#finance

188 articles found

Latest

Coin Center, a crypto-focused policy nonprofit, has reached out to Congress members, urging for more transparent crypto tax regulations. In a letter to Senate Finance Committee's Ron Wyden and Mike Crapo, Coin Center emphasized the need for guidance on cryptocurrency taxation, especially concerning capital gains. They suggested a threshold for gains below which no tax would be due. Coin Center also stressed the importance of a "de minimis" exemption, without which, every small crypto transaction could become a taxable event. This exemption would simplify the use of cryptocurrencies for daily payments, especially for micropayments.

Coin Center, a crypto-focused policy nonprofit, has reached out to Congress members, urging for more transparent crypto tax regulations. In a letter to Senate Finance Committee's Ron Wyden and Mike Crapo, Coin Center emphasized the need for guidance on cryptocurrency taxation, especially concerning capital gains. They suggested a threshold for gains below which no tax would be due. Coin Center also stressed the importance of a "de minimis" exemption, without which, every small crypto transaction could become a taxable event. This exemption would simplify the use of cryptocurrencies for daily payments, especially for micropayments.  Company’s CTO Paolo Ardoino has shared his excitement about a mobile app designed to facilitate international purchases settlements B2B, B2C and C2C based on USDT and XAUT payments.

Notably, the app will also incorporate support for Bitcoin Lightning.

Paolo stated that he envisions this app as the future of trade finance.

Having personally reviewed the code, his experience as a developer has left him genuinely impressed. Currently, the app is in its testing stages, with more specifics yet to be unveiled.

Company’s CTO Paolo Ardoino has shared his excitement about a mobile app designed to facilitate international purchases settlements B2B, B2C and C2C based on USDT and XAUT payments.

Notably, the app will also incorporate support for Bitcoin Lightning.

Paolo stated that he envisions this app as the future of trade finance.

