#liquidity

94 articles found

Latest

WOO Network Unleashed: Transform Finance with WOO Coin!

WOO Network operates at the intersection of DeFi and CeFi, striving to offer liquidity, fast execution, and low fees. It has a market cap of $361M and a supply of 3 billion WOO tokens, and users can engage in staking and yield farming with WOO tokens. Dive into the WOO Network review.

WOO Network operates at the intersection of DeFi and CeFi, striving to offer liquidity, fast execution, and low fees. It has a market cap of $361M and a supply of 3 billion WOO tokens, and users can engage in staking and yield farming with WOO tokens. Dive into the WOO Network review. Uniswap Labs reveals plans for Uniswap v4 protocol upgrade

Uniswap Labs has announced the draft code for Uniswap V4, a complete redesign of their popular decentralized exchange protocol. The new architecture aims to offer more customization and efficiency. The cost of creating liquidity pools is projected to reduce by 99%, and the protocol will permit developers to construct more cost-effective, minimalistic pools.

Uniswap Labs has announced the draft code for Uniswap V4, a complete redesign of their popular decentralized exchange protocol. The new architecture aims to offer more customization and efficiency. The cost of creating liquidity pools is projected to reduce by 99%, and the protocol will permit developers to construct more cost-effective, minimalistic pools. Passive Earnings from DeFi Liquidity Mining

If you've invested your money in digital assets and don't want to just leave them sitting in a wallet, you're in luck! The CeFi and DeFi markets have plenty of tools available to help you earn passive income, including staking and yield farming. Another option to consider is liquidity mining.

If you've invested your money in digital assets and don't want to just leave them sitting in a wallet, you're in luck! The CeFi and DeFi markets have plenty of tools available to help you earn passive income, including staking and yield farming. Another option to consider is liquidity mining.  According to the March 2023 reserve report , a total of 8.7 billion USDC is being held in six banks. However, three of these banks – Silvergate, Signature, and Silicon Valley Bank – are currently experiencing liquidity and solvency issues. The situation is especially dire for Silicon Valley Bank, which held 3.3 billion USDC and has been forced to close by the California Department of Financial Protection and Innovation.

The USDC price has dropped by 15%, to $0.86, in response to these developments. Additionally, the DAI stablecoin has fallen by 10%, as up to 50% of its collateral is held in USDC.

Currently, US Treasury bills account for 77% of the USDC reserves. The remaining 23% is held in cash at various banking institutions. The fate of these funds will depend on the outcome of the bankruptcy process for the affected banks and the amount of funds that can be recovered.

According to the March 2023 reserve report , a total of 8.7 billion USDC is being held in six banks. However, three of these banks – Silvergate, Signature, and Silicon Valley Bank – are currently experiencing liquidity and solvency issues. The situation is especially dire for Silicon Valley Bank, which held 3.3 billion USDC and has been forced to close by the California Department of Financial Protection and Innovation.

The USDC price has dropped by 15%, to $0.86, in response to these developments. Additionally, the DAI stablecoin has fallen by 10%, as up to 50% of its collateral is held in USDC.

Currently, US Treasury bills account for 77% of the USDC reserves. The remaining 23% is held in cash at various banking institutions. The fate of these funds will depend on the outcome of the bankruptcy process for the affected banks and the amount of funds that can be recovered. What are market makers and takers?

Markets are made up of both makers and takers. The makers create buy or sell orders that aren't executed immediately; this generates liquidity. And those who buy or sell instantly are referred to as "takers." In other words, the takers carry out the orders created by the makers.

Markets are made up of both makers and takers. The makers create buy or sell orders that aren't executed immediately; this generates liquidity. And those who buy or sell instantly are referred to as "takers." In other words, the takers carry out the orders created by the makers. America's Crypto Crown at Stake: Is the U.S. Losing its Grip?

ARK Invest, in their weekly dispatch to clients, is casting doubt on the U.S.'s ability to maintain its prime position within the crypto industry. The chief concerns listed are the total ambiguity over the regulation of digital assets, coupled with declining liquidity.

ARK Invest, in their weekly dispatch to clients, is casting doubt on the U.S.'s ability to maintain its prime position within the crypto industry. The chief concerns listed are the total ambiguity over the regulation of digital assets, coupled with declining liquidity. 2023 Trend: Liquid Staking & Top 4 Tokens to Watch

Platforms for liquid staking have emerged as a solution to the limitations of traditional staking, which prevent the use of locked assets. Essentially, this is a new sector of decentralized finance that allows you to release your liquidity without sacrificing rewards.

