#transactions

231 articles found

Latest

Base, engineered on OP Stack as a second layer network, has managed to surpass Arbitrum and Optimism in the number of daily transactions this week. Data from The Block highlighted that on August 15, Base's moving average reached 610,000 transactions, while the counts for Arbitrum and Optimism stood at 576,000 and 597,000, respectively. Although Optimism currently holds a slight lead, overall, the networks are closely competing.

Base, engineered on OP Stack as a second layer network, has managed to surpass Arbitrum and Optimism in the number of daily transactions this week. Data from The Block highlighted that on August 15, Base's moving average reached 610,000 transactions, while the counts for Arbitrum and Optimism stood at 576,000 and 597,000, respectively. Although Optimism currently holds a slight lead, overall, the networks are closely competing. Crypto Regulation in Brazil

Brazil reigns as the most substantial cryptocurrency hub in Latin America. Yet, its regulatory stance towards digital currencies is confounding. On one hand, they're not recognized as legitimate money; on the other, there's a push towards legitimizing crypto transactions.

Brazil reigns as the most substantial cryptocurrency hub in Latin America. Yet, its regulatory stance towards digital currencies is confounding. On one hand, they're not recognized as legitimate money; on the other, there's a push towards legitimizing crypto transactions. New Kid on the Block: Bitgert's Daring Claims Unmasked

Bitgert's BRISE token functions on the independent BRISE Chain, handling over 100,000 transactions per second at no gas fees. Despite some controversies, the BRISE token holds a market cap of $90.77 million and offers a broad utility set. Sounds promising, but let's check it!

Bitgert's BRISE token functions on the independent BRISE Chain, handling over 100,000 transactions per second at no gas fees. Despite some controversies, the BRISE token holds a market cap of $90.77 million and offers a broad utility set. Sounds promising, but let's check it! Lead the Pack with EURS: STASIS Pioneering EU Stablecoin

STASIS (EURS) is a blockchain platform headquartered in Malta that facilitates asset tokenization. EURS, a stablecoin, provides feeless transactions on the Ethereum network. With a 1:1 peg to the Euro, it holds a solid position as a Euro-backed digital asset. More information is on the website.

STASIS (EURS) is a blockchain platform headquartered in Malta that facilitates asset tokenization. EURS, a stablecoin, provides feeless transactions on the Ethereum network. With a 1:1 peg to the Euro, it holds a solid position as a Euro-backed digital asset. More information is on the website.  Ukraine's Security Service has successfully dismantled a significant underground network that was carrying out unauthorized financial transfers between Russia and Ukraine, making use of banned Russian payment systems and digital currencies.

Active in four regions, these secretive hubs were handling over $1 million each month. Platforms like Yumoney, Webmoney, and various cryptocurrencies were employed to change Russian rubles into digital currencies and subsequently into Ukrainian hryvnia. The primary customer base was made up of hackers and companies participating in under-the-table transactions with Russia.

Ukraine's Security Service has successfully dismantled a significant underground network that was carrying out unauthorized financial transfers between Russia and Ukraine, making use of banned Russian payment systems and digital currencies.

Active in four regions, these secretive hubs were handling over $1 million each month. Platforms like Yumoney, Webmoney, and various cryptocurrencies were employed to change Russian rubles into digital currencies and subsequently into Ukrainian hryvnia. The primary customer base was made up of hackers and companies participating in under-the-table transactions with Russia.  Currently, one token is equivalent to $3.5 in dollar terms. Conversely, the value of the CRV token hovers around $0.6 on other trading platforms.

Such price discrepancies have been spotted on other exchanges too.

We advise you to hold off on any transactions involving the CRV token for the time being.

Currently, one token is equivalent to $3.5 in dollar terms. Conversely, the value of the CRV token hovers around $0.6 on other trading platforms.

Such price discrepancies have been spotted on other exchanges too.

We advise you to hold off on any transactions involving the CRV token for the time being.  Layer 2 network Optimism has surpassed Arbitrum, recording 944,000 daily transactions, which is nearly 50% more than its former frontrunner with 660,000 daily transactions.

The surge in activity on Optimism can be attributed to the recent Bedrock update and the excitement surrounding the Worldcoin project, which enables user accounts within this network.

However, when it comes to Total Value Locked (TVL), Arbitrum remains in the lead, boasting over $2 billion — twice as much as its competitor.

Layer 2 network Optimism has surpassed Arbitrum, recording 944,000 daily transactions, which is nearly 50% more than its former frontrunner with 660,000 daily transactions.

The surge in activity on Optimism can be attributed to the recent Bedrock update and the excitement surrounding the Worldcoin project, which enables user accounts within this network.

