#cryptocurrency exchange

111 articles found

Latest

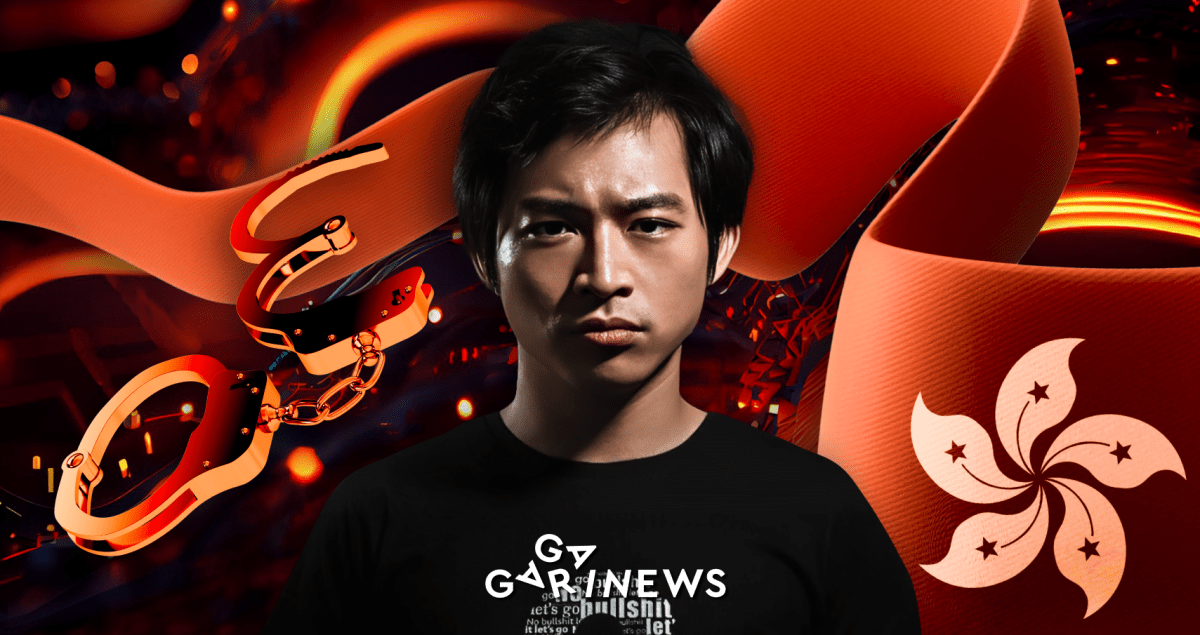

Hong Kong police have arrested Joseph Lam, a crypto influencer and former lawyer, in connection with the ongoing investigation into cryptocurrency exchange JPEX. Lam, who has over 190,000 Instagram followers, was arrested today and his office was raided. The arrest follows the Securities and Futures Commission's warning against JPEX for misleading statements about its licensing status. The police have received at least 83 complaints involving JPEX, with virtual assets worth about HK$34 million ($4.3 million) reported.

Hong Kong police have arrested Joseph Lam, a crypto influencer and former lawyer, in connection with the ongoing investigation into cryptocurrency exchange JPEX. Lam, who has over 190,000 Instagram followers, was arrested today and his office was raided. The arrest follows the Securities and Futures Commission's warning against JPEX for misleading statements about its licensing status. The police have received at least 83 complaints involving JPEX, with virtual assets worth about HK$34 million ($4.3 million) reported. WhiteBIT: Metalist 1925 Lives On!

The escalating missile attacks on Ukraine by the russian terrorists devastated the assets of the sponsor championing the rejuvenated football club "Metalist 1925." Facing financial collapse and potential dissolution, the team has found a lifeline through a timely partnership with the renowned cryptocurrency exchange, WhiteBIT!

