#us

324 articles found

Latest

As per BitInfoCharts, the wallet address bc1q…859v2 received its initial deposit of BTC on March 8. Over the following three and a half months, it amassed 118,000 BTC (nearly $3.1 billion). Speculations quickly spread across X (Twitter), suggesting it might be BlackRock strategically increasing its BTC holdings. However, the wallet belongs to the US-based exchange Gemini. It transferred its funds from an older wallet, which was also among the top BTC holders nearly a year ago. The current top three wallets are as follows: Binance cold wallet — 248,597 BTC.

Bitfinex cold wallet — 178,010 BTC.

Gemini new wallet — 118,300 BTC.

As per BitInfoCharts, the wallet address bc1q…859v2 received its initial deposit of BTC on March 8. Over the following three and a half months, it amassed 118,000 BTC (nearly $3.1 billion). Speculations quickly spread across X (Twitter), suggesting it might be BlackRock strategically increasing its BTC holdings. However, the wallet belongs to the US-based exchange Gemini. It transferred its funds from an older wallet, which was also among the top BTC holders nearly a year ago. The current top three wallets are as follows: Binance cold wallet — 248,597 BTC.

Bitfinex cold wallet — 178,010 BTC.

Gemini new wallet — 118,300 BTC. FedNow, CBDC, US Financial Evolution: Insights by Aaron Klein

The unveiling of the Fed's FedNow payment system has stirred discussions about its influence on banking and its repercussions for the crypto sector. Aaron Klein, Senior Fellow at the Brookings Institution's Center for Regulation and Markets, addresses questions about this new system, the prospective role of CBDCs, and cryptographic developments.

The unveiling of the Fed's FedNow payment system has stirred discussions about its influence on banking and its repercussions for the crypto sector. Aaron Klein, Senior Fellow at the Brookings Institution's Center for Regulation and Markets, addresses questions about this new system, the prospective role of CBDCs, and cryptographic developments.  Coinbase has obtained regulatory approval from the National Futures Association (NFA), a CFTC-designated self-regulatory organization.

This approval allows Coinbase to function as a Futures Commission Merchant (FCM) and provide eligible US customers with access to crypto futures through its platforms.

With this approval, Coinbase becomes the first crypto-native platform to offer a combined solution featuring traditional spot crypto trading and regulated, leveraged crypto futures for their US verified customers.

Coinbase has obtained regulatory approval from the National Futures Association (NFA), a CFTC-designated self-regulatory organization.

This approval allows Coinbase to function as a Futures Commission Merchant (FCM) and provide eligible US customers with access to crypto futures through its platforms.

With this approval, Coinbase becomes the first crypto-native platform to offer a combined solution featuring traditional spot crypto trading and regulated, leveraged crypto futures for their US verified customers.  US House Financial Services Committee members, led by Chair Patrick McHenry, are seeking clarity from the SEC and FINRA about how Prometheum secured a special purpose broker-dealer (SPBD) license.

They're probing if the SEC used Prometheum as a model firm to support Gary Gensler's stance that existing laws suffice for crypto regulation in the U.S.

Despite Prometheum's claims of being pivotal for regulated digital asset offerings, the lawmakers pointed out that the firm hasn't served any customers yet. Also they raised concerns about potential ties between Prometheum and the Chinese Communist Party.

The committee has requested related documents and communication records by Aug. 22.

US House Financial Services Committee members, led by Chair Patrick McHenry, are seeking clarity from the SEC and FINRA about how Prometheum secured a special purpose broker-dealer (SPBD) license.

They're probing if the SEC used Prometheum as a model firm to support Gary Gensler's stance that existing laws suffice for crypto regulation in the U.S.

Despite Prometheum's claims of being pivotal for regulated digital asset offerings, the lawmakers pointed out that the firm hasn't served any customers yet. Also they raised concerns about potential ties between Prometheum and the Chinese Communist Party.

The committee has requested related documents and communication records by Aug. 22.  Carlyle Group co-founder David Rubenstein, in an interview with Bloomberg, expressed his regret for missing the opportunity to invest in Bitcoin when a single coin was worth just $100.

Not one to dwell on past mistakes, David's currently pouring capital into companies making crypto trading accessible for everyone.

Sound familiar? David's story echoes in many of us.

Carlyle Group co-founder David Rubenstein, in an interview with Bloomberg, expressed his regret for missing the opportunity to invest in Bitcoin when a single coin was worth just $100.

