#it

1240 articles found

Latest

JPMorgan reports that Bitcoin miners are diversifying their operations in anticipation of the upcoming halving event, which will slash their rewards. Miners are now venturing into the booming artificial intelligence (AI) market, offering high-performance computing services. This shift is partly funded by selling newly minted or existing bitcoins. Companies like Applied Digital and Iris Energy are already making strides in AI cloud services. Additionally, post Ethereum's shift from proof-of-work, former Ethereum miners are leveraging GPUs for AI, finding it potentially more profitable than traditional mining.

JPMorgan reports that Bitcoin miners are diversifying their operations in anticipation of the upcoming halving event, which will slash their rewards. Miners are now venturing into the booming artificial intelligence (AI) market, offering high-performance computing services. This shift is partly funded by selling newly minted or existing bitcoins. Companies like Applied Digital and Iris Energy are already making strides in AI cloud services. Additionally, post Ethereum's shift from proof-of-work, former Ethereum miners are leveraging GPUs for AI, finding it potentially more profitable than traditional mining.  The immense wave of transactions and heightened user activity took Shibarium by surprise, causing some tech glitches, says Shytoshi Kusama, the co-founder of the Shiba Inu ecosystem.

He's also quick to debunk the rumors about funds getting stuck in the bridging contracts, terming it as pure FUD.

"Although we expected a very busy moment, we never expected THIS much traffic, instantly," reflects Shytoshi Kusama.

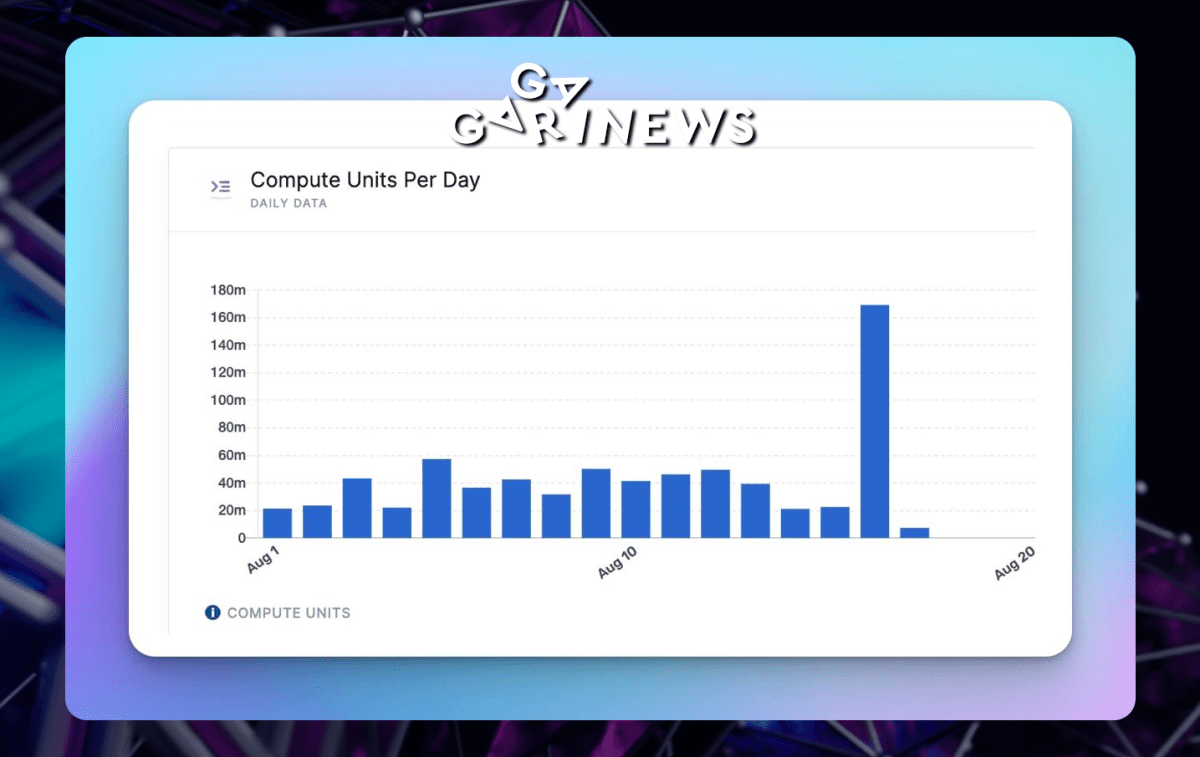

At its launch, the Shibarium team tackled a load of 160 million computational tasks in a span of about 30 minutes, while anticipating only 400 million within a month.

