#support

185 articles found

Latest

Today, key aspects of the summit's agenda were revealed, giving priority to risk management and support strategies.

Leaders from major countries, top tech organizations, academic circles, and civic groups will converge at the event to discuss expedient actions in the cutting-edge arena of AI development.

The UK's representatives are of the opinion that fostering AI investment could significantly benefit society and economic productivity, but only if done within a regulatory framework.

“Without appropriate guardrails, this technology also poses significant risks in ways that do not respect national boundaries. The need to address these risks, including at an international level, is increasingly urgent.“

Today, key aspects of the summit's agenda were revealed, giving priority to risk management and support strategies.

Leaders from major countries, top tech organizations, academic circles, and civic groups will converge at the event to discuss expedient actions in the cutting-edge arena of AI development.

The UK's representatives are of the opinion that fostering AI investment could significantly benefit society and economic productivity, but only if done within a regulatory framework.

“Without appropriate guardrails, this technology also poses significant risks in ways that do not respect national boundaries. The need to address these risks, including at an international level, is increasingly urgent.“  After the announcement that MakerDAO intends to roll out a new version of its platform on Solana, Anatoly Yakovenko suggested this shouldn't be viewed as a challenge to Ethereum. In his perspective, MakerDAO's move accentuates the merits of open-source solutions rather than the superiority of one blockchain over another, especially given Ethereum's pivotal role in research for numerous developers. "Ethereum is awesome. Solana wasn’t built in a vacuum, and tons and tons of things that make Solana special were built based on Ethereum’s r&d," commented the Solana co-founder. Meanwhile, Ethereum co-founder Vitalik Buterin has sold all his MKR tokens for 353 ETH.

After the announcement that MakerDAO intends to roll out a new version of its platform on Solana, Anatoly Yakovenko suggested this shouldn't be viewed as a challenge to Ethereum. In his perspective, MakerDAO's move accentuates the merits of open-source solutions rather than the superiority of one blockchain over another, especially given Ethereum's pivotal role in research for numerous developers. "Ethereum is awesome. Solana wasn’t built in a vacuum, and tons and tons of things that make Solana special were built based on Ethereum’s r&d," commented the Solana co-founder. Meanwhile, Ethereum co-founder Vitalik Buterin has sold all his MKR tokens for 353 ETH.  Polygon Labs has launched its Chain Development Kit (CDK), a software tool designed to help developers create Ethereum Layer 2 chains powered by zero-knowledge proofs.

The toolkit will support an "Interop Layer," a new protocol that aggregates zero-knowledge proofs from multiple Polygon chains and secures them on the Ethereum mainnet.

This move aligns with Polygon's shift towards creating more interconnected chains, similar to ecosystems like Cosmos and Polkadot.

Polygon Labs has launched its Chain Development Kit (CDK), a software tool designed to help developers create Ethereum Layer 2 chains powered by zero-knowledge proofs.

The toolkit will support an "Interop Layer," a new protocol that aggregates zero-knowledge proofs from multiple Polygon chains and secures them on the Ethereum mainnet.

This move aligns with Polygon's shift towards creating more interconnected chains, similar to ecosystems like Cosmos and Polkadot.  Xterio, the gaming Web3 platform, has revealed its decision to create an independent ecosystem following OpenSea's refusal to charge author royalties on NFT resales.

This new initiative will support content creators through the launch of an NFT marketplace, exclusive tokens, a rewarding mechanism, and diverse affiliate programs.

Xterio's officials have said that the launch of this marketplace is imminent, expected within the following weeks.

Xterio, the gaming Web3 platform, has revealed its decision to create an independent ecosystem following OpenSea's refusal to charge author royalties on NFT resales.

This new initiative will support content creators through the launch of an NFT marketplace, exclusive tokens, a rewarding mechanism, and diverse affiliate programs.

