Bisq review crypto – is privacy worth the P2P pain?

If centralized exchanges (CEXs) are the shiny, glass-walled banks of the crypto world, Bisq is the underground hacker basement where the real magic – and the real headaches – happen.

There’s no CEO to complain to, no “Forgot Password” button, and definitely no KYC officer asking for a selfie with your passport.

We’ve always been told that Bisq is the gold standard for privacy-maximalists, but let’s be real: usually, “decentralized” is just code for “terrible user interface.” To see if Bisq is actually usable for the average human (or just for people who live in Linux terminals), we went undercover.

Armed with a $200 mystery shopping budget, our team dove into the Bisq DAO. And we got our hands dirty – we moved real funds, navigated the quirks of the BSQ token, and braced ourselves for the possibility of a dispute just to see if the decentralized arbitration system actually has teeth. Is this the future of sovereign trading, or is it just an over-engineered obstacle course? Here is our unfiltered, hands-on Bisq review.

What makes Bisq different

If you’re used to the “P2P” sections on big-name exchanges, forget everything you know. Bisq isn’t a website; it’s a piece of software you run on your own machine. While platforms like Binance or OKX act as the middleman, judge, and jury, Bisq effectively deletes the middleman from the equation entirely. It’s the difference between trading in a high-security bank lobby and meeting someone in a park – except the park is protected by math and the Tor network.

The “holy grail” here is the lack of KYC (Know Your Customer). There is no “Verification” button. No one wants to see your ID, your utility bills, or a video of you turning your head in a circle. Your data stays on your hard drive, not on some server in a tax haven waiting to be leaked. In the middle of our Bisq crypto review testing, we realized just how liberating (and slightly terrifying) this is. You aren’t an “account holder”; you’re a node in a global, censorship-resistant network.

So, how does it stay safe? Instead of a central authority holding your hand, Bisq uses a 2-of-2 multi-signature escrow and a security deposit system. Both the buyer and the seller have to lock up some Bitcoin as collateral. If someone tries to pull a fast one, they don’t just lose the trade; they lose their deposit. It’s a “skin in the game” philosophy that keeps the peace without needing a corporate overlord.

How trades are executed on Bisq

Execution on Bisq is a masterclass in “trustless” engineering. Unlike centralized P2P desks, where the exchange holds your funds in a private wallet, Bisq uses a 2-of-2 multi-signature escrow. When you take an offer, both you and your counterparty must lock a security deposit (plus the trade amount from the seller) into a Bitcoin address that requires two digital signatures to release.

The process follows a strict, decentralized rhythm:

- The lock-up: You both send BTC to the multisig address. This creates “skin in the game.”

- The fiat jump: The buyer sends the fiat (USD, EUR, etc.) via their chosen payment method outside of Bisq.

- The release: Once the seller sees the cash in their bank account, they sign the transaction, and the multisig releases the BTC to the buyer’s wallet.

If you’re comparing platforms, this is a far cry from the high-leverage, centralized chaos, where the “house” always has the final say over your keys. As Bisq reviews note, there is no house. If things go south – say, a seller goes MIA after you’ve sent the wire – the system moves to a three-tier dispute resolution: encrypted chat, then mediation, and finally, a decentralized arbitrator.

The beauty? Even the mediators don’t have your keys. They can’t run off with your money because they don’t hold the third signature; they simply help the peers reach a consensus or use the security deposits to make the wronged party whole.

Supported assets and fiat options

You won’t find the “alphabet soup” of thousands of useless meme coins here. Bisq is a Bitcoin-centric universe. While it technically supports dozens of altcoins (Monero being the fan favorite for the privacy-conscious), everything revolves around the BTC pair. If you’re looking to swap your $200 for a random dog-themed token that launched five minutes ago, you’re in the wrong place.

