PrimeXBT futures review 2026: trading features, fees, and user experience

GNcrypto’s finance team tested PrimeXBT with live futures trading to evaluate fees, leverage, order execution, and overall platform usability. We assessed liquidity and key trust signals and rated the platform 4.0/5.

Fees & Funding

4.5/5

Leverage & Margin

4.5/5

Fees & Funding

4.2/5

Leverage & Margin

4.2/5

Fees & Funding

4.2/5

Leverage & Margin

4.3/5

Fees & Funding

4.4/5

Leverage & Margin

4.2/5

Fees & Funding

3.5/5

Leverage & Margin

3/5

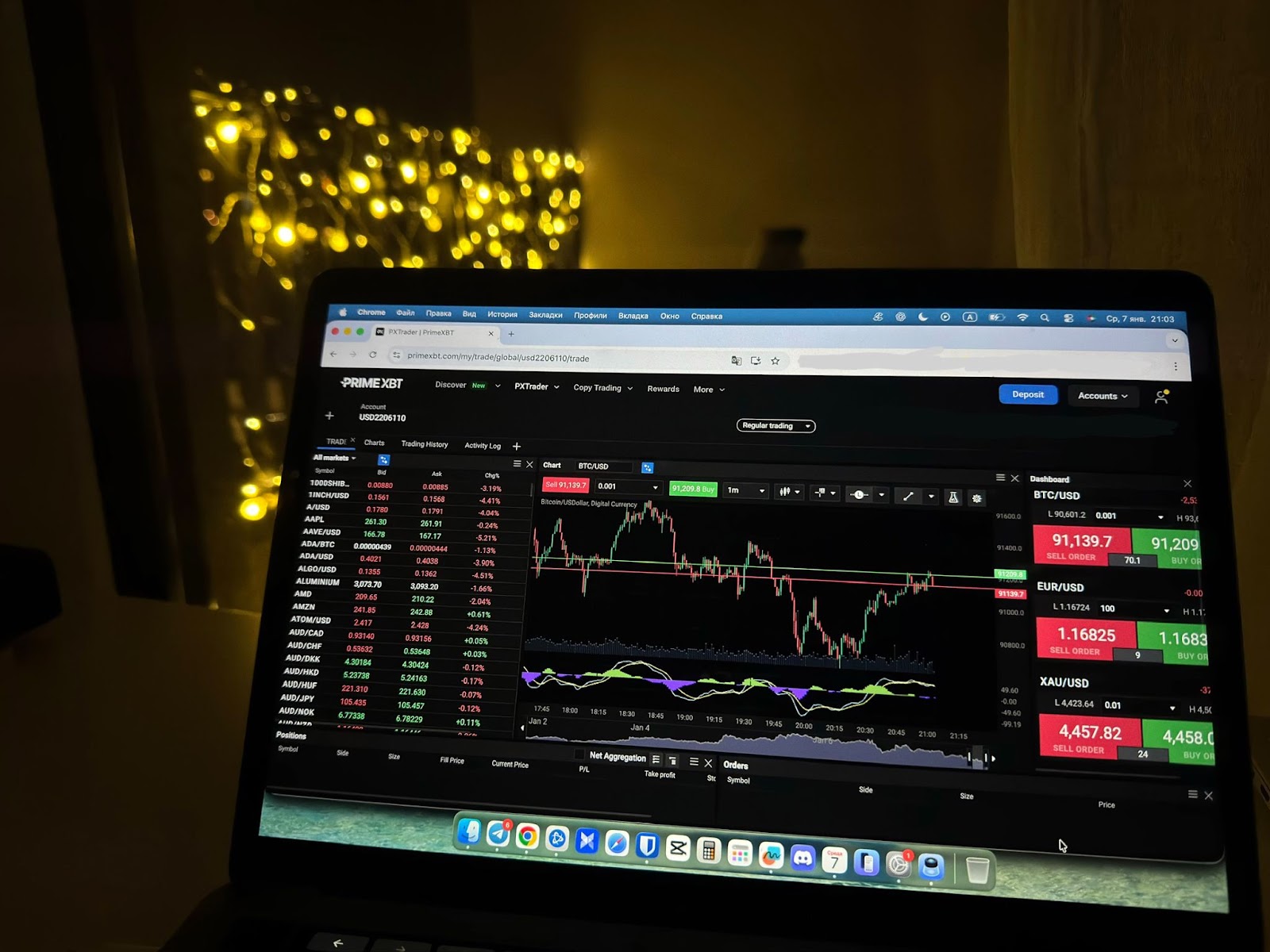

PrimeXBT is a derivatives-focused trading platform specializing in futures and CFDs, with no spot markets or asset custody. We tested the platform with $200 deposited, opening leveraged positions BTC/USD and ETH/USD perpetuals at 10x and 20x. Fees matched the advertised 0.05%, execution stayed reliable on majors, but funding costs added up over multi-day holds. A 50x test position liquidated in under 90 seconds during a 2% BTC drop. The platform does not publish a Proof of Reserves, which makes PrimeXBT primarily a tool for experienced traders rather than long-term investors.

How PrimeXBT futures trading works

In our PrimeXBT reviews, we tested futures trading under real market conditions and immediately noticed a core characteristic of the platform: it supports only perpetual cryptocurrency futures contracts – no expiry dates. We held a BTC long for 5 days without issue, but margin requirements tightened during a -8% cascade, forcing us to add collateral or face liquidation.

The available markets are concentrated around the most liquid crypto assets. During testing, we traded BTC, ETH, and several popular altcoins – and it was on these instruments that the platform delivered its best execution. All trading is conducted via derivatives, with no actual ownership of the underlying assets, which clearly positions PrimeXBT as a speculative trading venue rather than an investment-focused exchange.

Leverage is both one of the platform’s main advantages and a key source of risk. According to FXStreet and our own observations, maximum leverage on crypto futures can reach up to 500:1. We found that leverage levels can be adjusted flexibly when opening a position; however, even at moderate settings, small price moves have an immediate impact on margin.