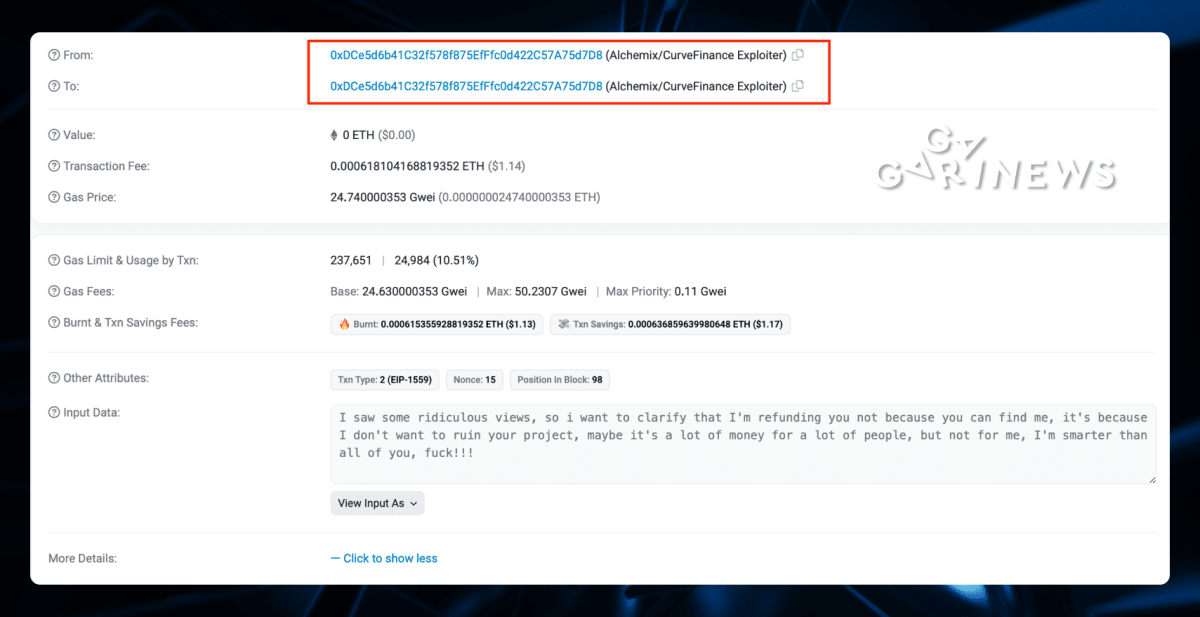

Having personally reviewed the code, his experience as a developer has left him genuinely impressed. Currently, the app is in its testing stages, with more specifics yet to be unveiled.  A Twitter user speculates that the Curve founder may be linked to the platform exploit based on a peculiar word choice. The hacker referred to users' reactions to the recent security breach as “ridiculous,” a term frequently used by Michael Egorov.

Additionally, concerns arise over Curve founder’s collateralized loans, with potential liquidation just weeks away.

The coincidence of “ridiculous” being mentioned around 20 times in the tweet makes this theory intriguing.

Furthermore, despite the deadline for fund reimbursement passing last night, the hacker has yet to return all stolen assets from the pools.

Curve Finance is offering a $1.85 million reward for anyone who can unmask the hacker.

A Twitter user speculates that the Curve founder may be linked to the platform exploit based on a peculiar word choice. The hacker referred to users' reactions to the recent security breach as “ridiculous,” a term frequently used by Michael Egorov.

Additionally, concerns arise over Curve founder’s collateralized loans, with potential liquidation just weeks away.

The coincidence of “ridiculous” being mentioned around 20 times in the tweet makes this theory intriguing.

Furthermore, despite the deadline for fund reimbursement passing last night, the hacker has yet to return all stolen assets from the pools.

Curve Finance is offering a $1.85 million reward for anyone who can unmask the hacker.  “I saw some ridiculous views, so i want to clarify that I’m refunding you not because you can find me, it’s because I don’t want to ruin your project, maybe it’s a lot of money for a lot of people, but not for me, I’m smarter than all of you, fuck!!!”

Was this hack simply for the thrill of causing disorder? Or was there a message he was trying to convey?

Given the thorough preparation that spanned weeks or perhaps even months, it's a thought-provoking consideration.

“I saw some ridiculous views, so i want to clarify that I’m refunding you not because you can find me, it’s because I don’t want to ruin your project, maybe it’s a lot of money for a lot of people, but not for me, I’m smarter than all of you, fuck!!!”

Was this hack simply for the thrill of causing disorder? Or was there a message he was trying to convey?

Given the thorough preparation that spanned weeks or perhaps even months, it's a thought-provoking consideration.  zkSync Era revenue aggregator Kannagi Finance has experienced a rugpull, and its official website is now expired.

On July 6, the company was audited by SolidProof, but the firm says they have nothing to do with the smart contract related to the incident.

In just one day, the Total Value Locked (TVL) in the platform plummeted from $2.13 million to nearly zero

zkSync Era revenue aggregator Kannagi Finance has experienced a rugpull, and its official website is now expired.

On July 6, the company was audited by SolidProof, but the firm says they have nothing to do with the smart contract related to the incident.

In just one day, the Total Value Locked (TVL) in the platform plummeted from $2.13 million to nearly zero  The United States House panel has approved two bills that could provide regulatory clarity for crypto firms, addressing the jurisdictional differences between the U.S. securities and commodities regulators.

The Republican bill introduces a process for firms to certify with the SEC that their projects are decentralized, enabling them to register digital assets as digital commodities with the CFTC.

The bipartisan Blockchain Regulatory Certainty Act aims to remove hurdles and requirements for “blockchain developers and service providers” such as miners, multisignature service providers, and decentralized finance platforms.

Congressmen praised the passing of these bills as a “huge win” for the United States.

The United States House panel has approved two bills that could provide regulatory clarity for crypto firms, addressing the jurisdictional differences between the U.S. securities and commodities regulators.