The escalating missile attacks on Ukraine by the russian terrorists devastated the assets of the sponsor championing the rejuvenated football club "Metalist 1925." Facing financial collapse and potential dissolution, the team has found a lifeline through a timely partnership with the renowned cryptocurrency exchange, WhiteBIT!  Coinbase, the cryptocurrency exchange, has joined forces with Peoples Trust Company. This collaboration facilitates access to the Interac e-Transfers system, streamlining deposit and withdrawal processes for its Canadian user base.

What's more, they're gifting users a one-month free gateway into the Coinbase One subscription. This means no trade-related fees, amplified staking profits, and swift client support.

"Canada is well positioned to be a global leader in the cryptoeconomy thanks to the high levels of crypto awareness, a passionate local tech ecosystem, and the progress towards a strong regulatory framework," voiced Nana Murugesan, the International Development VP at Coinbase.

Coinbase, the cryptocurrency exchange, has joined forces with Peoples Trust Company. This collaboration facilitates access to the Interac e-Transfers system, streamlining deposit and withdrawal processes for its Canadian user base.

What's more, they're gifting users a one-month free gateway into the Coinbase One subscription. This means no trade-related fees, amplified staking profits, and swift client support.

"Canada is well positioned to be a global leader in the cryptoeconomy thanks to the high levels of crypto awareness, a passionate local tech ecosystem, and the progress towards a strong regulatory framework," voiced Nana Murugesan, the International Development VP at Coinbase.  Football club Barcelona, an official partner of the cryptocurrency exchange WhiteBit, has divested some of its shares in Bridgeburg Invest.The aim? Raise funds for a new Web3 endeavor named Barca Vision.

This project is designed to become a hub for all club-related digital wonders, be it NFTs or metaverse explorations.

Football club Barcelona, an official partner of the cryptocurrency exchange WhiteBit, has divested some of its shares in Bridgeburg Invest.The aim? Raise funds for a new Web3 endeavor named Barca Vision.

This project is designed to become a hub for all club-related digital wonders, be it NFTs or metaverse explorations.  Ilya Lichtenstein and Heather Morgan, a husband and wife duo of crypto hackers, have pleaded guilty to federal money laundering conspiracy charges related to the 2016 hack of the cryptocurrency exchange Bitfinex.

Their guilty plea comes after a year and a half since their arrest and charges in February 2022 and seven years after the initial hack.

According to the government’s allegations, Lichtenstein hacked into Bitfinex and stole 119,754 bitcoins, which were valued at $72 million at the time and are now worth approximately $3.5 billion, for his personal benefit.

Ilya Lichtenstein and Heather Morgan, a husband and wife duo of crypto hackers, have pleaded guilty to federal money laundering conspiracy charges related to the 2016 hack of the cryptocurrency exchange Bitfinex.

Their guilty plea comes after a year and a half since their arrest and charges in February 2022 and seven years after the initial hack.

According to the government’s allegations, Lichtenstein hacked into Bitfinex and stole 119,754 bitcoins, which were valued at $72 million at the time and are now worth approximately $3.5 billion, for his personal benefit.  Yesterday, reports surfaced suggesting that KuCoin had dismissed 30% of its employees due to declining profits. However, the cryptocurrency exchange's representatives debunked these claims today, explaining that there was just a slight downsizing in line with their routine organizational strategy.

"To stay on top, we regularly evaluate our org structure based on employee performance and company development. So it is not layoffs, and it is all about making the organization more dynamic," asserted Johnny Lyu, the Chief Executive of KuCoin.

Yesterday, reports surfaced suggesting that KuCoin had dismissed 30% of its employees due to declining profits. However, the cryptocurrency exchange's representatives debunked these claims today, explaining that there was just a slight downsizing in line with their routine organizational strategy.

"To stay on top, we regularly evaluate our org structure based on employee performance and company development. So it is not layoffs, and it is all about making the organization more dynamic," asserted Johnny Lyu, the Chief Executive of KuCoin.  The lawsuit between the U.S Securities and Exchange Commission (SEC) and cryptocurrency exchange Coinbase is moving forward as the date for initial arguments has been confirmed. Coinbase's chief legal officer, Paul Grewal, revealed on Twitter that New York judge Katherine Polk Failla had approved the joint request from both parties to proceed with hearings.