Platforms for liquid staking have emerged as a solution to the limitations of traditional staking, which prevent the use of locked assets. Essentially, this is a new sector of decentralized finance that allows you to release your liquidity without sacrificing rewards. Synthetix Review: Fake Assets or a Promising Niche?

Synthetix is a decentralized liquidity layer that operates on both Ethereum and Optimism. Its principle is based on creating synthetic assets, which are pegged to the price of cryptocurrencies, fiat currencies, or even precious metals such as gold or silver.

Synthetix is a decentralized liquidity layer that operates on both Ethereum and Optimism. Its principle is based on creating synthetic assets, which are pegged to the price of cryptocurrencies, fiat currencies, or even precious metals such as gold or silver. PancakeSwap V3: A Delicious Update for Traders

PancakeSwap, the popular decentralized exchange (DEX), has announced the launch of its highly-anticipated third version on both the Binance Smart Chain and Ethereum blockchains. This exciting news brings a host of new features, including cutting-edge tools, low transaction fees, and increased profitability for liquidity providers.

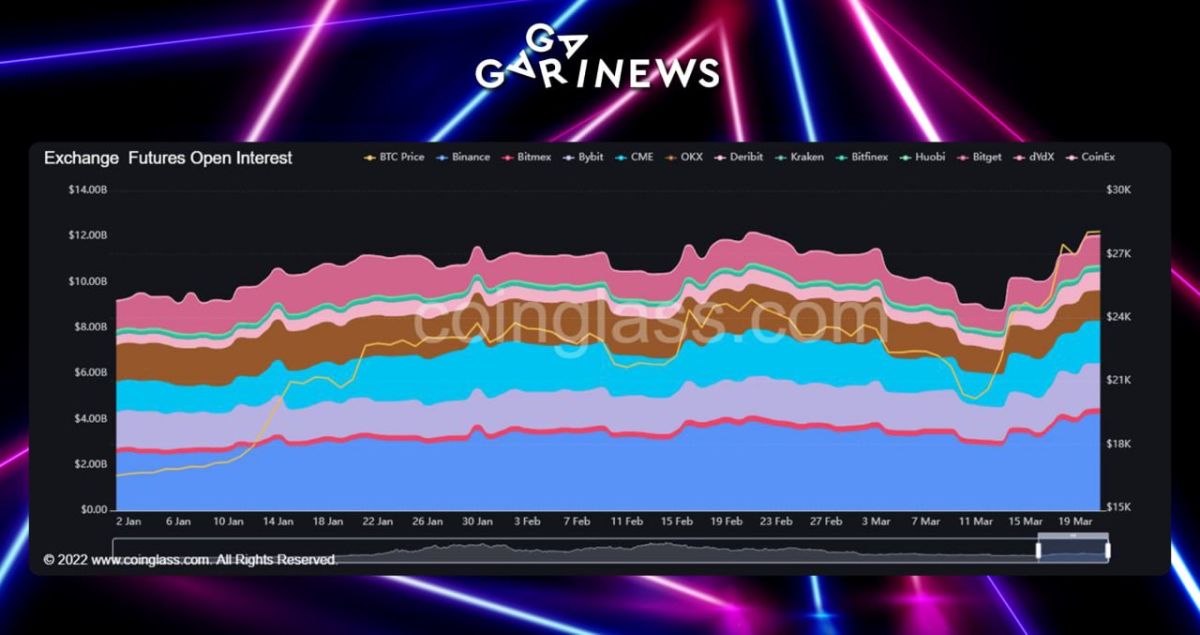

PancakeSwap, the popular decentralized exchange (DEX), has announced the launch of its highly-anticipated third version on both the Binance Smart Chain and Ethereum blockchains. This exciting news brings a host of new features, including cutting-edge tools, low transaction fees, and increased profitability for liquidity providers.  The open interest in bitcoin futures reached an annual high of $12 billion.

This indicates a notable increase in liquidity, which is a vital factor for the markets.

Also, trading volumes on decentralized exchanges hit all-time highs over the past 16 months.

The open interest in bitcoin futures reached an annual high of $12 billion.

This indicates a notable increase in liquidity, which is a vital factor for the markets.

Also, trading volumes on decentralized exchanges hit all-time highs over the past 16 months.