#bitcoin

1076 articles found

Latest

The number 8, when tilted, represents infinity, and 21 signifies the maximum number of Bitcoins (21 million). Thus, August 21st is often referred to as Bitcoin Infinity Day. This concept was conceived by Knut Svanholm, a philosopher, educator, and author of the books “Bitcoin: Sovereignty through Mathematics” and “Bitcoin: Everything Divided by 21 Million.”

The number 8, when tilted, represents infinity, and 21 signifies the maximum number of Bitcoins (21 million). Thus, August 21st is often referred to as Bitcoin Infinity Day. This concept was conceived by Knut Svanholm, a philosopher, educator, and author of the books “Bitcoin: Sovereignty through Mathematics” and “Bitcoin: Everything Divided by 21 Million.”  Coingecko has just unveiled a report that details the countries where mining 1 BTC could be either a lucrative venture or a costly mistake.

For example, mining a Bitcoin in Lebanon would cost only $266 in electricity, while the same task in Italy would run a shocking $206,000, or 783 times more.

Out of the top 10 nations with the highest electricity costs, 9 are European.

Coingecko has just unveiled a report that details the countries where mining 1 BTC could be either a lucrative venture or a costly mistake.

For example, mining a Bitcoin in Lebanon would cost only $266 in electricity, while the same task in Italy would run a shocking $206,000, or 783 times more.

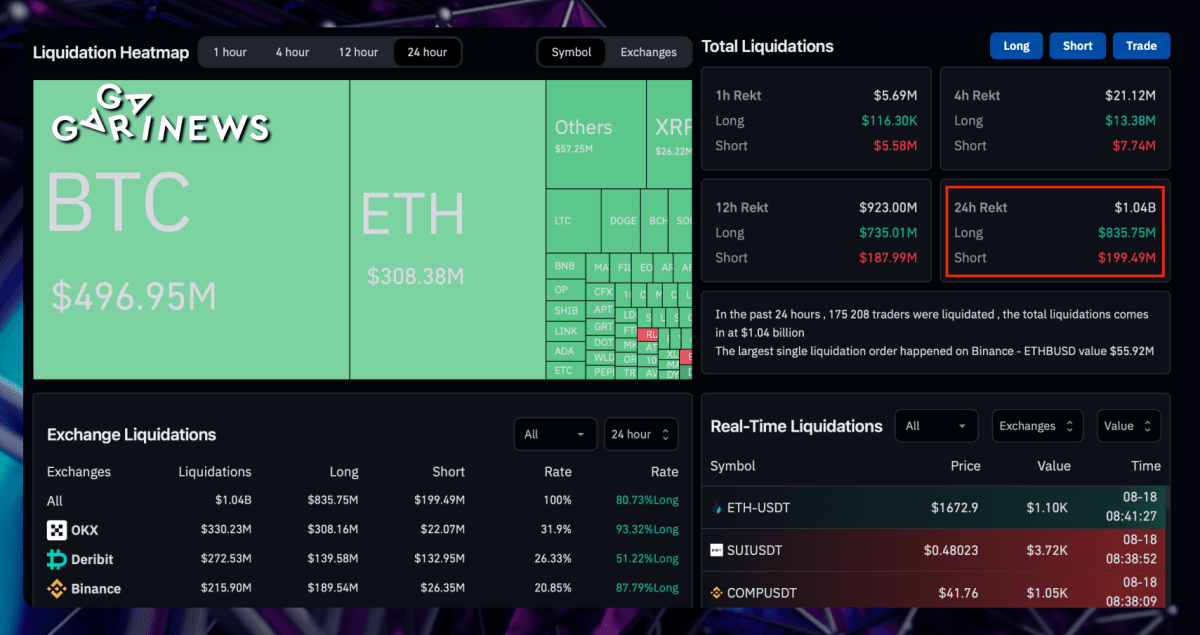

Out of the top 10 nations with the highest electricity costs, 9 are European.  Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.

Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

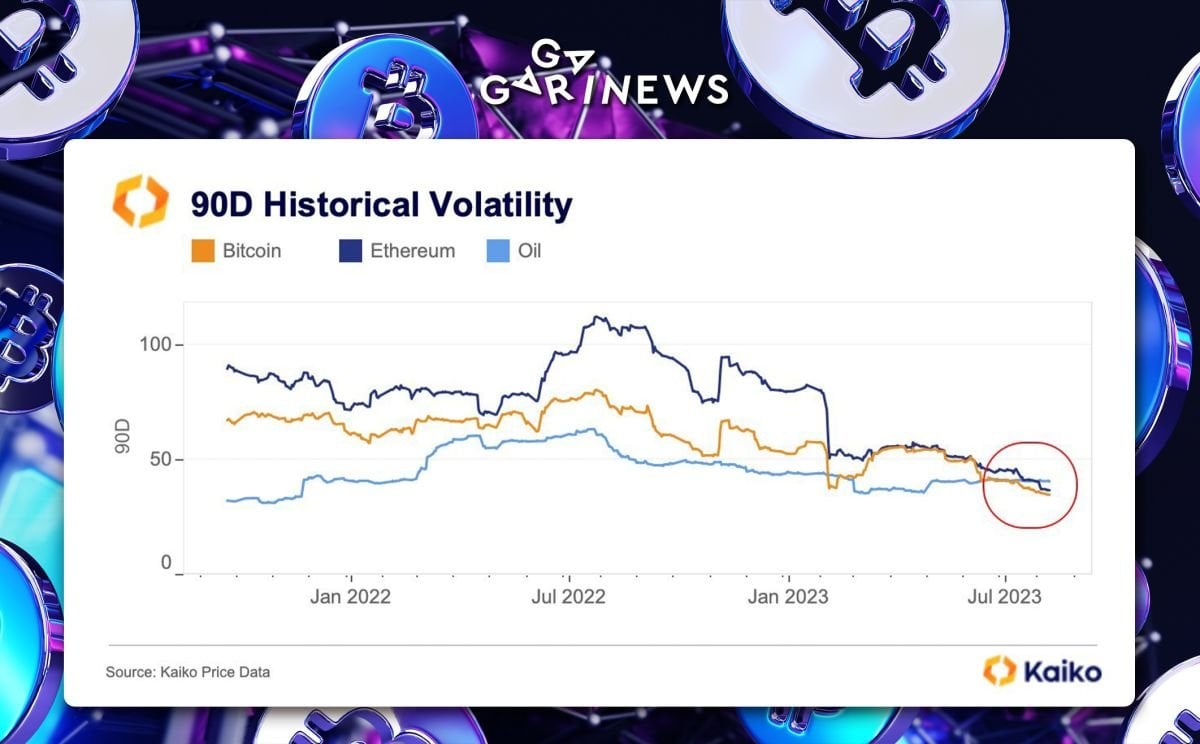

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.  According to Kaiko, BTC and ETH have recorded their lowest 90-day price volatility compared to oil in many years, a mark last reached in 2016.

Right now, Bitcoin's volatility sits at 35%, Ethereum's at 37%, while oil's is higher at 41%.

Experience tells us that after such periods of quiet , a significant move often follows. Judging by Bitcoin's recent dynamics, it appears such a shift might be kicking off.

According to Kaiko, BTC and ETH have recorded their lowest 90-day price volatility compared to oil in many years, a mark last reached in 2016.

Right now, Bitcoin's volatility sits at 35%, Ethereum's at 37%, while oil's is higher at 41%.

Experience tells us that after such periods of quiet , a significant move often follows. Judging by Bitcoin's recent dynamics, it appears such a shift might be kicking off.  The Central African Republic (CAR) is expanding its Sango blockchain initiative to include the tokenization of land and natural resources. Recently, the CAR National Assembly passed a law, receiving unanimous approval, that facilitates online business visa applications and simplifies the process for both locals and foreigners to establish businesses in sectors like real estate, agriculture, and forestry. This move follows CAR's earlier efforts in the crypto space, including the launch of Project Sango in May 2022 and its brief adoption of Bitcoin as a national currency.

The Central African Republic (CAR) is expanding its Sango blockchain initiative to include the tokenization of land and natural resources. Recently, the CAR National Assembly passed a law, receiving unanimous approval, that facilitates online business visa applications and simplifies the process for both locals and foreigners to establish businesses in sectors like real estate, agriculture, and forestry. This move follows CAR's earlier efforts in the crypto space, including the launch of Project Sango in May 2022 and its brief adoption of Bitcoin as a national currency.  After the market crash on August 18, analyst Andrew Kang adopted a bullish stance. He opened long positions on Bitcoin (BTC), Ethereum (ETH), and Arbitrum (ARB). However, this decision resulted in a significant loss.

Due to his use of extremely high leverage, which reached up to 100x, Kang's positions became vulnerable and were liquidated not once, but as many as fourteen times.

These successive liquidations caused Kang to lose approximately $432,000 in a single day. This incident highlights the risks associated with trading and employing high leverage, especially during periods of intense market volatility.

After the market crash on August 18, analyst Andrew Kang adopted a bullish stance. He opened long positions on Bitcoin (BTC), Ethereum (ETH), and Arbitrum (ARB). However, this decision resulted in a significant loss.

Due to his use of extremely high leverage, which reached up to 100x, Kang's positions became vulnerable and were liquidated not once, but as many as fourteen times.

These successive liquidations caused Kang to lose approximately $432,000 in a single day. This incident highlights the risks associated with trading and employing high leverage, especially during periods of intense market volatility.  DappRadar's recent report reveals a staggering 98% drop in Bitcoin Ordinals NFT trading volume since May, plummeting from $452 million to just $3 million.

Transaction numbers also fell by approximately 97% to 20,571 during this period.

While DappRadar acknowledges the decline, they emphasize the need for more time to discern if this is a short-term hiccup or a deeper issue with Bitcoin-based NFTs.

