#it

1240 articles found

Latest

Rose lost 40 rare NFTs worth over $1.1 million in a phishing attack.

Kevin personally reported the hack on Twitter and asked his followers to avoid buying any Autoglyph and Chromie Squiggles.

PROOF Vice President of Engineering Arran Schlosberg detailed the fraudulent scheme. According to him, "the technical aspect of the hack was limited to crafting signatures accepted by OpenSea's marketplace contract." They immediately used theft prevention tool Revoke Cash, but it was too late.

PROOF stressed that users' assets were not affected, since the vast majority of assets require multiple approvals for access.

Rose lost 40 rare NFTs worth over $1.1 million in a phishing attack.

Kevin personally reported the hack on Twitter and asked his followers to avoid buying any Autoglyph and Chromie Squiggles.

PROOF Vice President of Engineering Arran Schlosberg detailed the fraudulent scheme. According to him, "the technical aspect of the hack was limited to crafting signatures accepted by OpenSea's marketplace contract." They immediately used theft prevention tool Revoke Cash, but it was too late.

PROOF stressed that users' assets were not affected, since the vast majority of assets require multiple approvals for access.  Pedigree created a virtual shelter with 3D avatars of dogs who live in real-life shelters. Users can now bring a dog avatar into their virtual home and try to coexist with it.

Additionally, interactive pets need to be fed, taken for walks, and they even know how to destroy things. They also resemble their prototypes quite closely.

The Pedigree team is confident that this will help real dogs find families. Adoptions are available to Metaverse users at Pedigree.com/Fosterverse.

The Metaverse visitors also have the opportunity to donate in support of homeless dogs.

Pedigree created a virtual shelter with 3D avatars of dogs who live in real-life shelters. Users can now bring a dog avatar into their virtual home and try to coexist with it.

Additionally, interactive pets need to be fed, taken for walks, and they even know how to destroy things. They also resemble their prototypes quite closely.

The Pedigree team is confident that this will help real dogs find families. Adoptions are available to Metaverse users at Pedigree.com/Fosterverse.

The Metaverse visitors also have the opportunity to donate in support of homeless dogs.  At Genesis' first bankruptcy hearing, the company's lawyer expressed confidence that it would resolve its disputes with creditors by the end of the week. Genesis plans to exit the bankruptcy in 4 months from now.

The company plans to pay employees and vendors first, and then to auction off its assets to pay creditors by May. A simple calculation of the math shows that Genesis holds $5 billion in assets and liabilities, while its debt estimates to $3.4 billion.

At Genesis' first bankruptcy hearing, the company's lawyer expressed confidence that it would resolve its disputes with creditors by the end of the week. Genesis plans to exit the bankruptcy in 4 months from now.

The company plans to pay employees and vendors first, and then to auction off its assets to pay creditors by May. A simple calculation of the math shows that Genesis holds $5 billion in assets and liabilities, while its debt estimates to $3.4 billion.  Next month, The Open Network validators plan to vote on freezing 195 inactive addresses.

These addresses hold more than 1 billion TON coins, which amounts to $2.5 billion USD. If this decision is made, the blocking will last for 4 years and the owners of these wallets will not be able to make any transactions during this period.

A forced hold for long-term holders? It's interesting, but short term holders could definitely use some freezing!

Next month, The Open Network validators plan to vote on freezing 195 inactive addresses.

These addresses hold more than 1 billion TON coins, which amounts to $2.5 billion USD. If this decision is made, the blocking will last for 4 years and the owners of these wallets will not be able to make any transactions during this period.

