#markets

158 articles found

Latest

Two futures for crypto: Why FSB's warning matters for markets

The G20’s Financial Stability Board latest review reveals a fork in the road for crypto regulation. One path leads to coordinated global standards. The other to regulatory arbitrage and elevated systemic risk. Here's what each scenario means for investors.

The G20’s Financial Stability Board latest review reveals a fork in the road for crypto regulation. One path leads to coordinated global standards. The other to regulatory arbitrage and elevated systemic risk. Here's what each scenario means for investors. USDe drops to $0.65 on Binance before recovering to peg

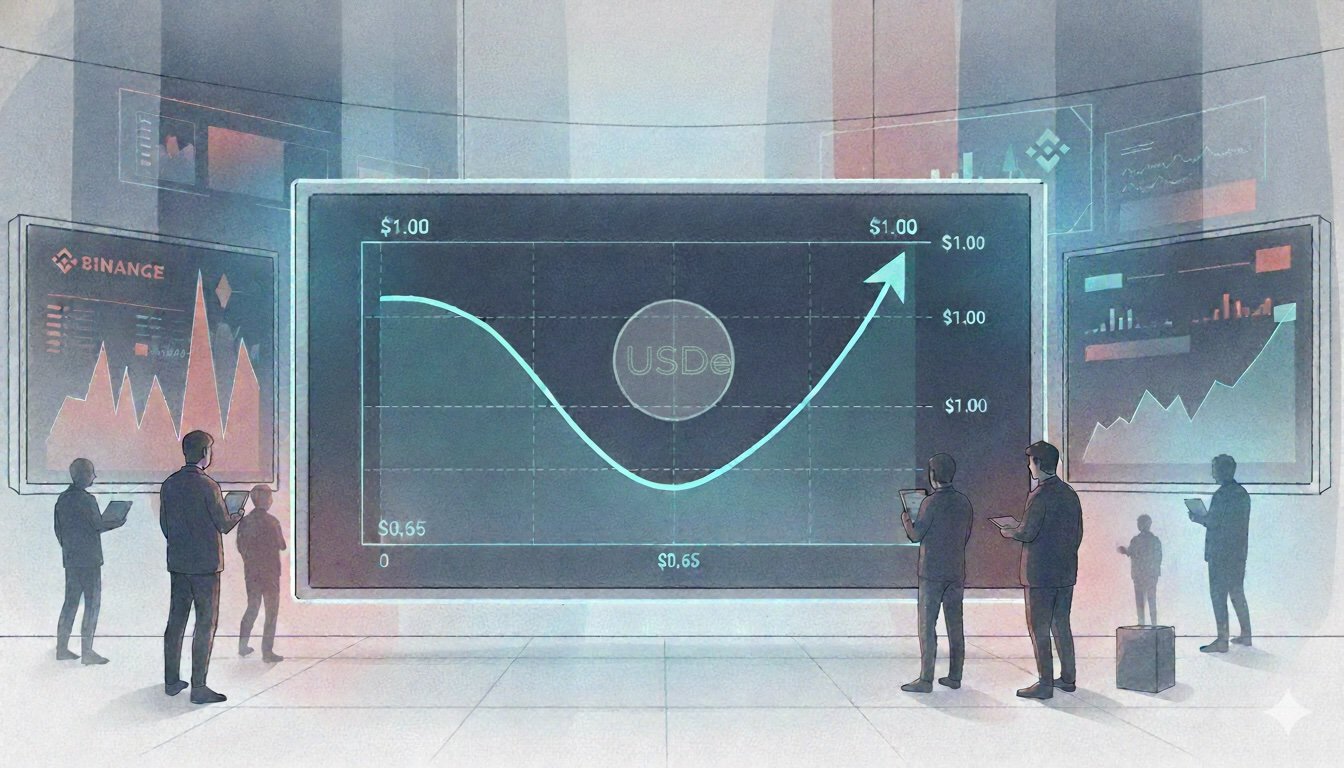

Ethena's USDe dropped to $0.65 on Binance on Saturday, October 11, before recovering toward its ~$1 peg. The token, which ranks as the third-largest stablecoin with over $13 billion in circulation, experienced the sharp decline during what became the largest 24-hour liquidation event in crypto markets.

Ethena's USDe dropped to $0.65 on Binance on Saturday, October 11, before recovering toward its ~$1 peg. The token, which ranks as the third-largest stablecoin with over $13 billion in circulation, experienced the sharp decline during what became the largest 24-hour liquidation event in crypto markets. Metaplanet suspends warrant exercises to optimize BTC plan

Metaplanet Inc. said it will pause the exercise of three outstanding batches of Stock Acquisition Rights – the 20th, 21st and 22nd series – citing a need to better manage fundraising amid changing markets. In a notice dated Oct 10, 2025, the company set a suspension window from Oct 20 (inclusive) to Nov 17 (inclusive), covering 20 trading days.

Metaplanet Inc. said it will pause the exercise of three outstanding batches of Stock Acquisition Rights – the 20th, 21st and 22nd series – citing a need to better manage fundraising amid changing markets. In a notice dated Oct 10, 2025, the company set a suspension window from Oct 20 (inclusive) to Nov 17 (inclusive), covering 20 trading days. Wall Street eyes IPO‑ready crypto firms over altcoins

A new note from Matrixport argues that this cycle’s “alpha” is migrating from early‑stage tokens to crypto businesses that can tap public markets. They estimate that a large lineup of crypto companies preparing IPOs could raise tens of billions of dollars. That pitch lands as BitGo publicly filed for a U.S. listing and as ETF deadlines stack up through October.

A new note from Matrixport argues that this cycle’s “alpha” is migrating from early‑stage tokens to crypto businesses that can tap public markets. They estimate that a large lineup of crypto companies preparing IPOs could raise tens of billions of dollars. That pitch lands as BitGo publicly filed for a U.S. listing and as ETF deadlines stack up through October. Beijing vows to fight to the end as markets brace for fallout

China is mixing tough talk with diplomacy, warning it will “fight to the end” while leaving the door open for talks to protect its economy. This stance accelerates the world’s drift into competing economic blocs and alters the rules of trade, capital flows and investor behavior.

China is mixing tough talk with diplomacy, warning it will “fight to the end” while leaving the door open for talks to protect its economy. This stance accelerates the world’s drift into competing economic blocs and alters the rules of trade, capital flows and investor behavior. U.S. growth near uptrend, but jobs weaken and inflation persists

The U.S. economy is expected to expand near its long-term uptrend as rising business investment offsets weaker consumer spending and slower global trade, according to a new survey by the National Association for Business Economics (NABE).

The U.S. economy is expected to expand near its long-term uptrend as rising business investment offsets weaker consumer spending and slower global trade, according to a new survey by the National Association for Business Economics (NABE). EBA warns of AML risks from crypto firms in MiCA transition

The European Banking Authority (EBA) warned on October 9 that crypto-asset service providers operating under transitional arrangements pose money-laundering and terrorist-financing risks as the EU phases in its Markets in Crypto-Assets regime.

The European Banking Authority (EBA) warned on October 9 that crypto-asset service providers operating under transitional arrangements pose money-laundering and terrorist-financing risks as the EU phases in its Markets in Crypto-Assets regime.

-O9S5Ybe2.png)

-tsC3kpWS.jpg)