#market

1020 articles found

Latest

Yi He: The Untold Success Story of Binance

Yi He, a co-founder and a leading expert in business, marketing, and branding at Binance, is among the most influential women in the worldwide cryptocurrency market. However, her significant contribution to the growth of this cryptocurrency exchange isn't often acknowledged, as Changpeng Zhao (CZ) is traditionally viewed as the company's public face.

Yi He, a co-founder and a leading expert in business, marketing, and branding at Binance, is among the most influential women in the worldwide cryptocurrency market. However, her significant contribution to the growth of this cryptocurrency exchange isn't often acknowledged, as Changpeng Zhao (CZ) is traditionally viewed as the company's public face. Unveiling LUKSO (LYXe): An Overwiev of the Project

LUKSO (LYXe) is the native token of the LUKSO platform, designed to cater to the needs of a dynamic and ever-changing creative economy. Originally introduced on the Ethereum blockchain, it has since transitioned to its own independent mainnet. Currently, LUKSO holds the 149th position in the cryptocurrency market cap rankings.

LUKSO (LYXe) is the native token of the LUKSO platform, designed to cater to the needs of a dynamic and ever-changing creative economy. Originally introduced on the Ethereum blockchain, it has since transitioned to its own independent mainnet. Currently, LUKSO holds the 149th position in the cryptocurrency market cap rankings. Pundi X (PUNDIX): Swipe Crypto, Shop Real!

Pundi X integrates crypto into e-commerce. Its open-source platform facilitates seamless crypto payments and expands globally with a one-stop app for digital payments. PUNDIX, the native token, has a $95 million market cap and a sound utility nature. Dive in to read more!

Pundi X integrates crypto into e-commerce. Its open-source platform facilitates seamless crypto payments and expands globally with a one-stop app for digital payments. PUNDIX, the native token, has a $95 million market cap and a sound utility nature. Dive in to read more! WOO Network Unleashed: Transform Finance with WOO Coin!

WOO Network operates at the intersection of DeFi and CeFi, striving to offer liquidity, fast execution, and low fees. It has a market cap of $361M and a supply of 3 billion WOO tokens, and users can engage in staking and yield farming with WOO tokens. Dive into the WOO Network review.

WOO Network operates at the intersection of DeFi and CeFi, striving to offer liquidity, fast execution, and low fees. It has a market cap of $361M and a supply of 3 billion WOO tokens, and users can engage in staking and yield farming with WOO tokens. Dive into the WOO Network review. The SEC Sets Its Sights on AI

The U.S. Securities and Exchange Commission (SEC) is broadening its horizons, extending its reach beyond BTC and altcoins to the AI market. This surprising development came to light when the former Chairman of the Commission discussed the latest regulatory initiatives involving cryptocurrencies.

The U.S. Securities and Exchange Commission (SEC) is broadening its horizons, extending its reach beyond BTC and altcoins to the AI market. This surprising development came to light when the former Chairman of the Commission discussed the latest regulatory initiatives involving cryptocurrencies. NFT Tech Introduces Breakout AI Platform

NFT TECHNOLOGIES INC (NFT Tech) has brought to market the groundbreaking Breakout AI platform, underpinned by artificial intelligence. This platform is a solution for the monetization of intellectual property, poised to solidify NFT Tech's leading position in the immersive experience industry.

NFT TECHNOLOGIES INC (NFT Tech) has brought to market the groundbreaking Breakout AI platform, underpinned by artificial intelligence. This platform is a solution for the monetization of intellectual property, poised to solidify NFT Tech's leading position in the immersive experience industry. Crypto Regulation and Market Anticipations

The MiCA's ratification has effectively legalized the cryptocurrency market across 27 EU countries. Eight more potential member nations will soon modify their laws to comply with MiCA. This move means the legislation will impact over half a billion people, making it a unique event of unprecedented scale.

The MiCA's ratification has effectively legalized the cryptocurrency market across 27 EU countries. Eight more potential member nations will soon modify their laws to comply with MiCA. This move means the legislation will impact over half a billion people, making it a unique event of unprecedented scale. Launchpad XYZ (LPX): The New Web3 Market Aggregator

The Web3 landscape appears complex and disjointed. The plethora of available platforms and resources necessary to navigate the third generation of the internet can be overwhelming for newcomers and tiring for seasoned users. Launchpad XYZ, a new platform, aims to tackle this issue by crafting a consolidated environment for Web3.

