Gavin Andresen in Epstein’s files: details of contact with Bitcoin developer

Among 3 million pages of Epstein files released by the US Department of Justice on January 30, 2026, are emails from 2011 showing attempts by Jeffrey Epstein to contact Bitcoin developer Gavin Andresen.

On this page

Emails released under the Epstein Files Transparency Act show Jeffrey Epstein attempted to connect with Bitcoin developers in June 2011, including a direct approach to Gavin Andresen that was turned down. The same documents reveal Epstein later donated over $500,000 to MIT Media Lab’s Digital Currency Initiative, which employed Bitcoin Core developers – including Andresen – during a funding crisis in 2015.

The correspondence sheds light on Epstein’s early interest in cryptocurrency and raises questions about how his institutional funding reached open-source developers, even as claims of direct control over Bitcoin development lack evidence in the released files.

Epstein’s contact attempts in June 2011

On June 4, 2011, Jeffrey Epstein emailed tech reporter and entrepreneur Jason Calacanis with a request: “I would like to get in touch with the Bitcoin guys.” Calacanis responded two days later, promising to send contact information for Gavin Andresen and developer Amir Taaki.

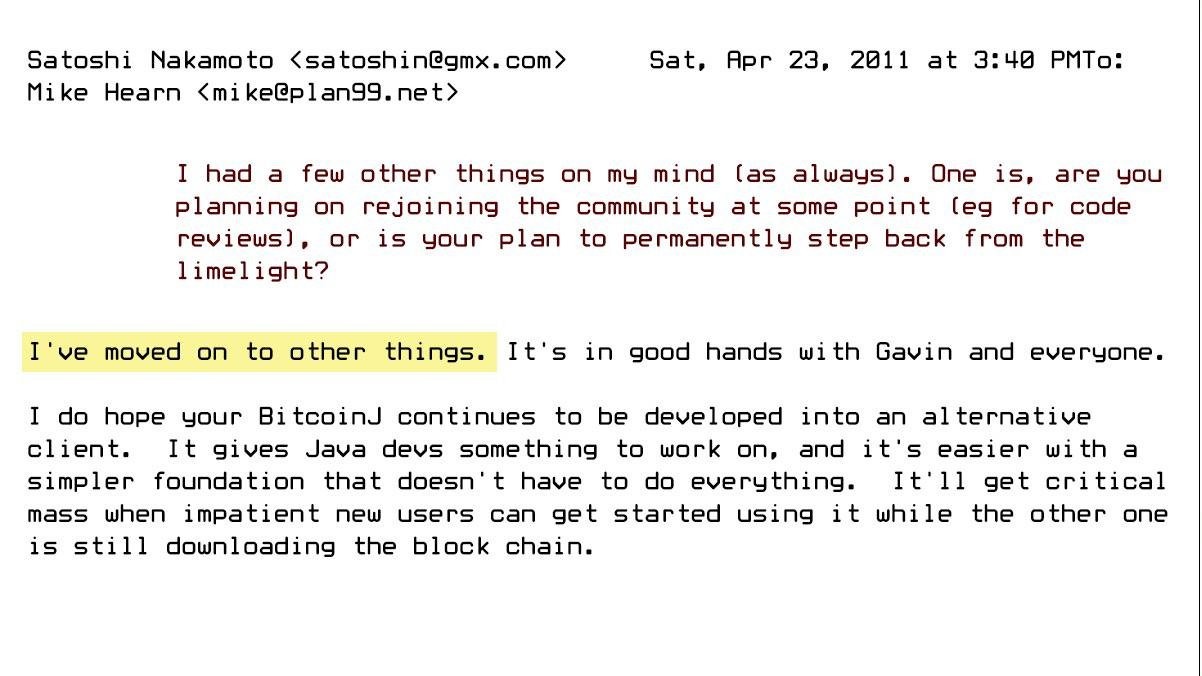

The timing is notable. Andresen had announced in late April 2011 that he would speak about Bitcoin at CIA headquarters in June. Satoshi Nakamoto, Bitcoin’s pseudonymous creator, had retired on April 26, 2011 – one day after Andresen’s announcement – leading to widespread speculation that Nakamoto was uncomfortable with government attention to Bitcoin development.

