLaw, John Deaton, argues that certain crypto enthusiasts might be overly buoyant about how XRP's price would respond to the court's verdict in the SEC dispute.

XRP has indeed grown by a whopping 85% this year, but Deaton asserts that a fresh peak price would likely coincide with Bitcoin's bull run.

"Until Bitcoin breaks it’s ATH, I don’t expect anything else to," he shared.