#uniswap

47 articles found

Latest

Uniswap has rolled out "Swap Protection" to shield Ethereum mainnet transactions from sandwich attacks and front-running.

When users enable this feature in the Uniswap Wallet, swaps are directed to a private transaction pool, enhancing security against potential threats. Due to this added layer, some swaps might have higher auto slippage to boost the likelihood of successful transactions.

Uniswap has rolled out "Swap Protection" to shield Ethereum mainnet transactions from sandwich attacks and front-running.

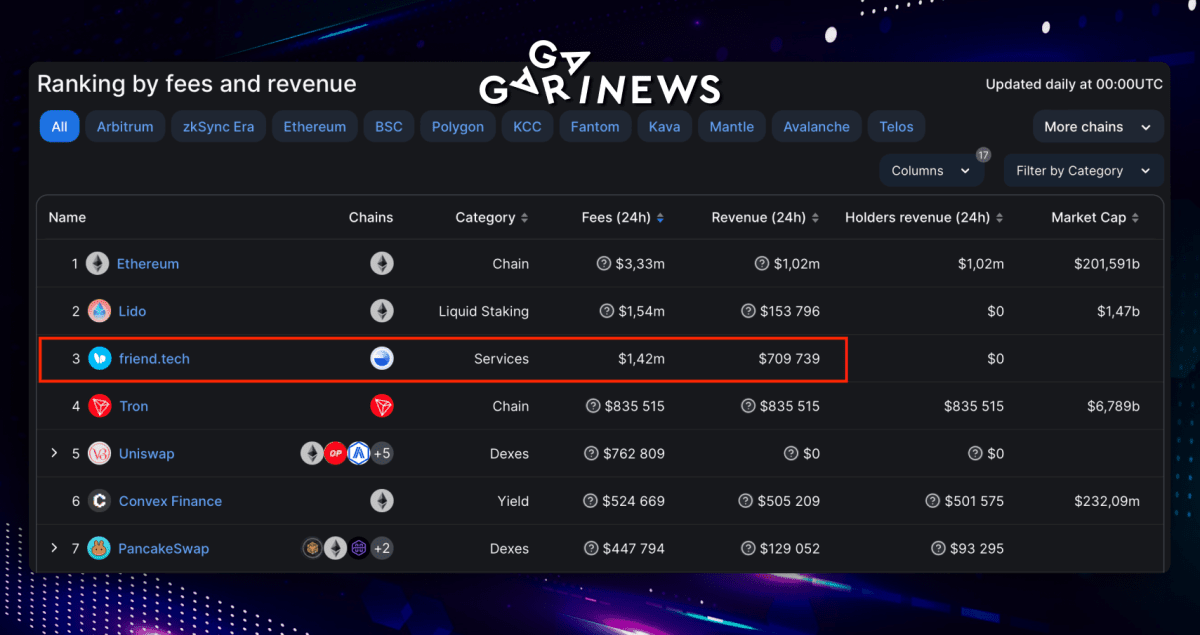

When users enable this feature in the Uniswap Wallet, swaps are directed to a private transaction pool, enhancing security against potential threats. Due to this added layer, some swaps might have higher auto slippage to boost the likelihood of successful transactions.  Social app friend.tech has recorded protocol fees amounting to more than $1.42 million within the past 24 hours, positioning it among the top three crypto projects in terms of user-paid fees. It now stands as the third-highest project for user-paid fees, following Ethereum and Lido Finance, according to data from DeFiLlama. Built on Coinbase’s Base Layer 2 chain, friend.tech is a social app that integrates with X (Twitter). It allows users to trade tokenized shares linked to each other’s profiles. Shareholders enjoy exclusive content access and private chat rooms in X.