We tested leverage limits deliberately: a $20 position at 125x controlled $2,500 notional on XRP/USD. When XRP dropped 2.3% in 4 minutes, the position liquidated before our stop-loss at -50% could execute. The liquidation fee took the remaining margin. At extreme leverage, liquidation engines move faster than stop orders – risk controls need to account for that gap.

Order execution during our tests was consistently stable. Market orders were filled almost instantly, with no noticeable delays. Limit orders were correctly placed in the order book and triggered once the price was reached. We did not observe significant slippage under normal market conditions, though it can occur during periods of heightened volatility – which is typical for high-leverage derivatives platforms.

The order types available match the needs of active traders: market, limit, stop-loss, take-profit, and OCO (one-cancels-the-other) orders. Funding rates are applied every eight hours, fully in line with the standard perpetual futures model and directly affecting the total cost of holding a position.

Key features & trading tools

PrimeXBT futures targets experienced traders, not beginners – the interface makes that clear. The order book occupies the chart’s usual position, and the position panel defaults to a collapsed state. We spent the first few minutes reorienting to the layout. If you’re coming from Binance or Bybit, expect a learning curve.

The charting module is built on TradingView, which immediately provides access to a wide range of indicators, timeframes, and technical analysis tools. During testing we encountered no chart refresh delays or price desynchronization – quotes on liquid pairs were in line with broader market data.

We rate execution quality on major crypto pairs as above average. According to FXStreet, PrimeXBT uses an aggregated liquidity model, and in practice this is reflected in tight spreads on BTC and ETH. Spreads widen on less liquid altcoins, which we view as a limitation for short-term scalping outside of top-tier markets.

The Covesting (copy-trading) module showed transparent stats during our follower test: one trader had +47% returns but a -22% max drawdown. We allocated $50 to follow them, and trades mirrored instantly – but when they took a 15% loss on an ETH short, so did we. The 20% profit-share fee stung: a $10 gain became $8 after the platform and trader took their cut. Trades are copied automatically and without noticeable delays; however, the fee model must be taken into account – a significant share of profits (up to 40%) is distributed between the trader and the platform.

