#activity

71 articles found

Latest

Manta, a modular L1 blockchain launched in September 2023, has clinched the 9th position in the list of top projects by Total Value Locked (TVL). With $468 million, it has outperformed rivals such as Sui, Cardano, and Base. Despite this achievement, the trading activity on its DEX remains relatively low ($4.6 million).

Manta, a modular L1 blockchain launched in September 2023, has clinched the 9th position in the list of top projects by Total Value Locked (TVL). With $468 million, it has outperformed rivals such as Sui, Cardano, and Base. Despite this achievement, the trading activity on its DEX remains relatively low ($4.6 million).  In the US, crypto industry lobbying is on the rise, with expenditures reaching $19 million in just the first three quarters of the year, surpassing the previous year's total. In 2022, the total lobbying budget reached $22 million, with FTX contributing significantly.

In the US, crypto industry lobbying is on the rise, with expenditures reaching $19 million in just the first three quarters of the year, surpassing the previous year's total. In 2022, the total lobbying budget reached $22 million, with FTX contributing significantly.  ThorChain's transaction volume has surged to a record $355 million. An influx of hacker activity on the network has led to total transactions topping $1 billion in just five days. Over the past four months, over 50% of the funds swapped from ETH to BTC on ThorSwap have been stolen.

ThorChain's transaction volume has surged to a record $355 million. An influx of hacker activity on the network has led to total transactions topping $1 billion in just five days. Over the past four months, over 50% of the funds swapped from ETH to BTC on ThorSwap have been stolen.  The immense wave of transactions and heightened user activity took Shibarium by surprise, causing some tech glitches, says Shytoshi Kusama, the co-founder of the Shiba Inu ecosystem.

He's also quick to debunk the rumors about funds getting stuck in the bridging contracts, terming it as pure FUD.

"Although we expected a very busy moment, we never expected THIS much traffic, instantly," reflects Shytoshi Kusama.

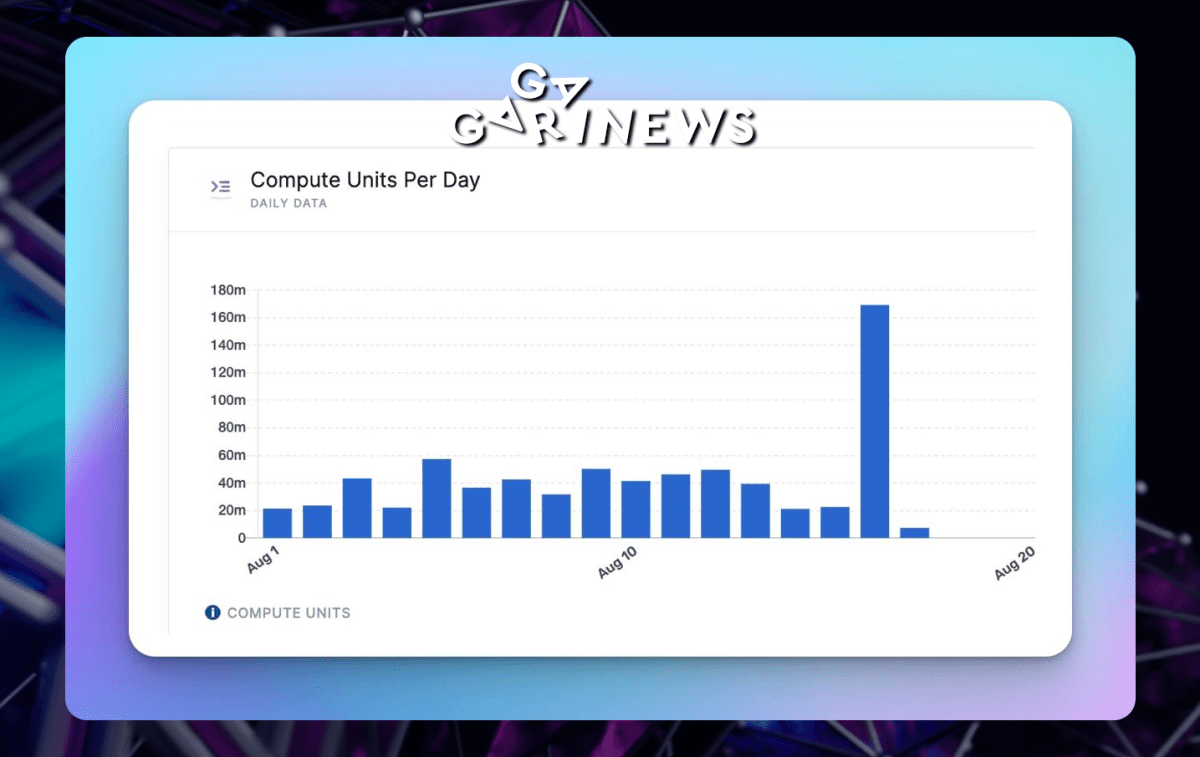

At its launch, the Shibarium team tackled a load of 160 million computational tasks in a span of about 30 minutes, while anticipating only 400 million within a month.