The Republican bill introduces a process for firms to certify with the SEC that their projects are decentralized, enabling them to register digital assets as digital commodities with the CFTC.

The bipartisan Blockchain Regulatory Certainty Act aims to remove hurdles and requirements for “blockchain developers and service providers” such as miners, multisignature service providers, and decentralized finance platforms.

Congressmen praised the passing of these bills as a “huge win” for the United States. WSM: The Meme Token of the Wall Street Memes Project

After the remarkable success of the PEPE meme token, which saw a staggering 7000% increase from its original price, a new contender has entered the arena - WSM. This token hails from the Wall Street Memes project, a venture that curates and shares trading and finance-related memes across social media platforms.

After the remarkable success of the PEPE meme token, which saw a staggering 7000% increase from its original price, a new contender has entered the arena - WSM. This token hails from the Wall Street Memes project, a venture that curates and shares trading and finance-related memes across social media platforms.  The U.S. Senate is considering a new bill aimed at imposing strict anti-money laundering (AML) rules on decentralized finance (DeFi) protocols.

The Crypto-Asset National Security Enhancement Act of 2023 targets entities controlling DeFi protocols or providing their applications. It requires customer vetting, AML programs, and reports of suspicious activities.

In absence of a controlling entity, anyone investing over $25 million in a protocol's development would be responsible.

The U.S. Senate is considering a new bill aimed at imposing strict anti-money laundering (AML) rules on decentralized finance (DeFi) protocols.

The Crypto-Asset National Security Enhancement Act of 2023 targets entities controlling DeFi protocols or providing their applications. It requires customer vetting, AML programs, and reports of suspicious activities.

In absence of a controlling entity, anyone investing over $25 million in a protocol's development would be responsible. From Suits to Satoshi: Bankers Flock to the Crypto Industry

Even in the face of regulatory challenges and the persistent downturn of 2022, former bankers who've made the shift to the crypto industry, particularly those from the traditional finance (TradFi) sector, seem uninterested in reverting to the old fiat-banking system.

