What is crypto liquidity and why it matters for traders

In cryptocurrency markets, cryptocurrency liquidity refers to how efficiently digital assets can be bought or sold without causing major price changes. It serves as a key measure of market health and maturity, indicating how active, balanced, and stable trading conditions are.

On this page

High liquidity supports fair pricing, quick execution, and reduced volatility. These are critical factors for traders managing short-term positions as well as long-term investors seeking predictable market behavior.

When liquidity dries up, price swings intensify and slippage rises, undermining confidence and making markets more fragile. Understanding liquidity, therefore, is essential to reading market sentiment and anticipating capital flows, setting the stage for why liquidity matters in crypto markets.

Why liquidity matters in crypto markets

Liquidity is often described as the backbone of a functioning digital asset market. For traders and investors, it determines how quickly positions can be opened or closed without distorting prices. So, what does liquidity mean in crypto? In practical terms, it means having sufficient market participants to enable smooth trading at stable prices. In a liquid market, orders are filled quickly and fairly, reducing execution risk and maintaining consistent market efficiency.

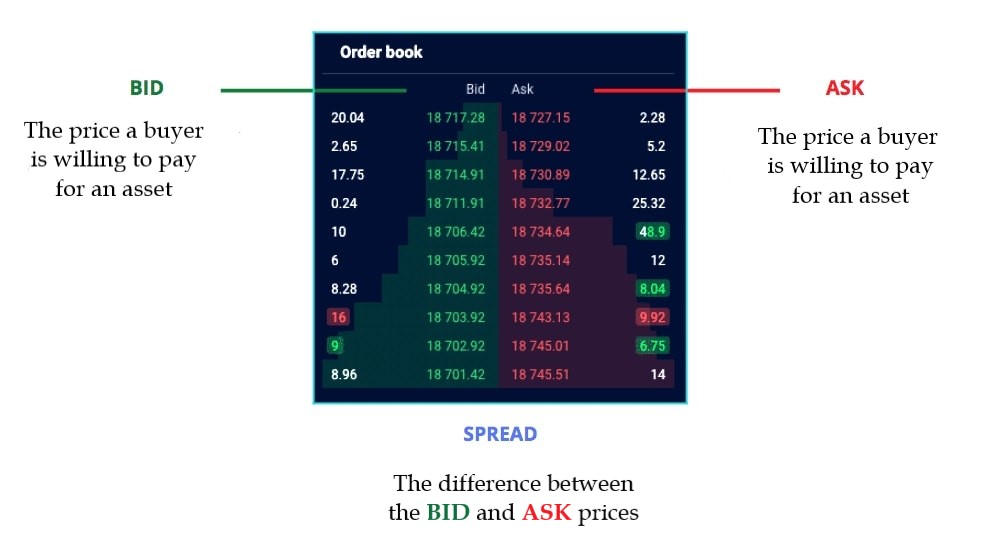

High liquidity translates into tighter bid-ask spreads, smoother trade execution, and less exposure to slippage. It also allows for better price discovery, as active markets reflect consensus valuations rather than isolated trades.

