#exchange

704 articles found

Latest

According to Coinbase CEO Brian Armstrong, the SEC requested the exchange to halt trading in all cryptocurrencies except bitcoin before filing a lawsuit against the platform in June.

“We really didn’t have a choice at that point. Delisting every asset other than bitcoin, which, by the way, is not what the law says, would have essentially meant the end of the crypto industry in the US,” said Armstrong.

According to Coinbase CEO Brian Armstrong, the SEC requested the exchange to halt trading in all cryptocurrencies except bitcoin before filing a lawsuit against the platform in June.

“We really didn’t have a choice at that point. Delisting every asset other than bitcoin, which, by the way, is not what the law says, would have essentially meant the end of the crypto industry in the US,” said Armstrong.  The Telegram trading bot, Unibot, is rapidly gaining popularity, thanks to its seamless integration with the decentralized exchange Uniswap and ETH payouts to token holders.

As the UNIBOT token soared to $170 its user base has surged to 6,500, and the daily trading volume has averaged $5.5 million.

The Telegram trading bot, Unibot, is rapidly gaining popularity, thanks to its seamless integration with the decentralized exchange Uniswap and ETH payouts to token holders.

As the UNIBOT token soared to $170 its user base has surged to 6,500, and the daily trading volume has averaged $5.5 million.  In a pivotal ruling on July 25, Judge Philip Jeyaretnam of the Singapore High Court declared cryptocurrency as personal property, placing it on par with fiat money. Judge Jeyaretnam's elucidation is notable for the legal status of digital assets.

It was stemmed from a case where ByBit accused its former employee, Ho Kai Xin, of illicitly transferring approximately 4.2 million USDT from the company's coffers to personal accounts. The court mandated Ho to return the funds to cryptocurrency exchange.

In a pivotal ruling on July 25, Judge Philip Jeyaretnam of the Singapore High Court declared cryptocurrency as personal property, placing it on par with fiat money. Judge Jeyaretnam's elucidation is notable for the legal status of digital assets.

It was stemmed from a case where ByBit accused its former employee, Ho Kai Xin, of illicitly transferring approximately 4.2 million USDT from the company's coffers to personal accounts. The court mandated Ho to return the funds to cryptocurrency exchange.  The lawsuit between the U.S Securities and Exchange Commission (SEC) and cryptocurrency exchange Coinbase is moving forward as the date for initial arguments has been confirmed. Coinbase's chief legal officer, Paul Grewal, revealed on Twitter that New York judge Katherine Polk Failla had approved the joint request from both parties to proceed with hearings.

Coinbase has until August 4, 2023, to submit its initial brief and additional supporting documents by August 11. The SEC's opposition brief is due on or before October 10, with Coinbase's reply by October 24 or sooner.

The lawsuit between the U.S Securities and Exchange Commission (SEC) and cryptocurrency exchange Coinbase is moving forward as the date for initial arguments has been confirmed. Coinbase's chief legal officer, Paul Grewal, revealed on Twitter that New York judge Katherine Polk Failla had approved the joint request from both parties to proceed with hearings.

Coinbase has until August 4, 2023, to submit its initial brief and additional supporting documents by August 11. The SEC's opposition brief is due on or before October 10, with Coinbase's reply by October 24 or sooner. Kyber Network Crystal and KNC Token: A Comprehensive Review

Kyber Network Crystal acts as a cross-chain liquidity aggregator, facilitating fast swap transactions for DeFi. Thanks to the Kyber Network, users of dApps, DEX, and DeFi solutions can tap into a multitude of liquidity pools to exchange assets with minimal fees.

Kyber Network Crystal acts as a cross-chain liquidity aggregator, facilitating fast swap transactions for DeFi. Thanks to the Kyber Network, users of dApps, DEX, and DeFi solutions can tap into a multitude of liquidity pools to exchange assets with minimal fees.  Web3 studio Toonstar is currently developing an animated satirical series named FORTUN3. The show's storyline draws inspiration from the real-life events surrounding the FTX exchange, spotlighting Sam Bankman-Fried.

The release of the series is scheduled for this coming fall. Viewers will have the opportunity to interact with the show through an online game that can be accessed via an NFT.

Web3 studio Toonstar is currently developing an animated satirical series named FORTUN3. The show's storyline draws inspiration from the real-life events surrounding the FTX exchange, spotlighting Sam Bankman-Fried.

The release of the series is scheduled for this coming fall. Viewers will have the opportunity to interact with the show through an online game that can be accessed via an NFT. BlackRock's Bitcoin ETF May Get the Green Light: Here's Why

If the Securities and Exchange Commission (SEC) greenlights the Bitcoin ETF application from BlackRock, the world's leading investment company with a staggering $10 trillion under management, it could result in a considerable surge in Bitcoin's value and consequently elevate the entire cryptocurrency market.

