#ftx

206 articles found

Latest

Cryptocurrency exchange FTX is making a court appeal to have FTX Dubai removed from bankruptcy proceedings, asserting that this division had not been in active operation before the official declaration of insolvency was lodged.

The legal plea also indicates that the division possesses assets totalling about $4.5 million, spread across multiple accounts. Notably, a substantial portion of these funds is held as collateral for the Virtual Assets Regulatory Authority of Dubai.

Cryptocurrency exchange FTX is making a court appeal to have FTX Dubai removed from bankruptcy proceedings, asserting that this division had not been in active operation before the official declaration of insolvency was lodged.

The legal plea also indicates that the division possesses assets totalling about $4.5 million, spread across multiple accounts. Notably, a substantial portion of these funds is held as collateral for the Virtual Assets Regulatory Authority of Dubai.  “FTX 2.0 would be worse than starting from scratch. No team, no tech, no licenses, no banking, tarnished brand. The trustee should just auction off the domain and trademark to the highest bidder. Anything beyond that is simply a fee extraction attack on delusional creditors,” — tweeted Kraken founder.

Who would actually be interested in buying FTX?

“FTX 2.0 would be worse than starting from scratch. No team, no tech, no licenses, no banking, tarnished brand. The trustee should just auction off the domain and trademark to the highest bidder. Anything beyond that is simply a fee extraction attack on delusional creditors,” — tweeted Kraken founder.

Who would actually be interested in buying FTX?  Bankrupt crypto firms FTX and Genesis have reportedly reached a preliminary agreement to settle outstanding issues. The companies have agreed to void all mutual claims.

This development was revealed in a letter sent to Bankruptcy Judge Sean Lane on July 27. The final decision and terms of the agreement, however, need to be officially approved by the court.

Bankrupt crypto firms FTX and Genesis have reportedly reached a preliminary agreement to settle outstanding issues. The companies have agreed to void all mutual claims.

This development was revealed in a letter sent to Bankruptcy Judge Sean Lane on July 27. The final decision and terms of the agreement, however, need to be officially approved by the court.  FTX, the prominent cryptocurrency exchange, was recently embroiled in controversy when court documents revealed a plan devised by Gabriel, the younger brother of FTX's CEO, SBF. According to the documents, Gabriel aimed to utilize FTX clients' funds to purchase the entire country of Nauru.

The idea was to transform Nauru into a post-apocalyptic sanctuary, complete with a highly secretive laboratory for conducting human genetics experiments and other projects. Who needs a private island when you can have a whole sovereign nation, right?

The court documents further detailed instances of transactions involving the founder's family, including those that have been previously disclosed.

While the idea of buying a nation for such purposes seems like something out of a sci-fi movie, it underscores the madness that was going on inside the FTX.

FTX, the prominent cryptocurrency exchange, was recently embroiled in controversy when court documents revealed a plan devised by Gabriel, the younger brother of FTX's CEO, SBF. According to the documents, Gabriel aimed to utilize FTX clients' funds to purchase the entire country of Nauru.

The idea was to transform Nauru into a post-apocalyptic sanctuary, complete with a highly secretive laboratory for conducting human genetics experiments and other projects. Who needs a private island when you can have a whole sovereign nation, right?

The court documents further detailed instances of transactions involving the founder's family, including those that have been previously disclosed.

While the idea of buying a nation for such purposes seems like something out of a sci-fi movie, it underscores the madness that was going on inside the FTX. Brett Harrison: Today Marks a Turning Point for Crypto Exchanges

Brett Harrison, the former CEO of FTX in the US, is advancing a novel software product for investors under the Architect Financial Technologies initiative. Thanks to ChatGPT's integration, users of Architect can effortlessly follow intricate trading strategies.