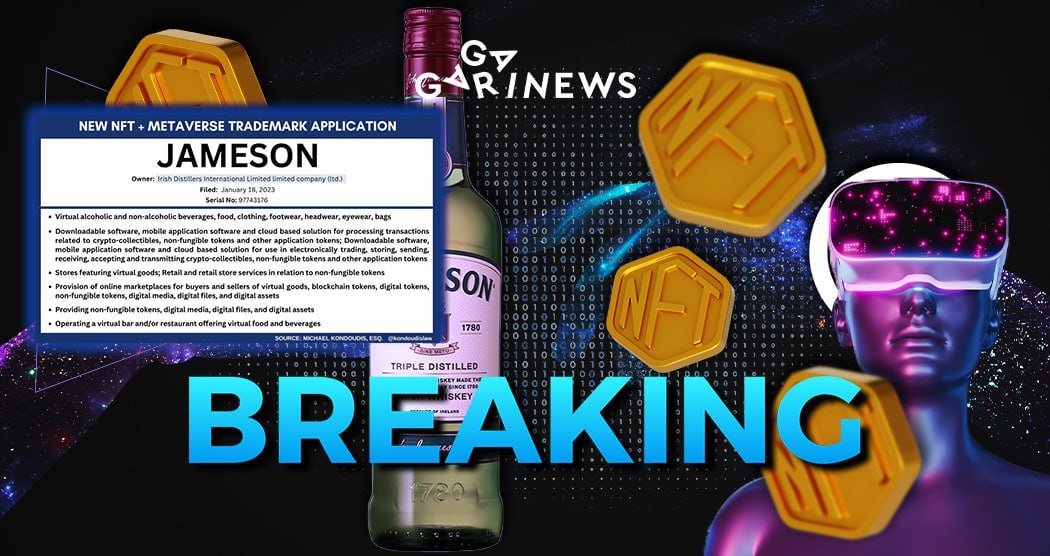

A forced hold for long-term holders? It's interesting, but short term holders could definitely use some freezing!  Welcome another legend to the crypto family! Irish Distillers Int'l, the company behind Jameson whiskey, has registered a metaverse trademark!

Based on the application, it can be concluded that the iconic manufacturer plans to sell virtual alcohol, items and accessories, NFT trading software, and maybe even create a marketplace and a virtual bar!

Go, go, Jameson! We do not know exactly how all this will look, but every brand like this plays into the hands of mass adoption.

Welcome another legend to the crypto family! Irish Distillers Int'l, the company behind Jameson whiskey, has registered a metaverse trademark!

Based on the application, it can be concluded that the iconic manufacturer plans to sell virtual alcohol, items and accessories, NFT trading software, and maybe even create a marketplace and a virtual bar!

Go, go, Jameson! We do not know exactly how all this will look, but every brand like this plays into the hands of mass adoption.  The agreement, which turned the crypto exchange into a Premium Partner of the Bundesliga club, will last until the end of June 2023.

Under the new terms, Coinbase will promote its products and services at Signal-Iduna-Park (the club's home stadium) and provide crypto-educational programs for team members.

The numbers of the deal are not disclosed.

But it is not that important. After all, we are still Barcelona's fans.

The agreement, which turned the crypto exchange into a Premium Partner of the Bundesliga club, will last until the end of June 2023.

Under the new terms, Coinbase will promote its products and services at Signal-Iduna-Park (the club's home stadium) and provide crypto-educational programs for team members.

The numbers of the deal are not disclosed.

But it is not that important. After all, we are still Barcelona's fans.  The Stellar Development Foundation has announced that it joins an advisory committee of the U.S. Commodity Futures Trading Commission.

Blockchain company Stellar will join representatives of traditional financial markets such as J.P. Morgan, Goldman Sachs, and BlackRock and get a say in institutional-level issues.

SDF representatives noted that they will primarily focus on the use of Layer 1 protocols in government agencies and bank transfers in stablecoins.

The Stellar Development Foundation has announced that it joins an advisory committee of the U.S. Commodity Futures Trading Commission.

Blockchain company Stellar will join representatives of traditional financial markets such as J.P. Morgan, Goldman Sachs, and BlackRock and get a say in institutional-level issues.

SDF representatives noted that they will primarily focus on the use of Layer 1 protocols in government agencies and bank transfers in stablecoins.  9 years ago, Vitalik Buterin presented his Ethereum smart contract platform to the world. He officially announced his invention on BitcoinTalk Forum with a post titled "Welcome to the New Beginning!"

