#market

1020 articles found

Latest

The FBI has sounded the alarm bells: Lazarus Group and APT38, North Korean hacker collectives, could potentially sell off stolen cryptocurrency amassing $40 million, potentially affecting Bitcoin's valuation.

Through their investigative work, the agency has identified nearly 1580 BTC across six distinct Bitcoin addresses. The stolen assets are reportedly from Alphapo, CoinsPaid, and Atomic Wallet.

In aiding market monitoring, the FBI has disclosed the associated wallet addresses, urging vigilance on any transactions involving them.

The FBI has sounded the alarm bells: Lazarus Group and APT38, North Korean hacker collectives, could potentially sell off stolen cryptocurrency amassing $40 million, potentially affecting Bitcoin's valuation.

Through their investigative work, the agency has identified nearly 1580 BTC across six distinct Bitcoin addresses. The stolen assets are reportedly from Alphapo, CoinsPaid, and Atomic Wallet.

In aiding market monitoring, the FBI has disclosed the associated wallet addresses, urging vigilance on any transactions involving them.  Imperial College London has teamed up with AI startup FluidAI to address challenges in the crypto market using artificial intaligance (AI).

The collaboration will focus on enhancing the tokenized market for various stakeholders, including institutions and retail investors.

FluidAI emphasizes the need to tackle liquidity aggregation issues in the crypto domain. AI can help predict and offer optimal bid and ask prices in the market.

Imperial College London has teamed up with AI startup FluidAI to address challenges in the crypto market using artificial intaligance (AI).

The collaboration will focus on enhancing the tokenized market for various stakeholders, including institutions and retail investors.

FluidAI emphasizes the need to tackle liquidity aggregation issues in the crypto domain. AI can help predict and offer optimal bid and ask prices in the market.  JPMorgan reports that Bitcoin miners are diversifying their operations in anticipation of the upcoming halving event, which will slash their rewards. Miners are now venturing into the booming artificial intelligence (AI) market, offering high-performance computing services. This shift is partly funded by selling newly minted or existing bitcoins. Companies like Applied Digital and Iris Energy are already making strides in AI cloud services. Additionally, post Ethereum's shift from proof-of-work, former Ethereum miners are leveraging GPUs for AI, finding it potentially more profitable than traditional mining.

JPMorgan reports that Bitcoin miners are diversifying their operations in anticipation of the upcoming halving event, which will slash their rewards. Miners are now venturing into the booming artificial intelligence (AI) market, offering high-performance computing services. This shift is partly funded by selling newly minted or existing bitcoins. Companies like Applied Digital and Iris Energy are already making strides in AI cloud services. Additionally, post Ethereum's shift from proof-of-work, former Ethereum miners are leveraging GPUs for AI, finding it potentially more profitable than traditional mining.  The current market landscape marks an unprecedented decline in liquidity, according to Bloomberg Intelligence's senior macro strategist, Mike McGlone.

If this pattern holds throughout 2023, he warns of a potential sharp descent in Bitcoin prices, which would ripple through Ethereum, XRP, and the general cryptocurrency domain.

“What should be early indications of recessionary times? The best indication should be bitcoin and that’s where I’m looking for the bleeding occasion from bitcoin and it’s still kind of showing what I expected.”

“Picture December: Recession looms, Fed hesitates on easing due to inflation,” said McGlone.

The current market landscape marks an unprecedented decline in liquidity, according to Bloomberg Intelligence's senior macro strategist, Mike McGlone.

If this pattern holds throughout 2023, he warns of a potential sharp descent in Bitcoin prices, which would ripple through Ethereum, XRP, and the general cryptocurrency domain.

“What should be early indications of recessionary times? The best indication should be bitcoin and that’s where I’m looking for the bleeding occasion from bitcoin and it’s still kind of showing what I expected.”

“Picture December: Recession looms, Fed hesitates on easing due to inflation,” said McGlone.  Bitmain, the manufacturer of ASIC miners, has rolled out a new protection scheme against market volatility for those buying the S19j XP model.

If there's a downturn of more than 20% in the subsequent three months post-purchase, company ensures compensation at $1.89/T.

Impressively, this offer is available even to current S19j XP owners.

The compensation will be directly credited to the user's account and is usable for any Bitmain product acquisitions.

Bitmain, the manufacturer of ASIC miners, has rolled out a new protection scheme against market volatility for those buying the S19j XP model.

If there's a downturn of more than 20% in the subsequent three months post-purchase, company ensures compensation at $1.89/T.

Impressively, this offer is available even to current S19j XP owners.

The compensation will be directly credited to the user's account and is usable for any Bitmain product acquisitions.  After the market crash on August 18, analyst Andrew Kang adopted a bullish stance. He opened long positions on Bitcoin (BTC), Ethereum (ETH), and Arbitrum (ARB). However, this decision resulted in a significant loss.

Due to his use of extremely high leverage, which reached up to 100x, Kang's positions became vulnerable and were liquidated not once, but as many as fourteen times.