Xterio's officials have said that the launch of this marketplace is imminent, expected within the following weeks.  Currently, Mantle DAO is evaluating a proposal that would prohibit the conversion of BIT tokens held by FTX Group into the new MNT token. Previously, Alameda Research, a branch of the FTX Group, swapped 3.4 million FTT tokens for a staggering 100 million BIT tokens, which equated to around $43 million. Yet FTX's descent into bankruptcy prompted DAO members to introduce this proposal. MNT is a token that was launched as Mantle's L2 mainnet went live. The blockchain was established by the Bybit exchange, which initiated the merge of BIT (BitDAO) and MNT tokens. Controversies aside, there's robust support for this proposal within the Mantle enclave, spotlighting the overarching investor community's interests.

Currently, Mantle DAO is evaluating a proposal that would prohibit the conversion of BIT tokens held by FTX Group into the new MNT token. Previously, Alameda Research, a branch of the FTX Group, swapped 3.4 million FTT tokens for a staggering 100 million BIT tokens, which equated to around $43 million. Yet FTX's descent into bankruptcy prompted DAO members to introduce this proposal. MNT is a token that was launched as Mantle's L2 mainnet went live. The blockchain was established by the Bybit exchange, which initiated the merge of BIT (BitDAO) and MNT tokens. Controversies aside, there's robust support for this proposal within the Mantle enclave, spotlighting the overarching investor community's interests.  PayPal suspends crypto buying services in the UK

Starting October 1, 2023, PayPal will no longer support cryptocurrency purchases for it's users from the United Kingdom. This action is consistent with the company's obligation to comply with local financial legislation.

While the measure is planned to last until the start of 2024, PayPal remains hopeful about restoring the service. During the suspension, users are free to either hold their existing cryptocurrencies without any associated fees or sell them if they choose.

PayPal suspends crypto buying services in the UK

Starting October 1, 2023, PayPal will no longer support cryptocurrency purchases for it's users from the United Kingdom. This action is consistent with the company's obligation to comply with local financial legislation.

While the measure is planned to last until the start of 2024, PayPal remains hopeful about restoring the service. During the suspension, users are free to either hold their existing cryptocurrencies without any associated fees or sell them if they choose.  Coinbase, the cryptocurrency exchange, has joined forces with Peoples Trust Company. This collaboration facilitates access to the Interac e-Transfers system, streamlining deposit and withdrawal processes for its Canadian user base.

What's more, they're gifting users a one-month free gateway into the Coinbase One subscription. This means no trade-related fees, amplified staking profits, and swift client support.

"Canada is well positioned to be a global leader in the cryptoeconomy thanks to the high levels of crypto awareness, a passionate local tech ecosystem, and the progress towards a strong regulatory framework," voiced Nana Murugesan, the International Development VP at Coinbase.

Coinbase, the cryptocurrency exchange, has joined forces with Peoples Trust Company. This collaboration facilitates access to the Interac e-Transfers system, streamlining deposit and withdrawal processes for its Canadian user base.

What's more, they're gifting users a one-month free gateway into the Coinbase One subscription. This means no trade-related fees, amplified staking profits, and swift client support.

"Canada is well positioned to be a global leader in the cryptoeconomy thanks to the high levels of crypto awareness, a passionate local tech ecosystem, and the progress towards a strong regulatory framework," voiced Nana Murugesan, the International Development VP at Coinbase.  Company’s CTO Paolo Ardoino has shared his excitement about a mobile app designed to facilitate international purchases settlements B2B, B2C and C2C based on USDT and XAUT payments.

Notably, the app will also incorporate support for Bitcoin Lightning.

Paolo stated that he envisions this app as the future of trade finance.

Having personally reviewed the code, his experience as a developer has left him genuinely impressed. Currently, the app is in its testing stages, with more specifics yet to be unveiled.

Company’s CTO Paolo Ardoino has shared his excitement about a mobile app designed to facilitate international purchases settlements B2B, B2C and C2C based on USDT and XAUT payments.

Notably, the app will also incorporate support for Bitcoin Lightning.

Paolo stated that he envisions this app as the future of trade finance.

