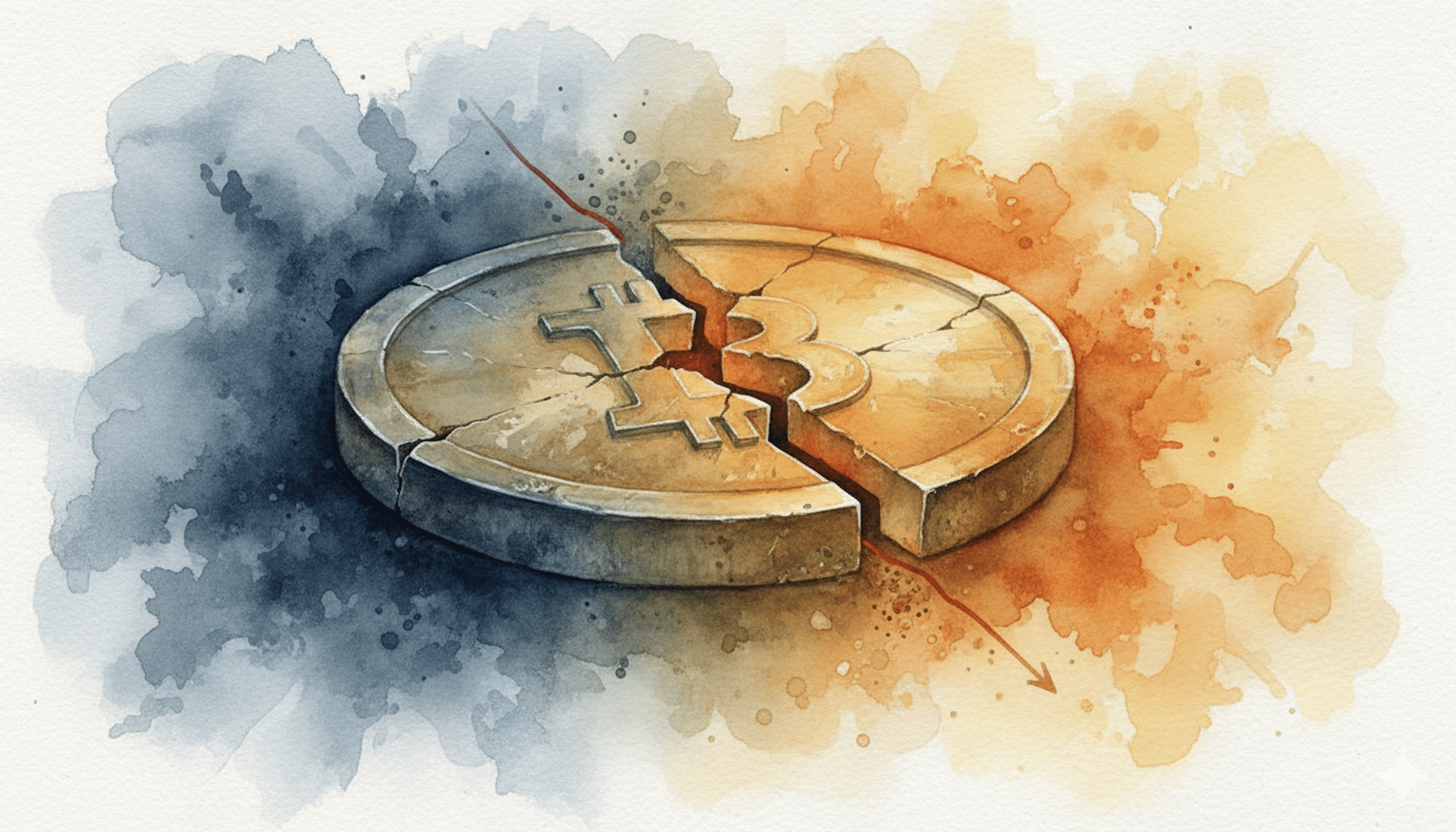

Crypto market crash: gift for smart investors or Armageddon?

On February 5, 2026, Bitcoin fell below $60,000, marking a 50% drop from its October peak of $126,000. In just three days, $5.4 billion in leveraged positions were liquidated, Strategy reported a $6.6 billion paper loss, and several altcoins dropped by up to 30%. Is this a healthy market correction after a hot rally, or the start of another crypto winter?

On this page

- Scale of the crash

- Will Strategy start selling?

- What broke the market?

- Geopolitics: war risk kills risk-on assets

- Macroeconomics: hawkish Fed and Dollar strength

- Bitcoin ETF outflows

- Technical crash

- What's next?

- Bearish Scenario: drop to $50,000-$25,000

- Bullish Scenario: correction before a new rally

- Realistic Scenario: sideways at $65,000–$80,000

- How professionals respond to the crash

- Market outlook: stress test for investors

Scale of the crash

As Bitcoin crosses key support levels, reactions vary: some investors brace for further losses, while others see potential buying opportunities.

