#tokens

378 articles found

Latest

Xterio, the gaming Web3 platform, has revealed its decision to create an independent ecosystem following OpenSea's refusal to charge author royalties on NFT resales.

This new initiative will support content creators through the launch of an NFT marketplace, exclusive tokens, a rewarding mechanism, and diverse affiliate programs.

Xterio's officials have said that the launch of this marketplace is imminent, expected within the following weeks.

Xterio, the gaming Web3 platform, has revealed its decision to create an independent ecosystem following OpenSea's refusal to charge author royalties on NFT resales.

This new initiative will support content creators through the launch of an NFT marketplace, exclusive tokens, a rewarding mechanism, and diverse affiliate programs.

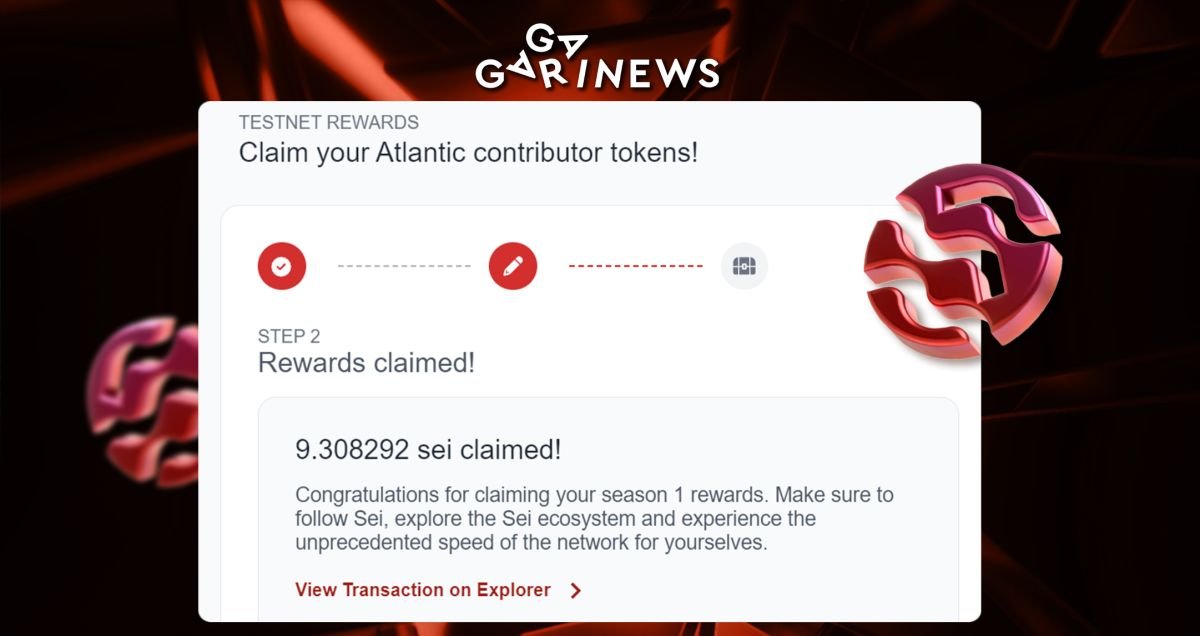

Xterio's officials have said that the launch of this marketplace is imminent, expected within the following weeks.  The Sei team has initiated token claims for those who participated in the testnet early on. However, the meager bonuses received have left many reevaluating their decision to engage in future airdrops, especially for Tier-2 or Tier-3 projects.

Rewards were disappointingly scant, with most individuals earning only a nominal amount for blockchain testing.

The SEI token price decreased by 20%, possibly attributed to either the overnight downturn in the crypto market or the airdrop itself.

P.S.:To claim your tokens, the Compass wallet is essential, and some regions might require a VPN.

The Sei team has initiated token claims for those who participated in the testnet early on. However, the meager bonuses received have left many reevaluating their decision to engage in future airdrops, especially for Tier-2 or Tier-3 projects.

