#investment

289 articles found

Latest

Charlie Munger: The Investment Genius and AI Skeptic

In 2024, Charles Thomas Munger, a titan of the financial world, was set to celebrate his 100th birthday. Until his last days, he actively contributed to his role, serving as the indispensable right-hand man to Warren Buffett and Vice Chairman of Berkshire Hathaway, a vast financial conglomerate with assets exceeding $1 trillion.

In 2024, Charles Thomas Munger, a titan of the financial world, was set to celebrate his 100th birthday. Until his last days, he actively contributed to his role, serving as the indispensable right-hand man to Warren Buffett and Vice Chairman of Berkshire Hathaway, a vast financial conglomerate with assets exceeding $1 trillion.  Since 1993, he held the position of portfolio manager at the investment firm T. Rowe Price, and he also served as its vice president. Most of the mentions of him date back to the early 2000s, making it challenging to unearth any fresh and intriguing information about Robert.

Since 1993, he held the position of portfolio manager at the investment firm T. Rowe Price, and he also served as its vice president. Most of the mentions of him date back to the early 2000s, making it challenging to unearth any fresh and intriguing information about Robert.  The country intention to seek a court-ordered shutdown of Facebook unless the social media giant takes decisive action to address alleged investment and cryptocurrency scam advertisements on its platform. According to the Ministry of Digital Economy and Society, over 200,000 individuals fell victim to deceptive Facebook ads. The ministry highlighted that common tactics employed by scammers included crypto investment and trading schemes, often featuring images of celebrities and prominent financial figures, and promising daily returns of up to 30%. The ministry is in the process of gathering evidence regarding these scam advertisements, with their number estimated to be over 5,300.

The country intention to seek a court-ordered shutdown of Facebook unless the social media giant takes decisive action to address alleged investment and cryptocurrency scam advertisements on its platform. According to the Ministry of Digital Economy and Society, over 200,000 individuals fell victim to deceptive Facebook ads. The ministry highlighted that common tactics employed by scammers included crypto investment and trading schemes, often featuring images of celebrities and prominent financial figures, and promising daily returns of up to 30%. The ministry is in the process of gathering evidence regarding these scam advertisements, with their number estimated to be over 5,300.  FTX's portfolio liquidation is unlikely to shake the market significantly, as noted by Coinbase in their latest weekly report.

They cited multiple reasons supporting this claim.

1. Weekly Sell Limits: Initially, liquidations are capped at $50 million per week for digital assets. This limit will gradually increase to $100 million in subsequent weeks. Any permanent increase to a maximum limit of $200 million requires approval from two committees representing FTX debtors.

2. Insider-Affiliated Tokens: Stricter controls govern the sale of “insider-affiliated” tokens, necessitating a 10-day advance notice to the same committees.

3. Locked Holdings: A significant portion of FTX’s SOL holdings, along with some other tokens, are locked until approximately 2025 due to token vesting schedules, limiting their availability for sale.

4. Hedging Measures: FTX has the option to hedge its sales of BTC, ETH, and other debtor-identified assets through an investment advisor, contingent on prior committee approval. These precautions ensure a measured and controlled approach to asset liquidation.

FTX's portfolio liquidation is unlikely to shake the market significantly, as noted by Coinbase in their latest weekly report.

They cited multiple reasons supporting this claim.

1. Weekly Sell Limits: Initially, liquidations are capped at $50 million per week for digital assets. This limit will gradually increase to $100 million in subsequent weeks. Any permanent increase to a maximum limit of $200 million requires approval from two committees representing FTX debtors.

2. Insider-Affiliated Tokens: Stricter controls govern the sale of “insider-affiliated” tokens, necessitating a 10-day advance notice to the same committees.

3. Locked Holdings: A significant portion of FTX’s SOL holdings, along with some other tokens, are locked until approximately 2025 due to token vesting schedules, limiting their availability for sale.

4. Hedging Measures: FTX has the option to hedge its sales of BTC, ETH, and other debtor-identified assets through an investment advisor, contingent on prior committee approval. These precautions ensure a measured and controlled approach to asset liquidation.  U.S., U.K., and European investment firms are increasingly appointing senior executives for digital asset strategies. Amberdata's recent report reveals that 24% of asset management firms have embraced a digital assets strategy, with another 13% aiming to do so within two years. The study, which surveyed 60 investment professionals, found that nearly half (48%) incorporate digital assets in their portfolios. Despite regulatory challenges, Amberdata anticipates a positive shift in the coming years, especially with Ripple's recent legal win against the SEC.

U.S., U.K., and European investment firms are increasingly appointing senior executives for digital asset strategies. Amberdata's recent report reveals that 24% of asset management firms have embraced a digital assets strategy, with another 13% aiming to do so within two years. The study, which surveyed 60 investment professionals, found that nearly half (48%) incorporate digital assets in their portfolios. Despite regulatory challenges, Amberdata anticipates a positive shift in the coming years, especially with Ripple's recent legal win against the SEC.  Today, key aspects of the summit's agenda were revealed, giving priority to risk management and support strategies.

