Prediction markets hit new trading-volume records

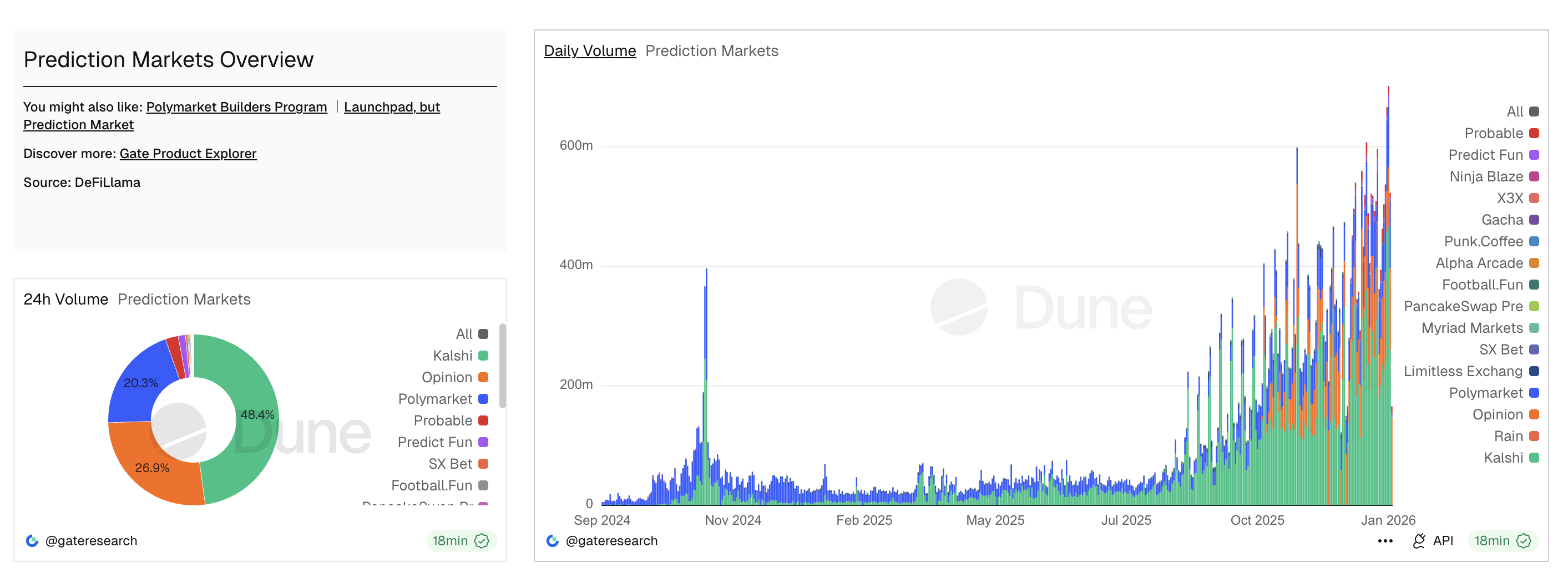

Just a couple of years ago, prediction markets felt like niche venues for political bets. By the end of 2025, they had started to look more like financial infrastructure with billions in turnover. Reports say weekly trading volume in this market has topped $2 billion for the first time.

Polymarket has been the main growth engine, accounting for more than 52% of global volume. Its closest competitor, the regulated platform Kalshi, is also expanding quickly. It holds roughly 47% of the market with about $950 million in weekly turnover.

For context, in November 2025 Kalshi and Polymarket reportedly cleared around $9.5 billion combined. Kalshi contributed about $5.8 billion, while Polymarket exceeded $3.7 billion for the month.

The surge in interest was driven by more than headline geopolitical events. The menu of contracts has expanded, too. Traders now place positions on Ethereum’s price, Federal Reserve rate decisions, sports outcomes, and even box office performance for new movie releases.

Rising liquidity is happening alongside rising visibility. For example, CNN picked Kalshi as an official prediction-market data partner. For platforms, that kind of placement helps them stay in the news cycle. For viewers, though, a contract price can look like a clean “probability,” even though it is shaped by liquidity, the news flow, and who is trading.

At the same time, the legal debate is getting louder. Regulators and courts are still arguing about where the line sits between an event-based financial contract and a traditional wager. In Tennessee, a judge temporarily paused a regulator’s effort to restrict access to Kalshi’s sports markets. In Connecticut, regulators sent Robinhood, Crypto.com, and Kalshi a cease-and-desist order demanding they stop offering certain sports-related contracts. That contract-versus-bet distinction directly affects how widely these products can be offered across U.S. states.

There are also questions about how platforms settle disputed outcomes. After the controversy around Venezuela-related contracts, Polymarket reportedly rejected paying out a market after a raid, putting the spotlight back on settlement processes, data sources, and insider-trading concerns. Against that backdrop, Kalshi’s CEO publicly backed the idea of banning insider trading in prediction markets.

Platforms are also broadening distribution and trying to look more regulated and mainstream. That shift is drawing attention from major market players. Coinbase is planning to roll out prediction markets and in-house tokenized stocks. Meanwhile, Gemini launched regulated prediction markets under a designated contract market model and said the product is available in all U.S. states.

This type of rollout helps platforms position prediction markets inside a broader federal framework, not only within crypto-native rails.

Another trend is automation. One example is Prophet Arena, where users test onchain agents and copy-trading strategies tied to Polymarket markets. Tools like these can lower the barrier to entry, but they can also push more volume into the most popular markets and amplify short-term price distortions.

The industry is also debating how much of the headline activity reflects real demand versus bots or manufactured churn. A Columbia University study estimated that roughly 25% of Polymarket’s trading volume could be artificial. With record numbers on the board, the push for clearer rules, monitoring, and transparent settlement procedures is only getting stronger. Otherwise, allegations of inflated volume may give regulators a fresh reason to tighten restrictions.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.