A practical advantage is the presence of a full-featured mobile app that doesn’t feel like a stripped-down version of the web terminal. All key functions are available in the app: opening and closing positions, order management, margin monitoring, and working with Covesting.

PrimeXBT prioritizes speed, leverage, and multi-asset access – not onboarding simplicity. If you’re looking to hold ETH long-term, this isn’t the platform. If you want to short oil while longing BTC at 50x leverage, it delivers.

Fees, costs & leverage

We conducted a separate test of PrimeXBT’s fee structure, as in derivatives trading the true cost of a transaction is determined not only by trading fees, but also by funding rates, spreads, and the impact of leverage on margin.

According to FXStreet and our own testing, PrimeXBT applies a fixed-fee model with no classic maker/taker split:

- Cryptocurrency futures: 0.05% per trade

- Forex and metals: 0.001%

- Indices, oil, and gas: 0.01%

The fee is charged when a position is opened. During active trading, we noticed that for high-frequency strategies (scalping and intraday), the crypto futures fee starts to noticeably affect overall performance, especially when using small take-profit targets.

As with most perpetual futures platforms, holding a position is accompanied by funding rates, which are applied every eight hours. Their size depends on the imbalance between longs and shorts in the specific market.

During testing we observed the following:

- funding on BTC and ETH is generally moderate;

- during sharp directional moves, the rate can rise quickly, increasing the cost of holding a position;

- with high leverage, funding becomes a noticeable factor even over short holding periods.

This is a standard mechanism for perpetual futures, but it’s important to account for it – especially when trading ranges rather than momentum.

PrimeXBT does not charge deposit fees, which is confirmed both in the documentation and in practice. Deposits can be made in cryptocurrency or via third-party payment providers (fiat on-ramps), where fees depend on the specific service provider.

When it comes to withdrawals, the situation is different:

- Fiat withdrawals are not supported at all;

- Withdrawals are only possible in cryptocurrency;

- A fixed withdrawal fee applies, depending on the specific asset (not a percentage of the amount).

One of PrimeXBT’s most aggressive features is its leverage:

- Cryptocurrency futures: up to 500:1

- Forex pairs: up to 1000:1

- Indices and commodities: lower, depending on the instrument

During the review of PrimeXBT, we observed that the platform lets you dial leverage freely, but defaults are aggressive. We opened a position and the slider defaulted to 100x. At 50x, a 2% move wiped half our margin. At 100x, a 1% move liquidated us. One careless click and your account is toast.

PrimeXBT does not impose leverage limits, nor does it provide protection against mistakes – full responsibility for risk management rests entirely with the user.

PrimeXBT pros and cons

After several days of active testing on PrimeXBT in real market conditions, we were able to pinpoint where the platform genuinely gives traders an edge and where its limitations lie — information that’s important to know upfront.

Strengths:

- Wide range of assets and shorting capability. We tested opening positions simultaneously on BTC, ETH, and crude oil and found it easy to diversify risk, including taking short positions. For example, when BTC dropped 3% in a couple of hours, our short position executed instantly, generating noticeable profit.

- High leverage. Testing 100x leverage on BTC/USD allowed us to open positions far exceeding our own capital. This gave a real sense of profit potential, but also highlighted how quickly margin can be eroded during volatility. For experienced traders, this is a major advantage; for beginners, it’s a clear reason for caution.

- Covesting copy trading. We followed one of the top traders’ strategies and observed trades being copied automatically. This is very convenient if you don’t have the time to monitor markets all day. It’s important, however, to check the trader’s statistics – we noticed some strategies take higher risks, which can lead to unexpected drawdowns.

- Convenient mobile app. We opened positions from our phone while on the move – all functions worked without limitations. Charts, orders, and margin management are all accessible on a single screen.

- Low fees. Trading costs were almost negligible during testing. On crypto futures and CFDs, we paid virtually no commissions, only spreads, which is convenient for frequent trading.

- Responsive and relatively fast support. We reached out regarding a verification issue. A bot responded first but quickly transferred us to a live agent within 3 minutes, who promptly addressed our questions.

Weaknesses:

- No spot trading. We wanted to buy a small amount of ETH for “holding,” but PrimeXBT does not allow ownership of actual coins. All positions are derivative-based. If your goal is investing rather than speculation, this is an immediate limitation.

