#tether

99 articles found

Latest

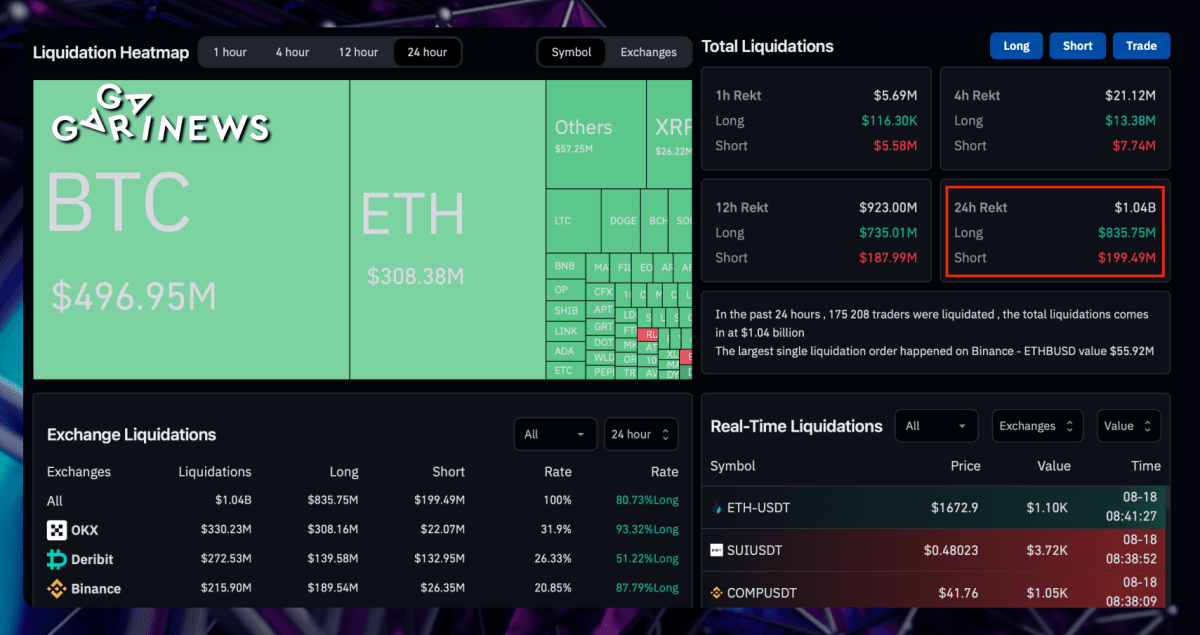

Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.

Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.  Company’s CTO Paolo Ardoino has shared his excitement about a mobile app designed to facilitate international purchases settlements B2B, B2C and C2C based on USDT and XAUT payments.

Notably, the app will also incorporate support for Bitcoin Lightning.

Paolo stated that he envisions this app as the future of trade finance.

Having personally reviewed the code, his experience as a developer has left him genuinely impressed. Currently, the app is in its testing stages, with more specifics yet to be unveiled.

Company’s CTO Paolo Ardoino has shared his excitement about a mobile app designed to facilitate international purchases settlements B2B, B2C and C2C based on USDT and XAUT payments.

Notably, the app will also incorporate support for Bitcoin Lightning.

Paolo stated that he envisions this app as the future of trade finance.

Having personally reviewed the code, his experience as a developer has left him genuinely impressed. Currently, the app is in its testing stages, with more specifics yet to be unveiled.  Renowned business analyst Adam Cochran recently shared insights concerning Huobi's financial state and its potential insolvency.

Key takeaways from Adam's analysis:

Investigation Underway: Both Huobi and Tron are facing scrutiny, with their staff being questioned by the police.

Unusual Asset Distribution: After Justin Sun's introduction of wrapped USDT (stUSDT), a whopping 98% of user assets intended for Tether bond redemptions ended up in the wallets of Huobi and Justin Sun.

Discrepancy with USDT Balance: Huobi's reported USDT balance is just $63 million, but their users hold a staggering $631 million worth of USDT. Something doesn't add up here.

ETH Holdings in Question: It appears that Huobi is holding all of its users' ETH as stETH, raising eyebrows about their handling of customer assets.

Binance Making Moves: Meanwhile, Binance is actively selling USDT and purchasing DAI, possibly indicating a shift in market dynamics.

Outdated Reserves Page: It's been a whole month since Huobi last updated its reserve page, and discrepancies between the reported figures and wallet balances need clarification.

Renowned business analyst Adam Cochran recently shared insights concerning Huobi's financial state and its potential insolvency.

Key takeaways from Adam's analysis:

Investigation Underway: Both Huobi and Tron are facing scrutiny, with their staff being questioned by the police.