Coinbase has until August 4, 2023, to submit its initial brief and additional supporting documents by August 11. The SEC's opposition brief is due on or before October 10, with Coinbase's reply by October 24 or sooner.

The lawsuit between the U.S Securities and Exchange Commission (SEC) and cryptocurrency exchange Coinbase is moving forward as the date for initial arguments has been confirmed. Coinbase's chief legal officer, Paul Grewal, revealed on Twitter that New York judge Katherine Polk Failla had approved the joint request from both parties to proceed with hearings.

Coinbase has until August 4, 2023, to submit its initial brief and additional supporting documents by August 11. The SEC's opposition brief is due on or before October 10, with Coinbase's reply by October 24 or sooner. Yi He: The Untold Success Story of Binance

Yi He, a co-founder and a leading expert in business, marketing, and branding at Binance, is among the most influential women in the worldwide cryptocurrency market. However, her significant contribution to the growth of this cryptocurrency exchange isn't often acknowledged, as Changpeng Zhao (CZ) is traditionally viewed as the company's public face.

Yi He, a co-founder and a leading expert in business, marketing, and branding at Binance, is among the most influential women in the worldwide cryptocurrency market. However, her significant contribution to the growth of this cryptocurrency exchange isn't often acknowledged, as Changpeng Zhao (CZ) is traditionally viewed as the company's public face.  Belgium’s Financial Services and Markets Authority (FSMA) has taken action against Binance, instructing the popular cryptocurrency exchange to immediately stop offering any virtual currency services in the country.

In a statement released on Friday, the FSMA emphasized that individuals and firms governed by Belgian law, but not belonging to the European Economic Area, are prohibited from offering exchange services involving virtual currencies and legal currencies, as well as custody wallet services.

Failure to comply with this order could result in criminal sanctions, as warned by the regulator.

Belgium’s Financial Services and Markets Authority (FSMA) has taken action against Binance, instructing the popular cryptocurrency exchange to immediately stop offering any virtual currency services in the country.

In a statement released on Friday, the FSMA emphasized that individuals and firms governed by Belgian law, but not belonging to the European Economic Area, are prohibited from offering exchange services involving virtual currencies and legal currencies, as well as custody wallet services.

Failure to comply with this order could result in criminal sanctions, as warned by the regulator.  Dasset, a cryptocurrency exchange in New Zealand, has left its users unable to access their holdings. Attempts to log onto the official site redirect customers to the webpage of the law firm Grant Thornton.

A released statement details that Grant Thornton will control the liquidation process of the exchange. It has immediate plans to cooperate with all customers to safeguard all the residual funds.

"Dasset’s management says a significant reduction in asset values and trading levels impacted its ability to trade profitably. It was determined the appointment of liquidators was in the best interests of all stakeholders," Grant Thornton highlighted.

Dasset, a cryptocurrency exchange in New Zealand, has left its users unable to access their holdings. Attempts to log onto the official site redirect customers to the webpage of the law firm Grant Thornton.

A released statement details that Grant Thornton will control the liquidation process of the exchange. It has immediate plans to cooperate with all customers to safeguard all the residual funds.

"Dasset’s management says a significant reduction in asset values and trading levels impacted its ability to trade profitably. It was determined the appointment of liquidators was in the best interests of all stakeholders," Grant Thornton highlighted.  Amid the unresolved dispute between Coinbase and the SEC, a number of esteemed legal academics have weighed in, penning a court statement in support of the cryptocurrency exchange.

Their stance is clear: an asset should only be deemed an investment contract if it promises profits, earnings, or assets from investments. Scholars assert that the court must strictly follow this legal definition, otherwise, it may jeopardize belief in existing securities laws.

Amid the unresolved dispute between Coinbase and the SEC, a number of esteemed legal academics have weighed in, penning a court statement in support of the cryptocurrency exchange.