The immense wave of transactions and heightened user activity took Shibarium by surprise, causing some tech glitches, says Shytoshi Kusama, the co-founder of the Shiba Inu ecosystem.

He's also quick to debunk the rumors about funds getting stuck in the bridging contracts, terming it as pure FUD.

"Although we expected a very busy moment, we never expected THIS much traffic, instantly," reflects Shytoshi Kusama.

At its launch, the Shibarium team tackled a load of 160 million computational tasks in a span of about 30 minutes, while anticipating only 400 million within a month.  Grayscale Investments is gearing up for a potential positive outcome in its lawsuit with the SEC, as it begins hiring for its ETF team. The firm is on the lookout for a "Senior Associate, ETFs" to bolster its ETF business development.

This move comes as the crypto community eagerly awaits a court decision on Grayscale's proposal to convert its GBTC fund into a spot bitcoin ETF.

The outcome could set a precedent for other asset managers seeking approvals for spot bitcoin funds, influencing the future of crypto ETFs.

Grayscale Investments is gearing up for a potential positive outcome in its lawsuit with the SEC, as it begins hiring for its ETF team. The firm is on the lookout for a "Senior Associate, ETFs" to bolster its ETF business development.

This move comes as the crypto community eagerly awaits a court decision on Grayscale's proposal to convert its GBTC fund into a spot bitcoin ETF.

The outcome could set a precedent for other asset managers seeking approvals for spot bitcoin funds, influencing the future of crypto ETFs.  The issuer of USDT has resolved to end support for Kusama, Bitcoin Cash SLP, and Omni Layer. This move follows an in-depth analysis of the functionality, safety, and stability of these particular blockchains.

Notably, Omni Layer, Tether's first transport layer since its inception in 2014, was instrumental during its early days. However, it has witnessed a decline in popularity due to rising competitive solutions.

Though minting of USDT on the aforesaid platforms will be terminated, the redemption process will stay in place for a duration extending at least a year.

The issuer of USDT has resolved to end support for Kusama, Bitcoin Cash SLP, and Omni Layer. This move follows an in-depth analysis of the functionality, safety, and stability of these particular blockchains.

Notably, Omni Layer, Tether's first transport layer since its inception in 2014, was instrumental during its early days. However, it has witnessed a decline in popularity due to rising competitive solutions.

Though minting of USDT on the aforesaid platforms will be terminated, the redemption process will stay in place for a duration extending at least a year.  PayPal suspends crypto buying services in the UK

Starting October 1, 2023, PayPal will no longer support cryptocurrency purchases for it's users from the United Kingdom. This action is consistent with the company's obligation to comply with local financial legislation.

While the measure is planned to last until the start of 2024, PayPal remains hopeful about restoring the service. During the suspension, users are free to either hold their existing cryptocurrencies without any associated fees or sell them if they choose.

PayPal suspends crypto buying services in the UK

Starting October 1, 2023, PayPal will no longer support cryptocurrency purchases for it's users from the United Kingdom. This action is consistent with the company's obligation to comply with local financial legislation.

While the measure is planned to last until the start of 2024, PayPal remains hopeful about restoring the service. During the suspension, users are free to either hold their existing cryptocurrencies without any associated fees or sell them if they choose.  The current market landscape marks an unprecedented decline in liquidity, according to Bloomberg Intelligence's senior macro strategist, Mike McGlone.

If this pattern holds throughout 2023, he warns of a potential sharp descent in Bitcoin prices, which would ripple through Ethereum, XRP, and the general cryptocurrency domain.

“What should be early indications of recessionary times? The best indication should be bitcoin and that’s where I’m looking for the bleeding occasion from bitcoin and it’s still kind of showing what I expected.”

