#etf

143 articles found

Latest

European crypto-related exchange-traded products (ETPs) experienced a boost in net inflows during June and July, breaking a nearly three-month trend of global ETP outflows.

Europe-based ETPs saw inflows of €150 million in June and €60 million in July.

The trend change might be attributed to BlackRock's spot bitcoin ETF application. However, recent data indicates a downturn in August, possibly due to the SEC's delay in deciding.

European crypto-related exchange-traded products (ETPs) experienced a boost in net inflows during June and July, breaking a nearly three-month trend of global ETP outflows.

Europe-based ETPs saw inflows of €150 million in June and €60 million in July.

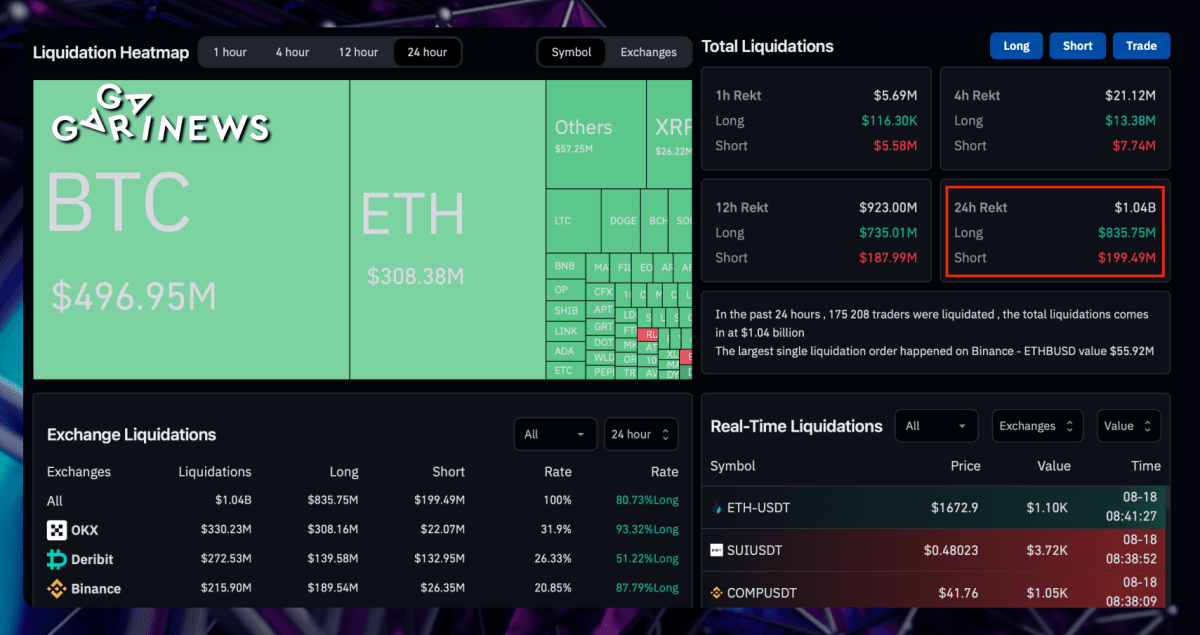

The trend change might be attributed to BlackRock's spot bitcoin ETF application. However, recent data indicates a downturn in August, possibly due to the SEC's delay in deciding.  Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.

Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.  acobi Asset Management Lists Europe’s First Spot Bitcoin ETF on Euronext Amsterdam Exchange.

“It is exciting to see Europe moving ahead of the US in opening up Bitcoin investing for institutional investors who want safe, secure access to the benefits of digital assets,” says the company’s CEO, Martin Bednall.

Well, now it’s the USA’s turn!

acobi Asset Management Lists Europe’s First Spot Bitcoin ETF on Euronext Amsterdam Exchange.

“It is exciting to see Europe moving ahead of the US in opening up Bitcoin investing for institutional investors who want safe, secure access to the benefits of digital assets,” says the company’s CEO, Martin Bednall.

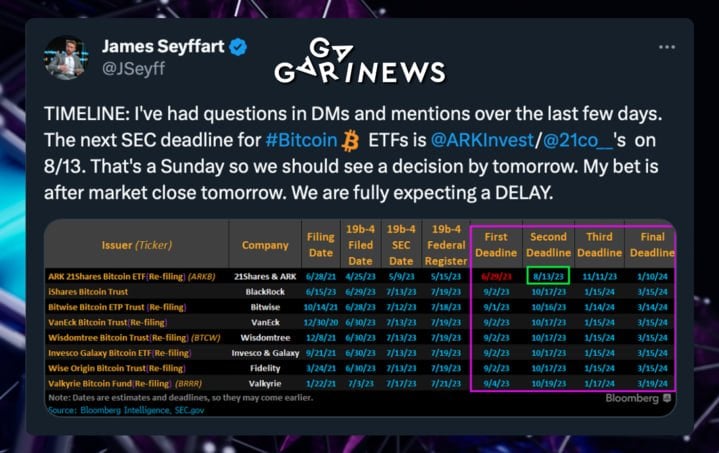

Well, now it’s the USA’s turn!  This Sunday (August 13) marks the first deadline for the SEC to weigh in on ARK 21Shares' Bitcoin ETF application.