Their stance is clear: an asset should only be deemed an investment contract if it promises profits, earnings, or assets from investments. Scholars assert that the court must strictly follow this legal definition, otherwise, it may jeopardize belief in existing securities laws.  The cryptocurrency exchange OPNX has tabled an offer to take over crypto lender Hodlnaut, which is undergoing a restructuring plan under the supervision of a Singapore court.

OPNX offered $30 million in FLEX to partially offset the creditors’ losses and cover their claims. If the bid is approved by the court and accepted by creditors, OPNX will own a 75% stake in Hodlnaut.

The cryptocurrency exchange OPNX has tabled an offer to take over crypto lender Hodlnaut, which is undergoing a restructuring plan under the supervision of a Singapore court.

OPNX offered $30 million in FLEX to partially offset the creditors’ losses and cover their claims. If the bid is approved by the court and accepted by creditors, OPNX will own a 75% stake in Hodlnaut.  Cryptocurrency exchange FTX is making a court appeal to have FTX Dubai removed from bankruptcy proceedings, asserting that this division had not been in active operation before the official declaration of insolvency was lodged.

The legal plea also indicates that the division possesses assets totalling about $4.5 million, spread across multiple accounts. Notably, a substantial portion of these funds is held as collateral for the Virtual Assets Regulatory Authority of Dubai.

Cryptocurrency exchange FTX is making a court appeal to have FTX Dubai removed from bankruptcy proceedings, asserting that this division had not been in active operation before the official declaration of insolvency was lodged.

The legal plea also indicates that the division possesses assets totalling about $4.5 million, spread across multiple accounts. Notably, a substantial portion of these funds is held as collateral for the Virtual Assets Regulatory Authority of Dubai.  In a pivotal ruling on July 25, Judge Philip Jeyaretnam of the Singapore High Court declared cryptocurrency as personal property, placing it on par with fiat money. Judge Jeyaretnam's elucidation is notable for the legal status of digital assets.

It was stemmed from a case where ByBit accused its former employee, Ho Kai Xin, of illicitly transferring approximately 4.2 million USDT from the company's coffers to personal accounts. The court mandated Ho to return the funds to cryptocurrency exchange.

In a pivotal ruling on July 25, Judge Philip Jeyaretnam of the Singapore High Court declared cryptocurrency as personal property, placing it on par with fiat money. Judge Jeyaretnam's elucidation is notable for the legal status of digital assets.