“Picture December: Recession looms, Fed hesitates on easing due to inflation,” said McGlone.

The current market landscape marks an unprecedented decline in liquidity, according to Bloomberg Intelligence's senior macro strategist, Mike McGlone.

If this pattern holds throughout 2023, he warns of a potential sharp descent in Bitcoin prices, which would ripple through Ethereum, XRP, and the general cryptocurrency domain.

“What should be early indications of recessionary times? The best indication should be bitcoin and that’s where I’m looking for the bleeding occasion from bitcoin and it’s still kind of showing what I expected.”

“Picture December: Recession looms, Fed hesitates on easing due to inflation,” said McGlone.  Stated to be a staggering 10 times faster than Solana, the network accomplishes transaction finality in just 250 milliseconds.

Trading of the blockchain's native token (SEI) has started on different centralized exchanges, and it's now valued at approximately $0.19.

There's also news of an airdrop, but claiming will be permitted only after the "initial warm-up period."

The time frame for this warm-up has not yet been revealed.

Stated to be a staggering 10 times faster than Solana, the network accomplishes transaction finality in just 250 milliseconds.

Trading of the blockchain's native token (SEI) has started on different centralized exchanges, and it's now valued at approximately $0.19.

There's also news of an airdrop, but claiming will be permitted only after the "initial warm-up period."

The time frame for this warm-up has not yet been revealed.  Dasset, a cryptocurrency exchange in New Zealand, has left its users unable to access their holdings. Attempts to log onto the official site redirect customers to the webpage of the law firm Grant Thornton.

A released statement details that Grant Thornton will control the liquidation process of the exchange. It has immediate plans to cooperate with all customers to safeguard all the residual funds.

"Dasset’s management says a significant reduction in asset values and trading levels impacted its ability to trade profitably. It was determined the appointment of liquidators was in the best interests of all stakeholders," Grant Thornton highlighted.

Dasset, a cryptocurrency exchange in New Zealand, has left its users unable to access their holdings. Attempts to log onto the official site redirect customers to the webpage of the law firm Grant Thornton.

A released statement details that Grant Thornton will control the liquidation process of the exchange. It has immediate plans to cooperate with all customers to safeguard all the residual funds.

"Dasset’s management says a significant reduction in asset values and trading levels impacted its ability to trade profitably. It was determined the appointment of liquidators was in the best interests of all stakeholders," Grant Thornton highlighted.  The community of Terra Luna Classic has dismissed the USTC Repeg team's request for funding. Voting outcomes showed 45% in support, 43% objecting with veto power, and 11% rejected it outright.

Even though 11 of the 17 validators were in support, the proposal failed to gain traction with the general public. The request was for 285 million LUNC ($20,000) to refine an instrument for the USTC Incremental Repeg Buybacks & Staking Swaps algorithm.

The community of Terra Luna Classic has dismissed the USTC Repeg team's request for funding. Voting outcomes showed 45% in support, 43% objecting with veto power, and 11% rejected it outright.

Even though 11 of the 17 validators were in support, the proposal failed to gain traction with the general public. The request was for 285 million LUNC ($20,000) to refine an instrument for the USTC Incremental Repeg Buybacks & Staking Swaps algorithm.  The founder of Cardano, Charles Hoskinson, stated that the Hydra protocol is not only active on Cardano's mainstream network, but it's also rapidly evolving. He highlighted the innovative transaction processing methods, including tiered pricing and the Babel commission system.

Hoskinson's comment was in response to a user, going by the pseudonym 0xONLY.arf, who expressed the opinion that Cardano is merely following in Ethereum's footsteps, albeit a few years behind.

The founder of Cardano, Charles Hoskinson, stated that the Hydra protocol is not only active on Cardano's mainstream network, but it's also rapidly evolving. He highlighted the innovative transaction processing methods, including tiered pricing and the Babel commission system.