Not one to dwell on past mistakes, David's currently pouring capital into companies making crypto trading accessible for everyone.

Sound familiar? David's story echoes in many of us.  US District Judge Analisa Torres in New York had previously indicated that XRP sales to sophisticated investors fulfilled the criteria for an investment contract under federal securities law

However, this characterization didn’t extend to programmatic investors, which pertains to the general public buying crypto through exchanges.

US District Judge Analisa Torres in New York had previously indicated that XRP sales to sophisticated investors fulfilled the criteria for an investment contract under federal securities law

However, this characterization didn’t extend to programmatic investors, which pertains to the general public buying crypto through exchanges.  The Exactly Protocol has suffered a hacking attack. Running on the Optimism blockchain, this lending DeFi platform was targeted by malefactors who stole over 4300 ETH, totaling approximately $7.3 million.

Both BlockSec and Beosin security agencies have corroborated the theft. The hackers reportedly found and exploited a weak point in the platform's smart contracts, although the finer details are still under wraps.

UPD: The team at Exactly Protocol would declare a $700,000 reward for any leads on the hacker, should they not receive a response from the malefactor by the end of August 22nd.

"You can return the funds, minus a 10% fee to you, without worries about us coming after you," the Exactly team conveyed in their message.

The Exactly Protocol has suffered a hacking attack. Running on the Optimism blockchain, this lending DeFi platform was targeted by malefactors who stole over 4300 ETH, totaling approximately $7.3 million.

Both BlockSec and Beosin security agencies have corroborated the theft. The hackers reportedly found and exploited a weak point in the platform's smart contracts, although the finer details are still under wraps.

UPD: The team at Exactly Protocol would declare a $700,000 reward for any leads on the hacker, should they not receive a response from the malefactor by the end of August 22nd.

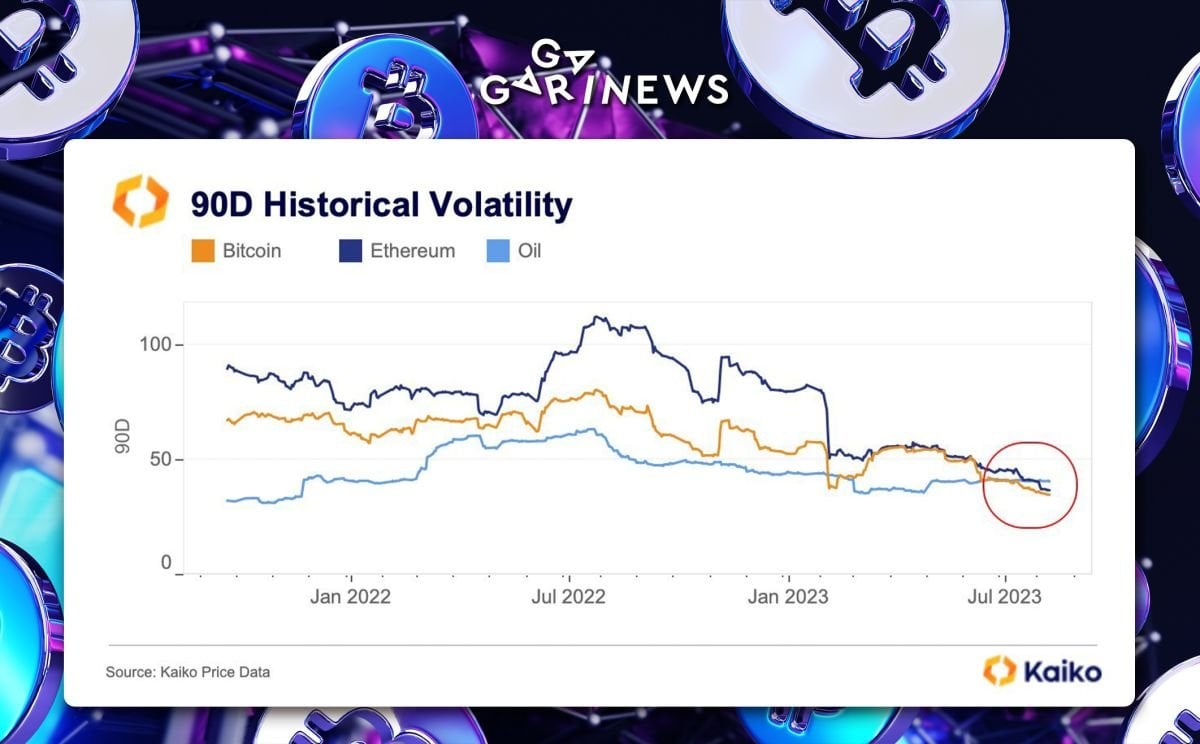

"You can return the funds, minus a 10% fee to you, without worries about us coming after you," the Exactly team conveyed in their message.  According to Kaiko, BTC and ETH have recorded their lowest 90-day price volatility compared to oil in many years, a mark last reached in 2016.