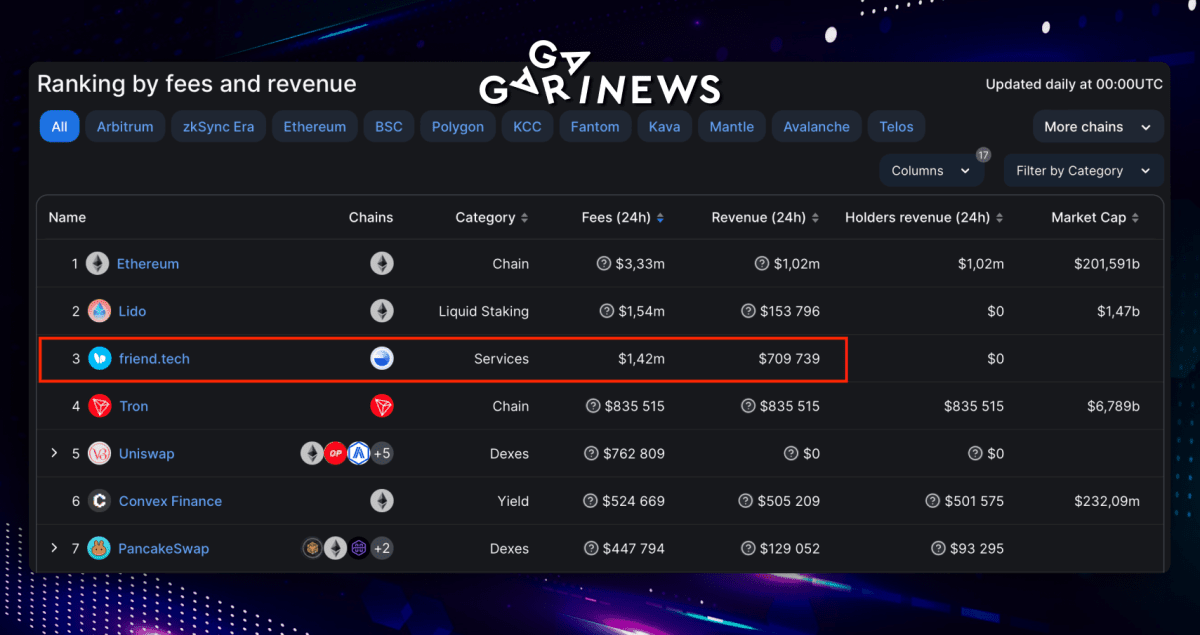

Even in the face of regulatory challenges and the persistent downturn of 2022, former bankers who've made the shift to the crypto industry, particularly those from the traditional finance (TradFi) sector, seem uninterested in reverting to the old fiat-banking system.  Social app friend.tech has recorded protocol fees amounting to more than $1.42 million within the past 24 hours, positioning it among the top three crypto projects in terms of user-paid fees. It now stands as the third-highest project for user-paid fees, following Ethereum and Lido Finance, according to data from DeFiLlama. Built on Coinbase’s Base Layer 2 chain, friend.tech is a social app that integrates with X (Twitter). It allows users to trade tokenized shares linked to each other’s profiles. Shareholders enjoy exclusive content access and private chat rooms in X.

Social app friend.tech has recorded protocol fees amounting to more than $1.42 million within the past 24 hours, positioning it among the top three crypto projects in terms of user-paid fees. It now stands as the third-highest project for user-paid fees, following Ethereum and Lido Finance, according to data from DeFiLlama. Built on Coinbase’s Base Layer 2 chain, friend.tech is a social app that integrates with X (Twitter). It allows users to trade tokenized shares linked to each other’s profiles. Shareholders enjoy exclusive content access and private chat rooms in X.  Brian Armstrong has expressed his belief that Binance has transferred some of their USDC assets to a different stablecoin, according to anonymous sources in Cointelegraph.

NotChaseColeman, an analyst, highlights that Binance and Justin Sun are strategically moving from USDT to USDC to secure USD, which will then be invested in FDUSD and TUSD (assets controlled by the company).

Adam Cochran, a name we're familiar with, weighed in, drawing attention to the activities associated with Binance addresses. He observed:

“Even with banks open in Asia and Europe and US coming online, USDT peg is off by the deepest sustained amount since the FTX fall out. Selling pressure once again coming in from the Binance.”

Adam thinks the uncertainty surrounding USDT is at an all-time high, and the Curve Finance and Uniswap platforms are overrun with USDT.

He was optimistic about a more promising USDT horizon today, but that seems to be deferred.

BTC has touched the 28,710 threshold. Indeed, Mondays have their unique trials.

Brian Armstrong has expressed his belief that Binance has transferred some of their USDC assets to a different stablecoin, according to anonymous sources in Cointelegraph.

NotChaseColeman, an analyst, highlights that Binance and Justin Sun are strategically moving from USDT to USDC to secure USD, which will then be invested in FDUSD and TUSD (assets controlled by the company).

Adam Cochran, a name we're familiar with, weighed in, drawing attention to the activities associated with Binance addresses. He observed:

“Even with banks open in Asia and Europe and US coming online, USDT peg is off by the deepest sustained amount since the FTX fall out. Selling pressure once again coming in from the Binance.”

Adam thinks the uncertainty surrounding USDT is at an all-time high, and the Curve Finance and Uniswap platforms are overrun with USDT.

He was optimistic about a more promising USDT horizon today, but that seems to be deferred.

BTC has touched the 28,710 threshold. Indeed, Mondays have their unique trials. Frax Finance: A Self-Sufficient DeFi Ecosystem

Frax Finance stands out as a DeFi platform that hosts its own decentralized stablecoins, an automated market maker, a lending platform, a cross-chain bridge, and native tokens. By the close of 2023, this ensemble will incorporate an L2 blockchain. For the time being, the Frax protocol is running on Ethereum.