Despite Nakamoto’s departure, Andresen proceeded with the CIA presentation scheduled for June 14, 2011. Eight days before that meeting, on June 6, Calacanis responded to Epstein’s request. Literary agent John Brockman provided Andresen’s email address to Epstein on June 11.

On June 12, 2011 – two days before Andresen’s CIA appointment – Epstein emailed Andresen directly, requesting a phone call. On June 15, Epstein’s associate Lesley Groff sent a follow-up invitation, noting that Epstein would be at Harvard on June 17 and 18 and would appreciate meeting Andresen if he had availability.

Andresen’s response, sent hours later, was brief: “No, sorry, I’m busy.”

Released documents contain no record of back-and-forth communication between Andresen and Epstein, and no evidence they ever spoke or met. Andresen declined subsequent invitations from Epstein.

Developer Amir Taaki later stated he also declined Epstein’s investment interest.

MIT Media Lab funding (2015-2017)

While Andresen avoided direct contact with Epstein in 2011, Epstein’s funding later reached Bitcoin Core developers through institutional channels at MIT.

Between 2002 and 2017, Epstein donated approximately $850,000 to MIT, with $525,000 directed to MIT Media Lab’s Digital Currency Initiative. In 2015, the Bitcoin Foundation faced bankruptcy, creating a funding crisis for Bitcoin Core development. MIT’s Digital Currency Initiative became the institutional home for several Bitcoin Core developers, including Gavin Andresen, Wladimir van der Laan, and Cory Fields.

Epstein’s donations to MIT helped fund developer salaries during this period, though the money flowed through MIT’s institutional budget rather than directly to individuals. MIT Media Lab director Joi Ito coordinated the funding while concealing Epstein’s involvement. Inside MIT, staff referred to Epstein as “Voldemort” to avoid using his name in official records.

A 2017 email from Ito to Epstein, titled “Digital Currency Initiative,” thanked the financier for gift funds that “allowed us to move quickly and win this round” in recruiting Bitcoin developers.

In September 2019, The New Yorker published an investigation exposing Ito’s attempts to conceal Epstein’s financial contributions to MIT. Ito resigned from his position as MIT Media Lab director shortly after publication. The scandal revealed how Epstein’s donations supported institutional infrastructure for Bitcoin development, even though Bitcoin Core operates as an open-source project without centralized control.

Epstein’s broader interest in cryptocurrency

The released files indicate Epstein maintained interest in cryptocurrency beyond his initial contact attempts with Andresen. In 2014, Epstein invested approximately $500,000 in Blockstream, a Bitcoin infrastructure company, through an investment vehicle tied to Joi Ito. Blockstream CEO Adam Back later stated that the company divested Epstein’s stake within months due to conflict of interest concerns after learning of Ito’s relationship with Epstein.

In 2016, Epstein pitched a plan to a Saudi royal advisor involving the creation of two digital currencies. In correspondence, he wrote:

“I have spoken to some of the founders of Bitcoin who are very excited.”

The identity of these individuals and the nature of their discussions remain unclear from available documents.

Epstein also reportedly discussed Bitcoin with venture capitalist Peter Thiel in 2014. Documents show Epstein invested $3 million in Coinbase’s Series C funding round in December 2014 at a $400 million valuation, using an entity called IGO Company LLC. Emails indicate Coinbase co-founder Fred Ehrsam was aware the investment came from Epstein, writing in response to a meeting request:

“I have a gap between noon and 3pm today… would be nice to meet him if it’s convenient.”

No cryptocurrency wallets, blockchain transactions, or crypto-enabled crimes attributed to Epstein have emerged in the released records.