- High leverage risk. When tested 500x on XRP – liquidated in 3 minutes during a 0.4% pullback. We had a stop-loss set at 0.5%, but price gapped through it and the liquidation engine hit first. At extreme leverage, stop-losses don’t save you – you need wider buffers or lower leverage.

- Country restrictions. We attempted to register an account using a US VPN – it didn’t work. The platform is unavailable in several major countries, including Canada, France, Japan, and Israel. Trying to bypass this may result in account suspension.

- Crypto-only withdrawals. We wanted to cash out $150 in profit to a bank card – impossible. We withdrew BTC, paid a $3.50 network fee, sent it to Kraken, sold it to USD, then withdrew. The entire process took 6 hours and cost $8 in combined fees. Frustrating.

- No built-in VPS. For high-frequency trading, the lack of a native VPS was a limitation. We had to rely on third-party solutions to minimize delays during fast market moves.

- Complex and unfamiliar interface. Switching from BTC to ETH futures required 4 clicks through nested menus. The position panel defaulted to “closed,” hiding our open trades. We eventually found the funding rate history buried in account settings. If you’re used to Binance’s layout, prepare for confusion.

Trustworthiness Check

We reviewed the key reliability signals for PrimeXBT.

- Apr 23, 2024 – PrimeXBT was officially acceptedʼ into the Financial Commission, an independent organization for resolving disputes between traders and brokers. The Commission provides a compensation fund of up to approximately €20,000 in cases of unresolved client complaints.

- Apr 15–16, 2025 – PrimeXBT was awarded “Most Trusted Online Broker 2025” by International Business Magazine, a global publication recognizing platforms with high standards of transparency, security, and customer service.

- June 1, 2025 – PrimeXBT obtained an FSCA (Financial Sector Conduct Authority) license in South Africa, expanding its regulatory coverage in this jurisdiction and strengthening the legal framework for serving clients in the country.

Financial Commission membership and FSCA licensing provide some legal recourse, but the €20,000 compensation cap won’t cover serious losses. The lack of Proof of Reserves is a red flag – we have no way to verify PrimeXBT actually holds user funds in reserve. For a derivatives-only platform handling leveraged positions, this transparency gap is concerning.

GNcrypto’s overall rating

| Criteria | Rating (out of 5) | Weight | Notes |

|---|---|---|---|

| Trading Fees & Funding Costs | 4.5/5 | 25% | Low trading fees (0.05%), but funding adds up on multi-day holds |

| Leverage & Margin Requirements | 4/5 | 20% | Up to 500x available, flexible isolated/cross margin, but no beginner protections |

| Contract Selection & Liquidity | 4/5 | 15% | Strong BTC/ETH depth, but altcoin spreads widen fast |

| Platform Performance & Risk Controls | 4/5 | 15% | Solid execution during testing, but liquidations hit faster than stops |

| Security & Regulatory Compliance | 3.5/5 | 10% | Financial Commission + FSCA licensed, but no Proof of Reserves |

| User Experience & Trading Interface | 3.5/5 | 10% | TradingView charts are great, but layout confuses Tier-1 exchange users |

| Customer Support & Educational Resources | 3.5/5 | 5% | Live chat responded in 3 minutes, but limited futures-specific guides |

Final Score: 4/5

Our verdict: PrimeXBT delivers competitive fees and deep liquidity for experienced futures traders comfortable with high leverage. Lack of Proof of Reserves and a steep learning curve make it unsuitable for beginners or conservative traders.

Methodology – Why You Should Trust Us

We tested PrimeXBT using our weighted, category-based model, depositing $200 in BTC and opening leveraged positions (10x-50x) on BTC/USD and ETH/USD perpetuals. We monitored funding rates over 5 days, tested stop-loss execution during volatility, measured spreads during US and Asia trading hours, and withdrew funds to verify processing times. We rate platforms on 7 weighted criteria with scores from 1.0 to 5.0. Our testing uses real capital, not demo accounts.

Read our full methodology: How We Test Crypto Futures Trading Services

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.