Weekend deadlines are tricky, but some analysts suggest the decision could drop today.

Analyst James Seyffart puts the odds of approval at less than 5%.

Keep an eye out for the next milestone: BlackRock's Bitcoin ETF deadline is September 2.

This Sunday (August 13) marks the first deadline for the SEC to weigh in on ARK 21Shares' Bitcoin ETF application.

Weekend deadlines are tricky, but some analysts suggest the decision could drop today.

Analyst James Seyffart puts the odds of approval at less than 5%.

Keep an eye out for the next milestone: BlackRock's Bitcoin ETF deadline is September 2.  Grayscale Investments has warned the US Securities and Exchange Commission (SEC) that granting approval to certain spot Bitcoin ETF proposals ahead of others could create an "unfairly discriminatory and prejudicial first-mover advantage".

The company's comments follow BlackRock's recent application to launch a spot Bitcoin ETF, which reignited hopes and triggered similar filings from other firms. Grayscale had previously attempted to convert its Bitcoin Trust (GBTC) to an ETF but was denied by the SEC.

The firm now supports the simultaneous approval of all proposed spot Bitcoin ETFs to maintain a level playing field.

Grayscale Investments has warned the US Securities and Exchange Commission (SEC) that granting approval to certain spot Bitcoin ETF proposals ahead of others could create an "unfairly discriminatory and prejudicial first-mover advantage".

The company's comments follow BlackRock's recent application to launch a spot Bitcoin ETF, which reignited hopes and triggered similar filings from other firms. Grayscale had previously attempted to convert its Bitcoin Trust (GBTC) to an ETF but was denied by the SEC.

The firm now supports the simultaneous approval of all proposed spot Bitcoin ETFs to maintain a level playing field. BlackRock's Bitcoin ETF May Get the Green Light: Here's Why

If the Securities and Exchange Commission (SEC) greenlights the Bitcoin ETF application from BlackRock, the world's leading investment company with a staggering $10 trillion under management, it could result in a considerable surge in Bitcoin's value and consequently elevate the entire cryptocurrency market.

If the Securities and Exchange Commission (SEC) greenlights the Bitcoin ETF application from BlackRock, the world's leading investment company with a staggering $10 trillion under management, it could result in a considerable surge in Bitcoin's value and consequently elevate the entire cryptocurrency market. Grayscale Criticize SEC for Approving First Leveraged ETF Launch

Grayscale, a crypto asset manager, has expressed criticism towards regulators for approving a leveraged bitcoin-based exchange-traded fund (ETF) while the company’s own spot bitcoin ETF application remains rejected by the U.S. Securities and Exchange Commission (SEC).

Grayscale, a crypto asset manager, has expressed criticism towards regulators for approving a leveraged bitcoin-based exchange-traded fund (ETF) while the company’s own spot bitcoin ETF application remains rejected by the U.S. Securities and Exchange Commission (SEC). BlackRock Files for Bitcoin Spot ETF

BlackRock, the world’s largest investment company with $10 trillion in assets, has submitted an application for a Bitcoin spot exchange traded fund (ETF), marking a significant milestone in the United States. This would be the first crypto spot ETF in the country, pending approval.

BlackRock, the world’s largest investment company with $10 trillion in assets, has submitted an application for a Bitcoin spot exchange traded fund (ETF), marking a significant milestone in the United States. This would be the first crypto spot ETF in the country, pending approval.  Grayscale Investments is gearing up for a potential positive outcome in its lawsuit with the SEC, as it begins hiring for its ETF team. The firm is on the lookout for a "Senior Associate, ETFs" to bolster its ETF business development.

This move comes as the crypto community eagerly awaits a court decision on Grayscale's proposal to convert its GBTC fund into a spot bitcoin ETF.

The outcome could set a precedent for other asset managers seeking approvals for spot bitcoin funds, influencing the future of crypto ETFs.

Grayscale Investments is gearing up for a potential positive outcome in its lawsuit with the SEC, as it begins hiring for its ETF team. The firm is on the lookout for a "Senior Associate, ETFs" to bolster its ETF business development.

This move comes as the crypto community eagerly awaits a court decision on Grayscale's proposal to convert its GBTC fund into a spot bitcoin ETF.

The outcome could set a precedent for other asset managers seeking approvals for spot bitcoin funds, influencing the future of crypto ETFs.  John Reed Stark, ex-chief of the SEC's Office of Internet Enforcement, believes the current SEC won't approve a Bitcoin spot ETF due to various reasons.

However, Stark suggests that if a Republican wins the 2024 presidential election, the SEC might ease its crypto-enforcement and be more open to a Bitcoin spot ETF.

He also speculates that SEC chair Gary Gensler might resign, potentially paving the way for Hester Peirce, known as "Crypto Mom", to take a leading role.

John Reed Stark, ex-chief of the SEC's Office of Internet Enforcement, believes the current SEC won't approve a Bitcoin spot ETF due to various reasons.