It’s not an anniversary date, so let’s do without flowers and applause.

But one thing that we would like to mention is that everyone who made their first steps at that time became most powerful people in crypto.

With its roots in the Ethereum team, crypto mafia has spread across the world:

- Charles Hoskinson launched Cardano in 2017.

- Anthony Di Iorio launched Decentral Inc. and the Jaxx wallet

- Joseph Lubin launched ConsenSys

- Gavin Wood created Polkadot and developed the Solidity smart contract language.

Our congratulations on these achievements, Vitalik!

9 years ago, Vitalik Buterin presented his Ethereum smart contract platform to the world. He officially announced his invention on BitcoinTalk Forum with a post titled "Welcome to the New Beginning!"

It’s not an anniversary date, so let’s do without flowers and applause.

But one thing that we would like to mention is that everyone who made their first steps at that time became most powerful people in crypto.

With its roots in the Ethereum team, crypto mafia has spread across the world:

- Charles Hoskinson launched Cardano in 2017.

- Anthony Di Iorio launched Decentral Inc. and the Jaxx wallet

- Joseph Lubin launched ConsenSys

- Gavin Wood created Polkadot and developed the Solidity smart contract language.

Our congratulations on these achievements, Vitalik!  Yes, they tighten the requirements and the nuts again. As of right now, European banks are required to view cryptocurrencies as the riskiest asset class.

Today, the relevant EU parliamentary committee approved such an initiative.

As a result, banks will actually need to hold EUR 1 in equity for every EUR they hold in cryptocurrencies.

The MEPs explained that similar capital requirements will help prevent the crypto world's insecurity from spreading to the financial system.

However, it was offensive. Which of the worlds is more unstable needs to be determined, though. But our arbiter is time. It will reveal everything.

Yes, they tighten the requirements and the nuts again. As of right now, European banks are required to view cryptocurrencies as the riskiest asset class.

Today, the relevant EU parliamentary committee approved such an initiative.

As a result, banks will actually need to hold EUR 1 in equity for every EUR they hold in cryptocurrencies.

The MEPs explained that similar capital requirements will help prevent the crypto world's insecurity from spreading to the financial system.

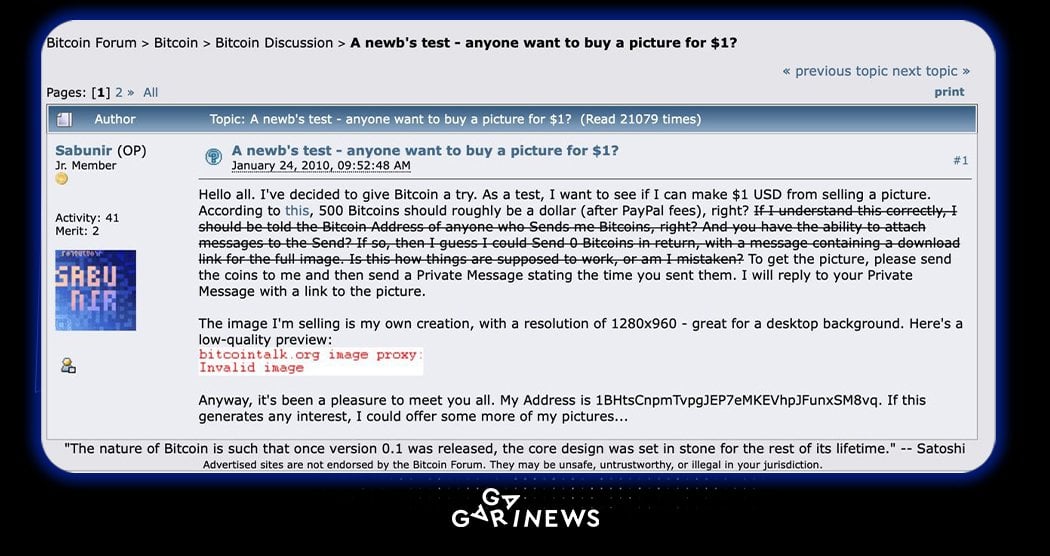

However, it was offensive. Which of the worlds is more unstable needs to be determined, though. But our arbiter is time. It will reveal everything.  This day 12 years ago was marked as the first attempt to use Bitcoin as a payment mean.