False claims about Bitcoin control

Following the January 2026 document release, social media posts circulated claims that Epstein “controlled Bitcoin development” or “ran Bitcoin on behalf of Mossad.” These assertions misrepresent the documents and fundamentally misunderstand how Bitcoin Core development operates.

One widely shared post claimed that “74.79% of Bitcoin core development and code was committed after Jeffrey Epstein took over the de facto senior management role as benefactor,” suggesting this proved Epstein controlled the project. This argument conflates timeline correlation with causation and ignores Bitcoin’s governance structure.

Bitcoin Core is an open-source software project with no centralized ownership or executive control. All code changes are proposed publicly, reviewed by multiple independent developers, and must achieve consensus before integration. The project’s repository is publicly viewable on GitHub, where anyone can audit code commits, review discussions, and verify the identity of contributors.

Epstein’s MIT donations funded developer salaries at an academic institution, but did not grant him authority over Bitcoin’s codebase, development roadmap, or technical decisions. The claim that funding salaries at one institution equals “control” of a global, decentralized open-source project does not align with how Bitcoin development actually functions.

The U.S. The Department of Justice stated in a July 2025 memo that investigators found no credible evidence Epstein used his network or donations to blackmail individuals or exert control over projects he funded.

Andresen’s role in Bitcoin history

Gavin Andresen became Bitcoin’s lead developer in 2010 after Satoshi Nakamoto personally selected him as successor. Nakamoto gave Andresen commit access to Bitcoin’s code repository and the alert key – a cryptographic tool that allowed broadcasting critical security warnings to the network.

In the email marking his departure on April 26, 2011, Nakamoto wrote to Andresen:

“I’ve moved on to other things and will probably be unavailable. Here’s the CAlert key and broadcast code in case you need it. You should probably give it to at least one or two other people.”

Andresen led Bitcoin Core development from 2010 to 2014, focusing on security improvements, scalability enhancements, and code optimization. He later transitioned to chief scientist at the Bitcoin Foundation. His 2014 book “Mastering Bitcoin” remains a foundational text on blockchain architecture. Time magazine recognized him in 2017 among the world’s 100 most influential people.

The alert key system was retired in 2016 due to security concerns about centralized control mechanisms in a decentralized protocol.

Document release and transparency efforts

The Epstein Files Transparency Act passed the U.S. House of Representatives in a 427-1 vote on November 18, 2025, with unanimous Senate approval. President Donald Trump signed the bill the following day, requiring the Department of Justice to release Epstein-related documents by December 19, 2025.

The DOJ released a relatively small initial batch by that deadline, drawing bipartisan criticism. On January 30, 2026, the department released an additional 3 million pages, including 2,000 videos and 180,000 images. The DOJ stated this would be the final release, though it acknowledged approximately 6 million pages might qualify under the act’s requirements.

The releases included Epstein’s contacts, flight logs, court documents, and correspondence with associates. Attorneys for abuse survivors criticized the DOJ for failing to properly redact victim identities while heavily redacting alleged perpetrators’ names.

The documents provide insight into Epstein’s network across business, academia, technology, and politics, though investigators found no evidence of the widely rumored “client list” used for blackmail. The July 2025 DOJ memo stated explicitly that no such list exists in the files.

What the documents show and don’t show

- Any meetings or phone calls between Andresen and Epstein

- Direct payments from Epstein to Bitcoin developers

- Evidence of operational control over Bitcoin Core development

- Coordination between Epstein and developers on technical decisions

- Use of funding as leverage to influence Bitcoin’s direction

Bitcoin Core development operates transparently through public code repositories, mailing lists, and review processes. Technical decisions result from consensus among distributed contributors, not institutional funders. The protocol’s design intentionally prevents centralized control, whether by governments, companies, or individual donors.

Andresen’s 2011 rejection of Epstein’s meeting request, combined with the indirect nature of later MIT funding, does not support claims of collaboration or control. The documents instead show Epstein’s attempts to gain access to emerging technology sectors during their formative phases, an investment pattern consistent with his documented activities across multiple industries.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.