The Web3 landscape appears complex and disjointed. The plethora of available platforms and resources necessary to navigate the third generation of the internet can be overwhelming for newcomers and tiring for seasoned users. Launchpad XYZ, a new platform, aims to tackle this issue by crafting a consolidated environment for Web3. When Will the Next Full-Scale Bull Run Begin?

In 2023, we've seen Bitcoin make an impressive leap from $16,500 to $30,000, along with several altcoins that have achieved exponential growth. However, it's difficult to label this as a full-fledged bull run. Instead, it mirrors more of a transitional market stage, reminiscent of the one we witnessed in 2019. So, when should we expect the genuine bull market to commence?

In 2023, we've seen Bitcoin make an impressive leap from $16,500 to $30,000, along with several altcoins that have achieved exponential growth. However, it's difficult to label this as a full-fledged bull run. Instead, it mirrors more of a transitional market stage, reminiscent of the one we witnessed in 2019. So, when should we expect the genuine bull market to commence?  Affected by the Azuki “Elementals” NFT incident (similar artworks, errors in the artwork, and collector dissatisfaction), the NFT market fell sharply again in the past 24 hours.

BAYC fell 16%, MAYC fell 20%, and Azuki fell 11%.

Earlier this year, Azuki NFTs gained significant popularity, surpassing even BAYC NFTs.

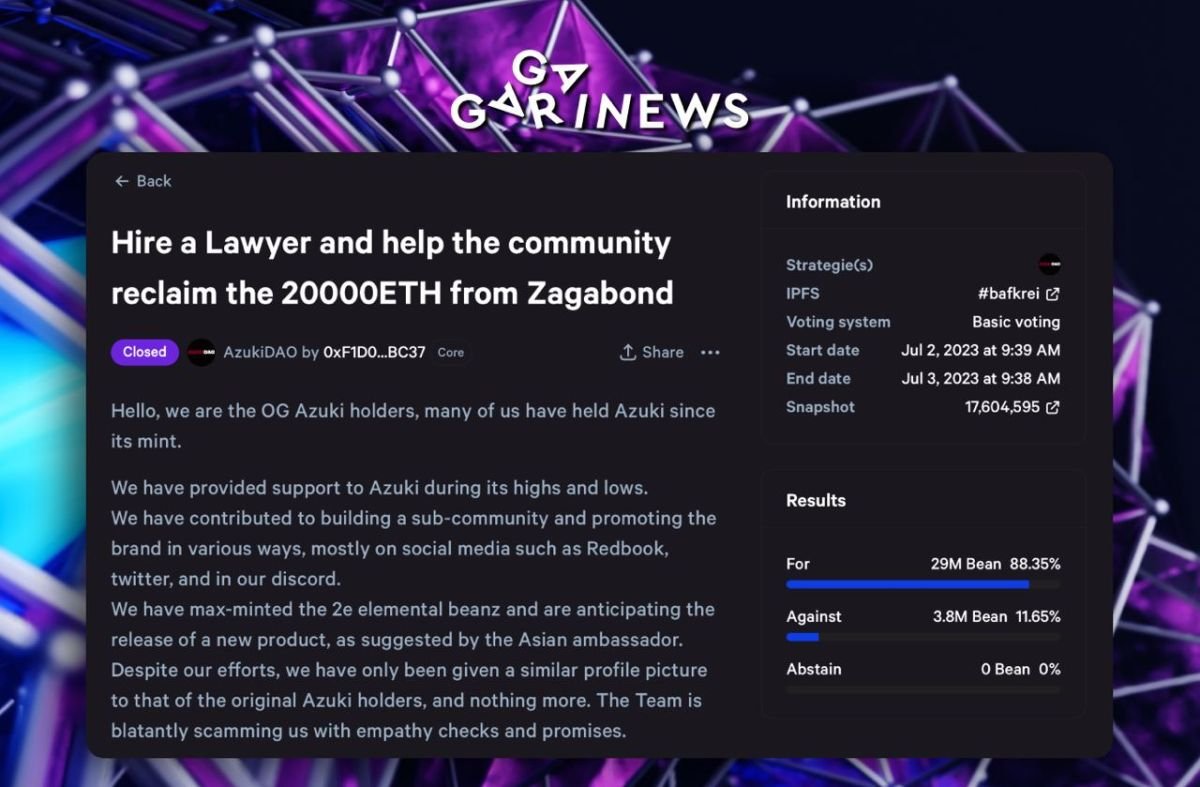

Meanwhile, AzukiDAO has proposed to recover 20,000 ETH from Azuki founder ‘Zagabond’.

The proposal suggests hiring a lawyer to take legal action against Zagabond for their alleged involvement in multiple “rug” projects. The aim of the clawback is to retrieve $39 million worth of ETH that was earned from the controversial launch of “Elementals” NFT collection.

