#markets

158 articles found

Latest

Belgium’s Financial Services and Markets Authority (FSMA) has taken action against Binance, instructing the popular cryptocurrency exchange to immediately stop offering any virtual currency services in the country.

In a statement released on Friday, the FSMA emphasized that individuals and firms governed by Belgian law, but not belonging to the European Economic Area, are prohibited from offering exchange services involving virtual currencies and legal currencies, as well as custody wallet services.

Failure to comply with this order could result in criminal sanctions, as warned by the regulator.

Belgium’s Financial Services and Markets Authority (FSMA) has taken action against Binance, instructing the popular cryptocurrency exchange to immediately stop offering any virtual currency services in the country.

In a statement released on Friday, the FSMA emphasized that individuals and firms governed by Belgian law, but not belonging to the European Economic Area, are prohibited from offering exchange services involving virtual currencies and legal currencies, as well as custody wallet services.

Failure to comply with this order could result in criminal sanctions, as warned by the regulator. ESMA to Initiate Consultations on Crypto Rules in EU

The European Securities and Markets Authority (ESMA), the European Union's securities market regulator, has announced a consultation set for July regarding new regulations for handling complaints and conflict of interest issues that cryptocurrency companies within the bloc would need to comply with.

The European Securities and Markets Authority (ESMA), the European Union's securities market regulator, has announced a consultation set for July regarding new regulations for handling complaints and conflict of interest issues that cryptocurrency companies within the bloc would need to comply with. Passive Earnings from DeFi Liquidity Mining

If you've invested your money in digital assets and don't want to just leave them sitting in a wallet, you're in luck! The CeFi and DeFi markets have plenty of tools available to help you earn passive income, including staking and yield farming. Another option to consider is liquidity mining.

If you've invested your money in digital assets and don't want to just leave them sitting in a wallet, you're in luck! The CeFi and DeFi markets have plenty of tools available to help you earn passive income, including staking and yield farming. Another option to consider is liquidity mining. Topaz NFT Marketplace: Everything You Need to Know

Step into the world of NFTs with Topaz, the premier NFT marketplace on the Aptos blockchain. With a focus on security, scalability, and an unparalleled user experience, the developers bring expertise from other markets to revolutionize the NFT space.

Step into the world of NFTs with Topaz, the premier NFT marketplace on the Aptos blockchain. With a focus on security, scalability, and an unparalleled user experience, the developers bring expertise from other markets to revolutionize the NFT space.  One of the oldest altcoins, has doubled in price since the beginning of the the last week – from $105 to $220.

Analysts credit this remarkable growth to the backing of the altcoin by the newly launched cryptocurrency exchange, EDX Markets.

EDX is new non-custodial cryptocurrency exchange, backed by major Wall Street players like Citadel Securities, Fidelity, and Schwab, has officially gone live a week ago.

It offers popular options like Bitcoin, Ether, Litecoin, and Bitcoin Cash, while consciously avoiding the list of tokens that the SEC considers to be financial securities.

One of the oldest altcoins, has doubled in price since the beginning of the the last week – from $105 to $220.

Analysts credit this remarkable growth to the backing of the altcoin by the newly launched cryptocurrency exchange, EDX Markets.

EDX is new non-custodial cryptocurrency exchange, backed by major Wall Street players like Citadel Securities, Fidelity, and Schwab, has officially gone live a week ago.

It offers popular options like Bitcoin, Ether, Litecoin, and Bitcoin Cash, while consciously avoiding the list of tokens that the SEC considers to be financial securities. IMF's XC: Enabling Cross-Border Transfers and Future CBDCs

The IMF has crafted the XC platform, a solution designed to streamline cross-border payments. This project's intricate details were unveiled by Tobias Adrian, the Director of the Monetary and Capital Markets Department. As his address drew to a close, it became clear that the XC platform is projected to lay the groundwork for the global deployment of CBDCs in the future.

The IMF has crafted the XC platform, a solution designed to streamline cross-border payments. This project's intricate details were unveiled by Tobias Adrian, the Director of the Monetary and Capital Markets Department. As his address drew to a close, it became clear that the XC platform is projected to lay the groundwork for the global deployment of CBDCs in the future. American Crypto Business? Welcome to France!

In late April, the European Parliament gave the green light to the Markets in Crypto Assets (MiCA) legislation. MiCA has emerged as the first-ever and most comprehensive package of standards and rules governing the crypto industry across EU nations. This development prompts us to ponder how the ripple effects of MiCA will be felt outside Europe.