Unusual Asset Distribution: After Justin Sun's introduction of wrapped USDT (stUSDT), a whopping 98% of user assets intended for Tether bond redemptions ended up in the wallets of Huobi and Justin Sun.

Discrepancy with USDT Balance: Huobi's reported USDT balance is just $63 million, but their users hold a staggering $631 million worth of USDT. Something doesn't add up here.

ETH Holdings in Question: It appears that Huobi is holding all of its users' ETH as stETH, raising eyebrows about their handling of customer assets.

Binance Making Moves: Meanwhile, Binance is actively selling USDT and purchasing DAI, possibly indicating a shift in market dynamics.

Outdated Reserves Page: It's been a whole month since Huobi last updated its reserve page, and discrepancies between the reported figures and wallet balances need clarification.  The CEO of Binance has repeatedly aired his distrust of USDT, dubbing it a "black box" due to its lack of transparency in audits and reports.

Also, Binance listed a new stablecoin, FDUSD, on July 26th, that has seen a rapid rise in capitalization. They are in the process of designing their own algorithmic stablecoin and are open to listing more USDT equivalents on their exchange.

Meanwhile, Tether's CTO has hinted at CZ's involvement in market manipulation in the stablecoin sector, mentioning a 10 basis point USDT depeg on July 28th.

"Isn't it interesting that USDt is being pressured down (slightly, within 10bps, just to push market makers to react), and USDc, the main competitor that you would expect being gaining from the situation, is redeemed heavily nevertheless, while suddenly a competitor born 2 days ago is getting it all? Exactly! It feels definitely organic and not manipulative at all. Some people never learn."

For the record, the Twitter account of First Digital Labs (FDUSD) has a mere 585 followers.

It's intriguing to watch the outcome of this power struggle. Is this just the tip of the iceberg?

Fingers crossed, this won't escalate into a challenge for a bout in the octagon, as seems to be a popular move among billionaires...

The CEO of Binance has repeatedly aired his distrust of USDT, dubbing it a "black box" due to its lack of transparency in audits and reports.

Also, Binance listed a new stablecoin, FDUSD, on July 26th, that has seen a rapid rise in capitalization. They are in the process of designing their own algorithmic stablecoin and are open to listing more USDT equivalents on their exchange.

Meanwhile, Tether's CTO has hinted at CZ's involvement in market manipulation in the stablecoin sector, mentioning a 10 basis point USDT depeg on July 28th.

"Isn't it interesting that USDt is being pressured down (slightly, within 10bps, just to push market makers to react), and USDc, the main competitor that you would expect being gaining from the situation, is redeemed heavily nevertheless, while suddenly a competitor born 2 days ago is getting it all? Exactly! It feels definitely organic and not manipulative at all. Some people never learn."

For the record, the Twitter account of First Digital Labs (FDUSD) has a mere 585 followers.

It's intriguing to watch the outcome of this power struggle. Is this just the tip of the iceberg?

