#stablecoin

252 articles found

Latest

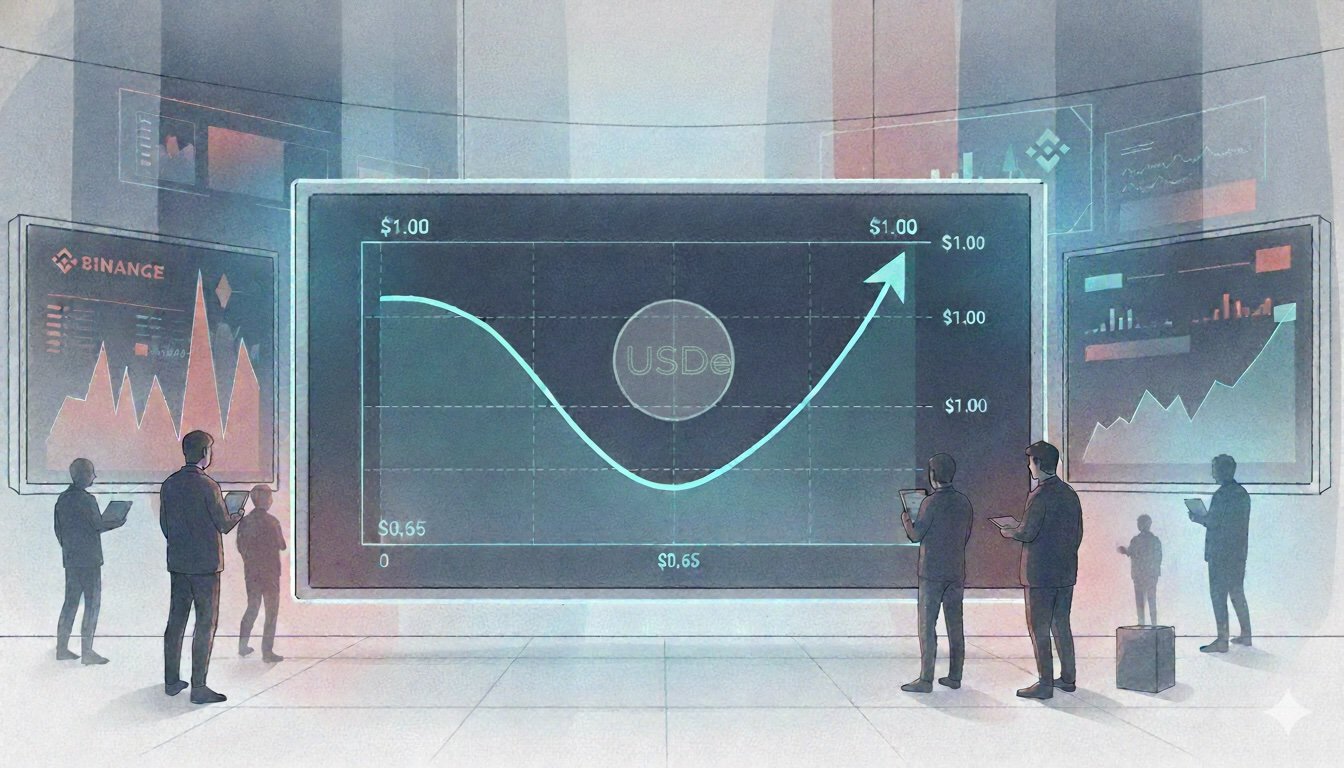

USDe drops to $0.65 on Binance before recovering to peg

Ethena's USDe dropped to $0.65 on Binance on Saturday, October 11, before recovering toward its ~$1 peg. The token, which ranks as the third-largest stablecoin with over $13 billion in circulation, experienced the sharp decline during what became the largest 24-hour liquidation event in crypto markets.

Ethena's USDe dropped to $0.65 on Binance on Saturday, October 11, before recovering toward its ~$1 peg. The token, which ranks as the third-largest stablecoin with over $13 billion in circulation, experienced the sharp decline during what became the largest 24-hour liquidation event in crypto markets. Stablecoin market cap tops $300B as crypto rebounds

The combined value of dollar‑pegged tokens has climbed past $300 billion for the first time, according to DefiLlama’s real‑time dashboard. It’s a fresh all‑time high for an asset class that powers trading, payments and DeFi plumbing, and a sign of renewed capital flowing into crypto rails.

The combined value of dollar‑pegged tokens has climbed past $300 billion for the first time, according to DefiLlama’s real‑time dashboard. It’s a fresh all‑time high for an asset class that powers trading, payments and DeFi plumbing, and a sign of renewed capital flowing into crypto rails. Tether engages as Vietnam rolls out licensed crypto pilot

Vietnam is moving ahead with a tightly scoped, five‑year pilot to bring crypto trading onto licensed rails. Officials say applications are under review and that about five platforms could be approved, while stablecoin issuer Tether has begun discussions on potential collaboration.

Vietnam is moving ahead with a tightly scoped, five‑year pilot to bring crypto trading onto licensed rails. Officials say applications are under review and that about five platforms could be approved, while stablecoin issuer Tether has begun discussions on potential collaboration. Coinbase, Mastercard in talks to buy BVNK for $2.5 billion

Coinbase and Mastercard are in advanced, separate talks to acquire BVNK, a London-based provider of stablecoin infrastructure. Source Fortune says the potential sale would value BVNK between $1.5 billion and $2.5 billion. No agreement has been reached and the talks could end without a deal.

Coinbase and Mastercard are in advanced, separate talks to acquire BVNK, a London-based provider of stablecoin infrastructure. Source Fortune says the potential sale would value BVNK between $1.5 billion and $2.5 billion. No agreement has been reached and the talks could end without a deal. Fasset becomes the first stablecoin‑powered Islamic digital bank

On October 7, 2025, Dubai-based Fasset announced that it had obtained a provisional banking license in Malaysia. The approval lets Fasset access an innovation sandbox for Islamic fintech and positions it as the world’s first Islamic digital bank operating on stablecoin rails.

On October 7, 2025, Dubai-based Fasset announced that it had obtained a provisional banking license in Malaysia. The approval lets Fasset access an innovation sandbox for Islamic fintech and positions it as the world’s first Islamic digital bank operating on stablecoin rails. Visa pilots stablecoin funding for Visa Direct

Visa announced a pilot that lets businesses fund Visa Direct with stablecoins to speed up cross‑border payouts. Instead of pre‑positioning idle fiat deposits, companies can use digital tokens pegged to national currencies. Visa will treat those balances as “on‑account funds” available for near‑instant disbursements.

Visa announced a pilot that lets businesses fund Visa Direct with stablecoins to speed up cross‑border payouts. Instead of pre‑positioning idle fiat deposits, companies can use digital tokens pegged to national currencies. Visa will treat those balances as “on‑account funds” available for near‑instant disbursements.

-tsC3kpWS.jpg)

-XFNUXN0B.png)