#it

1240 articles found

Latest

The Drivers Behind Bitcoin Cash's 200% Rally

Bitcoin Cash (BCH), widely regarded as one of the most successful Bitcoin forks, has experienced an astonishing 200% price surge within a mere 10-day span. This remarkable achievement positions it among the select few cryptocurrencies to triple their value in such a short period.

Bitcoin Cash (BCH), widely regarded as one of the most successful Bitcoin forks, has experienced an astonishing 200% price surge within a mere 10-day span. This remarkable achievement positions it among the select few cryptocurrencies to triple their value in such a short period. Unveiling LUKSO (LYXe): An Overwiev of the Project

LUKSO (LYXe) is the native token of the LUKSO platform, designed to cater to the needs of a dynamic and ever-changing creative economy. Originally introduced on the Ethereum blockchain, it has since transitioned to its own independent mainnet. Currently, LUKSO holds the 149th position in the cryptocurrency market cap rankings.

LUKSO (LYXe) is the native token of the LUKSO platform, designed to cater to the needs of a dynamic and ever-changing creative economy. Originally introduced on the Ethereum blockchain, it has since transitioned to its own independent mainnet. Currently, LUKSO holds the 149th position in the cryptocurrency market cap rankings. Celsius: SEC Darling to Debt Abyss!

Celsius Network, launched in 2017, was a crypto lending platform that adhered to SEC regulations. It enabled users to borrow cryptocurrencies and earn revenue from deposits. The native CEL token facilitated transactions and rewarded liquidity. With $903.8 million in funding, it was a promising venture.

Celsius Network, launched in 2017, was a crypto lending platform that adhered to SEC regulations. It enabled users to borrow cryptocurrencies and earn revenue from deposits. The native CEL token facilitated transactions and rewarded liquidity. With $903.8 million in funding, it was a promising venture. OECD Countries to Implement the Crypto Asset Reporting Framework

The Organisation for Economic Co-operation and Development (OECD) has introduced to its member nations CARF - an all-encompassing tax regime designed specifically for the crypto sector. It seems that cryptocurrencies are no longer serving as a "silent harbor" for anarchists who prefer not to share their hard-earned money with the government.

The Organisation for Economic Co-operation and Development (OECD) has introduced to its member nations CARF - an all-encompassing tax regime designed specifically for the crypto sector. It seems that cryptocurrencies are no longer serving as a "silent harbor" for anarchists who prefer not to share their hard-earned money with the government. Best Hosting Providers for Crypto Startups

Web hosting platforms provide a broad range of services for their clients, from creating and maintaining websites to customer support. This allows businesses, legal entities, or startups to operate their websites without needing to hire an IT specialist team.

Web hosting platforms provide a broad range of services for their clients, from creating and maintaining websites to customer support. This allows businesses, legal entities, or startups to operate their websites without needing to hire an IT specialist team. The Evolution of XRP: From Shitcoin to Respected Investment

The saga of Ripple commenced in 2012 and has since gone through numerous transformations involving developmental changes, rebranding, structural modifications, and changes in ownership. Still, it continually attracted banks and traders. Yet, that was merely the beginning of the trials...

The saga of Ripple commenced in 2012 and has since gone through numerous transformations involving developmental changes, rebranding, structural modifications, and changes in ownership. Still, it continually attracted banks and traders. Yet, that was merely the beginning of the trials... SEC Approval of Bitcoin ETF Won't Shift the Game, Say JPMorgan

In a recent report, JPMorgan expressed a measured outlook on the influence a spot bitcoin exchange-traded fund (ETF) would have on cryptocurrency markets, even if the U.S. Securities and Exchange Commission (SEC) gives it the green light. The financial institution pointed out that while the approval of such an ETF is eagerly awaited, it may not be the market-altering event some anticipate.

In a recent report, JPMorgan expressed a measured outlook on the influence a spot bitcoin exchange-traded fund (ETF) would have on cryptocurrency markets, even if the U.S. Securities and Exchange Commission (SEC) gives it the green light. The financial institution pointed out that while the approval of such an ETF is eagerly awaited, it may not be the market-altering event some anticipate.  Approximately $125 million worth of multi-chain assets has been observed flowing out of the cross-chain protocol Multichain into multiple wallets. As a response, the Multichain team has temporarily halted the protocol, without providing a specific timeline for recovery.