However, when it comes to Total Value Locked (TVL), Arbitrum remains in the lead, boasting over $2 billion — twice as much as its competitor.  Beginning on August 31, the popular NFT marketplace OpenSea will not charge royalties for NFT secondary transactions, signaling a change in artist earning policy. Previously, creators were able to set a commission of 2.5% to 10% and earn from every resale. However, with the new update, the creator fee is left up to the discretion of the buyer. For collections on non-Ethereum blockchains, the creator fee will only remain mandatory until February 29, 2024. After this date, the entire platform will make royalties optional.

Beginning on August 31, the popular NFT marketplace OpenSea will not charge royalties for NFT secondary transactions, signaling a change in artist earning policy. Previously, creators were able to set a commission of 2.5% to 10% and earn from every resale. However, with the new update, the creator fee is left up to the discretion of the buyer. For collections on non-Ethereum blockchains, the creator fee will only remain mandatory until February 29, 2024. After this date, the entire platform will make royalties optional.  The immense wave of transactions and heightened user activity took Shibarium by surprise, causing some tech glitches, says Shytoshi Kusama, the co-founder of the Shiba Inu ecosystem.

He's also quick to debunk the rumors about funds getting stuck in the bridging contracts, terming it as pure FUD.

"Although we expected a very busy moment, we never expected THIS much traffic, instantly," reflects Shytoshi Kusama.

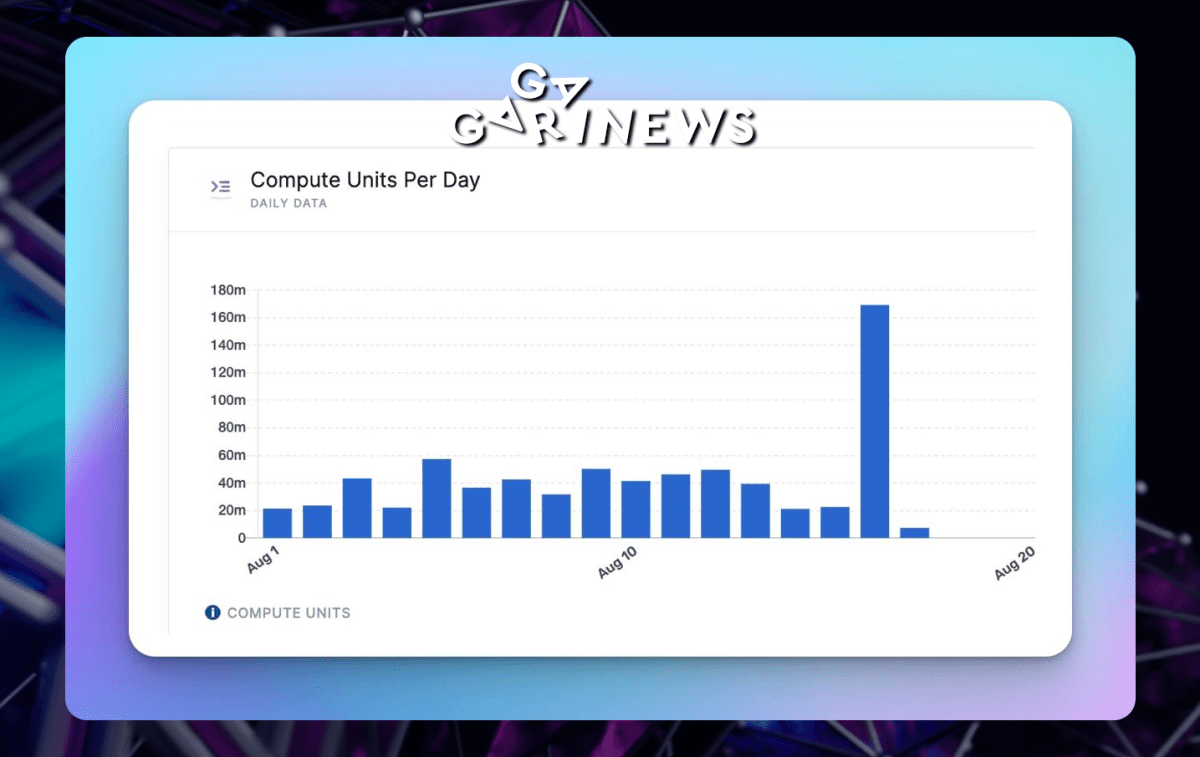

At its launch, the Shibarium team tackled a load of 160 million computational tasks in a span of about 30 minutes, while anticipating only 400 million within a month.

The immense wave of transactions and heightened user activity took Shibarium by surprise, causing some tech glitches, says Shytoshi Kusama, the co-founder of the Shiba Inu ecosystem.

He's also quick to debunk the rumors about funds getting stuck in the bridging contracts, terming it as pure FUD.