If the Securities and Exchange Commission (SEC) greenlights the Bitcoin ETF application from BlackRock, the world's leading investment company with a staggering $10 trillion under management, it could result in a considerable surge in Bitcoin's value and consequently elevate the entire cryptocurrency market.  The service is built on the Stellar blockchain and activated by the MoneyGram retail agent network, allowing the exchange's clients to convert digital currency into cash.

You can exchange USDC for hryvnias, dollars, and euros at respective MoneyGram branches throughout Ukraine.

Currently, the service is available only to users residing in Ukraine who have completed KYC verification with Ukrainian documents. There are no fees for this service until June 2024!

For the user, the entire process consists of several steps, which are thoroughly described in the comprehensive exchange instructions on the WhiteBIT website.

The service is built on the Stellar blockchain and activated by the MoneyGram retail agent network, allowing the exchange's clients to convert digital currency into cash.

You can exchange USDC for hryvnias, dollars, and euros at respective MoneyGram branches throughout Ukraine.

Currently, the service is available only to users residing in Ukraine who have completed KYC verification with Ukrainian documents. There are no fees for this service until June 2024!

For the user, the entire process consists of several steps, which are thoroughly described in the comprehensive exchange instructions on the WhiteBIT website.  Grayscale Investments has warned the US Securities and Exchange Commission (SEC) that granting approval to certain spot Bitcoin ETF proposals ahead of others could create an "unfairly discriminatory and prejudicial first-mover advantage".

The company's comments follow BlackRock's recent application to launch a spot Bitcoin ETF, which reignited hopes and triggered similar filings from other firms. Grayscale had previously attempted to convert its Bitcoin Trust (GBTC) to an ETF but was denied by the SEC.

The firm now supports the simultaneous approval of all proposed spot Bitcoin ETFs to maintain a level playing field.

Grayscale Investments has warned the US Securities and Exchange Commission (SEC) that granting approval to certain spot Bitcoin ETF proposals ahead of others could create an "unfairly discriminatory and prejudicial first-mover advantage".

The company's comments follow BlackRock's recent application to launch a spot Bitcoin ETF, which reignited hopes and triggered similar filings from other firms. Grayscale had previously attempted to convert its Bitcoin Trust (GBTC) to an ETF but was denied by the SEC.

The firm now supports the simultaneous approval of all proposed spot Bitcoin ETFs to maintain a level playing field.  The Sui Foundation has cut ties with decentralized exchange MovEx due to a contract breach involving the illicit movement of SUI tokens.

MovEx had received 2.5 million SUI tokens (around $1.6 million) for their work on the DeepBook exchange product, under an agreement involving a staged release of the tokens. MovEx, however, broke this agreement by making three transactions of 625,000 SUI to three different wallets without the Sui Foundation's consent or awareness.

Following the breach, MovEx's total SUI allotment has been moved to a custodial wallet to ensure the release adheres to the contractual schedule.

The Sui Foundation has cut ties with decentralized exchange MovEx due to a contract breach involving the illicit movement of SUI tokens.

MovEx had received 2.5 million SUI tokens (around $1.6 million) for their work on the DeepBook exchange product, under an agreement involving a staged release of the tokens. MovEx, however, broke this agreement by making three transactions of 625,000 SUI to three different wallets without the Sui Foundation's consent or awareness.

Following the breach, MovEx's total SUI allotment has been moved to a custodial wallet to ensure the release adheres to the contractual schedule.  Yesterday, reports surfaced suggesting that KuCoin had dismissed 30% of its employees due to declining profits. However, the cryptocurrency exchange's representatives debunked these claims today, explaining that there was just a slight downsizing in line with their routine organizational strategy.

"To stay on top, we regularly evaluate our org structure based on employee performance and company development. So it is not layoffs, and it is all about making the organization more dynamic," asserted Johnny Lyu, the Chief Executive of KuCoin.

Yesterday, reports surfaced suggesting that KuCoin had dismissed 30% of its employees due to declining profits. However, the cryptocurrency exchange's representatives debunked these claims today, explaining that there was just a slight downsizing in line with their routine organizational strategy.

"To stay on top, we regularly evaluate our org structure based on employee performance and company development. So it is not layoffs, and it is all about making the organization more dynamic," asserted Johnny Lyu, the Chief Executive of KuCoin.  Arkham Intel Exchange has acknowledged two on-chain investigators with approximately 9,519 ARKM (valued at ~$5,000) for information on Do Kwon & Terra's wallet holdings.

This new data suggests a potential inconsistency in Terra's previous declaration of possessing a single Luna Foundation Guard wallet.

Arkham Intel Exchange has acknowledged two on-chain investigators with approximately 9,519 ARKM (valued at ~$5,000) for information on Do Kwon & Terra's wallet holdings.