The immense wave of transactions and heightened user activity took Shibarium by surprise, causing some tech glitches, says Shytoshi Kusama, the co-founder of the Shiba Inu ecosystem.

He's also quick to debunk the rumors about funds getting stuck in the bridging contracts, terming it as pure FUD.

"Although we expected a very busy moment, we never expected THIS much traffic, instantly," reflects Shytoshi Kusama.

At its launch, the Shibarium team tackled a load of 160 million computational tasks in a span of about 30 minutes, while anticipating only 400 million within a month.  Hayden Adams, the founder of Uniswap Labs, has dismissed a developer known by the pseudonym AzFlin following allegations of creating a FrensTech meme coin and then withdrawing liquidity shortly after its launch.

Preliminary damages are estimated at 14 wETH, equivalent to approximately $25,830. Adams stressed that the company does not condone such actions and, therefore, felt compelled to respond accordingly.

The developer denies the accusations of fraud and describes the situation as FUD. According to him, he only withdrew 1 ETH from the liquidity pool, which he had initially provided from his own funds.

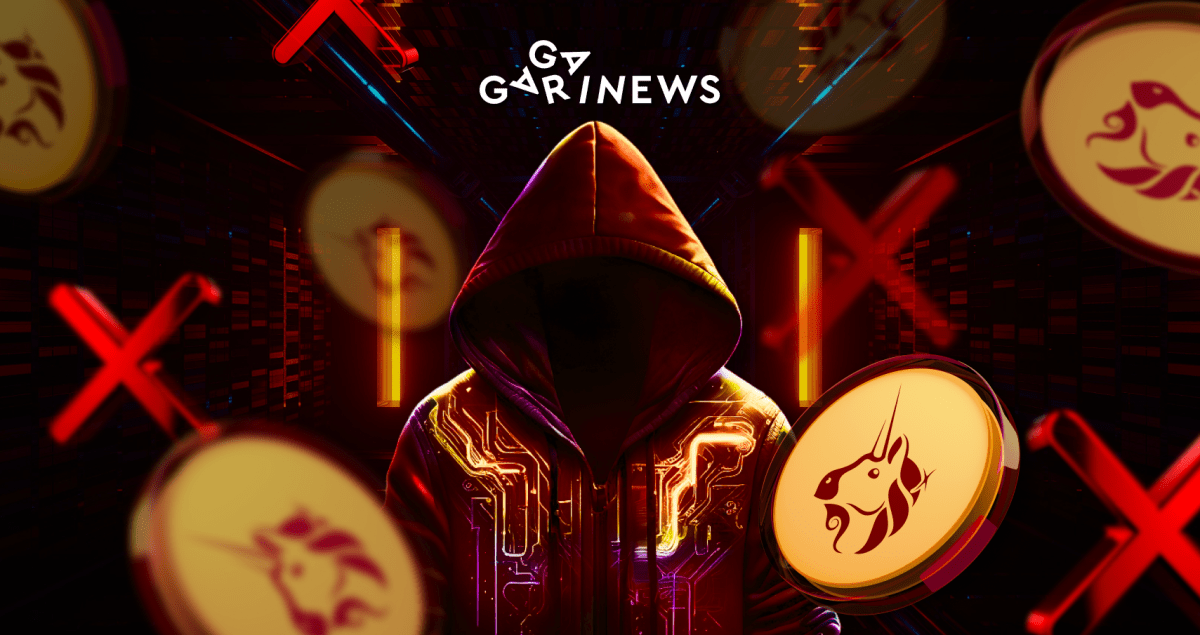

Hayden Adams, the founder of Uniswap Labs, has dismissed a developer known by the pseudonym AzFlin following allegations of creating a FrensTech meme coin and then withdrawing liquidity shortly after its launch.

Preliminary damages are estimated at 14 wETH, equivalent to approximately $25,830. Adams stressed that the company does not condone such actions and, therefore, felt compelled to respond accordingly.

The developer denies the accusations of fraud and describes the situation as FUD. According to him, he only withdrew 1 ETH from the liquidity pool, which he had initially provided from his own funds.  Layer 2 network Optimism has surpassed Arbitrum, recording 944,000 daily transactions, which is nearly 50% more than its former frontrunner with 660,000 daily transactions.