DappRadar's recent report reveals a staggering 98% drop in Bitcoin Ordinals NFT trading volume since May, plummeting from $452 million to just $3 million.

Transaction numbers also fell by approximately 97% to 20,571 during this period.

While DappRadar acknowledges the decline, they emphasize the need for more time to discern if this is a short-term hiccup or a deeper issue with Bitcoin-based NFTs.  JPMorgan reports that Bitcoin miners are diversifying their operations in anticipation of the upcoming halving event, which will slash their rewards. Miners are now venturing into the booming artificial intelligence (AI) market, offering high-performance computing services. This shift is partly funded by selling newly minted or existing bitcoins. Companies like Applied Digital and Iris Energy are already making strides in AI cloud services. Additionally, post Ethereum's shift from proof-of-work, former Ethereum miners are leveraging GPUs for AI, finding it potentially more profitable than traditional mining.

JPMorgan reports that Bitcoin miners are diversifying their operations in anticipation of the upcoming halving event, which will slash their rewards. Miners are now venturing into the booming artificial intelligence (AI) market, offering high-performance computing services. This shift is partly funded by selling newly minted or existing bitcoins. Companies like Applied Digital and Iris Energy are already making strides in AI cloud services. Additionally, post Ethereum's shift from proof-of-work, former Ethereum miners are leveraging GPUs for AI, finding it potentially more profitable than traditional mining.  Grayscale Investments is gearing up for a potential positive outcome in its lawsuit with the SEC, as it begins hiring for its ETF team. The firm is on the lookout for a "Senior Associate, ETFs" to bolster its ETF business development.

This move comes as the crypto community eagerly awaits a court decision on Grayscale's proposal to convert its GBTC fund into a spot bitcoin ETF.

The outcome could set a precedent for other asset managers seeking approvals for spot bitcoin funds, influencing the future of crypto ETFs.

Grayscale Investments is gearing up for a potential positive outcome in its lawsuit with the SEC, as it begins hiring for its ETF team. The firm is on the lookout for a "Senior Associate, ETFs" to bolster its ETF business development.

This move comes as the crypto community eagerly awaits a court decision on Grayscale's proposal to convert its GBTC fund into a spot bitcoin ETF.

The outcome could set a precedent for other asset managers seeking approvals for spot bitcoin funds, influencing the future of crypto ETFs.  The issuer of USDT has resolved to end support for Kusama, Bitcoin Cash SLP, and Omni Layer. This move follows an in-depth analysis of the functionality, safety, and stability of these particular blockchains.

Notably, Omni Layer, Tether's first transport layer since its inception in 2014, was instrumental during its early days. However, it has witnessed a decline in popularity due to rising competitive solutions.

Though minting of USDT on the aforesaid platforms will be terminated, the redemption process will stay in place for a duration extending at least a year.

The issuer of USDT has resolved to end support for Kusama, Bitcoin Cash SLP, and Omni Layer. This move follows an in-depth analysis of the functionality, safety, and stability of these particular blockchains.

Notably, Omni Layer, Tether's first transport layer since its inception in 2014, was instrumental during its early days. However, it has witnessed a decline in popularity due to rising competitive solutions.

Though minting of USDT on the aforesaid platforms will be terminated, the redemption process will stay in place for a duration extending at least a year.  Quantum Blockchain Technologies (QBT), a research company, has unveiled an innovative bitcoin mining method that utilizes artificial intelligence.

According to the company's statement, this new approach to hash verification, as opposed to random selection, boosts the chances of finding a winning hash by approximately 260%.

Quantum Blockchain Technologies (QBT), a research company, has unveiled an innovative bitcoin mining method that utilizes artificial intelligence.

According to the company's statement, this new approach to hash verification, as opposed to random selection, boosts the chances of finding a winning hash by approximately 260%.  The current market landscape marks an unprecedented decline in liquidity, according to Bloomberg Intelligence's senior macro strategist, Mike McGlone.

If this pattern holds throughout 2023, he warns of a potential sharp descent in Bitcoin prices, which would ripple through Ethereum, XRP, and the general cryptocurrency domain.

“What should be early indications of recessionary times? The best indication should be bitcoin and that’s where I’m looking for the bleeding occasion from bitcoin and it’s still kind of showing what I expected.”

“Picture December: Recession looms, Fed hesitates on easing due to inflation,” said McGlone.

The current market landscape marks an unprecedented decline in liquidity, according to Bloomberg Intelligence's senior macro strategist, Mike McGlone.

If this pattern holds throughout 2023, he warns of a potential sharp descent in Bitcoin prices, which would ripple through Ethereum, XRP, and the general cryptocurrency domain.

“What should be early indications of recessionary times? The best indication should be bitcoin and that’s where I’m looking for the bleeding occasion from bitcoin and it’s still kind of showing what I expected.”

“Picture December: Recession looms, Fed hesitates on easing due to inflation,” said McGlone.