#futures

75 articles found

Latest

With $549 billion, September recorded the lowest trading volume of the year for Bitcoin futures. The list of leaders comprises:

Binance with $247 billion in trades

OKX with $95 billion

ByBit accounting for $75 billion

Bitget recording $68 billion

On another note, DEX platforms also set an annual low with a trading volume of $32 billion.With $549 billion, September recorded the lowest trading volume of the year for Bitcoin futures.The list of leaders comprises:

Binance with $247 billion in trades

OKX with $95 billion

ByBit accounting for $75 billion

Bitget recording $68 billion

On another note, DEX platforms also set an annual low with a trading volume of $32 billion.

With $549 billion, September recorded the lowest trading volume of the year for Bitcoin futures. The list of leaders comprises:

Binance with $247 billion in trades

OKX with $95 billion

ByBit accounting for $75 billion

Bitget recording $68 billion

On another note, DEX platforms also set an annual low with a trading volume of $32 billion.With $549 billion, September recorded the lowest trading volume of the year for Bitcoin futures.The list of leaders comprises:

Binance with $247 billion in trades

OKX with $95 billion

ByBit accounting for $75 billion

Bitget recording $68 billion

On another note, DEX platforms also set an annual low with a trading volume of $32 billion.  Coinbase has obtained regulatory approval from the National Futures Association (NFA), a CFTC-designated self-regulatory organization.

This approval allows Coinbase to function as a Futures Commission Merchant (FCM) and provide eligible US customers with access to crypto futures through its platforms.

With this approval, Coinbase becomes the first crypto-native platform to offer a combined solution featuring traditional spot crypto trading and regulated, leveraged crypto futures for their US verified customers.

Coinbase has obtained regulatory approval from the National Futures Association (NFA), a CFTC-designated self-regulatory organization.

This approval allows Coinbase to function as a Futures Commission Merchant (FCM) and provide eligible US customers with access to crypto futures through its platforms.

With this approval, Coinbase becomes the first crypto-native platform to offer a combined solution featuring traditional spot crypto trading and regulated, leveraged crypto futures for their US verified customers.  On the morning of July 13, Alex Mashinsky, the former CEO of the now-bankrupt crypto lender Celsius, was reportedly arrested. The news broke minutes after the United States Securities and Exchange Commission filed a lawsuit against the crypto lender on the same day.

The company’s token dropped 6% upon hearing the news.

The former CEO was arrested following an investigation into the company’s collapse. Celsius Network initiated the process of filing for bankruptcy on July 14 of the previous year. Investigators at the Commodity Futures Trading Commission found Mashinsky guilty of breaking numerous U.S. regulations prior to the company’s implosion in 2022.

The investigation into the troubled crypto lender began after the New York Attorney General sued Mashinsky on January 5. The lawsuit alleged that the former CEO misled investors and caused billions of dollars in losses.

On the morning of July 13, Alex Mashinsky, the former CEO of the now-bankrupt crypto lender Celsius, was reportedly arrested. The news broke minutes after the United States Securities and Exchange Commission filed a lawsuit against the crypto lender on the same day.

The company’s token dropped 6% upon hearing the news.

The former CEO was arrested following an investigation into the company’s collapse. Celsius Network initiated the process of filing for bankruptcy on July 14 of the previous year. Investigators at the Commodity Futures Trading Commission found Mashinsky guilty of breaking numerous U.S. regulations prior to the company’s implosion in 2022.

The investigation into the troubled crypto lender began after the New York Attorney General sued Mashinsky on January 5. The lawsuit alleged that the former CEO misled investors and caused billions of dollars in losses.  Eric Balchunas from Bloomberg, a seasoned ETF Analyst, estimates a 90% chance of the first Ether Futures ETF receiving approval come early October.

According to him, Valkyrie Funds is set to lead with its application, with a series of affirmative decisions expected to follow.

“The spot ETF remains in limbo,” Balchunas points out.

Eric Balchunas from Bloomberg, a seasoned ETF Analyst, estimates a 90% chance of the first Ether Futures ETF receiving approval come early October.

According to him, Valkyrie Funds is set to lead with its application, with a series of affirmative decisions expected to follow.