As of now, the action has received support from 88.3% of AzukiDAO (BEAN) token holders, with 11.65% opposing it. The voting period for the proposal will conclude at 6:38 am UTC on July 3rd.

Affected by the Azuki “Elementals” NFT incident (similar artworks, errors in the artwork, and collector dissatisfaction), the NFT market fell sharply again in the past 24 hours.

BAYC fell 16%, MAYC fell 20%, and Azuki fell 11%.

Earlier this year, Azuki NFTs gained significant popularity, surpassing even BAYC NFTs.

Meanwhile, AzukiDAO has proposed to recover 20,000 ETH from Azuki founder ‘Zagabond’.

The proposal suggests hiring a lawyer to take legal action against Zagabond for their alleged involvement in multiple “rug” projects. The aim of the clawback is to retrieve $39 million worth of ETH that was earned from the controversial launch of “Elementals” NFT collection.

As of now, the action has received support from 88.3% of AzukiDAO (BEAN) token holders, with 11.65% opposing it. The voting period for the proposal will conclude at 6:38 am UTC on July 3rd.  On Friday, Fidelity Investments and several other firms submitted revised applications for spot Bitcoin exchange-traded funds (ETFs) after the US Securities and Exchange Commission (SEC) deemed the initial filings inadequate.

The companies, including Invesco, VanEck, 21Shares, and WisdomTree, are part of a group of eight firms aiming to launch the first wave of US spot Bitcoin ETFs.

BlackRock kickstarted the trend with its unexpected filing in mid-June.

In the latest filings, all five firms indicated that Coinbase Global Inc. will provide market surveillance for their ETFs, a detail that was missing from their previous applications.

On Friday, Fidelity Investments and several other firms submitted revised applications for spot Bitcoin exchange-traded funds (ETFs) after the US Securities and Exchange Commission (SEC) deemed the initial filings inadequate.

The companies, including Invesco, VanEck, 21Shares, and WisdomTree, are part of a group of eight firms aiming to launch the first wave of US spot Bitcoin ETFs.

BlackRock kickstarted the trend with its unexpected filing in mid-June.

In the latest filings, all five firms indicated that Coinbase Global Inc. will provide market surveillance for their ETFs, a detail that was missing from their previous applications. South Korea Passes First Domestic Law Dedicated to Virtual Assets

South Korea has approved its first standalone digital-asset bill aimed at enhancing investor protection. The move comes more than a year after the $2 trillion cryptocurrency market collapse caused by South Korean entrepreneur Do Kwon.

South Korea has approved its first standalone digital-asset bill aimed at enhancing investor protection. The move comes more than a year after the $2 trillion cryptocurrency market collapse caused by South Korean entrepreneur Do Kwon. TradFi Players Launch Their Own Crypto Platforms

Acknowledging the investment risks associated with largely unregulated crypto companies, titans of the traditional finance (TradFi) industry have made the strategic decision to enter the crypto market, launching their own platforms for digital assets.

Acknowledging the investment risks associated with largely unregulated crypto companies, titans of the traditional finance (TradFi) industry have made the strategic decision to enter the crypto market, launching their own platforms for digital assets.  A Twitter user (@hufhaus9) has created a visual timeline outlining the SEC’s response deadlines for the approval of BlackRock’s Bitcoin spot ETF.

Just 10 days ago, the renowned global investment firm with $10 trillion in assets applied for a groundbreaking Bitcoin spot exchange-traded fund in the United States.

First deadline: August 12, 2023

Second deadline: September 26, 2023

Third deadline: December 25, 2023

Final decision: February 23, 2024

If granted approval, BlackRock will be able to purchase BTC directly from the spot market, potentially utilizing platforms like Coinbase, on behalf of its clients.

With the BTC halving and these deadlines coinciding, the first quarter of 2024 promises to be an exciting period!

A Twitter user (@hufhaus9) has created a visual timeline outlining the SEC’s response deadlines for the approval of BlackRock’s Bitcoin spot ETF.

Just 10 days ago, the renowned global investment firm with $10 trillion in assets applied for a groundbreaking Bitcoin spot exchange-traded fund in the United States.

First deadline: August 12, 2023

Second deadline: September 26, 2023

Third deadline: December 25, 2023

Final decision: February 23, 2024

If granted approval, BlackRock will be able to purchase BTC directly from the spot market, potentially utilizing platforms like Coinbase, on behalf of its clients.

With the BTC halving and these deadlines coinciding, the first quarter of 2024 promises to be an exciting period!