The author of the ad wanted to sell a 1280x960 resolution picture for 500 BTC that he said would look great as a desktop background.

At that time 500 BTC worth $1. Today it is almost $12,000,000,000.

As we know, no one was ever interested in this offer. Crypto folks decided to spend their BTC on pizzas.

This day 12 years ago was marked as the first attempt to use Bitcoin as a payment mean.

The author of the ad wanted to sell a 1280x960 resolution picture for 500 BTC that he said would look great as a desktop background.

At that time 500 BTC worth $1. Today it is almost $12,000,000,000.

As we know, no one was ever interested in this offer. Crypto folks decided to spend their BTC on pizzas.  Fabio Panetta, a member of the board of the European Central Bank, said that the digital euro does not involve the ability to set limits on how funds can be spent.

This is one of the main concerns in society regarding the proliferation of Central Bank Digital Currencies (CBDCs), since today's technology will allow it to happen.

Well, we'd like to believe... But today it's one thing, and tomorrow another.

Fabio Panetta, a member of the board of the European Central Bank, said that the digital euro does not involve the ability to set limits on how funds can be spent.

This is one of the main concerns in society regarding the proliferation of Central Bank Digital Currencies (CBDCs), since today's technology will allow it to happen.

Well, we'd like to believe... But today it's one thing, and tomorrow another.  Conor Grogan, Head of Product Business Operations at Coinbase, called attention to dubious transactions carried out by anonymous wallets that were purchasing tokens minutes before Binance listing announcements and selling them during the pump.

The purchase of Rar, ERN, TORN, and RAMP tokens are examples of such transactions. A $100,000 to $900,000 worth of transactions were made. The "trader" earned several million dollars over the course of several transactions.

Grogan speculated that it could be either a rogue employee or a trader who might have access to the losing API.

Editors' note: don't make it up! Ukrainian deputy Oleh Liashko won the lottery three times and took home the grand prize each time. It's just luck, a strong instinct, and a desire for victory!

Conor Grogan, Head of Product Business Operations at Coinbase, called attention to dubious transactions carried out by anonymous wallets that were purchasing tokens minutes before Binance listing announcements and selling them during the pump.

The purchase of Rar, ERN, TORN, and RAMP tokens are examples of such transactions. A $100,000 to $900,000 worth of transactions were made. The "trader" earned several million dollars over the course of several transactions.

Grogan speculated that it could be either a rogue employee or a trader who might have access to the losing API.

Editors' note: don't make it up! Ukrainian deputy Oleh Liashko won the lottery three times and took home the grand prize each time. It's just luck, a strong instinct, and a desire for victory!  Ethereum supporters are looking forward to the upcoming crypto spring. Another network update, dubbed Shanghai Fork, is scheduled for March. Shanghai Fork will allow users to access the funds locked into the Ethereum Beacon Chain. Depositors will be able to participate in validating transactions and earn newly-created Ethereum.

J.P. Morgan believes Shanghai Fork will be a pleasant surprise for Coinbase as well. It estimates that up to 95% of retail investors of this crypto exchange will be able to participate in Ethereum staking after the update. The matter is that Coinbase may get additional revenue of about $225-$545 million per year.

Ethereum supporters are looking forward to the upcoming crypto spring. Another network update, dubbed Shanghai Fork, is scheduled for March. Shanghai Fork will allow users to access the funds locked into the Ethereum Beacon Chain. Depositors will be able to participate in validating transactions and earn newly-created Ethereum.

J.P. Morgan believes Shanghai Fork will be a pleasant surprise for Coinbase as well. It estimates that up to 95% of retail investors of this crypto exchange will be able to participate in Ethereum staking after the update. The matter is that Coinbase may get additional revenue of about $225-$545 million per year.