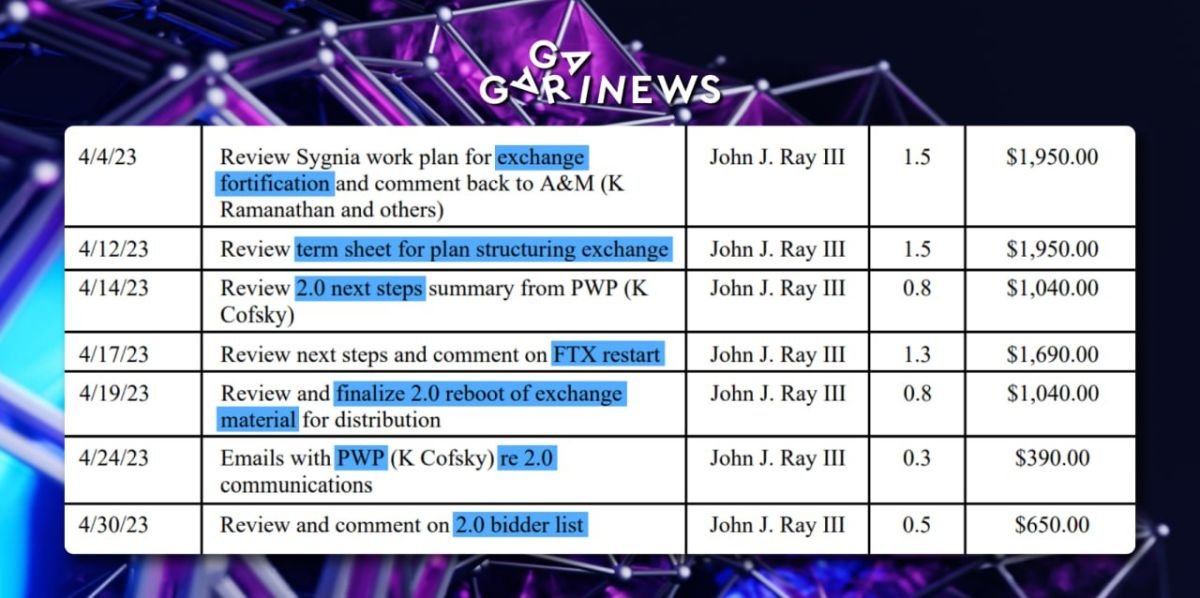

Brett Harrison, the former CEO of FTX in the US, is advancing a novel software product for investors under the Architect Financial Technologies initiative. Thanks to ChatGPT's integration, users of Architect can effortlessly follow intricate trading strategies.  John Ray III, the newly appointed CEO of the beleaguered FTX exchange, has dropped some hints that a potential revival of the exchange may be in the works. Ray, who took over the reins to navigate FTX's bankruptcy proceedings, indicated earlier this year that a resurgence was not off the table.

Recent billing reports reveal intriguing developments - Ray spent 6.7 hours working on aspects related to "2.0," thought to signify the possible relaunch of the exchange as FTX 2.0.

As of now, tangible evidence supporting the exchange's resurrection is scant, with only theoretical remarks and internal plans to go by. However, Ray hasn't entirely dismissed the prospect, stating in January, "Everything is on the table. If there's a feasible way forward, we'll not only explore it, we'll undertake it."

In a conversation in April, FTX's chief lawyer, Andy Dietderich, floated the idea that the crypto exchange could potentially spring back into operation. Such a move would demand substantial capital infusion and could even provide customers with stakes in the future exchange. However, Dietderich clarified that this is merely one of numerous possibilities and nothing has been finalized yet.

Venture Capital firm Tribe Capital has reportedly shown interest in spearheading a funding round to reboot the exchange.

John Ray III, the newly appointed CEO of the beleaguered FTX exchange, has dropped some hints that a potential revival of the exchange may be in the works. Ray, who took over the reins to navigate FTX's bankruptcy proceedings, indicated earlier this year that a resurgence was not off the table.

Recent billing reports reveal intriguing developments - Ray spent 6.7 hours working on aspects related to "2.0," thought to signify the possible relaunch of the exchange as FTX 2.0.

As of now, tangible evidence supporting the exchange's resurrection is scant, with only theoretical remarks and internal plans to go by. However, Ray hasn't entirely dismissed the prospect, stating in January, "Everything is on the table. If there's a feasible way forward, we'll not only explore it, we'll undertake it."

In a conversation in April, FTX's chief lawyer, Andy Dietderich, floated the idea that the crypto exchange could potentially spring back into operation. Such a move would demand substantial capital infusion and could even provide customers with stakes in the future exchange. However, Dietderich clarified that this is merely one of numerous possibilities and nothing has been finalized yet.

Venture Capital firm Tribe Capital has reportedly shown interest in spearheading a funding round to reboot the exchange.  Brian Armstrong has expressed his belief that Binance has transferred some of their USDC assets to a different stablecoin, according to anonymous sources in Cointelegraph.

NotChaseColeman, an analyst, highlights that Binance and Justin Sun are strategically moving from USDT to USDC to secure USD, which will then be invested in FDUSD and TUSD (assets controlled by the company).

Adam Cochran, a name we're familiar with, weighed in, drawing attention to the activities associated with Binance addresses. He observed:

“Even with banks open in Asia and Europe and US coming online, USDT peg is off by the deepest sustained amount since the FTX fall out. Selling pressure once again coming in from the Binance.”

Adam thinks the uncertainty surrounding USDT is at an all-time high, and the Curve Finance and Uniswap platforms are overrun with USDT.

He was optimistic about a more promising USDT horizon today, but that seems to be deferred.

BTC has touched the 28,710 threshold. Indeed, Mondays have their unique trials.

Brian Armstrong has expressed his belief that Binance has transferred some of their USDC assets to a different stablecoin, according to anonymous sources in Cointelegraph.

NotChaseColeman, an analyst, highlights that Binance and Justin Sun are strategically moving from USDT to USDC to secure USD, which will then be invested in FDUSD and TUSD (assets controlled by the company).