This is more than a routine correction; the scale and speed of selling highlight systemic stress. In three days, about $800 billion in market cap has been wiped out, Bitcoin dropped out of the top 10 global assets, and the liquidation cascade reached $5.4 billion in 72 hours.

Over the past seven days, Bitcoin has lost 20%, marking one of the steepest weekly declines in its history. About 165,000 traders faced simultaneous margin calls, with 93% of liquidations hitting long positions.

Altcoins suffered even more. Ethereum lost 30% in a week, dropping to $1,960. Solana fell to $85 with a 27% loss, XRP rolled down to $1.29 (-28%). Technical indicators across major cryptocurrencies show extreme oversold conditions, yet the market keeps declining, ignoring potential reversal signals.

Institutions are bleeding too: Strategy – the largest corporate Bitcoin holder with 712,647 BTC on its balance sheet – for the first time since April 2025 went deeply into the red, with the company’s unrealized loss exceeding $6 billion. Strategy’s BTC holdings are under pressure as the price declines, affecting corporate balance sheets.

Will Strategy start selling?

Strategy was the locomotive of the 2024–2025 bull rally. The company systematically bought bitcoins regardless of price, raising capital through stock and convertible bond issuances. It worked while BTC was rising. But now the game seems to have changed.

The company’s balance holds approximately 3.4% of the entire Bitcoin supply. Their average purchase price is $76,037 per coin. Thus, the critical cost basis has already been breached by $9,000 downward, creating serious pressure not only on Strategy but on the entire market.

The psychological effect cannot be underestimated. If the pioneer and flagship of the Bitcoin treasury strategy is carrying billion-dollar losses, it undermines confidence in the corporate Bitcoin accumulation model. Other companies are now watching Saylor closely: he never sells, but… he may well find himself in conditions where he’ll be forced to start doing so.

Financial pressure is mounting on the company, as Strategy financed purchases through the issuance of preferred shares with an annual dividend. While BTC was rising, this looked like brilliant financial engineering. But now the company is paying high interest on a falling base asset. If the decline continues, the question arises: will Strategy’s cash reserve ($2.25 billion according to the latest data) be enough to service the debt without selling Bitcoin?

Everyone who can count fears a possible domino effect. Metaplanet – another bitcoin-oriented company – shows -30% paper loss, Strive minus 29%, GD Culture Group minus 36%. They’re all underwater now, and a sale by a major corporate holder could increase market selling pressure.

Shortly before the latest drop, Strategy continued buying. On February 2, the company bought another 480 BTC for $10 million, and Saylor again claimed that “volatility is Satoshi’s gift to the faithful.” But critics are already asking the reasonable question: when will Strategy investors want to jump from the sinking ship?

What broke the market?

Market declines result from a combination of macroeconomic events, technical factors, and investor behavior.

Geopolitics: war risk kills risk-on assets

The first blow came from escalating tensions between the US and Iran. President Trump publicly threatened a strike “worse than last year” if Iran doesn’t negotiate. This forced investors to flee all risk assets – from stocks to crypto.

Bitcoin, commonly called “digital gold” and a store of value, is so far failing this test. Instead of rising amid geopolitical chaos, BTC fell along with the stock market. Moreover, gold and silver – traditional safe havens – also crashed: gold lost 9% in a session, silver collapsed by a historic 26%. This suggests investors weren’t seeking protection but liquidity, selling everything.

Macroeconomics: hawkish Fed and Dollar strength

On January 29, the Fed announced a pause in rate cuts, signaling a “higher for longer” policy (high rates for a long time). This killed the market’s hopes for quick monetary policy easing. Worse, Trump nominated Kevin Warsh for Fed Chair – a known inflation “hawk” advocating for tight monetary policy. The market interpreted this as a signal: low rates won’t return soon, and bond yields will continue to rise.

High rates make bonds more attractive than risk assets. Investors are leaving crypto for US Treasuries with guaranteed four-to-five percent returns. Plus, dollar strengthening makes Bitcoin more expensive for international buyers, reducing global demand. A partial US government shutdown added fuel to the fire, freezing about $200 billion in liquidity.

Bitcoin ETF outflows

In a month, BTC ETFs experienced $1.61 billion in net outflows. On January 29, an $818 million outflow was recorded in one day – the largest since November 20. Underwater are institutional investors who bought Bitcoin through ETFs at peaks from $100,000 to $126,000. Such risks and volatility are unacceptable for traditional investing, forcing many to realize losses. This creates a so-called “feedback loop”: sales push the price lower, price decline triggers new sales.

Ki Young Ju, CEO of CryptoQuant, stated that new money stopped coming to the market, and the market lives on “old” capital gradually leaving crypto.