Some analysts suggest that the situation may not be a result of a hacker attack. They point out that the asset transfer occurred gradually, with a small test transfer of 2 USDC before the larger outflow. Each asset was transferred to an independent wallet, and no further actions such as swapping or mixing took place. The receiving wallets remain completely clean.

Considering the technical characteristics of Multichain, it is possible that the transferor gained control of private key fragments exceeding the threshold through some means. The investigation into this potential exploit is ongoing.

Approximately $125 million worth of multi-chain assets has been observed flowing out of the cross-chain protocol Multichain into multiple wallets. As a response, the Multichain team has temporarily halted the protocol, without providing a specific timeline for recovery.

Some analysts suggest that the situation may not be a result of a hacker attack. They point out that the asset transfer occurred gradually, with a small test transfer of 2 USDC before the larger outflow. Each asset was transferred to an independent wallet, and no further actions such as swapping or mixing took place. The receiving wallets remain completely clean.

Considering the technical characteristics of Multichain, it is possible that the transferor gained control of private key fragments exceeding the threshold through some means. The investigation into this potential exploit is ongoing. When Will the Next Full-Scale Bull Run Begin?

In 2023, we've seen Bitcoin make an impressive leap from $16,500 to $30,000, along with several altcoins that have achieved exponential growth. However, it's difficult to label this as a full-fledged bull run. Instead, it mirrors more of a transitional market stage, reminiscent of the one we witnessed in 2019. So, when should we expect the genuine bull market to commence?

In 2023, we've seen Bitcoin make an impressive leap from $16,500 to $30,000, along with several altcoins that have achieved exponential growth. However, it's difficult to label this as a full-fledged bull run. Instead, it mirrors more of a transitional market stage, reminiscent of the one we witnessed in 2019. So, when should we expect the genuine bull market to commence? 5 Thrilling NFT Debuts in Modern Art

Every month, the blockchain witnesses a flood of thousands of new NFTs birthed by artists, musicians, actors, and diverse creative minds. Amidst this creative deluge, it's easy to miss the sight of some particularly captivating conceptual pieces. Thankfully, you have Gagarin News at your service.

Every month, the blockchain witnesses a flood of thousands of new NFTs birthed by artists, musicians, actors, and diverse creative minds. Amidst this creative deluge, it's easy to miss the sight of some particularly captivating conceptual pieces. Thankfully, you have Gagarin News at your service. The Challenge of Global AI Regulation: Is it a Feasible Goal?

Calls for universal principles to regulate the AI sector are voiced by supporters and skeptics of the swift evolution of large language models alike. Yet, the cues from international institutions and historical precedents suggest it's unavailing to anticipate any significant progression in this direction until a clear crisis emerges.

Calls for universal principles to regulate the AI sector are voiced by supporters and skeptics of the swift evolution of large language models alike. Yet, the cues from international institutions and historical precedents suggest it's unavailing to anticipate any significant progression in this direction until a clear crisis emerges. WOO Network Unleashed: Transform Finance with WOO Coin!

WOO Network operates at the intersection of DeFi and CeFi, striving to offer liquidity, fast execution, and low fees. It has a market cap of $361M and a supply of 3 billion WOO tokens, and users can engage in staking and yield farming with WOO tokens. Dive into the WOO Network review.

WOO Network operates at the intersection of DeFi and CeFi, striving to offer liquidity, fast execution, and low fees. It has a market cap of $361M and a supply of 3 billion WOO tokens, and users can engage in staking and yield farming with WOO tokens. Dive into the WOO Network review.  Affected by the Azuki “Elementals” NFT incident (similar artworks, errors in the artwork, and collector dissatisfaction), the NFT market fell sharply again in the past 24 hours.

BAYC fell 16%, MAYC fell 20%, and Azuki fell 11%.

Earlier this year, Azuki NFTs gained significant popularity, surpassing even BAYC NFTs.