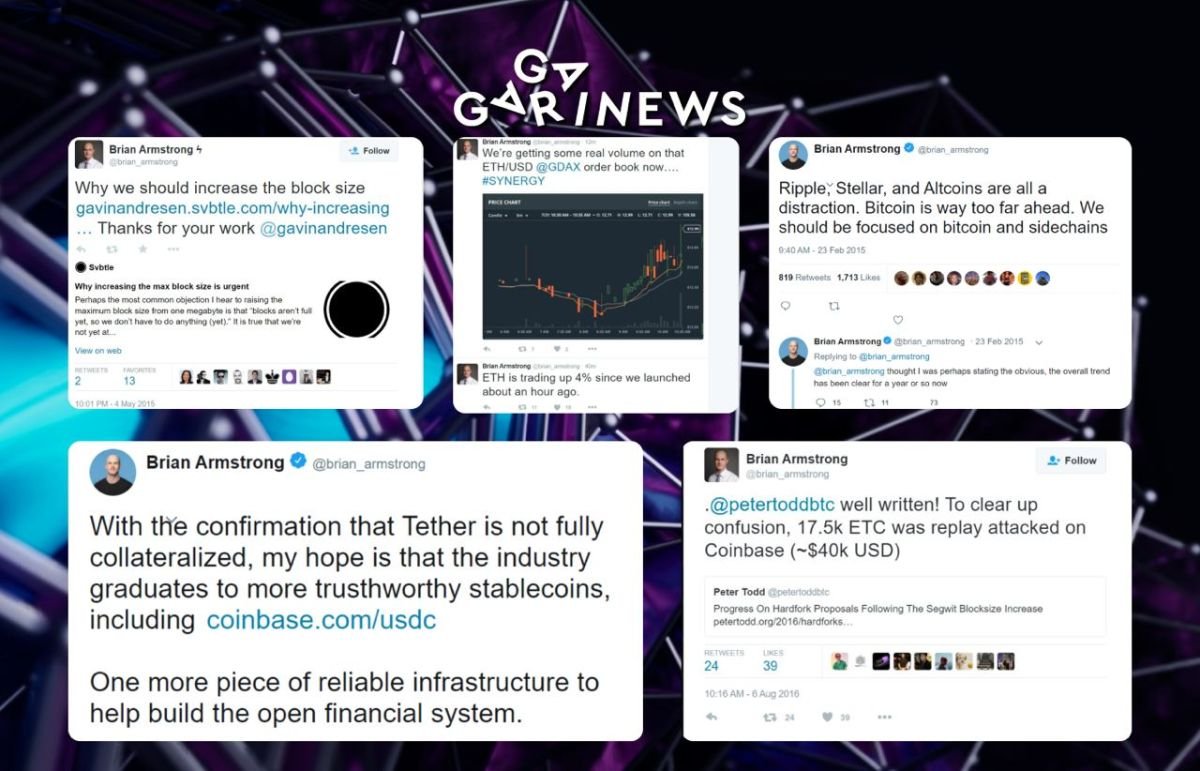

Fingers crossed, this won't escalate into a challenge for a bout in the octagon, as seems to be a popular move among billionaires...  Coinbase CEO Brian Armstrong has recently deleted a substantial number of his tweets from the years 2015 to 2018. Additionally, the digital archive of the World Wide Web, known as the WayBackMachine, has also removed its archive of his tweets.

These tweets from that period covered a range of topics, including Brian expressing his support for increasing Bitcoin’s block size, referring to altcoins as distractions, discussing “replay attacks” on Coinbase, highlighting Ethereum’s price surge after its listing on Coinbase, questioning the full collateralization of Tether, and endorsing USDC, among other things.

As a result of the deletions, these tweets now only exist in the form of screenshots that were captured and shared by others during that time.

Coinbase CEO Brian Armstrong has recently deleted a substantial number of his tweets from the years 2015 to 2018. Additionally, the digital archive of the World Wide Web, known as the WayBackMachine, has also removed its archive of his tweets.

These tweets from that period covered a range of topics, including Brian expressing his support for increasing Bitcoin’s block size, referring to altcoins as distractions, discussing “replay attacks” on Coinbase, highlighting Ethereum’s price surge after its listing on Coinbase, questioning the full collateralization of Tether, and endorsing USDC, among other things.

As a result of the deletions, these tweets now only exist in the form of screenshots that were captured and shared by others during that time. Tether and Georgia Government Collaborate to Drive Blockchain

Tether, the leading stablecoin provider, has signed a Memorandum of Understanding (MOU) with the Government of Georgia to develop and promote blockchain, Bitcoin, and peer-to-peer infrastructure. This strategic partnership aims to position Georgia as a central hub for cutting-edge technologies, sparking a wave of innovation and economic growth.

Tether, the leading stablecoin provider, has signed a Memorandum of Understanding (MOU) with the Government of Georgia to develop and promote blockchain, Bitcoin, and peer-to-peer infrastructure. This strategic partnership aims to position Georgia as a central hub for cutting-edge technologies, sparking a wave of innovation and economic growth.  Tether has executed a significant freeze of $225 million in assets, targeting an international crime ring involved in human trafficking. This strategic move was a result of a collaboration between Tether, the U.S. Department of Justice, and the cryptocurrency exchange OKX.

Tether has executed a significant freeze of $225 million in assets, targeting an international crime ring involved in human trafficking. This strategic move was a result of a collaboration between Tether, the U.S. Department of Justice, and the cryptocurrency exchange OKX.  On Wednesday, U.S. lawmakers introduced a bill that prohibits federal government officials from engaging with Chinese blockchain companies, reflecting the U.S. government’s ongoing concerns regarding Chinese involvement in the cryptocurrency sector.

On Wednesday, U.S. lawmakers introduced a bill that prohibits federal government officials from engaging with Chinese blockchain companies, reflecting the U.S. government’s ongoing concerns regarding Chinese involvement in the cryptocurrency sector. Tether’s Multimillion-Dollar Foray into AI and Mining

Tether Group has invested $420 million in computer chips. Specifically, they acquired 10,000 H100 GPUs from Nvidia, a popular choice in the artificial intelligence sector. This deal also includes a 20% ownership stake in Northern Data, a German-listed bitcoin mining company.

Tether Group has invested $420 million in computer chips. Specifically, they acquired 10,000 H100 GPUs from Nvidia, a popular choice in the artificial intelligence sector. This deal also includes a 20% ownership stake in Northern Data, a German-listed bitcoin mining company.  The issuer of USDT has resolved to end support for Kusama, Bitcoin Cash SLP, and Omni Layer. This move follows an in-depth analysis of the functionality, safety, and stability of these particular blockchains.