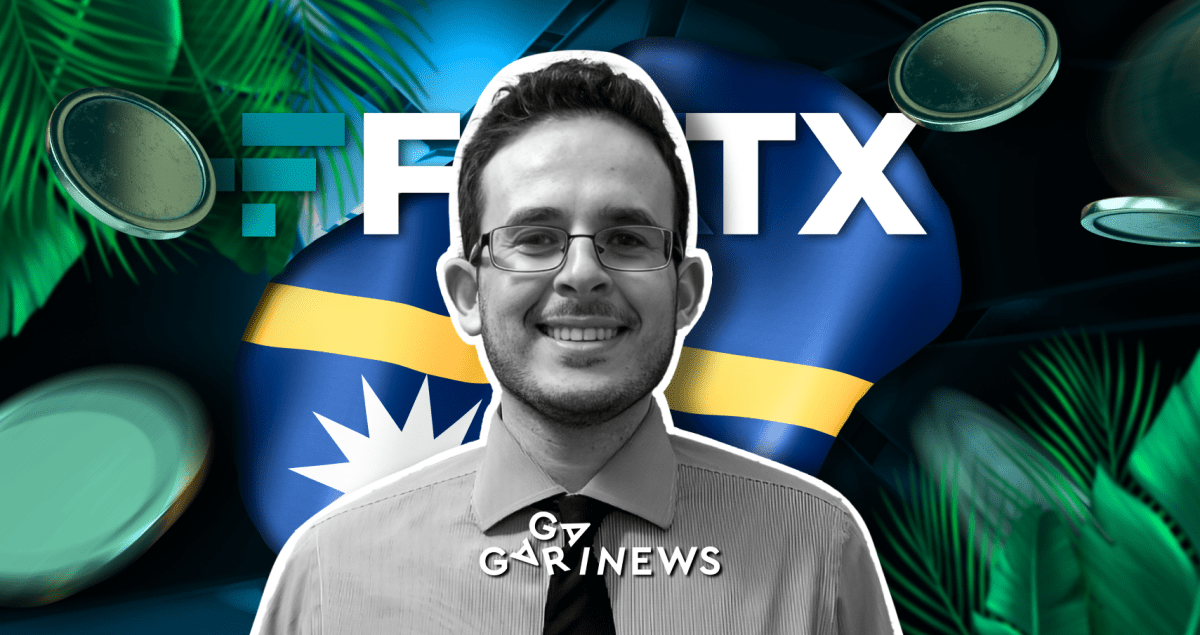

This new data suggests a potential inconsistency in Terra's previous declaration of possessing a single Luna Foundation Guard wallet.  FTX, the prominent cryptocurrency exchange, was recently embroiled in controversy when court documents revealed a plan devised by Gabriel, the younger brother of FTX's CEO, SBF. According to the documents, Gabriel aimed to utilize FTX clients' funds to purchase the entire country of Nauru.

The idea was to transform Nauru into a post-apocalyptic sanctuary, complete with a highly secretive laboratory for conducting human genetics experiments and other projects. Who needs a private island when you can have a whole sovereign nation, right?

The court documents further detailed instances of transactions involving the founder's family, including those that have been previously disclosed.

While the idea of buying a nation for such purposes seems like something out of a sci-fi movie, it underscores the madness that was going on inside the FTX.

FTX, the prominent cryptocurrency exchange, was recently embroiled in controversy when court documents revealed a plan devised by Gabriel, the younger brother of FTX's CEO, SBF. According to the documents, Gabriel aimed to utilize FTX clients' funds to purchase the entire country of Nauru.

The idea was to transform Nauru into a post-apocalyptic sanctuary, complete with a highly secretive laboratory for conducting human genetics experiments and other projects. Who needs a private island when you can have a whole sovereign nation, right?

The court documents further detailed instances of transactions involving the founder's family, including those that have been previously disclosed.

While the idea of buying a nation for such purposes seems like something out of a sci-fi movie, it underscores the madness that was going on inside the FTX.  Valkyrie's spot Bitcoin ETF application has officially entered the review stage at the U.S. Securities and Exchange Commission (SEC). It comes right after BlackRock's recent submission.

Here's an interesting detail: this ETF has been given the ticker symbol BRRR, a sound crypto enthusiasts often equate with the whir of a money printing machine!

The SEC has a window of up to 45 days (which can be extended to 90 days in special cases) to review Valkyrie's application.

Valkyrie's spot Bitcoin ETF application has officially entered the review stage at the U.S. Securities and Exchange Commission (SEC). It comes right after BlackRock's recent submission.

Here's an interesting detail: this ETF has been given the ticker symbol BRRR, a sound crypto enthusiasts often equate with the whir of a money printing machine!

The SEC has a window of up to 45 days (which can be extended to 90 days in special cases) to review Valkyrie's application. Europe’s First Bitcoin ETF to Finally Launch

After facing significant delays, Europe’s first spot Bitcoin exchange-traded fund (ETF) is expected to launch later this year. Jacobi Asset Management, a London-based multi-asset investment platform, plans to debut its Bitcoin ETF on the Euronext Amsterdam exchange.

After facing significant delays, Europe’s first spot Bitcoin exchange-traded fund (ETF) is expected to launch later this year. Jacobi Asset Management, a London-based multi-asset investment platform, plans to debut its Bitcoin ETF on the Euronext Amsterdam exchange.