Frax Finance stands out as a DeFi platform that hosts its own decentralized stablecoins, an automated market maker, a lending platform, a cross-chain bridge, and native tokens. By the close of 2023, this ensemble will incorporate an L2 blockchain. For the time being, the Frax protocol is running on Ethereum. Travala.com: Bringing Blockchain to the Tourism Industry

If blockchain proves beneficial in fields such as finance, data storage, supply chain management, healthcare, and even religion, why not exploit its potential in tourism? We're showcasing the merits of this approach through the established crypto platform, Travala.com!

If blockchain proves beneficial in fields such as finance, data storage, supply chain management, healthcare, and even religion, why not exploit its potential in tourism? We're showcasing the merits of this approach through the established crypto platform, Travala.com!  The total loss incurred surpassed $50 million, causing the Total Value Locked (TVL) of the project to drop by over 40% following the news.

CRV price also plummeted by over 20%.

Security analysts at Beosin reported that the attacker specifically targeted Curve’s factory pools associated with several projects, including Alchemix, JPEG’d, MetronomeDAO, deBridge, and Ellipsis.

The total loss incurred surpassed $50 million, causing the Total Value Locked (TVL) of the project to drop by over 40% following the news.

CRV price also plummeted by over 20%.

Security analysts at Beosin reported that the attacker specifically targeted Curve’s factory pools associated with several projects, including Alchemix, JPEG’d, MetronomeDAO, deBridge, and Ellipsis.  The United States Government Accountability Office (GAO) has published a report suggesting that a more robust regulatory framework is required for the use of blockchain in finance.

The report highlighted the lack of regulation around crypto asset trading platforms and stablecoins and identified non-security crypto asset spot markets as the main regulatory gap. According to the GAO, Congress could address these issues by designating a federal regulator to oversee these markets.

Moreover, the report suggests a need for more regulatory coordination and proposes the establishment of a formal mechanism to identify risks and respond to them within an agreed timeframe.

The United States Government Accountability Office (GAO) has published a report suggesting that a more robust regulatory framework is required for the use of blockchain in finance.

The report highlighted the lack of regulation around crypto asset trading platforms and stablecoins and identified non-security crypto asset spot markets as the main regulatory gap. According to the GAO, Congress could address these issues by designating a federal regulator to oversee these markets.

Moreover, the report suggests a need for more regulatory coordination and proposes the establishment of a formal mechanism to identify risks and respond to them within an agreed timeframe.  This platform, crafted to stabilize liquidity pools within the Curve DeFi protocol, has fallen victim to a hacker who made off with 1700 ETH, a haul worth $3.2 million.

The culprit leveraged a re-entrancy vulnerability and manipulated a malfunctioning price oracle to achieve this.

The Conic Finance team has disclosed that this particular exploit is solely connected to the ETH Omnipool.

This platform, crafted to stabilize liquidity pools within the Curve DeFi protocol, has fallen victim to a hacker who made off with 1700 ETH, a haul worth $3.2 million.

The culprit leveraged a re-entrancy vulnerability and manipulated a malfunctioning price oracle to achieve this.

The Conic Finance team has disclosed that this particular exploit is solely connected to the ETH Omnipool. FSB's Crypto Guidelines Greeted Positively by G20 Leaders

The Financial Stability Board's (FSB) guidelines on crypto assets and international stablecoin operations have gained support from the Group of Twenty (G20) nations. This development was announced by Nirmala Sitharaman, India's Finance Minister, in a press briefing on Tuesday. Currently, India holds the presidency of the G20.

The Financial Stability Board's (FSB) guidelines on crypto assets and international stablecoin operations have gained support from the Group of Twenty (G20) nations. This development was announced by Nirmala Sitharaman, India's Finance Minister, in a press briefing on Tuesday. Currently, India holds the presidency of the G20.