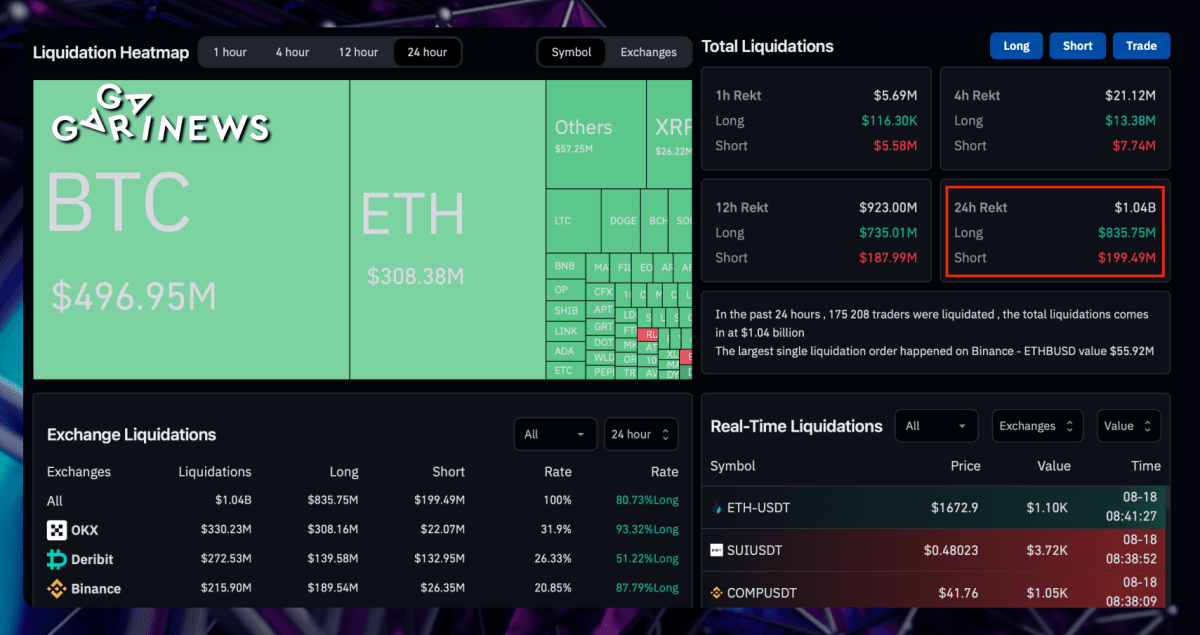

Hoskinson's comment was in response to a user, going by the pseudonym 0xONLY.arf, who expressed the opinion that Cardano is merely following in Ethereum's footsteps, albeit a few years behind.  Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.

Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

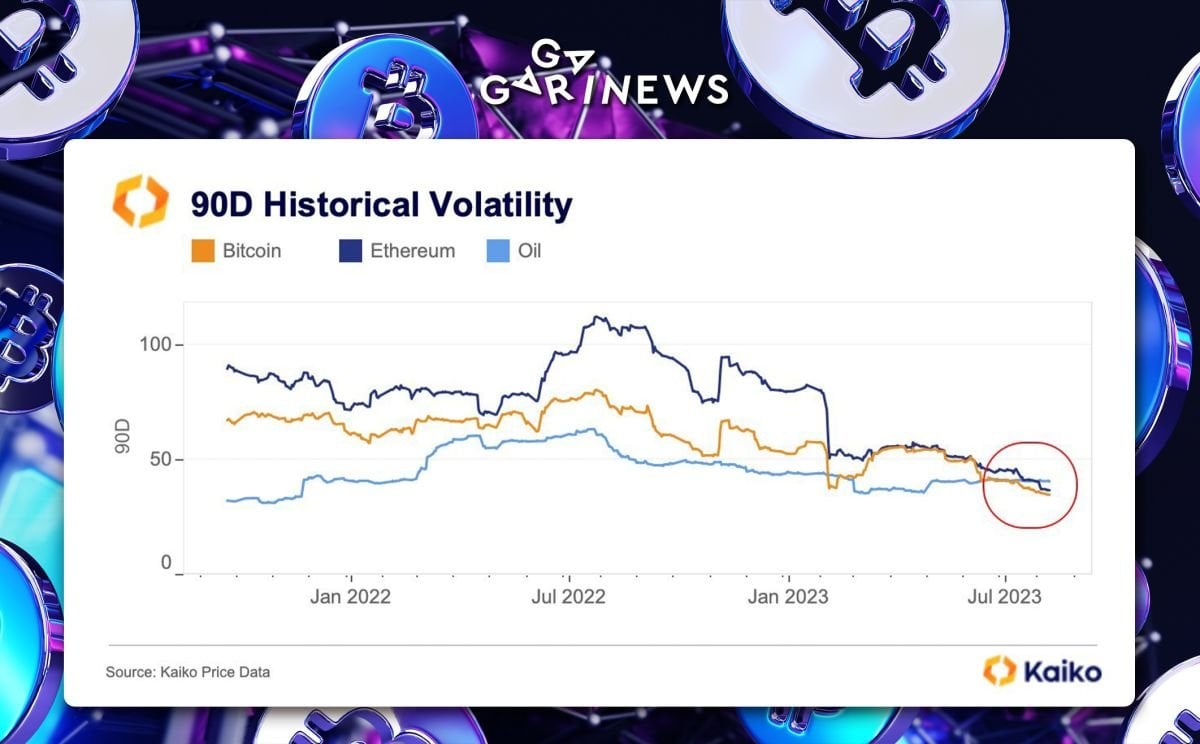

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.  According to Kaiko, BTC and ETH have recorded their lowest 90-day price volatility compared to oil in many years, a mark last reached in 2016.

Right now, Bitcoin's volatility sits at 35%, Ethereum's at 37%, while oil's is higher at 41%.

Experience tells us that after such periods of quiet , a significant move often follows. Judging by Bitcoin's recent dynamics, it appears such a shift might be kicking off.

According to Kaiko, BTC and ETH have recorded their lowest 90-day price volatility compared to oil in many years, a mark last reached in 2016.

Right now, Bitcoin's volatility sits at 35%, Ethereum's at 37%, while oil's is higher at 41%.

Experience tells us that after such periods of quiet , a significant move often follows. Judging by Bitcoin's recent dynamics, it appears such a shift might be kicking off.  The SEI token, having just been released, now finds itself in the 85th spot in terms of market capitalization, as reported by Coinmarketcap. It's also making its presence felt in daily trading, occupying the seventh position with a volume of $1,6 billion.

While current metrics paint a promising picture for the project, it's worth noting that the cryptocurrency arena frequently sees such developments. Therefore, it's wise to approach this news with measured optimism.

The SEI token, having just been released, now finds itself in the 85th spot in terms of market capitalization, as reported by Coinmarketcap. It's also making its presence felt in daily trading, occupying the seventh position with a volume of $1,6 billion.

While current metrics paint a promising picture for the project, it's worth noting that the cryptocurrency arena frequently sees such developments. Therefore, it's wise to approach this news with measured optimism. Liquity USD (LUSD): A DeFi Stablecoin Review

Liquity USD, or LUSD, is a stablecoin that maintains a 1:1 peg with the US dollar. It's used by the Liquity lending protocol as the primary asset for issuing loans backed by Ethereum (ETH). When LUSD is repaid, the loan is resolved, and the ETH collateral is returned to the owner at its nominal value.

Liquity USD, or LUSD, is a stablecoin that maintains a 1:1 peg with the US dollar. It's used by the Liquity lending protocol as the primary asset for issuing loans backed by Ethereum (ETH). When LUSD is repaid, the loan is resolved, and the ETH collateral is returned to the owner at its nominal value. EthereumPoW (ETHW) Coin Review

On September 15, 2022, Ethereum introduced a pivotal upgrade, transitioning from the Proof-of-Work (PoW) consensus mechanism to Proof-of-Stake (PoS), dubbed "The Merge." However, some in the crypto community resisted this shift, seeing it as a deviation from Satoshi Nakamoto's foundational principles, and chose to retain the original algorithm.

On September 15, 2022, Ethereum introduced a pivotal upgrade, transitioning from the Proof-of-Work (PoW) consensus mechanism to Proof-of-Stake (PoS), dubbed "The Merge." However, some in the crypto community resisted this shift, seeing it as a deviation from Satoshi Nakamoto's foundational principles, and chose to retain the original algorithm.