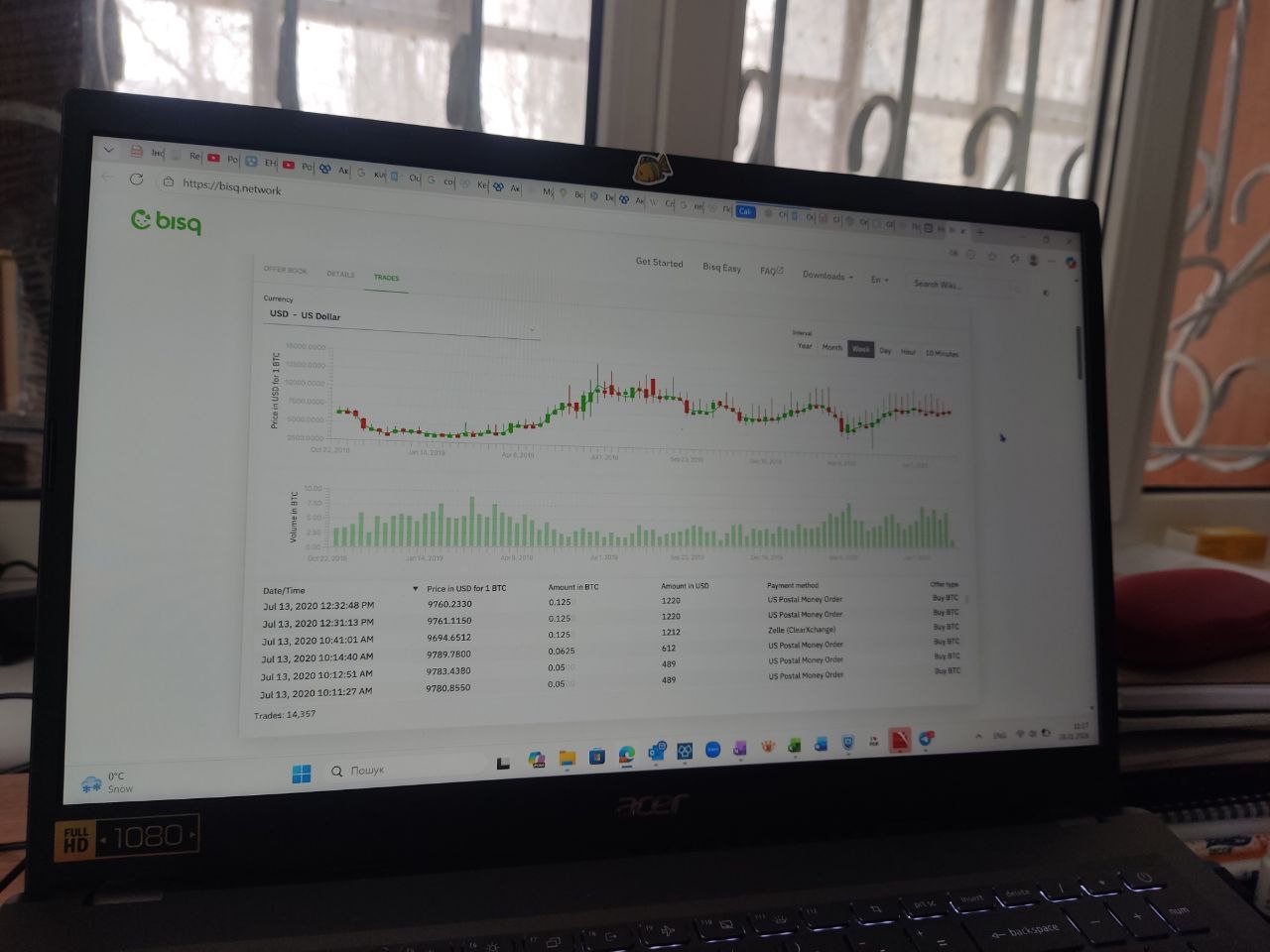

During our mystery shopping, we focused on the most common path: turning fiat into Bitcoin. Bisq supports an impressive array of fiat options – SEPA, Zelle, Revolut, and even Western Union – but the “support” is only as good as the humans on the other side. When we looked at the Bisq p2p order books for our $200 test, we saw plenty of action for USD and EUR, but try trading a more “exotic” currency like the Kazakhstani Tenge, and you might be waiting until the next halving for a counterparty.

Here’s the reality of our $200 experiment:

- The asset spread: We found Monero (XMR) and Bitcoin (BTC) to be the only truly liquid assets. Everything else felt like a ghost town.

- The fiat paradox: There are over 120 fiat currencies listed, but only about 5–10 actually have active “makers” at any given time.

- The BSQ factor: We also had to look at BSQ, the platform’s native token. You don’t need it, but since it cuts trading fees in half, we used a tiny slice of our budget to grab some. It’s a “meta-asset” that keeps the DAO’s lights on.