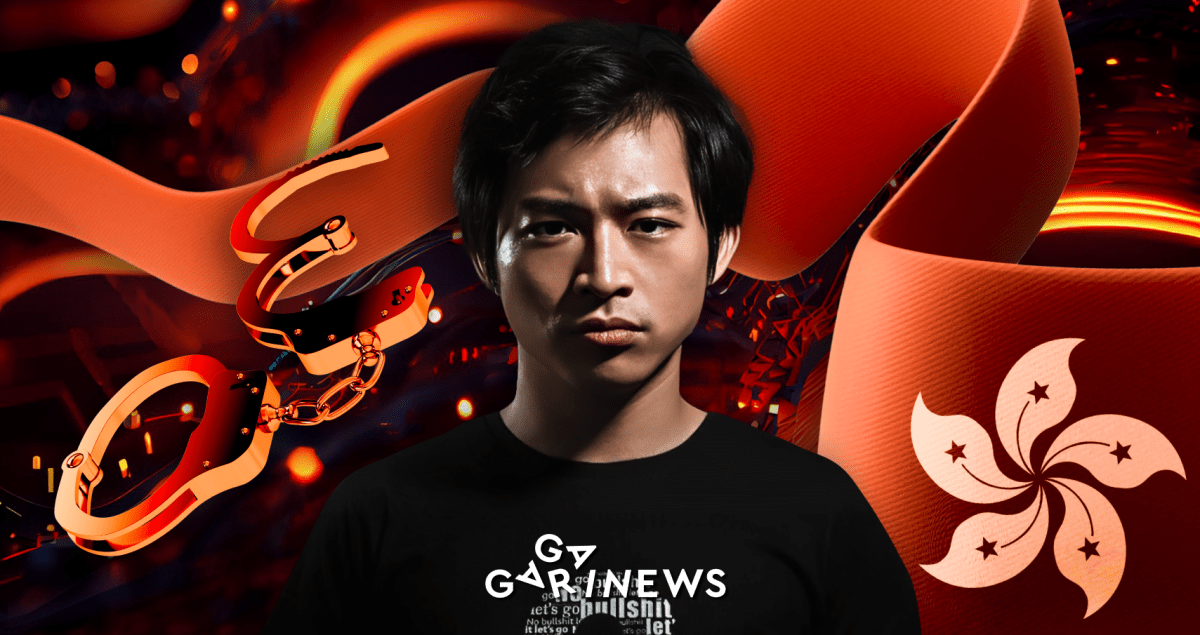

“The spot ETF remains in limbo,” Balchunas points out.  Hong Kong police have arrested Joseph Lam, a crypto influencer and former lawyer, in connection with the ongoing investigation into cryptocurrency exchange JPEX. Lam, who has over 190,000 Instagram followers, was arrested today and his office was raided. The arrest follows the Securities and Futures Commission's warning against JPEX for misleading statements about its licensing status. The police have received at least 83 complaints involving JPEX, with virtual assets worth about HK$34 million ($4.3 million) reported.

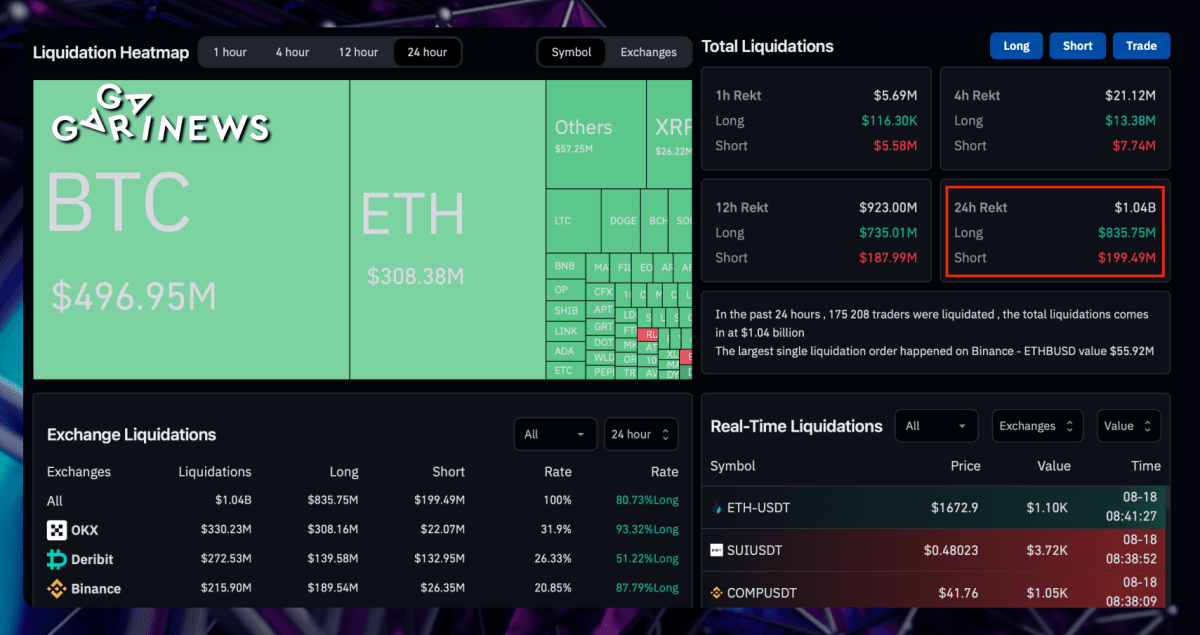

Hong Kong police have arrested Joseph Lam, a crypto influencer and former lawyer, in connection with the ongoing investigation into cryptocurrency exchange JPEX. Lam, who has over 190,000 Instagram followers, was arrested today and his office was raided. The arrest follows the Securities and Futures Commission's warning against JPEX for misleading statements about its licensing status. The police have received at least 83 complaints involving JPEX, with virtual assets worth about HK$34 million ($4.3 million) reported.  Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.

Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.  Michael and Amanda Griffis are in hot water with the Commodity Futures Trading Commission (CFTC) as the agency alleges the couple pulled off a grand-scale fraud.

Operating under the auspicious name "Blessings of God Thru Crypto," they enticed over 100 individuals to contribute to their digital assets commodity pool. Accumulating over $6 million, the couple promised high returns and security for the pooled resources.

According to CFTC, these pledges were not only empty but the pooled funds frequently ended up mingling with the Griffis' personal finances.

Michael and Amanda Griffis are in hot water with the Commodity Futures Trading Commission (CFTC) as the agency alleges the couple pulled off a grand-scale fraud.

Operating under the auspicious name "Blessings of God Thru Crypto," they enticed over 100 individuals to contribute to their digital assets commodity pool. Accumulating over $6 million, the couple promised high returns and security for the pooled resources.

According to CFTC, these pledges were not only empty but the pooled funds frequently ended up mingling with the Griffis' personal finances.