#Ethereum

566 articles found

Latest

Polygon Labs has launched its Chain Development Kit (CDK), a software tool designed to help developers create Ethereum Layer 2 chains powered by zero-knowledge proofs.

The toolkit will support an "Interop Layer," a new protocol that aggregates zero-knowledge proofs from multiple Polygon chains and secures them on the Ethereum mainnet.

This move aligns with Polygon's shift towards creating more interconnected chains, similar to ecosystems like Cosmos and Polkadot.

Polygon Labs has launched its Chain Development Kit (CDK), a software tool designed to help developers create Ethereum Layer 2 chains powered by zero-knowledge proofs.

The toolkit will support an "Interop Layer," a new protocol that aggregates zero-knowledge proofs from multiple Polygon chains and secures them on the Ethereum mainnet.

This move aligns with Polygon's shift towards creating more interconnected chains, similar to ecosystems like Cosmos and Polkadot.  Shibarium, the Layer 2 blockchain by Shiba Inu's creators, is back in action. After a temporary shutdown due to scalability issues, the team has reopened withdrawals on its bridge to Ethereum. The pause initially locked millions in user funds and caused community unrest.

Now, the mainnet and bridge are fully functional, allowing withdrawals of various assets like SHIB, LEASH, and WETH within 45 minutes to 3 hours. BONE token withdrawals are also back but may take up to 7 days.

Shibarium, the Layer 2 blockchain by Shiba Inu's creators, is back in action. After a temporary shutdown due to scalability issues, the team has reopened withdrawals on its bridge to Ethereum. The pause initially locked millions in user funds and caused community unrest.

Now, the mainnet and bridge are fully functional, allowing withdrawals of various assets like SHIB, LEASH, and WETH within 45 minutes to 3 hours. BONE token withdrawals are also back but may take up to 7 days.  After the market crash on August 18, analyst Andrew Kang adopted a bullish stance. He opened long positions on Bitcoin (BTC), Ethereum (ETH), and Arbitrum (ARB). However, this decision resulted in a significant loss.

Due to his use of extremely high leverage, which reached up to 100x, Kang's positions became vulnerable and were liquidated not once, but as many as fourteen times.

These successive liquidations caused Kang to lose approximately $432,000 in a single day. This incident highlights the risks associated with trading and employing high leverage, especially during periods of intense market volatility.

After the market crash on August 18, analyst Andrew Kang adopted a bullish stance. He opened long positions on Bitcoin (BTC), Ethereum (ETH), and Arbitrum (ARB). However, this decision resulted in a significant loss.

Due to his use of extremely high leverage, which reached up to 100x, Kang's positions became vulnerable and were liquidated not once, but as many as fourteen times.

These successive liquidations caused Kang to lose approximately $432,000 in a single day. This incident highlights the risks associated with trading and employing high leverage, especially during periods of intense market volatility.  JPMorgan reports that Bitcoin miners are diversifying their operations in anticipation of the upcoming halving event, which will slash their rewards. Miners are now venturing into the booming artificial intelligence (AI) market, offering high-performance computing services. This shift is partly funded by selling newly minted or existing bitcoins. Companies like Applied Digital and Iris Energy are already making strides in AI cloud services. Additionally, post Ethereum's shift from proof-of-work, former Ethereum miners are leveraging GPUs for AI, finding it potentially more profitable than traditional mining.

