Fed signals a possible rate hike if inflation fails to ease

The Fed’s January minutes show the regulator is again open to a rate hike if inflation stays above target. Markets are cautious – investors await the March meeting.

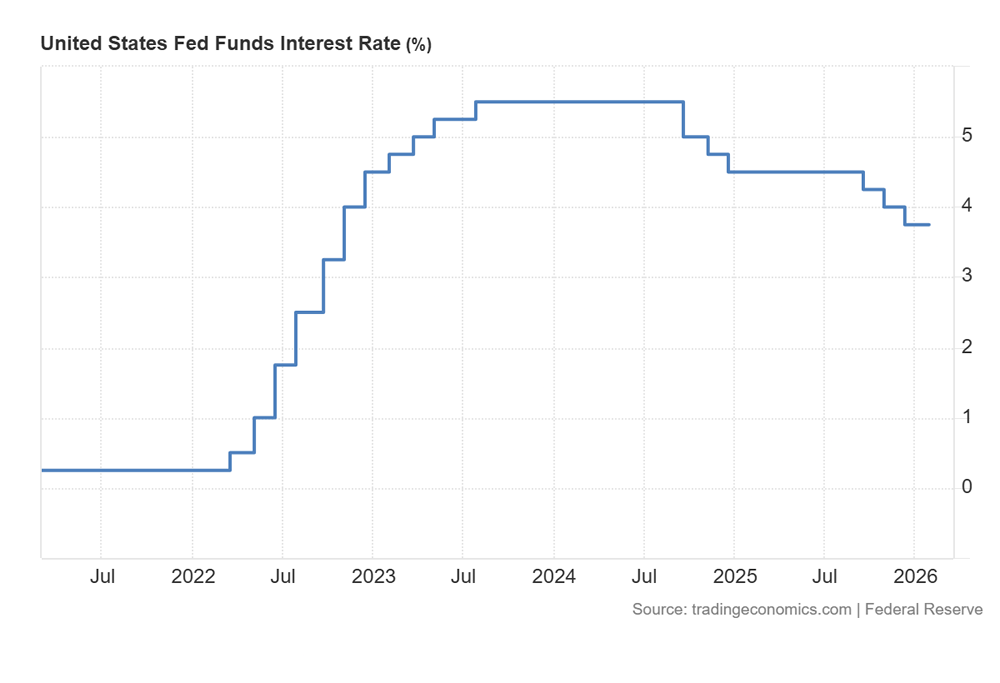

The Federal Reserve discussed the possibility of another rate hike in January – the first such consideration since 2023. According to the newly released minutes, several FOMC members said they would support tighter policy if inflation remains stuck above 2%.

The rate was held at 3.5–3.75% after three cuts at the end of 2025. But the mention of a potential shift back toward tightening surprised markets: “several participants” noted that a hike could be warranted if disinflation slows. CME futures currently assign only a 6% probability of a rate change at the March meeting.

The minutes highlight growing caution inside the committee. A large group of members supports an extended pause, arguing the economy needs “more information” before resuming the easing cycle. Others insist that without clear evidence of renewed disinflation, further cuts would be inappropriate.

US inflation stands at 2.4% – still above target. January’s 0.2% CPI increase has reinforced concerns that returning to a stable 2% path may take longer than expected. The minutes warn of a “significant risk” that inflation could remain above target for longer.

For crypto markets, such signals are typically bearish. Higher rates increase the appeal of bonds and cash, restrict cheap leverage, and cool speculative activity. With sentiment already weak, even hints of renewed tightening from the Fed can intensify pressure on risk assets.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.