Leaders from major countries, top tech organizations, academic circles, and civic groups will converge at the event to discuss expedient actions in the cutting-edge arena of AI development.

The UK's representatives are of the opinion that fostering AI investment could significantly benefit society and economic productivity, but only if done within a regulatory framework.

“Without appropriate guardrails, this technology also poses significant risks in ways that do not respect national boundaries. The need to address these risks, including at an international level, is increasingly urgent.“

Today, key aspects of the summit's agenda were revealed, giving priority to risk management and support strategies.

Leaders from major countries, top tech organizations, academic circles, and civic groups will converge at the event to discuss expedient actions in the cutting-edge arena of AI development.

The UK's representatives are of the opinion that fostering AI investment could significantly benefit society and economic productivity, but only if done within a regulatory framework.

“Without appropriate guardrails, this technology also poses significant risks in ways that do not respect national boundaries. The need to address these risks, including at an international level, is increasingly urgent.“  This collaboration seeks to digitize various sectors, including government services, healthcare, and education. The Google Distributed Cloud (GDC) services will enhance local infrastructure and data processing capabilities, aligning with El Salvador’s vision to become an innovation hub. President Nayib Bukele emphasized the importance of technology and foreign investment for the nation’s development: “Google’s global experience combined with the audacity of El Salvador will redefine the technological landscape.”

This collaboration seeks to digitize various sectors, including government services, healthcare, and education. The Google Distributed Cloud (GDC) services will enhance local infrastructure and data processing capabilities, aligning with El Salvador’s vision to become an innovation hub. President Nayib Bukele emphasized the importance of technology and foreign investment for the nation’s development: “Google’s global experience combined with the audacity of El Salvador will redefine the technological landscape.”  Investment fund Pantera Capital has forecasted a boost in Bitcoin's price following the forthcoming halving in April 2024, a pattern observed in the past.

With historical trends as a basis, they anticipate Bitcoin will hit $35,000 before the halving and surge to $148,000 by 2025.

Decisive events, like a positive court verdict for XRP and the greenlight for BlackRock's spot Bitcoin ETF, are expected to shape these potential outcomes.

Investment fund Pantera Capital has forecasted a boost in Bitcoin's price following the forthcoming halving in April 2024, a pattern observed in the past.

With historical trends as a basis, they anticipate Bitcoin will hit $35,000 before the halving and surge to $148,000 by 2025.

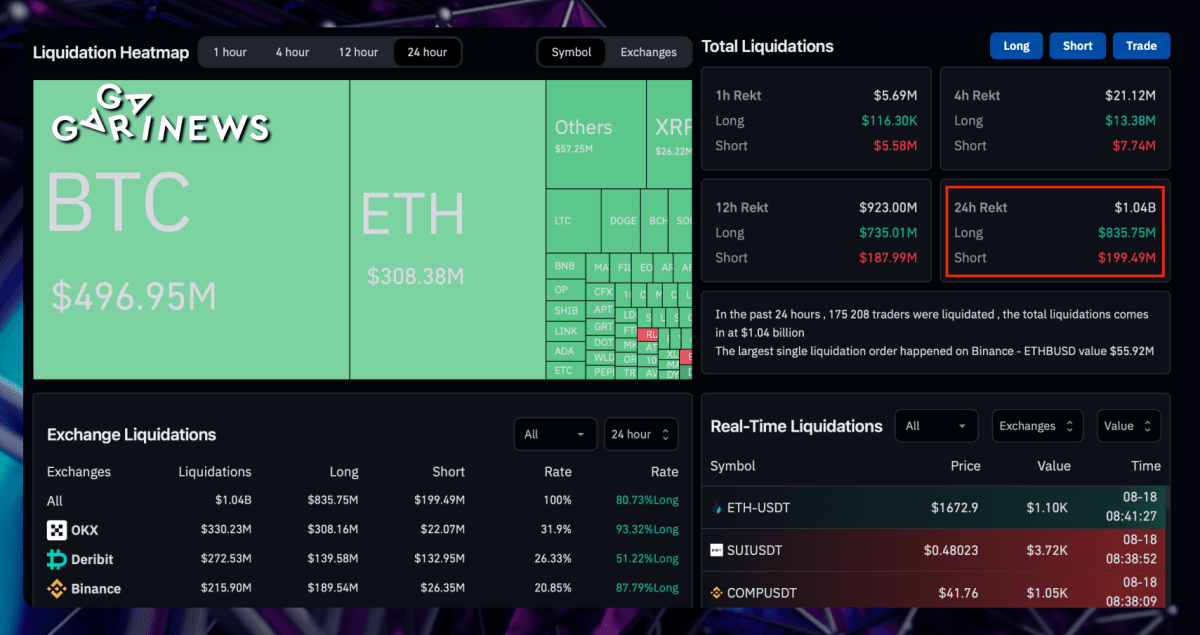

Decisive events, like a positive court verdict for XRP and the greenlight for BlackRock's spot Bitcoin ETF, are expected to shape these potential outcomes.  Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.

Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.