"Although we expected a very busy moment, we never expected THIS much traffic, instantly," reflects Shytoshi Kusama.

At its launch, the Shibarium team tackled a load of 160 million computational tasks in a span of about 30 minutes, while anticipating only 400 million within a month.  DeBank has introduced a new Layer-2 solution based on OP Stack for user experimentation. It's now live for testing, and the mainnet is slated for 2024.

According to an official briefing, developers have accomplished cost reductions ranging from 100 to 400 times for specific transactions, all the while targeting gas expenditure.

Besides, to fortify user defense and trim L1 data leaks, transactions will be signed with a specially devised second-tier private key.

DeBank has introduced a new Layer-2 solution based on OP Stack for user experimentation. It's now live for testing, and the mainnet is slated for 2024.

According to an official briefing, developers have accomplished cost reductions ranging from 100 to 400 times for specific transactions, all the while targeting gas expenditure.

Besides, to fortify user defense and trim L1 data leaks, transactions will be signed with a specially devised second-tier private key.  Japan's Soramitsu is at the forefront of crafting a system that enables cross-border transactions specifically tailored to the Asian market.

This initiative involves leveraging the Cambodian CBDC to cater to markets in India, China, and Japan.

Additionally, Soramitsu aspires to establish a Japanese exchange for stablecoins, simplifying currency conversion across various countries.

Japan's Soramitsu is at the forefront of crafting a system that enables cross-border transactions specifically tailored to the Asian market.

This initiative involves leveraging the Cambodian CBDC to cater to markets in India, China, and Japan.

Additionally, Soramitsu aspires to establish a Japanese exchange for stablecoins, simplifying currency conversion across various countries.  The data analysis company, Santiment, has detected a notable surge in transactions (exceeding $10 million) within certain renowned altcoins, including AAVE, APE, COMP and others.

The majority of these have seen a price decline, with AAVE being the exception, as its value increased by 1.14%. This shift was discernible not only against the dollar but also when compared to Bitcoin.

The data analysis company, Santiment, has detected a notable surge in transactions (exceeding $10 million) within certain renowned altcoins, including AAVE, APE, COMP and others.

The majority of these have seen a price decline, with AAVE being the exception, as its value increased by 1.14%. This shift was discernible not only against the dollar but also when compared to Bitcoin.  Justin Sun has purchased 5 million CRV from Curve founder Michael Egorov via OTC transactions at a price of $0.4. This move is set to marginally enhance Egorov’s position in FRAX.

Along with Justin, seven other addresses conducted OTC transactions with Michael Egorov at $0.4 per CRV.

Currently, CRV trades at $0.59.

Hopefully, the Curve founder can avert the liquidation of his position; otherwise, it could have a negative impact on a large number of protocols in the ecosystem.

Justin Sun has purchased 5 million CRV from Curve founder Michael Egorov via OTC transactions at a price of $0.4. This move is set to marginally enhance Egorov’s position in FRAX.

Along with Justin, seven other addresses conducted OTC transactions with Michael Egorov at $0.4 per CRV.

Currently, CRV trades at $0.59.

Hopefully, the Curve founder can avert the liquidation of his position; otherwise, it could have a negative impact on a large number of protocols in the ecosystem.  Bendigo Bank, one of Australia's leading banks, has decided to limit high-risk crypto payments to protect its customers from potential scams.

As a result, Bendigo Bank has become the fourth major bank in Australia to implement such security measures. However, the precise criteria used to block transactions remain unknown.

Bendigo Bank, one of Australia's leading banks, has decided to limit high-risk crypto payments to protect its customers from potential scams.

As a result, Bendigo Bank has become the fourth major bank in Australia to implement such security measures. However, the precise criteria used to block transactions remain unknown.  The Sui Foundation has cut ties with decentralized exchange MovEx due to a contract breach involving the illicit movement of SUI tokens.

MovEx had received 2.5 million SUI tokens (around $1.6 million) for their work on the DeepBook exchange product, under an agreement involving a staged release of the tokens. MovEx, however, broke this agreement by making three transactions of 625,000 SUI to three different wallets without the Sui Foundation's consent or awareness.

Following the breach, MovEx's total SUI allotment has been moved to a custodial wallet to ensure the release adheres to the contractual schedule.

The Sui Foundation has cut ties with decentralized exchange MovEx due to a contract breach involving the illicit movement of SUI tokens.

MovEx had received 2.5 million SUI tokens (around $1.6 million) for their work on the DeepBook exchange product, under an agreement involving a staged release of the tokens. MovEx, however, broke this agreement by making three transactions of 625,000 SUI to three different wallets without the Sui Foundation's consent or awareness.

Following the breach, MovEx's total SUI allotment has been moved to a custodial wallet to ensure the release adheres to the contractual schedule.