These successive liquidations caused Kang to lose approximately $432,000 in a single day. This incident highlights the risks associated with trading and employing high leverage, especially during periods of intense market volatility.

After the market crash on August 18, analyst Andrew Kang adopted a bullish stance. He opened long positions on Bitcoin (BTC), Ethereum (ETH), and Arbitrum (ARB). However, this decision resulted in a significant loss.

Due to his use of extremely high leverage, which reached up to 100x, Kang's positions became vulnerable and were liquidated not once, but as many as fourteen times.

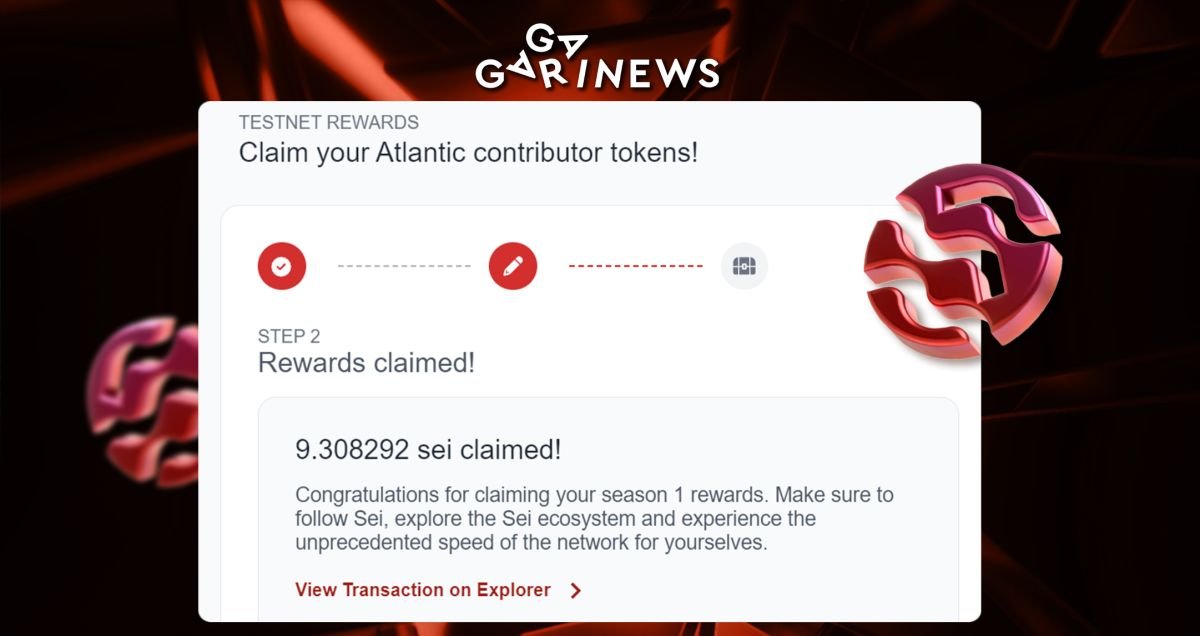

These successive liquidations caused Kang to lose approximately $432,000 in a single day. This incident highlights the risks associated with trading and employing high leverage, especially during periods of intense market volatility.  The Sei team has initiated token claims for those who participated in the testnet early on. However, the meager bonuses received have left many reevaluating their decision to engage in future airdrops, especially for Tier-2 or Tier-3 projects.

Rewards were disappointingly scant, with most individuals earning only a nominal amount for blockchain testing.

The SEI token price decreased by 20%, possibly attributed to either the overnight downturn in the crypto market or the airdrop itself.

P.S.:To claim your tokens, the Compass wallet is essential, and some regions might require a VPN.

The Sei team has initiated token claims for those who participated in the testnet early on. However, the meager bonuses received have left many reevaluating their decision to engage in future airdrops, especially for Tier-2 or Tier-3 projects.

Rewards were disappointingly scant, with most individuals earning only a nominal amount for blockchain testing.

The SEI token price decreased by 20%, possibly attributed to either the overnight downturn in the crypto market or the airdrop itself.

P.S.:To claim your tokens, the Compass wallet is essential, and some regions might require a VPN.  The SEI token, having just been released, now finds itself in the 85th spot in terms of market capitalization, as reported by Coinmarketcap. It's also making its presence felt in daily trading, occupying the seventh position with a volume of $1,6 billion.

While current metrics paint a promising picture for the project, it's worth noting that the cryptocurrency arena frequently sees such developments. Therefore, it's wise to approach this news with measured optimism.

The SEI token, having just been released, now finds itself in the 85th spot in terms of market capitalization, as reported by Coinmarketcap. It's also making its presence felt in daily trading, occupying the seventh position with a volume of $1,6 billion.

While current metrics paint a promising picture for the project, it's worth noting that the cryptocurrency arena frequently sees such developments. Therefore, it's wise to approach this news with measured optimism.