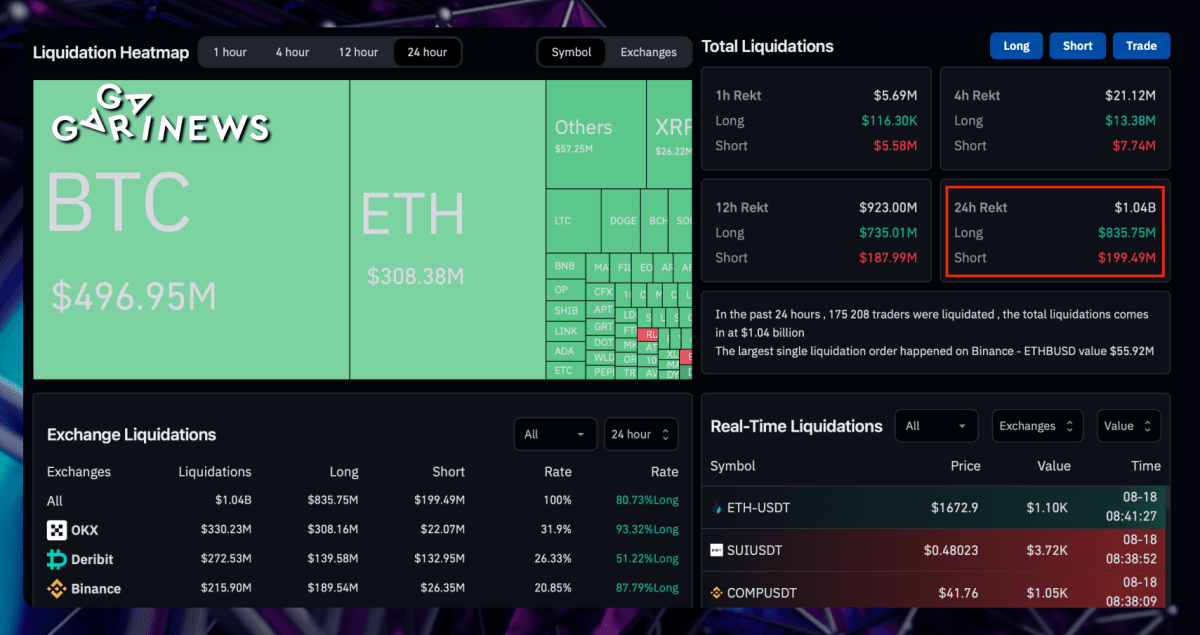

JPMorgan reports that Bitcoin miners are diversifying their operations in anticipation of the upcoming halving event, which will slash their rewards. Miners are now venturing into the booming artificial intelligence (AI) market, offering high-performance computing services. This shift is partly funded by selling newly minted or existing bitcoins. Companies like Applied Digital and Iris Energy are already making strides in AI cloud services. Additionally, post Ethereum's shift from proof-of-work, former Ethereum miners are leveraging GPUs for AI, finding it potentially more profitable than traditional mining.  Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.

Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.  RocketSwap, a DEX on the Base Layer 2 network, suffered a hack, losing 471 ETH ($862,000). The team identified lapses, including offline signatures during launchpad deployment and storing private keys on the server.

While some accused the team of a potential rug pull, RocketSwap blames a third-party hacker who brute-forced a server to extract private keys.

Post-hack, the hacker moved assets to Ethereum, creating a meme token, "LoveRCKT", which saw a brief price surge on Uniswap before plummeting.

RocketSwap, a DEX on the Base Layer 2 network, suffered a hack, losing 471 ETH ($862,000). The team identified lapses, including offline signatures during launchpad deployment and storing private keys on the server.

While some accused the team of a potential rug pull, RocketSwap blames a third-party hacker who brute-forced a server to extract private keys.

Post-hack, the hacker moved assets to Ethereum, creating a meme token, "LoveRCKT", which saw a brief price surge on Uniswap before plummeting. Verkle Trees: Paving a New Path to Ethereum Decentralization

Ethereum, the frontrunner in smart contract platforms, is preparing for an upgrade that might substantially enhance its decentralization through the use of Verkle trees (distinct from Merkle trees!). This anticipated shift aims to cut down the amount of data essential for the network's infrastructure, making it both more user-friendly and resilient.

Ethereum, the frontrunner in smart contract platforms, is preparing for an upgrade that might substantially enhance its decentralization through the use of Verkle trees (distinct from Merkle trees!). This anticipated shift aims to cut down the amount of data essential for the network's infrastructure, making it both more user-friendly and resilient.  Beginning on August 31, the popular NFT marketplace OpenSea will not charge royalties for NFT secondary transactions, signaling a change in artist earning policy. Previously, creators were able to set a commission of 2.5% to 10% and earn from every resale. However, with the new update, the creator fee is left up to the discretion of the buyer. For collections on non-Ethereum blockchains, the creator fee will only remain mandatory until February 29, 2024. After this date, the entire platform will make royalties optional.