Rewards were disappointingly scant, with most individuals earning only a nominal amount for blockchain testing.

The SEI token price decreased by 20%, possibly attributed to either the overnight downturn in the crypto market or the airdrop itself.

P.S.:To claim your tokens, the Compass wallet is essential, and some regions might require a VPN.  In collaboration with its subsidiary Zynga, acquired for $12.7 billion last year, Take-Two is launching “Sugartown,” a web3 game built on Ethereum, marking the debut of a “major mobile game developer” crafting a crypto-based game “from the ground up.”

Players will utilize Ethereum (or ERC-721) tokens to access the game, stake for energy, and earn in-game currency.

Access tokens named Oras will also be minted this year as part of an initial release.

In collaboration with its subsidiary Zynga, acquired for $12.7 billion last year, Take-Two is launching “Sugartown,” a web3 game built on Ethereum, marking the debut of a “major mobile game developer” crafting a crypto-based game “from the ground up.”

Players will utilize Ethereum (or ERC-721) tokens to access the game, stake for energy, and earn in-game currency.

Access tokens named Oras will also be minted this year as part of an initial release.  The Snapshot platform has recently showcased a proposal: allocate 1 million FRAX tokens from the treasury and use them to buy CRV tokens.

This, according to the initiative's creator, will fortify the community's foothold in DeFi for years to come and enhance liquidity for pairs involving FRAX.

The Snapshot platform has recently showcased a proposal: allocate 1 million FRAX tokens from the treasury and use them to buy CRV tokens.

This, according to the initiative's creator, will fortify the community's foothold in DeFi for years to come and enhance liquidity for pairs involving FRAX.  Following a probe by the Twitter user OnchainPenguin, a dubious $9.5 million transaction was tied to a fresh acquisition proposal.

The inflow to Hodlnaut's wallet was 2221 times higher than the average. Insights from OnchainPenguin pinpoint this account as the source of rewards to OPNX’s leadership.

It seems that Hodlnaut's funds were in some way supporting OPNX's functional outlays,and the trading platform's chiefs might be on a mission to save the virtual currencies FLEX and OX. There's a looming risk that these tokens could nosedive in value if Hodlnaut opts to liquidate its possessions to repay its lenders.

Following a probe by the Twitter user OnchainPenguin, a dubious $9.5 million transaction was tied to a fresh acquisition proposal.

The inflow to Hodlnaut's wallet was 2221 times higher than the average. Insights from OnchainPenguin pinpoint this account as the source of rewards to OPNX’s leadership.

It seems that Hodlnaut's funds were in some way supporting OPNX's functional outlays,and the trading platform's chiefs might be on a mission to save the virtual currencies FLEX and OX. There's a looming risk that these tokens could nosedive in value if Hodlnaut opts to liquidate its possessions to repay its lenders.  The largest copycat token was launched shortly after the news and managed to amass a trading volume of $2.6 million within just eight hours, experiencing an astonishing surge of 12,000%. However, its price has since significantly dropped.

Another noteworthy token, going by the name PepeYieldUnibotSatoshiDoge, also exhibited remarkable growth of 3,000%.

Most of these fake PYUSD tokens are probably created as "honeypots."

The largest copycat token was launched shortly after the news and managed to amass a trading volume of $2.6 million within just eight hours, experiencing an astonishing surge of 12,000%. However, its price has since significantly dropped.

Another noteworthy token, going by the name PepeYieldUnibotSatoshiDoge, also exhibited remarkable growth of 3,000%.

Most of these fake PYUSD tokens are probably created as "honeypots."  As Elon Musk occupies himself with the Twitter rebrand, the crypto community is enthusiastically trading tokens that bear association with the well-known platform only through its former name.

The TwitterDAO (TWITTER) token is presently priced at $0.0001, despite a rocky start.This rise is attributed to the automatic system's verification and contract audit.