Adam Cochran, a name we're familiar with, weighed in, drawing attention to the activities associated with Binance addresses. He observed:

“Even with banks open in Asia and Europe and US coming online, USDT peg is off by the deepest sustained amount since the FTX fall out. Selling pressure once again coming in from the Binance.”

Adam thinks the uncertainty surrounding USDT is at an all-time high, and the Curve Finance and Uniswap platforms are overrun with USDT.

He was optimistic about a more promising USDT horizon today, but that seems to be deferred.

BTC has touched the 28,710 threshold. Indeed, Mondays have their unique trials.  Arkham Intel Exchange has launched a new search, offering 100,000 ARKM to anyone who can provide crucial details about the culprit behind the last year’s exploit.

The FTX hack occurred in November 2022, resulting in an approximate loss of $415 million in cryptocurrency.

Arkham Intel Exchange has launched a new search, offering 100,000 ARKM to anyone who can provide crucial details about the culprit behind the last year’s exploit.

The FTX hack occurred in November 2022, resulting in an approximate loss of $415 million in cryptocurrency.  But officials are concerned about potential negative impacts on consumers, according to Semafor media.

The fear is that an indictment could trigger a run on the exchange, leading to consumer losses and causing panic in the crypto markets, similar to what happened with FTX, which eventually went bankrupt.

As a result, prosecutors are exploring alternative options such as fines and deferred or non-prosecution agreements.

But officials are concerned about potential negative impacts on consumers, according to Semafor media.

The fear is that an indictment could trigger a run on the exchange, leading to consumer losses and causing panic in the crypto markets, similar to what happened with FTX, which eventually went bankrupt.

As a result, prosecutors are exploring alternative options such as fines and deferred or non-prosecution agreements.  A Twitter debate has erupted, speculating that Sam Bankman-Fried (SBF) might be involved with the BALD memcoin rugpull.

Blockchain analysts delved into the developer’s on-chain history and discovered a connection between the wallet address deploying the BALD token and ETH funding from wallets linked to FTX and Alameda Research.

An anonymous DeFi commentator suggested that this link might indicate SBF’s attempt to recover some losses.

Data editors found that the same wallet address had made numerous transfers (400) to blacklisted USDT addresses and appeared to have strong connections with Alameda Research.

A Twitter debate has erupted, speculating that Sam Bankman-Fried (SBF) might be involved with the BALD memcoin rugpull.

Blockchain analysts delved into the developer’s on-chain history and discovered a connection between the wallet address deploying the BALD token and ETH funding from wallets linked to FTX and Alameda Research.

An anonymous DeFi commentator suggested that this link might indicate SBF’s attempt to recover some losses.

Data editors found that the same wallet address had made numerous transfers (400) to blacklisted USDT addresses and appeared to have strong connections with Alameda Research.  A federal judge overseeing the criminal case against Sam Bankman-Fried is set to review the possibility of revoking the former FTX CEO’s $250 million bail following allegations of intimidation against Caroline Ellison.

Additionally, federal prosecutors in New York have requested that Sam Bankman-Fried be jailed before his scheduled October trial.

At a hearing in Manhattan federal court, prosecutor Danielle Sassoon argued that “no set of release conditions can ensure the safety of the community.”

A federal judge overseeing the criminal case against Sam Bankman-Fried is set to review the possibility of revoking the former FTX CEO’s $250 million bail following allegations of intimidation against Caroline Ellison.

Additionally, federal prosecutors in New York have requested that Sam Bankman-Fried be jailed before his scheduled October trial.

At a hearing in Manhattan federal court, prosecutor Danielle Sassoon argued that “no set of release conditions can ensure the safety of the community.”  Web3 studio Toonstar is currently developing an animated satirical series named FORTUN3. The show's storyline draws inspiration from the real-life events surrounding the FTX exchange, spotlighting Sam Bankman-Fried.

The release of the series is scheduled for this coming fall. Viewers will have the opportunity to interact with the show through an online game that can be accessed via an NFT.

Web3 studio Toonstar is currently developing an animated satirical series named FORTUN3. The show's storyline draws inspiration from the real-life events surrounding the FTX exchange, spotlighting Sam Bankman-Fried.

The release of the series is scheduled for this coming fall. Viewers will have the opportunity to interact with the show through an online game that can be accessed via an NFT. 360+ Companies Eager to Back FTX Relaunch

Alvarez & Marsal, legal advisor to crypto exchange FTX, made public in late June a list of companies prepared to invest in the exchange's reboot. Despite the harshly negative publicity surrounding Sam Bankman-Fried's enterprise, significant players have shown a readiness to back his now-bankrupt venture.

Alvarez & Marsal, legal advisor to crypto exchange FTX, made public in late June a list of companies prepared to invest in the exchange's reboot. Despite the harshly negative publicity surrounding Sam Bankman-Fried's enterprise, significant players have shown a readiness to back his now-bankrupt venture.