In late April, the European Parliament gave the green light to the Markets in Crypto Assets (MiCA) legislation. MiCA has emerged as the first-ever and most comprehensive package of standards and rules governing the crypto industry across EU nations. This development prompts us to ponder how the ripple effects of MiCA will be felt outside Europe. Three Market Trends: Uptrend, Downtrend, and Sideways Trends

When we discuss trends, we typically envision something long-lasting, stable, influential, and even dominant within the market. In the realm of financial markets, including the dynamic world of cryptocurrencies, distinct trends come into play.

When we discuss trends, we typically envision something long-lasting, stable, influential, and even dominant within the market. In the realm of financial markets, including the dynamic world of cryptocurrencies, distinct trends come into play. What Is the Sell in May and Go Away Strategy?

"Sell in May and go away" is a well-known finance saying passed down through generations of traders and investors. It suggests that markets are likely to go down in late spring. But what is the story behind this phrase and can it be considered reliable advice for crypto portfolio holders?

"Sell in May and go away" is a well-known finance saying passed down through generations of traders and investors. It suggests that markets are likely to go down in late spring. But what is the story behind this phrase and can it be considered reliable advice for crypto portfolio holders? OPNX: A Groundbreaking Exchange with $1.26 Trading Volume

The highly anticipated bankruptcy claims exchange OPNX, co-founded by former Three Arrows Capital (3AC) managers Kyle Davies and Su Zhu, made a grand entrance on Tuesday—boasting a staggering $1.26 trading volume across all spot and derivatives markets. The exchange's native token, FLEX, is down by 28% in the past 24 hours.

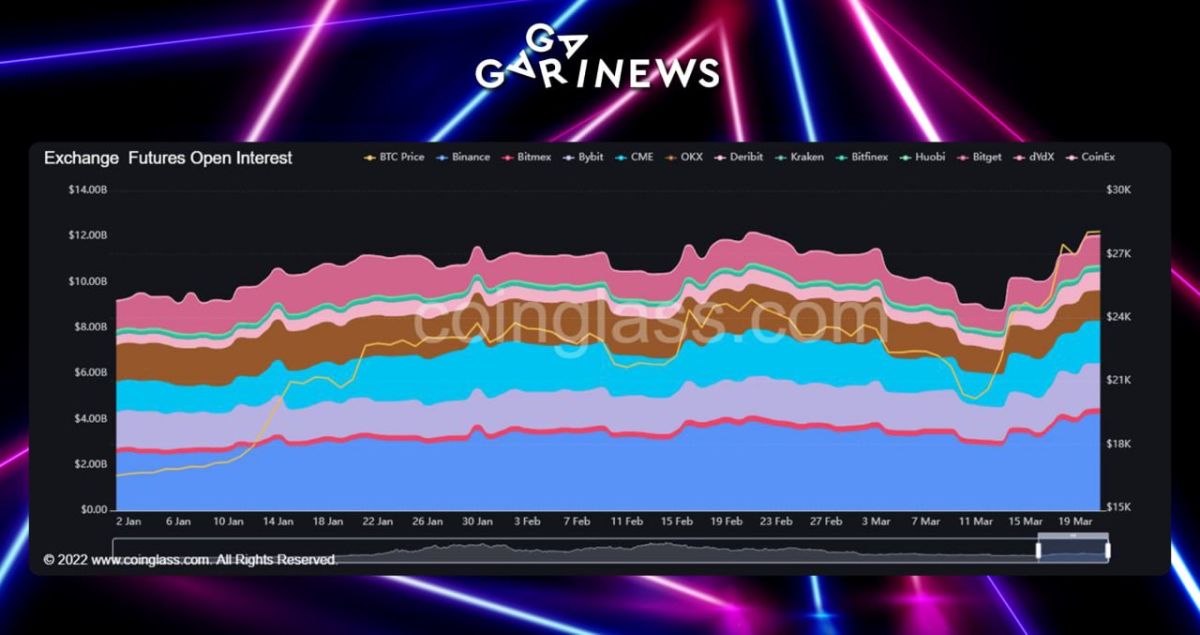

The highly anticipated bankruptcy claims exchange OPNX, co-founded by former Three Arrows Capital (3AC) managers Kyle Davies and Su Zhu, made a grand entrance on Tuesday—boasting a staggering $1.26 trading volume across all spot and derivatives markets. The exchange's native token, FLEX, is down by 28% in the past 24 hours.  The open interest in bitcoin futures reached an annual high of $12 billion.

This indicates a notable increase in liquidity, which is a vital factor for the markets.

Also, trading volumes on decentralized exchanges hit all-time highs over the past 16 months.

The open interest in bitcoin futures reached an annual high of $12 billion.

This indicates a notable increase in liquidity, which is a vital factor for the markets.

Also, trading volumes on decentralized exchanges hit all-time highs over the past 16 months.