Yet, it's vital to bear in mind that such tokens often morph into money-making tools for fraudsters, leading to a total wipeout of the assets belonging to external investors. The recent situation with BALD serves as a stark reminder of this risk.

As Elon Musk occupies himself with the Twitter rebrand, the crypto community is enthusiastically trading tokens that bear association with the well-known platform only through its former name.

The TwitterDAO (TWITTER) token is presently priced at $0.0001, despite a rocky start.This rise is attributed to the automatic system's verification and contract audit.

Yet, it's vital to bear in mind that such tokens often morph into money-making tools for fraudsters, leading to a total wipeout of the assets belonging to external investors. The recent situation with BALD serves as a stark reminder of this risk.  The team behind the largest token on the Base blockchain, Bald, has withdrawn a substantial amount of liquidity from LeetSwap, removing 7,000 ETH and 142 million BALD tokens in a significant transaction.

The price of BALD has plummeted to as low as $0.015, experiencing a decline of over 84%.

In the past few days, BALD had seen a gain of over 30,000%, even without having an official website or active presence on social media.

The team behind the largest token on the Base blockchain, Bald, has withdrawn a substantial amount of liquidity from LeetSwap, removing 7,000 ETH and 142 million BALD tokens in a significant transaction.

The price of BALD has plummeted to as low as $0.015, experiencing a decline of over 84%.

In the past few days, BALD had seen a gain of over 30,000%, even without having an official website or active presence on social media.  Currently, Mantle DAO is evaluating a proposal that would prohibit the conversion of BIT tokens held by FTX Group into the new MNT token. Previously, Alameda Research, a branch of the FTX Group, swapped 3.4 million FTT tokens for a staggering 100 million BIT tokens, which equated to around $43 million. Yet FTX's descent into bankruptcy prompted DAO members to introduce this proposal. MNT is a token that was launched as Mantle's L2 mainnet went live. The blockchain was established by the Bybit exchange, which initiated the merge of BIT (BitDAO) and MNT tokens. Controversies aside, there's robust support for this proposal within the Mantle enclave, spotlighting the overarching investor community's interests.

Currently, Mantle DAO is evaluating a proposal that would prohibit the conversion of BIT tokens held by FTX Group into the new MNT token. Previously, Alameda Research, a branch of the FTX Group, swapped 3.4 million FTT tokens for a staggering 100 million BIT tokens, which equated to around $43 million. Yet FTX's descent into bankruptcy prompted DAO members to introduce this proposal. MNT is a token that was launched as Mantle's L2 mainnet went live. The blockchain was established by the Bybit exchange, which initiated the merge of BIT (BitDAO) and MNT tokens. Controversies aside, there's robust support for this proposal within the Mantle enclave, spotlighting the overarching investor community's interests.  A year has passed since WhiteBIT's exchange token was unveiled on August 14th.

In this brief time, the team behind it didn't just rest on their laurels; they launched a blockchain, making WBT's first anniversary a celebration of a genuine coin!

Facing the challenges of a prolonged bear market head-on, WBT swiftly carved out its own space, gaining a legion of ardent supporters.

Its market standing? A noteworthy triple of its inaugural IEO pricing and a 5th rank amidst centralized exchange tokens, as chronicled by CoinGecko.

We salute this shining star and hope for further ascent, delighting all crypto enthusiasts who set the level!

A year has passed since WhiteBIT's exchange token was unveiled on August 14th.

In this brief time, the team behind it didn't just rest on their laurels; they launched a blockchain, making WBT's first anniversary a celebration of a genuine coin!

Facing the challenges of a prolonged bear market head-on, WBT swiftly carved out its own space, gaining a legion of ardent supporters.

Its market standing? A noteworthy triple of its inaugural IEO pricing and a 5th rank amidst centralized exchange tokens, as chronicled by CoinGecko.