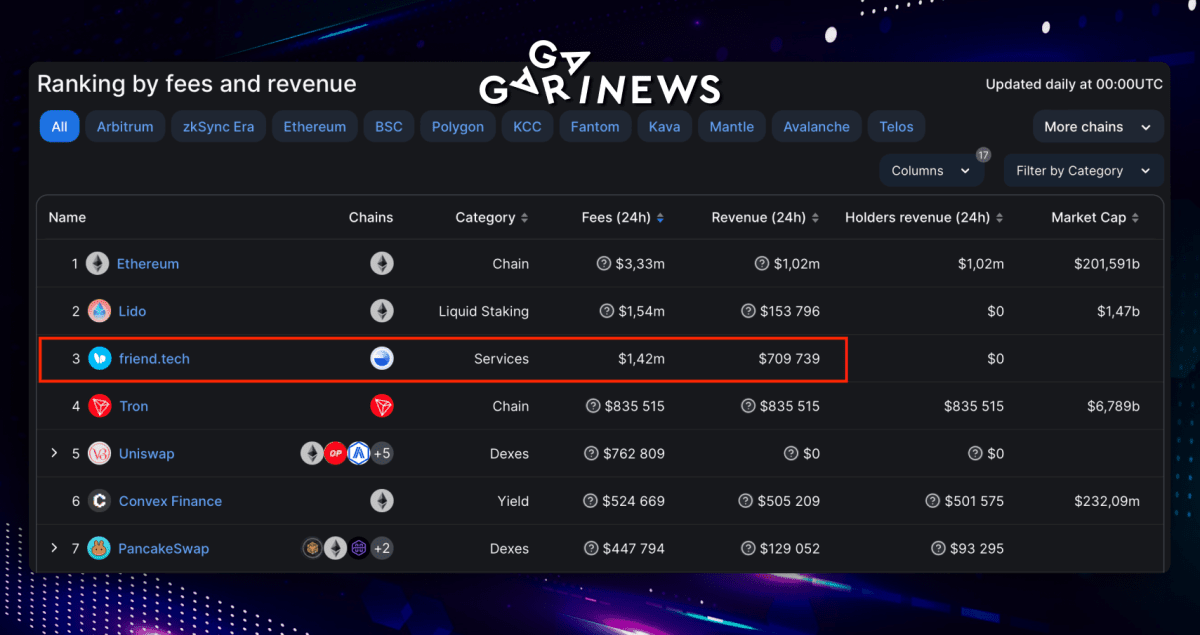

Beginning on August 31, the popular NFT marketplace OpenSea will not charge royalties for NFT secondary transactions, signaling a change in artist earning policy. Previously, creators were able to set a commission of 2.5% to 10% and earn from every resale. However, with the new update, the creator fee is left up to the discretion of the buyer. For collections on non-Ethereum blockchains, the creator fee will only remain mandatory until February 29, 2024. After this date, the entire platform will make royalties optional.  Social app friend.tech has recorded protocol fees amounting to more than $1.42 million within the past 24 hours, positioning it among the top three crypto projects in terms of user-paid fees. It now stands as the third-highest project for user-paid fees, following Ethereum and Lido Finance, according to data from DeFiLlama. Built on Coinbase’s Base Layer 2 chain, friend.tech is a social app that integrates with X (Twitter). It allows users to trade tokenized shares linked to each other’s profiles. Shareholders enjoy exclusive content access and private chat rooms in X.

Social app friend.tech has recorded protocol fees amounting to more than $1.42 million within the past 24 hours, positioning it among the top three crypto projects in terms of user-paid fees. It now stands as the third-highest project for user-paid fees, following Ethereum and Lido Finance, according to data from DeFiLlama. Built on Coinbase’s Base Layer 2 chain, friend.tech is a social app that integrates with X (Twitter). It allows users to trade tokenized shares linked to each other’s profiles. Shareholders enjoy exclusive content access and private chat rooms in X.  The founder of Cardano, Charles Hoskinson, stated that the Hydra protocol is not only active on Cardano's mainstream network, but it's also rapidly evolving. He highlighted the innovative transaction processing methods, including tiered pricing and the Babel commission system.

Hoskinson's comment was in response to a user, going by the pseudonym 0xONLY.arf, who expressed the opinion that Cardano is merely following in Ethereum's footsteps, albeit a few years behind.

The founder of Cardano, Charles Hoskinson, stated that the Hydra protocol is not only active on Cardano's mainstream network, but it's also rapidly evolving. He highlighted the innovative transaction processing methods, including tiered pricing and the Babel commission system.