Notably, Omni Layer, Tether's first transport layer since its inception in 2014, was instrumental during its early days. However, it has witnessed a decline in popularity due to rising competitive solutions.

Though minting of USDT on the aforesaid platforms will be terminated, the redemption process will stay in place for a duration extending at least a year.

The issuer of USDT has resolved to end support for Kusama, Bitcoin Cash SLP, and Omni Layer. This move follows an in-depth analysis of the functionality, safety, and stability of these particular blockchains.

Notably, Omni Layer, Tether's first transport layer since its inception in 2014, was instrumental during its early days. However, it has witnessed a decline in popularity due to rising competitive solutions.

Though minting of USDT on the aforesaid platforms will be terminated, the redemption process will stay in place for a duration extending at least a year.  Tether CTO:

"The launch of PayPal stablecoin doesn’t impact Tether as the firm does not serve U.S. users. If PYUSD launches in international markets, it could have a positive impact on the crypto industry and potentially erode revenues for payment giants like MasterCard and Visa."

Co-founder of zkLend:

"PayPal will indeed bolster the perception and acceptance of cryptocurrencies, but it can lead to a diminished market share for decentralized stablecoins, threatening the very principles of decentralization that underpin the crypto space."

Analysts at JPMorgan:

"This could boost Ethereum activity and enhance Ethereum’s network utility as a stablecoin/DeFi platform. PYUSD could fill the void left by the $20 billion shrinkage of Binance's BUSD stablecoin, which was forced to shut down by U.S. regulators earlier this year."

Co-founder of Sei Network:

"The gas fees of using PYUSD will be ridiculous, which will disincentivize its usage. To help make the user experience better, PayPal will either need to subsidize transaction costs or will need to help support PYUSD on other networks with cheaper gas fees."

It's worth noting that PayPal currently serves 435 million customers globally.

Tether CTO:

"The launch of PayPal stablecoin doesn’t impact Tether as the firm does not serve U.S. users. If PYUSD launches in international markets, it could have a positive impact on the crypto industry and potentially erode revenues for payment giants like MasterCard and Visa."

Co-founder of zkLend:

"PayPal will indeed bolster the perception and acceptance of cryptocurrencies, but it can lead to a diminished market share for decentralized stablecoins, threatening the very principles of decentralization that underpin the crypto space."

Analysts at JPMorgan:

"This could boost Ethereum activity and enhance Ethereum’s network utility as a stablecoin/DeFi platform. PYUSD could fill the void left by the $20 billion shrinkage of Binance's BUSD stablecoin, which was forced to shut down by U.S. regulators earlier this year."

Co-founder of Sei Network:

"The gas fees of using PYUSD will be ridiculous, which will disincentivize its usage. To help make the user experience better, PayPal will either need to subsidize transaction costs or will need to help support PYUSD on other networks with cheaper gas fees."

It's worth noting that PayPal currently serves 435 million customers globally.  The company's developers are gearing up to release JavaScript libraries tailored to facilitate the transmission of commands and signals to mining hardware.

Tether CTO Paolo Ardoino confirmed his direct involvement in the coding process, asserting that this new development will bolster both performance and security.

The company's developers are gearing up to release JavaScript libraries tailored to facilitate the transmission of commands and signals to mining hardware.

Tether CTO Paolo Ardoino confirmed his direct involvement in the coding process, asserting that this new development will bolster both performance and security.  A user fell victim to a 'Zero Transfer Phishing' scam, losing $20 million USDT. These malicious parties imitated a few characters in the wallet address to deceive the unsuspecting victim. Fortunately, Tether reacted swiftly and froze the assets in just 50 minutes.Always stay vigilant when copying wallet addresses from transaction records.Scammers create custom smart contracts to generate look-alike addresses and dupe potential victims.

Correct Address: 0xa7B4BAC8f0f9692e56750aEFB5f6cB5516E90570

Phishing Address: 0xa7Bf48749D2E4aA29e3209879956b9bAa9E90570

A user fell victim to a 'Zero Transfer Phishing' scam, losing $20 million USDT. These malicious parties imitated a few characters in the wallet address to deceive the unsuspecting victim. Fortunately, Tether reacted swiftly and froze the assets in just 50 minutes.Always stay vigilant when copying wallet addresses from transaction records.Scammers create custom smart contracts to generate look-alike addresses and dupe potential victims.

Correct Address: 0xa7B4BAC8f0f9692e56750aEFB5f6cB5516E90570

Phishing Address: 0xa7Bf48749D2E4aA29e3209879956b9bAa9E90570