Technical crash

The crypto market is notoriously known for high leverage. Traders who were still actively opening longs in January expecting continued growth faced cascading margin calls. When BTC falls, leveraged long positions face margin shortages – and exchanges forcibly close positions. These forced liquidations push BTC onto the market, intensifying selling. This feedback loop further amplifies downward pressure.

The market, heavily leveraged, saw the correction snowball into a cascading collapse. Technical indicators also speak of a bearish reversal. The “Death Cross” pattern (when the “slow” 50-day MA crosses the “fast” 200-day MA from top to bottom) formed for the first time since 2022.

What’s next?

Bearish Scenario: drop to $50,000-$25,000

Pessimists already see parallels with the 2022 crypto winter. Then BTC fell 80% from ATH (from $69,000 to $15,000). If we apply the same logic to the current cycle, a similar 80% drop brings us to $25,000.

Bullish Scenario: correction before a new rally

Optimists see the current drop as a “healthy correction” that the extremely overheated market needed after the 2024–2025 growth. The RSI oscillator is in the oversold zone, which historically preceded strong bounces.

While retail panics, mega-whales quietly buy. Glassnode registers accumulation by large holders.

Multi-billion liquidations washed out leverage. It’s painful but good for the market in the long term: the less leverage – the more stable the next growth. Some institutional surveys show that 71% consider BTC undervalued in the range between $85,000 and $95,000. We’re now significantly lower.

Technical targets for bulls start at $87,000, where key resistance is now located. Breaking above opens the path to $100,000, according to analyst Michaël van de Poppe. The psychological level of $100,000 will return retail interest, and a new ATH above $126,000 will be possible if macro factors reverse through Fed rate cuts and dollar weakening.

Jeff Park from Bitwise offers an unconventional scenario. By his estimates, Kevin Warsh’s policy could break the financial system through aggressive Fed balance sheet reduction. This will cause catastrophic repricing of bonds and stocks, and capital will flow to Bitcoin as an asset outside the system. In this case, BTC could shoot up despite macro headwinds.

Realistic Scenario: sideways at $65,000–$80,000

Most analysts lean toward sideways movement for several months. Bitcoin will likely trade in the $65,000–$80,000 range until new catalysts appear. Fed policy reversal is unlikely before mid-2026. The geopolitical situation is also unpredictable for now. The return of institutional demand through ETFs entirely depends on macroeconomics.

The key level is $65,000. If BTC holds this support, the market will avoid catastrophe. If it breaks down, the path to $55,000–$60,000 opens. And if Strategy is forced to sell – real panic could begin. However, Michael Saylor and his director Phong Le have already stated on the company’s strategic call that the corporate balance will remain safe down to $8,000 per BTC.

How professionals respond to the crash

Experienced investors often act differently from retail participants during sharp market moves. While panic can dominate the behavior of smaller traders, larger holders tend to view volatility as an opportunity for strategic accumulation and portfolio adjustment. Professional players generally follow several approaches:

Dollar-cost averaging (DCA): professionals often apply DCA, gradually increasing exposure during market dips. Rather than reacting to short-term swings, they use price drops to incrementally increase exposure in a controlled manner.

Accumulation at historical support levels: key levels, such as $60,000 for Bitcoin, serve as reference points. Professionals may concentrate purchases near these historically significant zones, where previous demand and liquidity have been strong.

Scalping and short-term opportunities: traders may capitalize on price volatility rather than directional trends. However, these activities are generally supplementary to longer-term accumulation strategies rather than the main driver of their decisions.

Portfolio rebalancing: declines in altcoins often lead to reallocation within professional portfolios. By adjusting weights between core holdings and undervalued assets, investors seek to maintain overall risk balance and take advantage of potential rebounds.

Across these strategies, the common pattern is measured action: professionals assess risk, track liquidity, and respond to market conditions strategically rather than emotionally. The crash provides them with the chance to increase exposure at favorable prices while retail panic can exacerbate downward pressure.

Market outlook: stress test for investors

Such drops are always a stress test for the crypto industry. The market exposed its weak points: excessive credit leverage, dependence on institutional demand, fragile liquidity, and a crowd that flees at the first signs of trouble.

While retail investors may react emotionally, whales often view sharp drops as an opportunity to accumulate. For those who bought near $100,000–$126,000, losses are steep, yet such capitulation phases often signal the start of a market bottom.

For professionals, the picture looks different. “Buy when blood runs in the streets.” Whales use drawdowns to accumulate undervalued assets. Crypto history is full of examples when the most painful corrections became the best entry points for those who kept a cool head.

Over the past year, Bitcoin helped investors adjust to extreme volatility. Now, it’s returning – and perhaps the familiar, wild rallies will return too.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.