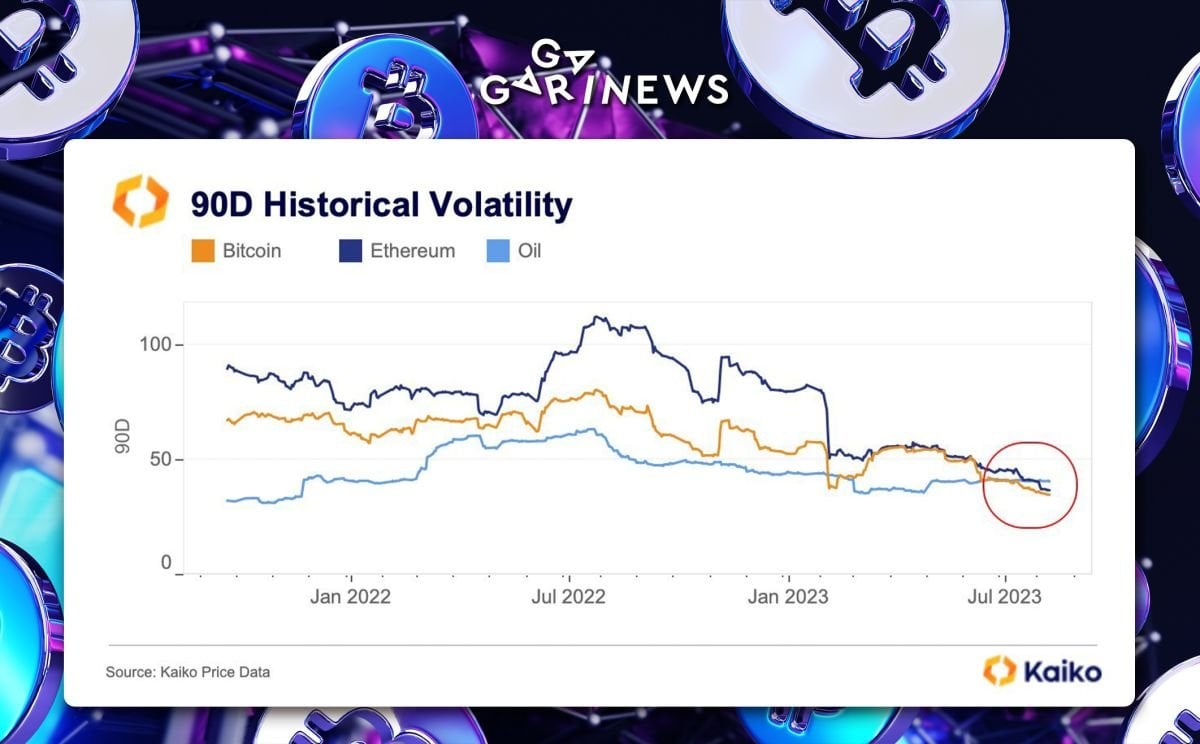

Hoskinson's comment was in response to a user, going by the pseudonym 0xONLY.arf, who expressed the opinion that Cardano is merely following in Ethereum's footsteps, albeit a few years behind.  According to Kaiko, BTC and ETH have recorded their lowest 90-day price volatility compared to oil in many years, a mark last reached in 2016.

Right now, Bitcoin's volatility sits at 35%, Ethereum's at 37%, while oil's is higher at 41%.

Experience tells us that after such periods of quiet , a significant move often follows. Judging by Bitcoin's recent dynamics, it appears such a shift might be kicking off.

According to Kaiko, BTC and ETH have recorded their lowest 90-day price volatility compared to oil in many years, a mark last reached in 2016.

Right now, Bitcoin's volatility sits at 35%, Ethereum's at 37%, while oil's is higher at 41%.

Experience tells us that after such periods of quiet , a significant move often follows. Judging by Bitcoin's recent dynamics, it appears such a shift might be kicking off.  The current market landscape marks an unprecedented decline in liquidity, according to Bloomberg Intelligence's senior macro strategist, Mike McGlone.

If this pattern holds throughout 2023, he warns of a potential sharp descent in Bitcoin prices, which would ripple through Ethereum, XRP, and the general cryptocurrency domain.

“What should be early indications of recessionary times? The best indication should be bitcoin and that’s where I’m looking for the bleeding occasion from bitcoin and it’s still kind of showing what I expected.”

“Picture December: Recession looms, Fed hesitates on easing due to inflation,” said McGlone.

The current market landscape marks an unprecedented decline in liquidity, according to Bloomberg Intelligence's senior macro strategist, Mike McGlone.

If this pattern holds throughout 2023, he warns of a potential sharp descent in Bitcoin prices, which would ripple through Ethereum, XRP, and the general cryptocurrency domain.

“What should be early indications of recessionary times? The best indication should be bitcoin and that’s where I’m looking for the bleeding occasion from bitcoin and it’s still kind of showing what I expected.”

“Picture December: Recession looms, Fed hesitates on easing due to inflation,” said McGlone. Liquity USD (LUSD): A DeFi Stablecoin Review

Liquity USD, or LUSD, is a stablecoin that maintains a 1:1 peg with the US dollar. It's used by the Liquity lending protocol as the primary asset for issuing loans backed by Ethereum (ETH). When LUSD is repaid, the loan is resolved, and the ETH collateral is returned to the owner at its nominal value.

Liquity USD, or LUSD, is a stablecoin that maintains a 1:1 peg with the US dollar. It's used by the Liquity lending protocol as the primary asset for issuing loans backed by Ethereum (ETH). When LUSD is repaid, the loan is resolved, and the ETH collateral is returned to the owner at its nominal value.