The asset list is narrow by design. Bisq is trying to be a fortress. If an asset doesn’t help you exit the centralized system, it’s probably not here.

Pros, cons & limitations

How Bisq compares to other P2P platforms when you’re actually in the trenches:

Strengths:

- Since there’s no central server, your data doesn’t just “stay private” – it technically doesn’t exist for anyone but you and your peer. We loved not having to play “show me your passport” just to move $200.

- You aren’t “requesting” a withdrawal from a CEO; you’re interacting with the Bitcoin blockchain directly via multisig. During our mystery shopping, the sense of security knowing Bisq never touches our keys was worth the learning curve.

- Because payments happen peer-to-peer via Zelle or Revolut, your bank just sees a normal transfer to another person, not a red-flagged “Crypto Exchange Inc.” transaction.

Weaknesses:

- To buy Bitcoin on Bisq, you ironically need a little Bitcoin first for the security deposit. We had to dig up an old wallet just to fund our $200 test trade–a major barrier for true beginners.

- This isn’t a “light” app. It’s a full node that runs over Tor. On our test machine, the startup time felt like waiting for a dial-up modem, and it chewed through RAM like a Chrome browser with 50 tabs open.

- Unless you’re trading BTC/XMR or BTC/USD, you might be staring at an empty order book for hours. We tried to find niche fiat pairs and quickly realized Bisq is a “patience-required” zone.

- The interface looks like it was designed by engineers, for engineers. If you aren’t comfortable managing backup seeds or understanding how Tor works, the $200 you put in might feel like it’s trapped in a digital maze.

Our Bisq exchange review shows the platform is a fortress for privacy-maxis, but a frustration for anyone looking for the “one-click” convenience of a centralized app. It’s the best tool for the job, provided you’re willing to learn how the tool works.

Trustworthiness check

When we talk about security on a “decentralized” platform, we usually mean two things: is the code solid, and can I trust the person on the other side? For our $200 mystery shopping mission, we didn’t just want to know if the software worked; we wanted to know if Bisq has ever folded under pressure.

Unlike centralized exchanges that “lose” millions in mysterious database hacks, Bisq’s history is relatively clean – but it isn’t perfect. Because Bisq is open-source and peer-to-peer, the vulnerabilities usually lie in the logic of the trade protocol itself rather than a central honeypot of funds.