Social app friend.tech has recorded protocol fees amounting to more than $1.42 million within the past 24 hours, positioning it among the top three crypto projects in terms of user-paid fees. It now stands as the third-highest project for user-paid fees, following Ethereum and Lido Finance, according to data from DeFiLlama. Built on Coinbase’s Base Layer 2 chain, friend.tech is a social app that integrates with X (Twitter). It allows users to trade tokenized shares linked to each other’s profiles. Shareholders enjoy exclusive content access and private chat rooms in X.  Hayden Adams, the founder of Uniswap Labs, has dismissed a developer known by the pseudonym AzFlin following allegations of creating a FrensTech meme coin and then withdrawing liquidity shortly after its launch.

Preliminary damages are estimated at 14 wETH, equivalent to approximately $25,830. Adams stressed that the company does not condone such actions and, therefore, felt compelled to respond accordingly.

The developer denies the accusations of fraud and describes the situation as FUD. According to him, he only withdrew 1 ETH from the liquidity pool, which he had initially provided from his own funds.

Hayden Adams, the founder of Uniswap Labs, has dismissed a developer known by the pseudonym AzFlin following allegations of creating a FrensTech meme coin and then withdrawing liquidity shortly after its launch.

Preliminary damages are estimated at 14 wETH, equivalent to approximately $25,830. Adams stressed that the company does not condone such actions and, therefore, felt compelled to respond accordingly.

The developer denies the accusations of fraud and describes the situation as FUD. According to him, he only withdrew 1 ETH from the liquidity pool, which he had initially provided from his own funds. Next-Level Scam: Impersonators Take on Uniswap Executives

In a shocking turn of events, Hayden Adams, the creator of Uniswap, took to Twitter to express his disbelief at an audacious scam that targeted the platform. The scammers behind this elaborate scheme not only devised a deceptive Uniswap website but also went the extra mile by organizing a meticulously planned hour-long Zoom call, complete with deepfake versions of their own employees.

In a shocking turn of events, Hayden Adams, the creator of Uniswap, took to Twitter to express his disbelief at an audacious scam that targeted the platform. The scammers behind this elaborate scheme not only devised a deceptive Uniswap website but also went the extra mile by organizing a meticulously planned hour-long Zoom call, complete with deepfake versions of their own employees. LINK and UNI Altcoin Analysis for November 3, 2023

Bitcoin continues to trade sideways between a support level of $33,300 and a resistance point of $35,400, showing no significant changes on the chart. Here’s an overview of the market situation for Chainlink (LINK) and Uniswap (UNI) as of Friday, November 3.

Bitcoin continues to trade sideways between a support level of $33,300 and a resistance point of $35,400, showing no significant changes on the chart. Here’s an overview of the market situation for Chainlink (LINK) and Uniswap (UNI) as of Friday, November 3.  Back in 2018, when Uniswap's founder, Hayden Adams, rolled out the HayCoin tokens for a platform trial, little did anyone anticipate their meteoric rise. The recent destruction of 99.99% of these tokens by Adams has pushed their price to an astounding $2.5 million.

Back in 2018, when Uniswap's founder, Hayden Adams, rolled out the HayCoin tokens for a platform trial, little did anyone anticipate their meteoric rise. The recent destruction of 99.99% of these tokens by Adams has pushed their price to an astounding $2.5 million.  On August 30, Judge Katherine Polk Failla delivered a significant ruling on a case brought forth by Uniswap users who alleged they lost funds due to scam tokens on the platform. She stated that ETH and Bitcoin qualify as crypto commodities, a pivotal factor in her decision to close the Uniswap case.J udge was not persuaded by arguments suggesting Uniswap token sales were subject to the Exchange Act. Failla is also the judge overseeing the SEC’s case against Coinbase.

On August 30, Judge Katherine Polk Failla delivered a significant ruling on a case brought forth by Uniswap users who alleged they lost funds due to scam tokens on the platform. She stated that ETH and Bitcoin qualify as crypto commodities, a pivotal factor in her decision to close the Uniswap case.J udge was not persuaded by arguments suggesting Uniswap token sales were subject to the Exchange Act. Failla is also the judge overseeing the SEC’s case against Coinbase.  RocketSwap, a DEX on the Base Layer 2 network, suffered a hack, losing 471 ETH ($862,000). The team identified lapses, including offline signatures during launchpad deployment and storing private keys on the server.

