#central bank

84 articles found

Latest

Ulrich Bindseil, Director General of Market Infrastructure and Payments at the European Central Bank, along with his advisor Jürgen Schaaf, have openly expressed their disappointment with Bitcoin ETFs and the influx of capital into the crypto sector after the SEC's landmark decision.

Ulrich Bindseil, Director General of Market Infrastructure and Payments at the European Central Bank, along with his advisor Jürgen Schaaf, have openly expressed their disappointment with Bitcoin ETFs and the influx of capital into the crypto sector after the SEC's landmark decision.  The Bank of England, together with the UK's Treasury, is actively deliberating the risks and advantages of introducing a Central Bank Digital Currency, dubbed Britcoin. Their focus is on its potential economic impact and benefits for UK citizens.

The Bank of England, together with the UK's Treasury, is actively deliberating the risks and advantages of introducing a Central Bank Digital Currency, dubbed Britcoin. Their focus is on its potential economic impact and benefits for UK citizens.  The Central Bank of Nigeria has reversed its directive that barred commercial banks from engaging with cryptocurrency platforms. This change has, however, stirred discontent among P2P traders, who had largely taken over the market after the initial ban.

The Central Bank of Nigeria has reversed its directive that barred commercial banks from engaging with cryptocurrency platforms. This change has, however, stirred discontent among P2P traders, who had largely taken over the market after the initial ban.  The Philippines’ Bureau of the Treasury collaborates with the nation's central bank to use digital currency (CBDC) for the sale of tokenized government securities. This week, the government successfully raised $271 million through tokenized one-year bonds.

The Philippines’ Bureau of the Treasury collaborates with the nation's central bank to use digital currency (CBDC) for the sale of tokenized government securities. This week, the government successfully raised $271 million through tokenized one-year bonds.  Deutsche Bank and SC Ventures have successfully executed the first stablecoin swaps within the Universal Digital Payments Network (UDPN). This platform was established to facilitate transactions using stablecoins and Central Bank Digital Currencies (CBDC).

Deutsche Bank and SC Ventures have successfully executed the first stablecoin swaps within the Universal Digital Payments Network (UDPN). This platform was established to facilitate transactions using stablecoins and Central Bank Digital Currencies (CBDC).  Mairead McGuinness, the European Commissioner for Financial Services, believes there's no need to rush the launch of a digital euro before the next EU elections in June 2024. She advises the next EU Commission to take a careful and measured approach to the CBDC rollout. Furthermore, McGuinness mentioned that the European Central Bank will finalize its stance on the project this coming October.

Mairead McGuinness, the European Commissioner for Financial Services, believes there's no need to rush the launch of a digital euro before the next EU elections in June 2024. She advises the next EU Commission to take a careful and measured approach to the CBDC rollout. Furthermore, McGuinness mentioned that the European Central Bank will finalize its stance on the project this coming October.  At a parliamentary committee session, New Zealand central bank governor Adrian Orr voiced his skepticism towards stablecoins, labeling them as inherently unstable. He argued that their reliability is solely contingent on the financial reserves of the issuing entity. The governor also dismissed the notion of Bitcoin or any similar cryptocurrency as a viable substitute for fiat money or a store of value.

At a parliamentary committee session, New Zealand central bank governor Adrian Orr voiced his skepticism towards stablecoins, labeling them as inherently unstable. He argued that their reliability is solely contingent on the financial reserves of the issuing entity. The governor also dismissed the notion of Bitcoin or any similar cryptocurrency as a viable substitute for fiat money or a store of value.  Nigerian banks are teaming up with the nation's Central Bank and various blockchain companies to launch a new stablecoin, Naira (cNGN), slated for 2024. This comes after previous unsuccessful attempts by the government to initiate a similar project and a digital national currency.

Nigerian banks are teaming up with the nation's Central Bank and various blockchain companies to launch a new stablecoin, Naira (cNGN), slated for 2024. This comes after previous unsuccessful attempts by the government to initiate a similar project and a digital national currency.  U.K. House of Commons Treasury Committee lawmakers, in its recent report, have urged the government to reconsider the regulations for a potential Central Bank Digital Currency (CBDC). Proposed changes include setting a lower limit on individual holdings (up to £3,000) and the option to earn interest on these holdings.

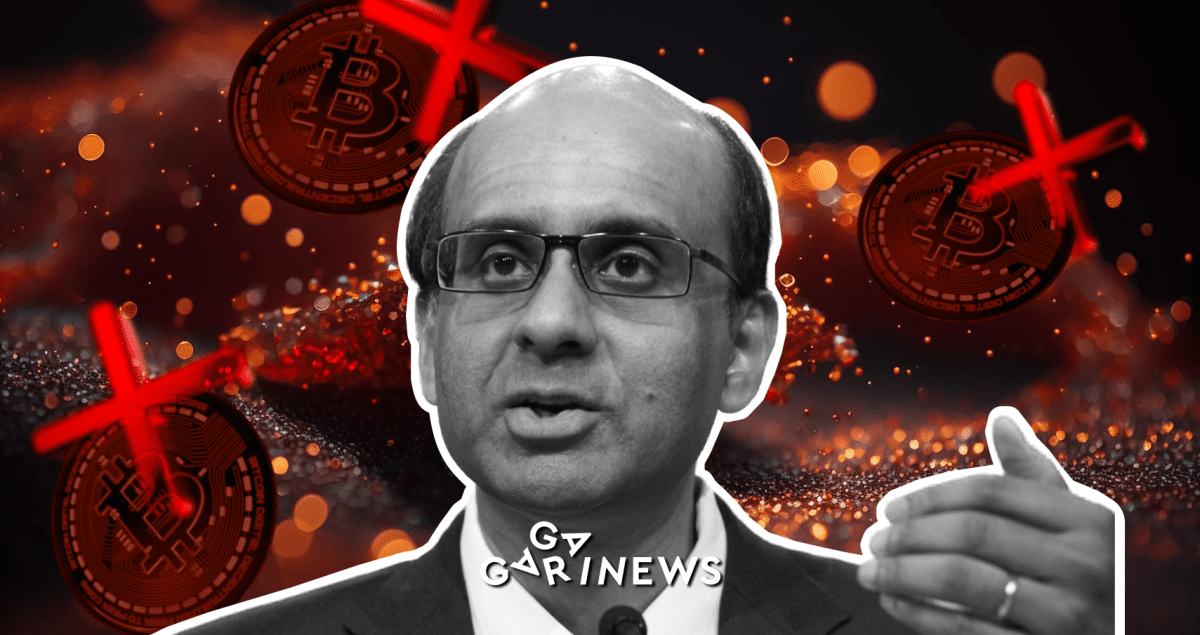

U.K. House of Commons Treasury Committee lawmakers, in its recent report, have urged the government to reconsider the regulations for a potential Central Bank Digital Currency (CBDC). Proposed changes include setting a lower limit on individual holdings (up to £3,000) and the option to earn interest on these holdings. Cryptocurrency skeptic elected as Singapore's president

With 70.4% of the vote, 66-year-old Tharman Shanmugaratnam has been chosen as Singapore's new President. Formerly the Finance Minister and Central Bank head, he'd expressed that cryptocurrencies are "purely speculative assets" and "slightly crazy."

With 70.4% of the vote, 66-year-old Tharman Shanmugaratnam has been chosen as Singapore's new President. Formerly the Finance Minister and Central Bank head, he'd expressed that cryptocurrencies are "purely speculative assets" and "slightly crazy."