Right now, Bitcoin's volatility sits at 35%, Ethereum's at 37%, while oil's is higher at 41%.

Experience tells us that after such periods of quiet , a significant move often follows. Judging by Bitcoin's recent dynamics, it appears such a shift might be kicking off.

According to Kaiko, BTC and ETH have recorded their lowest 90-day price volatility compared to oil in many years, a mark last reached in 2016.

Right now, Bitcoin's volatility sits at 35%, Ethereum's at 37%, while oil's is higher at 41%.

Experience tells us that after such periods of quiet , a significant move often follows. Judging by Bitcoin's recent dynamics, it appears such a shift might be kicking off. Liquity USD (LUSD): A DeFi Stablecoin Review

Liquity USD, or LUSD, is a stablecoin that maintains a 1:1 peg with the US dollar. It's used by the Liquity lending protocol as the primary asset for issuing loans backed by Ethereum (ETH). When LUSD is repaid, the loan is resolved, and the ETH collateral is returned to the owner at its nominal value.

Liquity USD, or LUSD, is a stablecoin that maintains a 1:1 peg with the US dollar. It's used by the Liquity lending protocol as the primary asset for issuing loans backed by Ethereum (ETH). When LUSD is repaid, the loan is resolved, and the ETH collateral is returned to the owner at its nominal value.  acobi Asset Management Lists Europe’s First Spot Bitcoin ETF on Euronext Amsterdam Exchange.

“It is exciting to see Europe moving ahead of the US in opening up Bitcoin investing for institutional investors who want safe, secure access to the benefits of digital assets,” says the company’s CEO, Martin Bednall.

Well, now it’s the USA’s turn!

acobi Asset Management Lists Europe’s First Spot Bitcoin ETF on Euronext Amsterdam Exchange.

“It is exciting to see Europe moving ahead of the US in opening up Bitcoin investing for institutional investors who want safe, secure access to the benefits of digital assets,” says the company’s CEO, Martin Bednall.

Well, now it’s the USA’s turn! Bittrex US's Alleged Bankruptcy: A Blow to the SEC

Instead of targeting market giants like Binance or Coinbase, the US Securities and Exchange Commission (SEC) directed its attention towards Bittrex, a smaller-scale crypto exchange. The aftermath of this conflict provides significant insights for the wider market.

Instead of targeting market giants like Binance or Coinbase, the US Securities and Exchange Commission (SEC) directed its attention towards Bittrex, a smaller-scale crypto exchange. The aftermath of this conflict provides significant insights for the wider market.  The US Consumer Price Index, which measures inflation, is set to be unveiled at 12:30 pm UTC.

Current index level: 3.0%

Forecast: 3.3%, marking a 0.3% CPI increase

Discover more about the CPI in our article.

Stay vigilant during potential market swings and approach trading wisely!

UPD: The rate of inflation in the United States has risen to 3.2%, a bit under the forecasted amount.

The US Consumer Price Index, which measures inflation, is set to be unveiled at 12:30 pm UTC.

Current index level: 3.0%

Forecast: 3.3%, marking a 0.3% CPI increase

Discover more about the CPI in our article.

Stay vigilant during potential market swings and approach trading wisely!

UPD: The rate of inflation in the United States has risen to 3.2%, a bit under the forecasted amount.  US President caused a buzz in the crypto world with a recent Twitter post featuring him sporting laser eyes.

This sparked discussions about a potential connection to Bitcoin, as red 'laser eyes' are a popular modification used by crypto enthusiasts in their profile pictures.

What do you think? Is Joe Biden a secret crypto enthusiast?

US President caused a buzz in the crypto world with a recent Twitter post featuring him sporting laser eyes.

This sparked discussions about a potential connection to Bitcoin, as red 'laser eyes' are a popular modification used by crypto enthusiasts in their profile pictures.

What do you think? Is Joe Biden a secret crypto enthusiast?