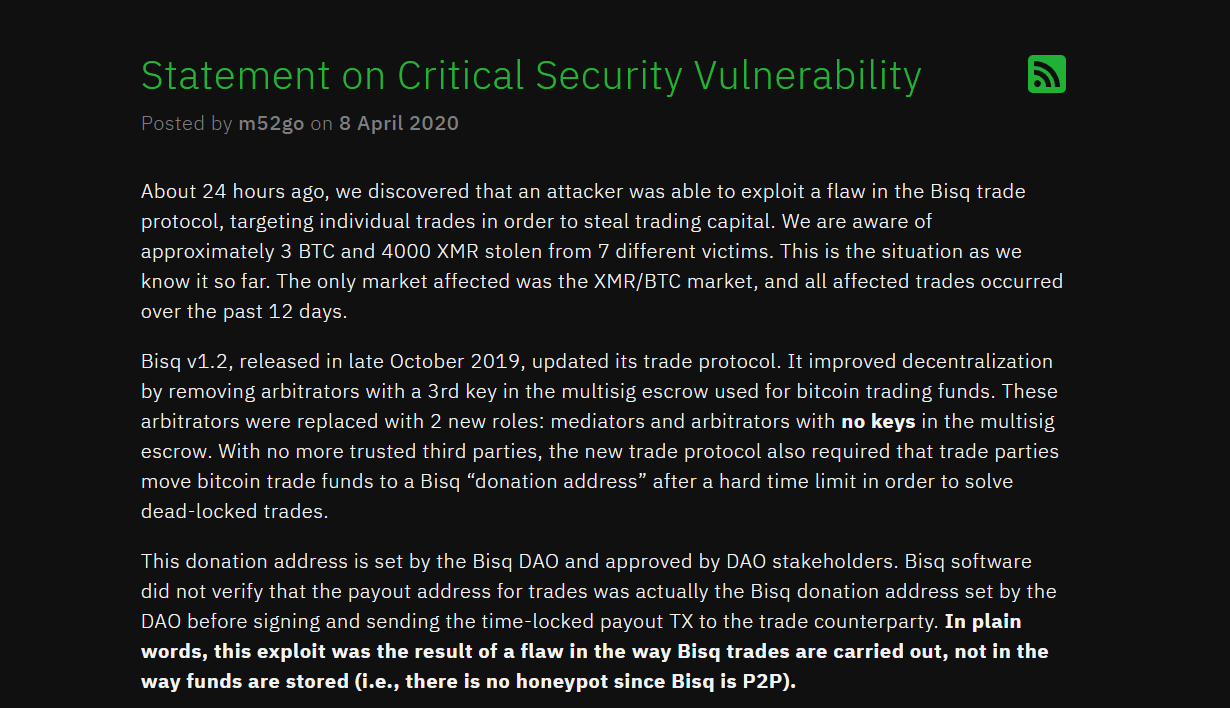

The April 2020 exploit

The biggest stain on Bisq’s record occurred in April 2020. An attacker exploited a flaw in the trade protocol’s move from version 1.1 to 1.2. By manipulating the way the software handled the security deposit and payout, the hacker managed to steal approximately $250,000 (roughly 3 BTC and 4,000 XMR at the time) from 7 different users.

Bisq didn’t hide. They disabled the trading protocol immediately, issued a hotfix within 24 hours, and eventually used the Bisq DAO to compensate the victims. This is a rare “trust win” – even though they were hacked, the community paid the victims back out of future trading fees.

The “chargeback” menace

Beyond code exploits, the biggest risk we identified during our review is “Social Engineering.” Since Bisq handles fiat through traditional banks, a malicious buyer can send you $200 via Zelle, receive the BTC, and then call their bank to claim fraud.

- Our Test Observation: Bisq mitigates this by “signing” accounts. New accounts have tiny limits (like 0.01 BTC) that only grow once you’ve proven you aren’t a scammer.

It’s annoying for our mystery shop, but it’s the only thing keeping the platform from becoming a playground for bank-transfer fraudsters.

The verdict on safety

Bisq is a “trust-the-code” platform. Your biggest threat isn’t a hacker breaking into Bisq HQ (there is no HQ); it’s your own operational security. If you lose your seed phrase or your computer is compromised, there is no “support ticket” that can get your $200 back.

In the world of P2P, Bisq is the closest thing to a digital vault, provided you know how to lock the door yourself.

Bisq – final verdict

After burning through our $200 mystery shopping budget, we’ve concluded that Bisq is the “Final Boss” of crypto exchanges. It is peerless in privacy but demands a level of technical patience that would make a sysadmin sweat. Our experience was a mix of “Aha!” moments and “Why is this still syncing?” frustration.

GNcrypto’s overall Bisq rating

| Criterion | Score |

|---|---|

| Escrow & Trade Safety | 4.5 |

| Liquidity & Order Book Depth | 2.5 |

| Fees & Payment Methods | 3.0 |

| Verification & Account Limits | 5.0 |

| Platform Performance & Reliability | 2.0 |

| User Experience & Trade Flow | 2.5 |

| Customer Support & Dispute Handling | 4.0 |

| Total | 3.5 / 5.0 |

How we test P2P platforms

At GNcrypto, we put transparency first when evaluating peer-to-peer (P2P) cryptocurrency trading platforms. Our reviews are based on hands-on testing and thorough analysis across all key dimensions that matter for safely buying and selling crypto directly with other users.

We do not audit platform solvency or guarantee user safety from all scams. Instead, our scores reflect observable escrow mechanisms, order book depth, and platform support quality. We do not accept payment for ratings or modify scores based on partnerships.

Categories & weights

We rate P2P platforms on seven criteria. Escrow and Liquidity are weighted heaviest because a platform that isn’t safe or has no one to trade with is useless, regardless of how pretty the UI is.

- Escrow & Trade Safety – 25%

- Liquidity & Order Book Depth – 20%

- Fees & Payment Methods – 15%

- Verification & Account Limits – 15%

- Platform Performance & Reliability – 10%

- User Experience & Trade Flow – 10%

- Customer Support & Dispute Handling – 5%

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.