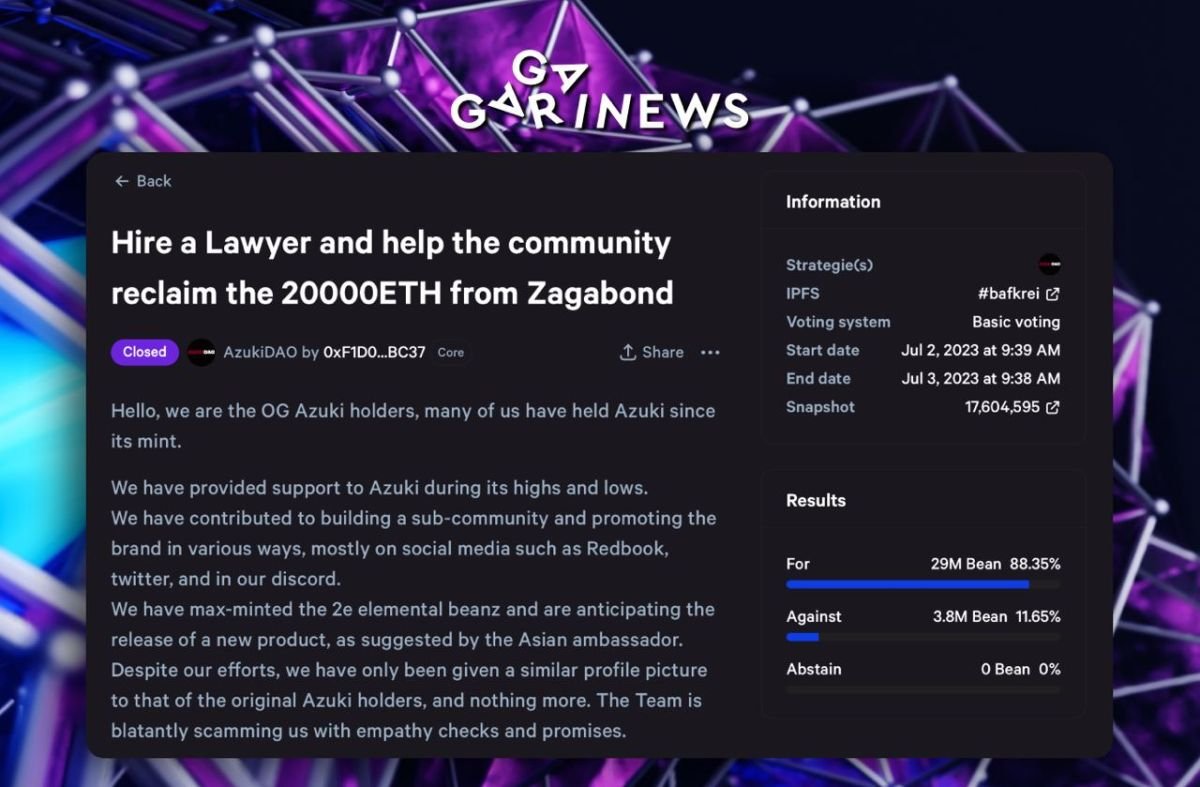

Meanwhile, AzukiDAO has proposed to recover 20,000 ETH from Azuki founder ‘Zagabond’.

The proposal suggests hiring a lawyer to take legal action against Zagabond for their alleged involvement in multiple “rug” projects. The aim of the clawback is to retrieve $39 million worth of ETH that was earned from the controversial launch of “Elementals” NFT collection.

As of now, the action has received support from 88.3% of AzukiDAO (BEAN) token holders, with 11.65% opposing it. The voting period for the proposal will conclude at 6:38 am UTC on July 3rd.

Affected by the Azuki “Elementals” NFT incident (similar artworks, errors in the artwork, and collector dissatisfaction), the NFT market fell sharply again in the past 24 hours.

BAYC fell 16%, MAYC fell 20%, and Azuki fell 11%.

Earlier this year, Azuki NFTs gained significant popularity, surpassing even BAYC NFTs.

Meanwhile, AzukiDAO has proposed to recover 20,000 ETH from Azuki founder ‘Zagabond’.

The proposal suggests hiring a lawyer to take legal action against Zagabond for their alleged involvement in multiple “rug” projects. The aim of the clawback is to retrieve $39 million worth of ETH that was earned from the controversial launch of “Elementals” NFT collection.

As of now, the action has received support from 88.3% of AzukiDAO (BEAN) token holders, with 11.65% opposing it. The voting period for the proposal will conclude at 6:38 am UTC on July 3rd.