Having personally reviewed the code, his experience as a developer has left him genuinely impressed. Currently, the app is in its testing stages, with more specifics yet to be unveiled.  American Senators Elizabeth Warren, Roger Marshall, Joe Manchin, and Lindsey Graham have once again introduced a proposal to tackle money laundering through cryptocurrencies.

The Institute of Banking Policy wasted no time and promptly voiced its support for this bipartisan legislation, which seeks to tighten regulations on digital assets to ensure they fully comply with existing financial system rules

American Senators Elizabeth Warren, Roger Marshall, Joe Manchin, and Lindsey Graham have once again introduced a proposal to tackle money laundering through cryptocurrencies.

The Institute of Banking Policy wasted no time and promptly voiced its support for this bipartisan legislation, which seeks to tighten regulations on digital assets to ensure they fully comply with existing financial system rules FSB's Crypto Guidelines Greeted Positively by G20 Leaders

The Financial Stability Board's (FSB) guidelines on crypto assets and international stablecoin operations have gained support from the Group of Twenty (G20) nations. This development was announced by Nirmala Sitharaman, India's Finance Minister, in a press briefing on Tuesday. Currently, India holds the presidency of the G20.

The Financial Stability Board's (FSB) guidelines on crypto assets and international stablecoin operations have gained support from the Group of Twenty (G20) nations. This development was announced by Nirmala Sitharaman, India's Finance Minister, in a press briefing on Tuesday. Currently, India holds the presidency of the G20.  X, previously known as Twitter, has successfully obtained the Rhode Island Currency Transmitter License, enabling it to offer cryptocurrency payments and trading services in the U.S.

This acquisition, confirmed on August 28 via NMLS data, aligns with X's ambition to be a "cryptocurrency-friendly" platform.

Earlier, X had integrated features like Bitcoin tipping and NFT profile picture support. With this license, users might soon be able to send, receive, and store crypto directly on X, further mainstreaming cryptocurrency use.

X, previously known as Twitter, has successfully obtained the Rhode Island Currency Transmitter License, enabling it to offer cryptocurrency payments and trading services in the U.S.

This acquisition, confirmed on August 28 via NMLS data, aligns with X's ambition to be a "cryptocurrency-friendly" platform.

Earlier, X had integrated features like Bitcoin tipping and NFT profile picture support. With this license, users might soon be able to send, receive, and store crypto directly on X, further mainstreaming cryptocurrency use.  The community of Terra Luna Classic has dismissed the USTC Repeg team's request for funding. Voting outcomes showed 45% in support, 43% objecting with veto power, and 11% rejected it outright.

Even though 11 of the 17 validators were in support, the proposal failed to gain traction with the general public. The request was for 285 million LUNC ($20,000) to refine an instrument for the USTC Incremental Repeg Buybacks & Staking Swaps algorithm.

The community of Terra Luna Classic has dismissed the USTC Repeg team's request for funding. Voting outcomes showed 45% in support, 43% objecting with veto power, and 11% rejected it outright.

Even though 11 of the 17 validators were in support, the proposal failed to gain traction with the general public. The request was for 285 million LUNC ($20,000) to refine an instrument for the USTC Incremental Repeg Buybacks & Staking Swaps algorithm.  The issuer of USDT has resolved to end support for Kusama, Bitcoin Cash SLP, and Omni Layer. This move follows an in-depth analysis of the functionality, safety, and stability of these particular blockchains.

Notably, Omni Layer, Tether's first transport layer since its inception in 2014, was instrumental during its early days. However, it has witnessed a decline in popularity due to rising competitive solutions.

Though minting of USDT on the aforesaid platforms will be terminated, the redemption process will stay in place for a duration extending at least a year.

The issuer of USDT has resolved to end support for Kusama, Bitcoin Cash SLP, and Omni Layer. This move follows an in-depth analysis of the functionality, safety, and stability of these particular blockchains.

Notably, Omni Layer, Tether's first transport layer since its inception in 2014, was instrumental during its early days. However, it has witnessed a decline in popularity due to rising competitive solutions.