The surge in activity on Optimism can be attributed to the recent Bedrock update and the excitement surrounding the Worldcoin project, which enables user accounts within this network.

However, when it comes to Total Value Locked (TVL), Arbitrum remains in the lead, boasting over $2 billion — twice as much as its competitor.

Layer 2 network Optimism has surpassed Arbitrum, recording 944,000 daily transactions, which is nearly 50% more than its former frontrunner with 660,000 daily transactions.

The surge in activity on Optimism can be attributed to the recent Bedrock update and the excitement surrounding the Worldcoin project, which enables user accounts within this network.

However, when it comes to Total Value Locked (TVL), Arbitrum remains in the lead, boasting over $2 billion — twice as much as its competitor.  Despite the ongoing rally in June, spot trade volumes in Q2 experienced a substantial decline, reaching their lowest level since 2020, according to Kaiko.

Binance saw the most significant drop in trading activity, with volumes plunging by nearly 70%.

Other exchanges such as Coinbase, Kraken, OKX, and Huobi also witnessed a decline of over 50% in trade volumes.

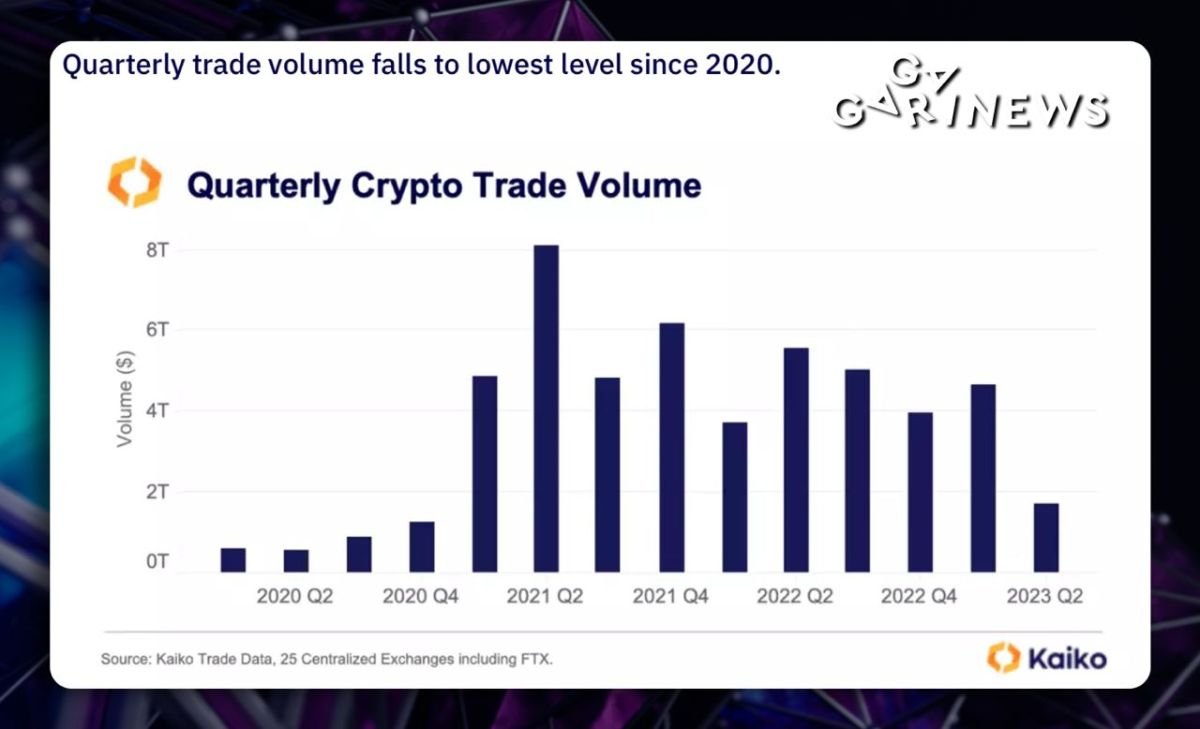

Despite the ongoing rally in June, spot trade volumes in Q2 experienced a substantial decline, reaching their lowest level since 2020, according to Kaiko.

Binance saw the most significant drop in trading activity, with volumes plunging by nearly 70%.

Other exchanges such as Coinbase, Kraken, OKX, and Huobi also witnessed a decline of over 50% in trade volumes. Why Are People Still Buying NFTs in 2023?

The crisis in the non-fungible token market, which for a long time held great appeal for investors, continues. In April 2023, trading activity on NFT marketplaces hit new lows. The daily number of individuals wishing to sell their NFTs consistently exceeded the number of potential buyers.