While some accused the team of a potential rug pull, RocketSwap blames a third-party hacker who brute-forced a server to extract private keys.

Post-hack, the hacker moved assets to Ethereum, creating a meme token, "LoveRCKT", which saw a brief price surge on Uniswap before plummeting.

RocketSwap, a DEX on the Base Layer 2 network, suffered a hack, losing 471 ETH ($862,000). The team identified lapses, including offline signatures during launchpad deployment and storing private keys on the server.

While some accused the team of a potential rug pull, RocketSwap blames a third-party hacker who brute-forced a server to extract private keys.

Post-hack, the hacker moved assets to Ethereum, creating a meme token, "LoveRCKT", which saw a brief price surge on Uniswap before plummeting.  Brian Armstrong has expressed his belief that Binance has transferred some of their USDC assets to a different stablecoin, according to anonymous sources in Cointelegraph.

NotChaseColeman, an analyst, highlights that Binance and Justin Sun are strategically moving from USDT to USDC to secure USD, which will then be invested in FDUSD and TUSD (assets controlled by the company).

Adam Cochran, a name we're familiar with, weighed in, drawing attention to the activities associated with Binance addresses. He observed:

“Even with banks open in Asia and Europe and US coming online, USDT peg is off by the deepest sustained amount since the FTX fall out. Selling pressure once again coming in from the Binance.”

Adam thinks the uncertainty surrounding USDT is at an all-time high, and the Curve Finance and Uniswap platforms are overrun with USDT.

He was optimistic about a more promising USDT horizon today, but that seems to be deferred.

BTC has touched the 28,710 threshold. Indeed, Mondays have their unique trials.

Brian Armstrong has expressed his belief that Binance has transferred some of their USDC assets to a different stablecoin, according to anonymous sources in Cointelegraph.

NotChaseColeman, an analyst, highlights that Binance and Justin Sun are strategically moving from USDT to USDC to secure USD, which will then be invested in FDUSD and TUSD (assets controlled by the company).

Adam Cochran, a name we're familiar with, weighed in, drawing attention to the activities associated with Binance addresses. He observed:

“Even with banks open in Asia and Europe and US coming online, USDT peg is off by the deepest sustained amount since the FTX fall out. Selling pressure once again coming in from the Binance.”

Adam thinks the uncertainty surrounding USDT is at an all-time high, and the Curve Finance and Uniswap platforms are overrun with USDT.

He was optimistic about a more promising USDT horizon today, but that seems to be deferred.

BTC has touched the 28,710 threshold. Indeed, Mondays have their unique trials.  The Telegram trading bot, Unibot, is rapidly gaining popularity, thanks to its seamless integration with the decentralized exchange Uniswap and ETH payouts to token holders.

As the UNIBOT token soared to $170 its user base has surged to 6,500, and the daily trading volume has averaged $5.5 million.

The Telegram trading bot, Unibot, is rapidly gaining popularity, thanks to its seamless integration with the decentralized exchange Uniswap and ETH payouts to token holders.

As the UNIBOT token soared to $170 its user base has surged to 6,500, and the daily trading volume has averaged $5.5 million. Uniswap Labs reveals plans for Uniswap v4 protocol upgrade

Uniswap Labs has announced the draft code for Uniswap V4, a complete redesign of their popular decentralized exchange protocol. The new architecture aims to offer more customization and efficiency. The cost of creating liquidity pools is projected to reduce by 99%, and the protocol will permit developers to construct more cost-effective, minimalistic pools.

Uniswap Labs has announced the draft code for Uniswap V4, a complete redesign of their popular decentralized exchange protocol. The new architecture aims to offer more customization and efficiency. The cost of creating liquidity pools is projected to reduce by 99%, and the protocol will permit developers to construct more cost-effective, minimalistic pools.