Though minting of USDT on the aforesaid platforms will be terminated, the redemption process will stay in place for a duration extending at least a year.  US House Financial Services Committee members, led by Chair Patrick McHenry, are seeking clarity from the SEC and FINRA about how Prometheum secured a special purpose broker-dealer (SPBD) license.

They're probing if the SEC used Prometheum as a model firm to support Gary Gensler's stance that existing laws suffice for crypto regulation in the U.S.

Despite Prometheum's claims of being pivotal for regulated digital asset offerings, the lawmakers pointed out that the firm hasn't served any customers yet. Also they raised concerns about potential ties between Prometheum and the Chinese Communist Party.

The committee has requested related documents and communication records by Aug. 22.

US House Financial Services Committee members, led by Chair Patrick McHenry, are seeking clarity from the SEC and FINRA about how Prometheum secured a special purpose broker-dealer (SPBD) license.

They're probing if the SEC used Prometheum as a model firm to support Gary Gensler's stance that existing laws suffice for crypto regulation in the U.S.

Despite Prometheum's claims of being pivotal for regulated digital asset offerings, the lawmakers pointed out that the firm hasn't served any customers yet. Also they raised concerns about potential ties between Prometheum and the Chinese Communist Party.

The committee has requested related documents and communication records by Aug. 22.  Amid the unresolved dispute between Coinbase and the SEC, a number of esteemed legal academics have weighed in, penning a court statement in support of the cryptocurrency exchange.

Their stance is clear: an asset should only be deemed an investment contract if it promises profits, earnings, or assets from investments. Scholars assert that the court must strictly follow this legal definition, otherwise, it may jeopardize belief in existing securities laws.

Amid the unresolved dispute between Coinbase and the SEC, a number of esteemed legal academics have weighed in, penning a court statement in support of the cryptocurrency exchange.

Their stance is clear: an asset should only be deemed an investment contract if it promises profits, earnings, or assets from investments. Scholars assert that the court must strictly follow this legal definition, otherwise, it may jeopardize belief in existing securities laws.  Several leading venture capital companies such as Temasek, Sequoia Capital, and Softbank, are now facing legal challenges over alleged complicity in FTX fraud.

The claimants in the lawsuit accuse the investors of using their power and financial resources to support the exchange's activities, despite numerous legal violations and misappropriation of customer funds by FTX.

For instance, before the eventual bankruptcy of the exchange, Temasek affirmed that their rigorous eight-month scrutiny of financial aspects and compliance standards yielded no troubling findings.

Several leading venture capital companies such as Temasek, Sequoia Capital, and Softbank, are now facing legal challenges over alleged complicity in FTX fraud.

The claimants in the lawsuit accuse the investors of using their power and financial resources to support the exchange's activities, despite numerous legal violations and misappropriation of customer funds by FTX.

For instance, before the eventual bankruptcy of the exchange, Temasek affirmed that their rigorous eight-month scrutiny of financial aspects and compliance standards yielded no troubling findings.  Brian Armstrong has publicly urged US residents to actively support the 21st Century Financial Innovation and Technology Bill, which promises to bring much-needed clarity to cryptocurrency regulation.

Armstrong emphasized that it is ordinary Americans who can have a decisive impact on the outcome of the vote by sending an email to their representatives asking them to support the bill.

In a more detailed statement, Coinbase added that the bill, in addition to protecting consumer rights and enhancing national security, has the potential to spur job creation in the US.

Brian Armstrong has publicly urged US residents to actively support the 21st Century Financial Innovation and Technology Bill, which promises to bring much-needed clarity to cryptocurrency regulation.

Armstrong emphasized that it is ordinary Americans who can have a decisive impact on the outcome of the vote by sending an email to their representatives asking them to support the bill.