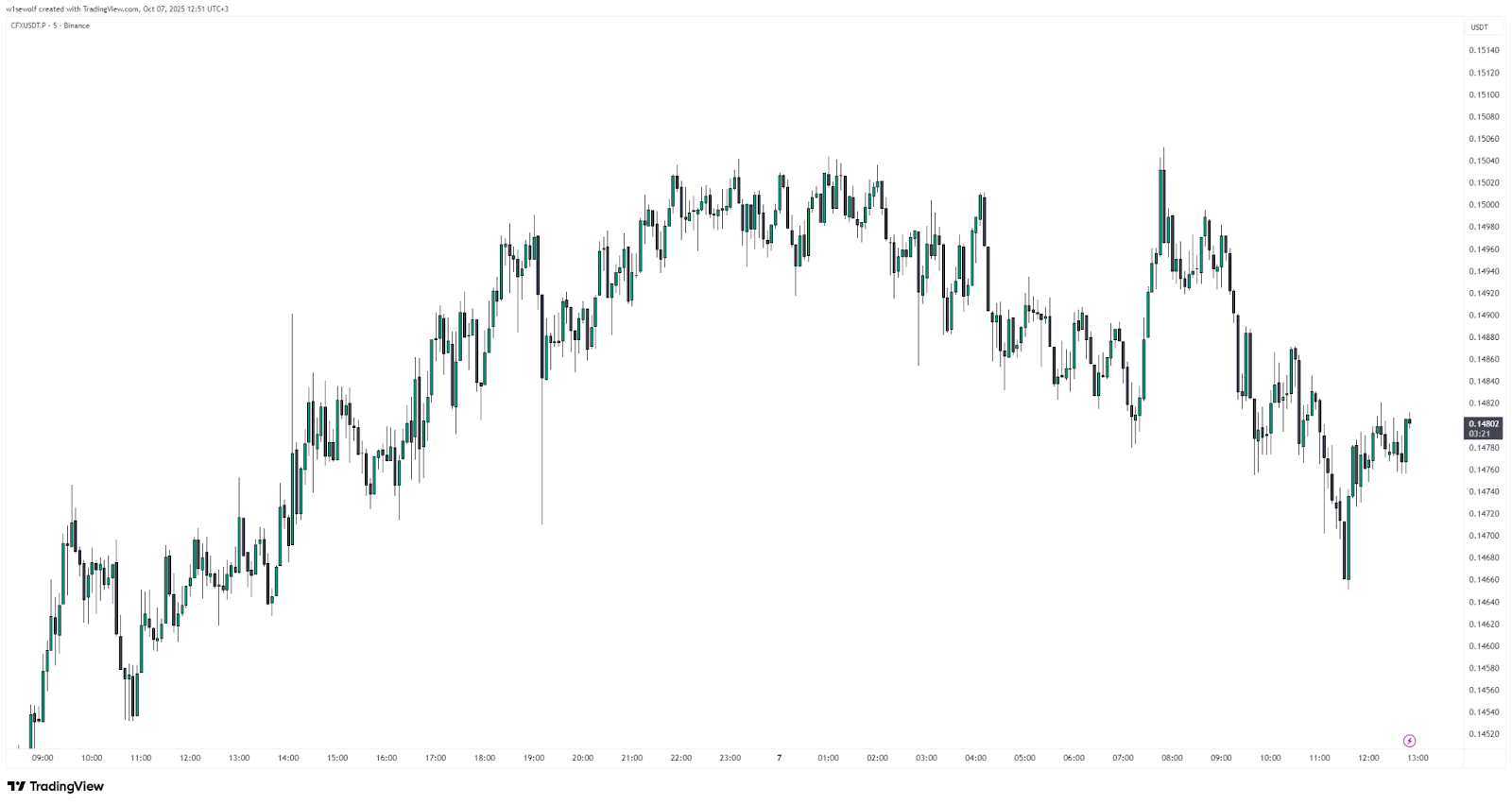

For example, Bitcoin and Ethereum maintain deep liquidity across exchanges, making them less vulnerable to abrupt price spikes. In contrast, smaller altcoins with thin order books can experience double-digit swings from a single large trade.

In short, liquidity not only stabilizes market behavior but also builds confidence among participants. It supports healthy capital inflows, enables institutional trading, and strengthens the foundation for long-term market growth.

How crypto liquidity is measured

Evaluating liquidity in digital asset markets relies on a set of measurable indicators that reflect how efficiently an asset can be traded. Understanding how to check liquidity of a crypto helps traders gauge market depth, stability, and execution quality before entering or exiting a position. The most common metrics include trading volume, bid-ask spread, and market depth, with each offering a distinct view of market activity.

Read more: What is a Footprint Chart and How to Read It?