However, Stark suggests that if a Republican wins the 2024 presidential election, the SEC might ease its crypto-enforcement and be more open to a Bitcoin spot ETF.

He also speculates that SEC chair Gary Gensler might resign, potentially paving the way for Hester Peirce, known as "Crypto Mom", to take a leading role.  She now believes that the SEC may approve multiple spot-Bitcoin ETFs simultaneously, instead of approving them one by one.

This comes after her earlier expectation that her firm would be among the first to receive approval for a Bitcoin ETF.

Bloomberg ETF analyst James Seyffart also shares the same opinion, stating that the path of least resistance for regulators is to approve multiple spot bitcoin ETFs at once or possibly all of them together.

She now believes that the SEC may approve multiple spot-Bitcoin ETFs simultaneously, instead of approving them one by one.

This comes after her earlier expectation that her firm would be among the first to receive approval for a Bitcoin ETF.

Bloomberg ETF analyst James Seyffart also shares the same opinion, stating that the path of least resistance for regulators is to approve multiple spot bitcoin ETFs at once or possibly all of them together.  Valkyrie's spot Bitcoin ETF application has officially entered the review stage at the U.S. Securities and Exchange Commission (SEC). It comes right after BlackRock's recent submission.

Here's an interesting detail: this ETF has been given the ticker symbol BRRR, a sound crypto enthusiasts often equate with the whir of a money printing machine!

The SEC has a window of up to 45 days (which can be extended to 90 days in special cases) to review Valkyrie's application.

Valkyrie's spot Bitcoin ETF application has officially entered the review stage at the U.S. Securities and Exchange Commission (SEC). It comes right after BlackRock's recent submission.

Here's an interesting detail: this ETF has been given the ticker symbol BRRR, a sound crypto enthusiasts often equate with the whir of a money printing machine!

The SEC has a window of up to 45 days (which can be extended to 90 days in special cases) to review Valkyrie's application. Europe’s First Bitcoin ETF to Finally Launch

After facing significant delays, Europe’s first spot Bitcoin exchange-traded fund (ETF) is expected to launch later this year. Jacobi Asset Management, a London-based multi-asset investment platform, plans to debut its Bitcoin ETF on the Euronext Amsterdam exchange.

After facing significant delays, Europe’s first spot Bitcoin exchange-traded fund (ETF) is expected to launch later this year. Jacobi Asset Management, a London-based multi-asset investment platform, plans to debut its Bitcoin ETF on the Euronext Amsterdam exchange. SEC Approval of Bitcoin ETF Won't Shift the Game, Say JPMorgan

In a recent report, JPMorgan expressed a measured outlook on the influence a spot bitcoin exchange-traded fund (ETF) would have on cryptocurrency markets, even if the U.S. Securities and Exchange Commission (SEC) gives it the green light. The financial institution pointed out that while the approval of such an ETF is eagerly awaited, it may not be the market-altering event some anticipate.

In a recent report, JPMorgan expressed a measured outlook on the influence a spot bitcoin exchange-traded fund (ETF) would have on cryptocurrency markets, even if the U.S. Securities and Exchange Commission (SEC) gives it the green light. The financial institution pointed out that while the approval of such an ETF is eagerly awaited, it may not be the market-altering event some anticipate.  A Twitter user (@hufhaus9) has created a visual timeline outlining the SEC’s response deadlines for the approval of BlackRock’s Bitcoin spot ETF.

Just 10 days ago, the renowned global investment firm with $10 trillion in assets applied for a groundbreaking Bitcoin spot exchange-traded fund in the United States.

First deadline: August 12, 2023

Second deadline: September 26, 2023

Third deadline: December 25, 2023

Final decision: February 23, 2024

If granted approval, BlackRock will be able to purchase BTC directly from the spot market, potentially utilizing platforms like Coinbase, on behalf of its clients.

With the BTC halving and these deadlines coinciding, the first quarter of 2024 promises to be an exciting period!

A Twitter user (@hufhaus9) has created a visual timeline outlining the SEC’s response deadlines for the approval of BlackRock’s Bitcoin spot ETF.

Just 10 days ago, the renowned global investment firm with $10 trillion in assets applied for a groundbreaking Bitcoin spot exchange-traded fund in the United States.

First deadline: August 12, 2023

Second deadline: September 26, 2023

Third deadline: December 25, 2023

Final decision: February 23, 2024

If granted approval, BlackRock will be able to purchase BTC directly from the spot market, potentially utilizing platforms like Coinbase, on behalf of its clients.

With the BTC halving and these deadlines coinciding, the first quarter of 2024 promises to be an exciting period! BlackRock's Spot BTC Application Сonsidered Provocative

BlackRock, a financial juggernaut handling assets worth more than $10 trillion, has lodged a proposal with the U.S. Securities and Exchange Commission for the initiation of an ETF. This action has incited a range of reactions within the crypto community and among industry experts. Why?

BlackRock, a financial juggernaut handling assets worth more than $10 trillion, has lodged a proposal with the U.S. Securities and Exchange Commission for the initiation of an ETF. This action has incited a range of reactions within the crypto community and among industry experts. Why?