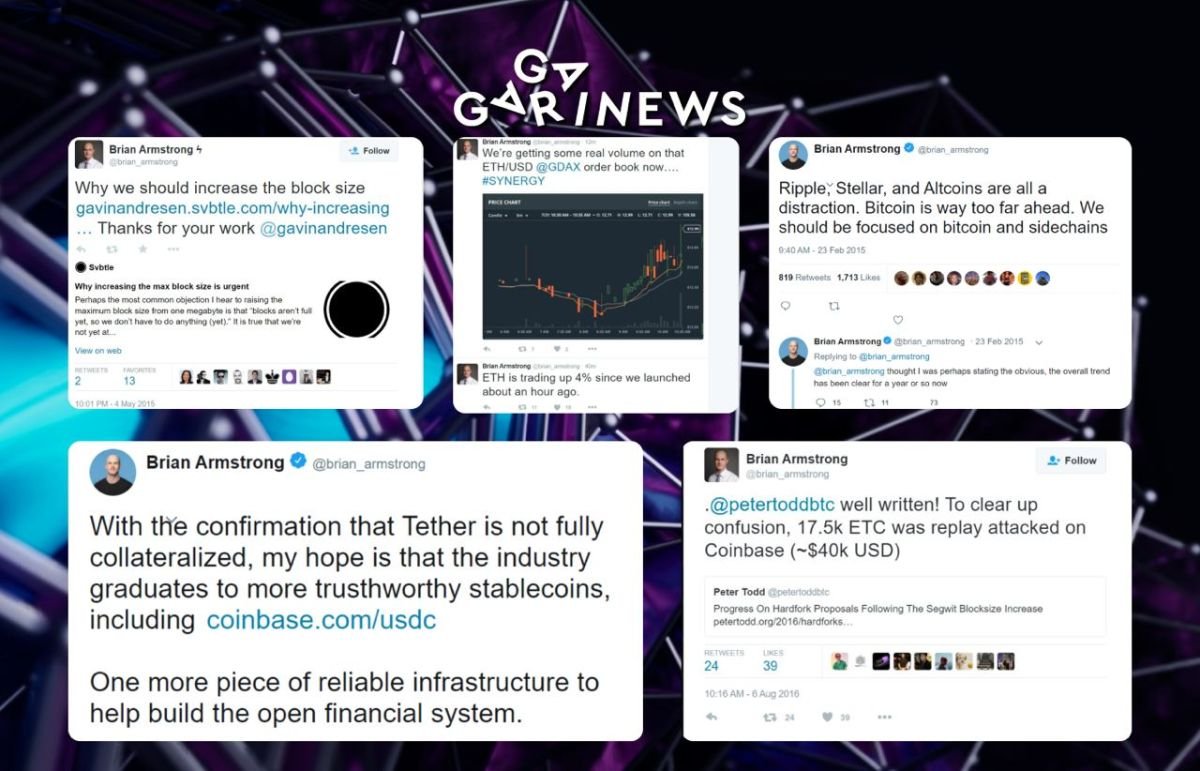

In a more detailed statement, Coinbase added that the bill, in addition to protecting consumer rights and enhancing national security, has the potential to spur job creation in the US.  Coinbase CEO Brian Armstrong has recently deleted a substantial number of his tweets from the years 2015 to 2018. Additionally, the digital archive of the World Wide Web, known as the WayBackMachine, has also removed its archive of his tweets.

These tweets from that period covered a range of topics, including Brian expressing his support for increasing Bitcoin’s block size, referring to altcoins as distractions, discussing “replay attacks” on Coinbase, highlighting Ethereum’s price surge after its listing on Coinbase, questioning the full collateralization of Tether, and endorsing USDC, among other things.

As a result of the deletions, these tweets now only exist in the form of screenshots that were captured and shared by others during that time.

Coinbase CEO Brian Armstrong has recently deleted a substantial number of his tweets from the years 2015 to 2018. Additionally, the digital archive of the World Wide Web, known as the WayBackMachine, has also removed its archive of his tweets.

These tweets from that period covered a range of topics, including Brian expressing his support for increasing Bitcoin’s block size, referring to altcoins as distractions, discussing “replay attacks” on Coinbase, highlighting Ethereum’s price surge after its listing on Coinbase, questioning the full collateralization of Tether, and endorsing USDC, among other things.

As a result of the deletions, these tweets now only exist in the form of screenshots that were captured and shared by others during that time.