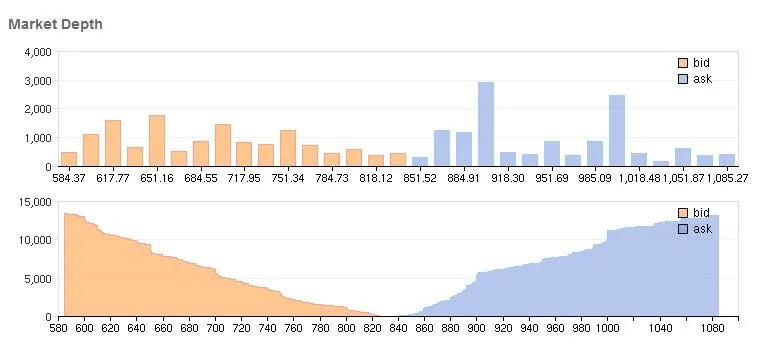

Trading volume represents the total value or number of tokens exchanged within a given timeframe, often over 24 hours. Higher volume generally indicates more active participation and stronger liquidity. The bid-ask spread measures the difference between the highest price buyers are willing to pay and the lowest price sellers will accept; narrower spreads imply a healthier, more liquid market. Meanwhile, market depth reflects the cumulative size of buy and sell orders at various price levels, showing how much pressure the market can absorb before significant price movement occurs.

Platforms such as Binance, CoinGecko, and CoinMarketCap provide real-time data on these indicators, allowing traders to assess market strength. In essence, smaller spreads, deeper order books, and consistent trading volume signal robust liquidity – conditions that reduce volatility and support efficient price discovery.

Factors that influence crypto liquidity

Several interrelated factors determine how easily digital assets can be traded and at what cost. In broader terms, what is liquidity in crypto depends on market participation, exchange infrastructure, and overall investor confidence. One of the strongest drivers is trading volume – the higher the daily activity, the more seamless transactions become. Assets like Bitcoin or Ethereum maintain consistent liquidity because they attract a wide base of retail and institutional participants.

Another important factor is the number of exchange listings. When a cryptocurrency is available on multiple reputable exchanges, its accessibility and trading opportunities expand, boosting overall liquidity. Market makers – entities providing continuous buy and sell orders – also play a central role by narrowing spreads and maintaining market depth.

Beyond technical and structural aspects, liquidity is shaped by token utility and regulatory clarity. Tokens with real-world use cases or strong integration in DeFi ecosystems tend to see steadier demand, while uncertain regulations can discourage trading activity and reduce liquidity. Finally, macroeconomic trends and investor sentiment, such as shifts in risk appetite or global monetary policy, can either strengthen or weaken liquidity across the crypto market.

Examples and real-world implications

The difference between liquid and illiquid cryptocurrencies illustrates how market conditions shape price behavior and trading efficiency. In the case of liquidity in crypto, Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) stand out as highly liquid assets. They trade across dozens of global exchanges with deep order books and large volumes, allowing investors to buy or sell substantial amounts with minimal price impact.

By contrast, small-cap tokens with limited listings and lower demand often face significant slippage and wider bid-ask spreads. A single large order can cause abrupt price swings, making it harder for traders to enter or exit positions efficiently. This low-liquidity environment not only increases volatility but also exposes investors to execution risk and unexpected losses.

In practice, traders manage liquidity risk by focusing on assets with steady trading volume, using limit orders instead of market orders, and diversifying across multiple liquid assets. Understanding these real-world implications helps investors navigate the crypto landscape more strategically, balancing opportunity with the inherent risks of low-liquidity markets.

Conclusion

Liquidity is one of the clearest indicators of how efficient, stable, and mature the cryptocurrency market has become. It underpins smooth trading, fair price discovery, and investor confidence across all asset classes. When liquidity is strong, volatility tends to decrease, trade execution improves, and prices better reflect real demand and supply. Conversely, when liquidity weakens, even minor trades can trigger sharp price reactions and increase overall market risk.

Ultimately, understanding and tracking cryptocurrency liquidity allows traders and investors to make more informed, lower-risk decisions. It provides a window into market sentiment, helps identify sustainable opportunities, and distinguishes robust projects from speculative ones. As the digital asset ecosystem continues to evolve, liquidity will remain the foundation that determines its resilience and long-term growth potential.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.