We salute this shining star and hope for further ascent, delighting all crypto enthusiasts who set the level!  Casting their gaze five years into the future, investment company Bernstein speculates the stablecoin market will burgeon to a staggering $2.8 trillion.

A key catalyst for this boom? The widespread adoption of stablecoins by financial platforms, a trend set to amplify the circulation of these tokens.

Casting their gaze five years into the future, investment company Bernstein speculates the stablecoin market will burgeon to a staggering $2.8 trillion.

A key catalyst for this boom? The widespread adoption of stablecoins by financial platforms, a trend set to amplify the circulation of these tokens.  Kaiko Research’s data highlights reduced engagement in prominent tokens:

“AXS, the governance token of the Axie Infinity ecosystem is down more than 90% since early 2022 and SAND, MANA and GALA tokens have seen a a similar drop in value.”

Analysts point out that monetary incentives were a primary motivator for users, but these platforms faced challenges in maintaining their user base due to diminishing in-game rewards.

Kaiko Research’s data highlights reduced engagement in prominent tokens:

“AXS, the governance token of the Axie Infinity ecosystem is down more than 90% since early 2022 and SAND, MANA and GALA tokens have seen a a similar drop in value.”

Analysts point out that monetary incentives were a primary motivator for users, but these platforms faced challenges in maintaining their user base due to diminishing in-game rewards. Frax Finance: A Self-Sufficient DeFi Ecosystem

Frax Finance stands out as a DeFi platform that hosts its own decentralized stablecoins, an automated market maker, a lending platform, a cross-chain bridge, and native tokens. By the close of 2023, this ensemble will incorporate an L2 blockchain. For the time being, the Frax protocol is running on Ethereum.

Frax Finance stands out as a DeFi platform that hosts its own decentralized stablecoins, an automated market maker, a lending platform, a cross-chain bridge, and native tokens. By the close of 2023, this ensemble will incorporate an L2 blockchain. For the time being, the Frax protocol is running on Ethereum.  Kenya’s Interior Minister Kithure Kindiki announced the suspension of Worldcoin’s local activities in the country.

Relevant agencies are conducting inquiries and investigations to determine the authenticity and legality of the activities, ensuring the absence of risks to Kenyans.

The video shows people lining up to have their irises scanned, with the promise of receiving 25 free Worldcoin tokens ($56) in Kenya.

We've previously detailed Sam Altman's vision for the Worldcoin project in our article.

Kenya’s Interior Minister Kithure Kindiki announced the suspension of Worldcoin’s local activities in the country.

Relevant agencies are conducting inquiries and investigations to determine the authenticity and legality of the activities, ensuring the absence of risks to Kenyans.

The video shows people lining up to have their irises scanned, with the promise of receiving 25 free Worldcoin tokens ($56) in Kenya.

We've previously detailed Sam Altman's vision for the Worldcoin project in our article. BTSE: The Crypto Oasis with 150+ Coins!

BTSE is a crypto exchange with 150+ assets listed. It uses BTSE tokens, part of the Liquid Network, and has a market cap of $274M. It offers multiple rewards and staking program benefits. Founded by pros with experience in Wall Street, it is focused on innovation and usability.

BTSE is a crypto exchange with 150+ assets listed. It uses BTSE tokens, part of the Liquid Network, and has a market cap of $274M. It offers multiple rewards and staking program benefits. Founded by pros with experience in Wall Street, it is focused on innovation and usability.  CryptoQuant data indicates that there's been a 99% decrease in the number of active addresses, along with a 98% drop in transaction volume.

The majority of airdrop recipients (95% of them) opted to sell their tokens, with a significant 80% getting rid of their tokens entirely.

CryptoQuant data indicates that there's been a 99% decrease in the number of active addresses, along with a 98% drop in transaction volume.

The majority of airdrop recipients (95% of them) opted to sell their tokens, with a significant 80% getting rid of their tokens entirely.