The crisis in the non-fungible token market, which for a long time held great appeal for investors, continues. In April 2023, trading activity on NFT marketplaces hit new lows. The daily number of individuals wishing to sell their NFTs consistently exceeded the number of potential buyers.  • Growth in economic activity has slowed down.

• Job gains have decelerated, yet unemployment rates remain low.

• The U.S. banking system is sound and resilient.

• Stricter financial and credit conditions for households and businesses may influence economic activity, hiring, and inflation.

• The target inflation rate of 2% remains a constant goal.

• Growth in economic activity has slowed down.

• Job gains have decelerated, yet unemployment rates remain low.

• The U.S. banking system is sound and resilient.

• Stricter financial and credit conditions for households and businesses may influence economic activity, hiring, and inflation.

• The target inflation rate of 2% remains a constant goal. Bitcoin laundering suspicions arise over old wallet activity

A Bitcoin wallet, stagnant since 2018 with a hefty 10,000 bitcoins (approximately $260 million), recently caught the attention of blockchain researcher ZachXBT. It's now moving these assets through certain cryptocurrency mixers, raising eyebrows.

A Bitcoin wallet, stagnant since 2018 with a hefty 10,000 bitcoins (approximately $260 million), recently caught the attention of blockchain researcher ZachXBT. It's now moving these assets through certain cryptocurrency mixers, raising eyebrows.  In his exploration of the $36 billion Horizon Worlds metaverse, video blogger Jarvis Johnson found player activity to be surprisingly sparse.

He counted roughly 900 daily English-speaking users. Many of these were children who managed to circumventing the platform's age restrictions.

These findings cast serious doubt on Meta's prior claim of 200,000 engaged users every month, hinting at possible exaggeration.

In his exploration of the $36 billion Horizon Worlds metaverse, video blogger Jarvis Johnson found player activity to be surprisingly sparse.

He counted roughly 900 daily English-speaking users. Many of these were children who managed to circumventing the platform's age restrictions.

These findings cast serious doubt on Meta's prior claim of 200,000 engaged users every month, hinting at possible exaggeration.  Tether CTO:

"The launch of PayPal stablecoin doesn’t impact Tether as the firm does not serve U.S. users. If PYUSD launches in international markets, it could have a positive impact on the crypto industry and potentially erode revenues for payment giants like MasterCard and Visa."

Co-founder of zkLend:

"PayPal will indeed bolster the perception and acceptance of cryptocurrencies, but it can lead to a diminished market share for decentralized stablecoins, threatening the very principles of decentralization that underpin the crypto space."

Analysts at JPMorgan:

"This could boost Ethereum activity and enhance Ethereum’s network utility as a stablecoin/DeFi platform. PYUSD could fill the void left by the $20 billion shrinkage of Binance's BUSD stablecoin, which was forced to shut down by U.S. regulators earlier this year."

Co-founder of Sei Network:

"The gas fees of using PYUSD will be ridiculous, which will disincentivize its usage. To help make the user experience better, PayPal will either need to subsidize transaction costs or will need to help support PYUSD on other networks with cheaper gas fees."

It's worth noting that PayPal currently serves 435 million customers globally.

Tether CTO:

"The launch of PayPal stablecoin doesn’t impact Tether as the firm does not serve U.S. users. If PYUSD launches in international markets, it could have a positive impact on the crypto industry and potentially erode revenues for payment giants like MasterCard and Visa."

Co-founder of zkLend:

"PayPal will indeed bolster the perception and acceptance of cryptocurrencies, but it can lead to a diminished market share for decentralized stablecoins, threatening the very principles of decentralization that underpin the crypto space."

Analysts at JPMorgan:

"This could boost Ethereum activity and enhance Ethereum’s network utility as a stablecoin/DeFi platform. PYUSD could fill the void left by the $20 billion shrinkage of Binance's BUSD stablecoin, which was forced to shut down by U.S. regulators earlier this year."

Co-founder of Sei Network:

"The gas fees of using PYUSD will be ridiculous, which will disincentivize its usage. To help make the user experience better, PayPal will either need to subsidize transaction costs or will need to help support PYUSD on other networks with cheaper gas fees."

It's worth noting that PayPal currently serves 435 million customers globally.  WhiteBIT has just announced that they've taken a snapshot and closed Zealy quests.

The launch date for the WB Network's mainnet is still under wraps, but it might be coming soon. Right now, the company is busy checking user activity leading up to the snapshot.

So, let's keep our eyes peeled for the airdrop!

WhiteBIT has just announced that they've taken a snapshot and closed Zealy quests.

The launch date for the WB Network's mainnet is still under wraps, but it might be coming soon. Right now, the company is busy checking user activity leading up to the snapshot.

So, let's keep our eyes peeled for the airdrop!