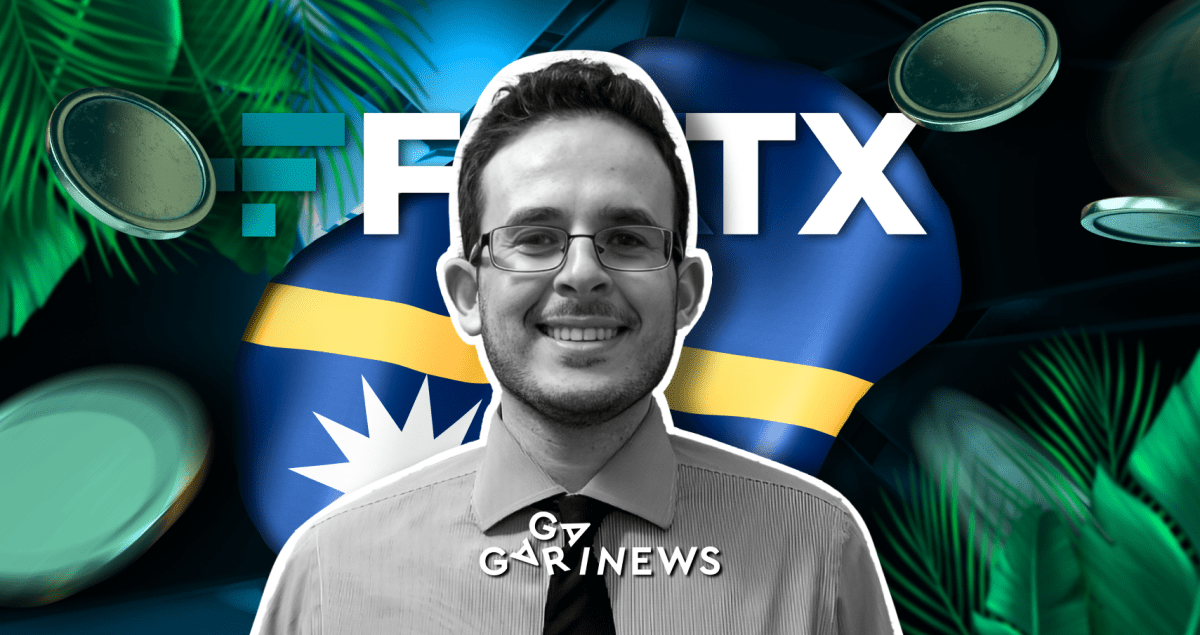

It was stemmed from a case where ByBit accused its former employee, Ho Kai Xin, of illicitly transferring approximately 4.2 million USDT from the company's coffers to personal accounts. The court mandated Ho to return the funds to cryptocurrency exchange.  FTX, the prominent cryptocurrency exchange, was recently embroiled in controversy when court documents revealed a plan devised by Gabriel, the younger brother of FTX's CEO, SBF. According to the documents, Gabriel aimed to utilize FTX clients' funds to purchase the entire country of Nauru.

The idea was to transform Nauru into a post-apocalyptic sanctuary, complete with a highly secretive laboratory for conducting human genetics experiments and other projects. Who needs a private island when you can have a whole sovereign nation, right?

The court documents further detailed instances of transactions involving the founder's family, including those that have been previously disclosed.

While the idea of buying a nation for such purposes seems like something out of a sci-fi movie, it underscores the madness that was going on inside the FTX.

FTX, the prominent cryptocurrency exchange, was recently embroiled in controversy when court documents revealed a plan devised by Gabriel, the younger brother of FTX's CEO, SBF. According to the documents, Gabriel aimed to utilize FTX clients' funds to purchase the entire country of Nauru.

The idea was to transform Nauru into a post-apocalyptic sanctuary, complete with a highly secretive laboratory for conducting human genetics experiments and other projects. Who needs a private island when you can have a whole sovereign nation, right?

The court documents further detailed instances of transactions involving the founder's family, including those that have been previously disclosed.

While the idea of buying a nation for such purposes seems like something out of a sci-fi movie, it underscores the madness that was going on inside the FTX.  One of the oldest altcoins, has doubled in price since the beginning of the the last week – from $105 to $220.

Analysts credit this remarkable growth to the backing of the altcoin by the newly launched cryptocurrency exchange, EDX Markets.

EDX is new non-custodial cryptocurrency exchange, backed by major Wall Street players like Citadel Securities, Fidelity, and Schwab, has officially gone live a week ago.

It offers popular options like Bitcoin, Ether, Litecoin, and Bitcoin Cash, while consciously avoiding the list of tokens that the SEC considers to be financial securities.

One of the oldest altcoins, has doubled in price since the beginning of the the last week – from $105 to $220.

Analysts credit this remarkable growth to the backing of the altcoin by the newly launched cryptocurrency exchange, EDX Markets.

EDX is new non-custodial cryptocurrency exchange, backed by major Wall Street players like Citadel Securities, Fidelity, and Schwab, has officially gone live a week ago.

It offers popular options like Bitcoin, Ether, Litecoin, and Bitcoin Cash, while consciously avoiding the list of tokens that the SEC considers to be financial securities. Crypto Exchange Backed by Wall Street Giants Goes Live

EDX, the new non-custodial cryptocurrency exchange, backed by major Wall Street players like Citadel Securities ($7.5 billion), Fidelity Investments ($4.3 billion), and Charles Schwab Corporation ($7.5 billion), has officially gone live and is already executing orders for its clients.

EDX, the new non-custodial cryptocurrency exchange, backed by major Wall Street players like Citadel Securities ($7.5 billion), Fidelity Investments ($4.3 billion), and Charles Schwab Corporation ($7.5 billion), has officially gone live and is already executing orders for its clients.