Crypto VC funding in October 2025 - Wu Blockchain report

Venture activity in the crypto sector increased in October. According to Wu Blockchain, around 75 deals were recorded this month, with total funding of roughly $4.6 billion.

The number of funding rounds rose by about 21% compared to September, while the total amount decreased by 25%. Compared with last year, the deal count was about 25% smaller, but the monthly dynamics showed a moderate recovery.

Financing is often split into tranches and tied to specific milestones: launching a testnet or mainnet, passing a smart‑contract audit, acquiring the first paying users, and integrating with partners.

Wu Blockchain’s analysis shows most attention went to projects that help others build products and services: security and custody, developer tools, and compliance services. There is also clear interest in AI + crypto where technology reduces costs or speeds up operations - for example, fraud detection, user support, and data analysis.

The number and size of deals is gradually increasing for projects that connect blockchain with real‑world assets and devices (RWA/DePIN). The share of decentralized finance remains steady thanks to payment and trading services with clear monetization paths. Areas like NFT and GameFi receive funding selectively, tied to specific product hypotheses and user‑growth plans.

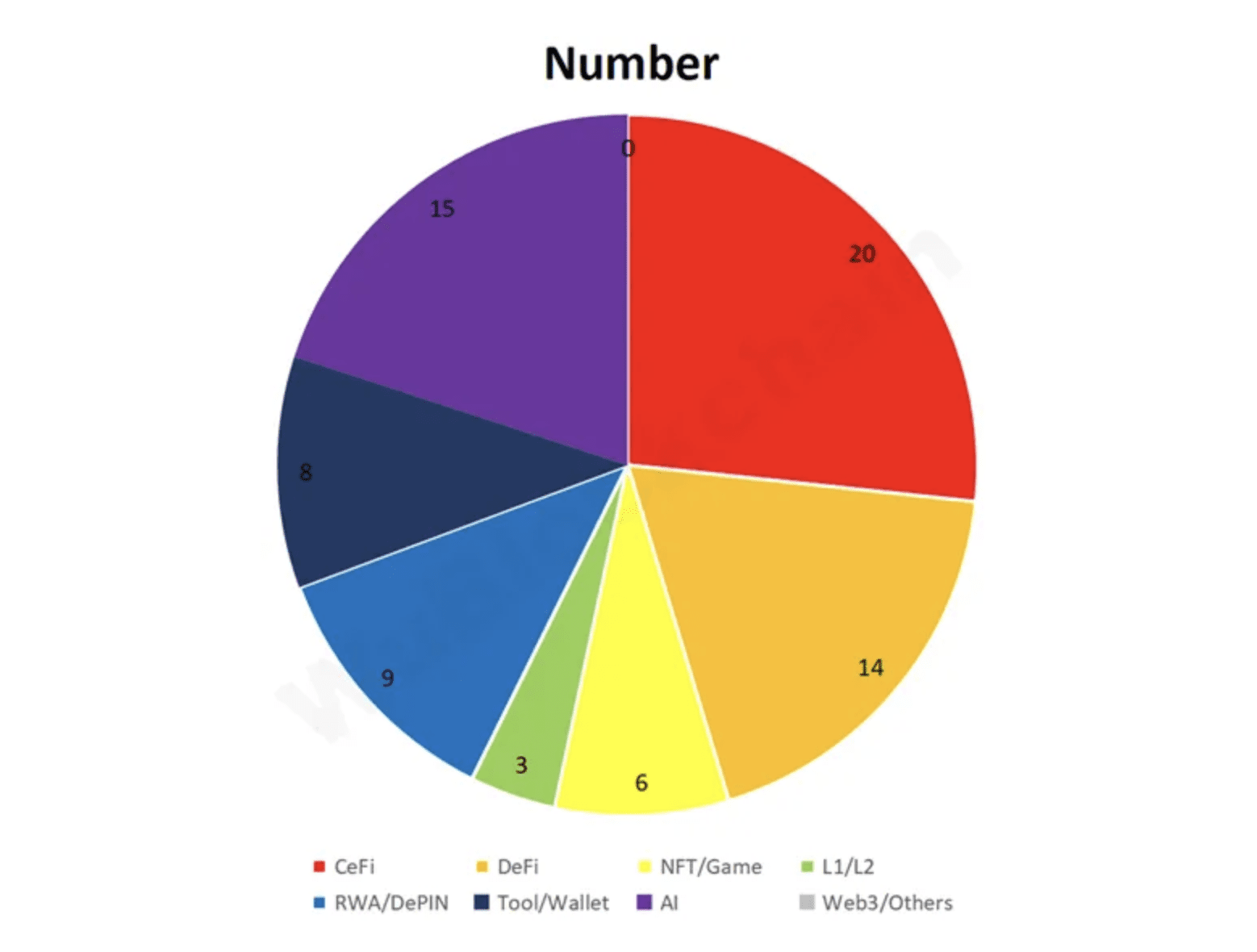

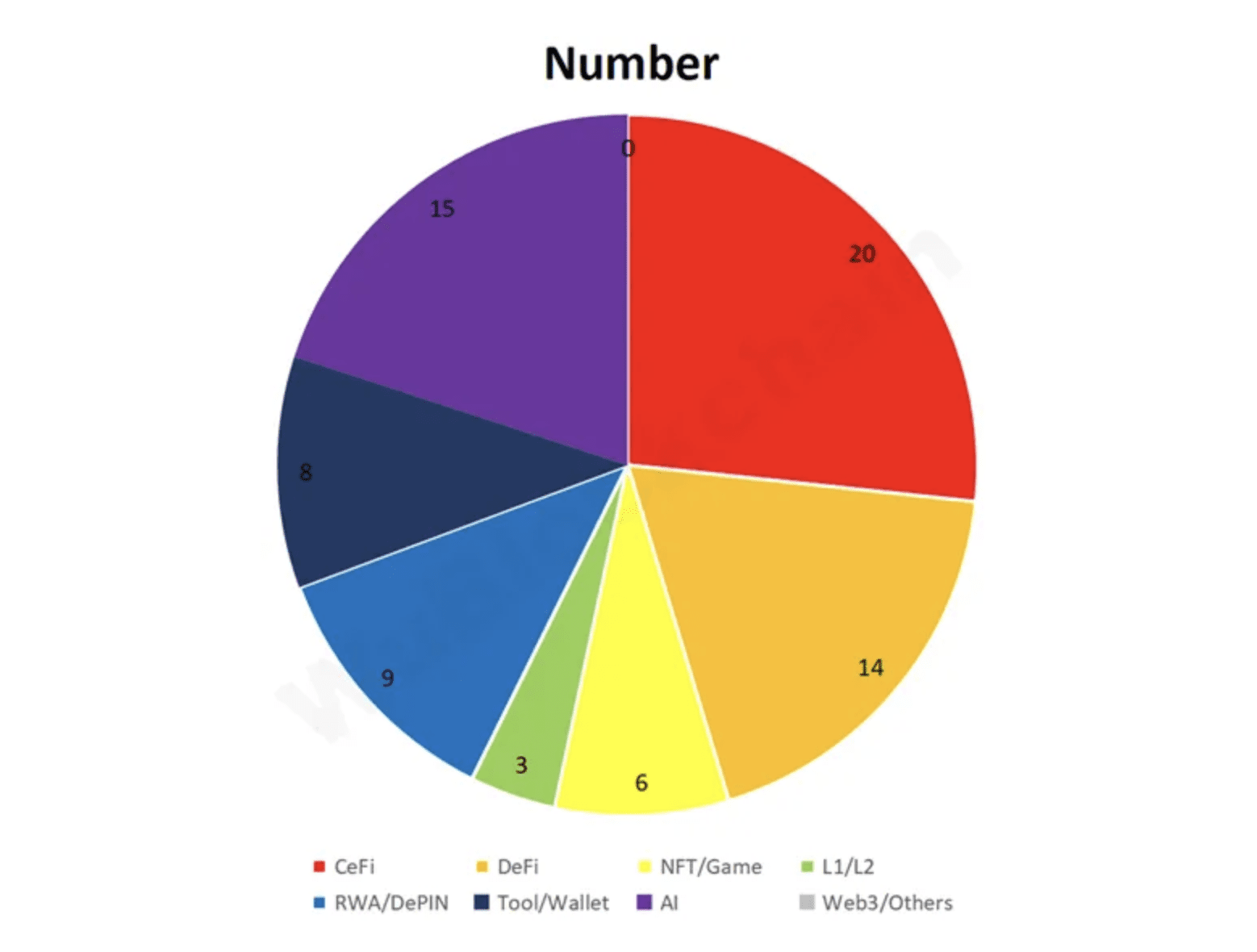

The largest share of deals went to CeFi (≈20%) and AI‑related projects (≈15%). Next come DeFi (≈14%), RWA/DePIN (≈9%), and tools/wallets (≈8%). The smallest shares were in NFT/GameFi (≈6%) and L1/L2 (≈3%).

Sector split of investments. Source: Wu Blockchain

At the same time, large late‑stage rounds are becoming rare. Most funding now goes to early-stage projects where investors look for real evidence that the product works:

- working MVP (a minimal version of the product that can be tested with users),

- active‑user and revenue/MRR stats,

- the share of users retained after 30 days (30‑day retention),

- signed pilots with business clients.

For teams, this means down‑to‑earth expectations and a stronger focus on practical value. Pitch decks alone won’t do: investors expect basic demand and retention metrics, a clear customer value story, and an explanation of how the funding converts into product growth.

If November–December keeps a pace of around 70–90 deals per month and there are no major external shocks, Q4 could consolidate a cautious recovery. Venture money goes where the product is clear, the user benefit is measurable, and the roadmap is transparent. October suggests there are more such cases on the market.

Recommended