#BTC

506 articles found

Latest

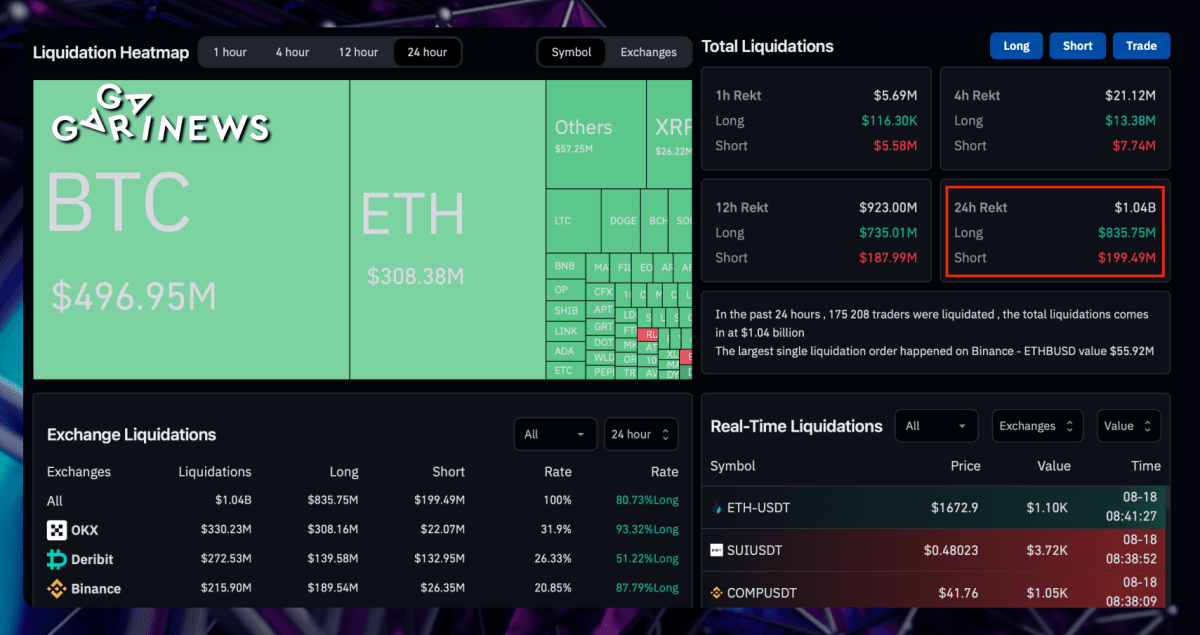

Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.

Statistics from Coinglass indicate liquidations of $1 billion in the last 12 hours, with $483 million in BTC and $300 million in Ethereum.

Some market analysts are identifying potential incidents that may have instigated this downfall:

The Wall Street Journal has noted that SpaceX liquidated $373 million in Bitcoin across 2021 and 2022, and Tesla has divested more than 30,000 BTC (75% of its stake) for $936 million in Q2 of 2022.

The investment holding company China Evergrande Group has filed for bankruptcy. It was rumored that Tether had backed a portion of its USDT using commercial papers from this entity.

Sellers sprang into action shortly after.

With Bloomberg announcing that the SEC is slated to approve the first-ever Ethereum-based ETF futures by October, Ethereum's market value promptly surged by 11%.  The FBI has sounded the alarm bells: Lazarus Group and APT38, North Korean hacker collectives, could potentially sell off stolen cryptocurrency amassing $40 million, potentially affecting Bitcoin's valuation.

Through their investigative work, the agency has identified nearly 1580 BTC across six distinct Bitcoin addresses. The stolen assets are reportedly from Alphapo, CoinsPaid, and Atomic Wallet.

In aiding market monitoring, the FBI has disclosed the associated wallet addresses, urging vigilance on any transactions involving them.

The FBI has sounded the alarm bells: Lazarus Group and APT38, North Korean hacker collectives, could potentially sell off stolen cryptocurrency amassing $40 million, potentially affecting Bitcoin's valuation.

Through their investigative work, the agency has identified nearly 1580 BTC across six distinct Bitcoin addresses. The stolen assets are reportedly from Alphapo, CoinsPaid, and Atomic Wallet.

In aiding market monitoring, the FBI has disclosed the associated wallet addresses, urging vigilance on any transactions involving them.  As per BitInfoCharts, the wallet address bc1q…859v2 received its initial deposit of BTC on March 8. Over the following three and a half months, it amassed 118,000 BTC (nearly $3.1 billion). Speculations quickly spread across X (Twitter), suggesting it might be BlackRock strategically increasing its BTC holdings. However, the wallet belongs to the US-based exchange Gemini. It transferred its funds from an older wallet, which was also among the top BTC holders nearly a year ago. The current top three wallets are as follows: Binance cold wallet — 248,597 BTC.

Bitfinex cold wallet — 178,010 BTC.

Gemini new wallet — 118,300 BTC.

As per BitInfoCharts, the wallet address bc1q…859v2 received its initial deposit of BTC on March 8. Over the following three and a half months, it amassed 118,000 BTC (nearly $3.1 billion). Speculations quickly spread across X (Twitter), suggesting it might be BlackRock strategically increasing its BTC holdings. However, the wallet belongs to the US-based exchange Gemini. It transferred its funds from an older wallet, which was also among the top BTC holders nearly a year ago. The current top three wallets are as follows: Binance cold wallet — 248,597 BTC.

Bitfinex cold wallet — 178,010 BTC.

Gemini new wallet — 118,300 BTC.  After the market crash on August 18, analyst Andrew Kang adopted a bullish stance. He opened long positions on Bitcoin (BTC), Ethereum (ETH), and Arbitrum (ARB). However, this decision resulted in a significant loss.

Due to his use of extremely high leverage, which reached up to 100x, Kang's positions became vulnerable and were liquidated not once, but as many as fourteen times.

These successive liquidations caused Kang to lose approximately $432,000 in a single day. This incident highlights the risks associated with trading and employing high leverage, especially during periods of intense market volatility.

After the market crash on August 18, analyst Andrew Kang adopted a bullish stance. He opened long positions on Bitcoin (BTC), Ethereum (ETH), and Arbitrum (ARB). However, this decision resulted in a significant loss.

Due to his use of extremely high leverage, which reached up to 100x, Kang's positions became vulnerable and were liquidated not once, but as many as fourteen times.

These successive liquidations caused Kang to lose approximately $432,000 in a single day. This incident highlights the risks associated with trading and employing high leverage, especially during periods of intense market volatility.  Coingecko has just unveiled a report that details the countries where mining 1 BTC could be either a lucrative venture or a costly mistake.

For example, mining a Bitcoin in Lebanon would cost only $266 in electricity, while the same task in Italy would run a shocking $206,000, or 783 times more.

Out of the top 10 nations with the highest electricity costs, 9 are European.

Coingecko has just unveiled a report that details the countries where mining 1 BTC could be either a lucrative venture or a costly mistake.

For example, mining a Bitcoin in Lebanon would cost only $266 in electricity, while the same task in Italy would run a shocking $206,000, or 783 times more.

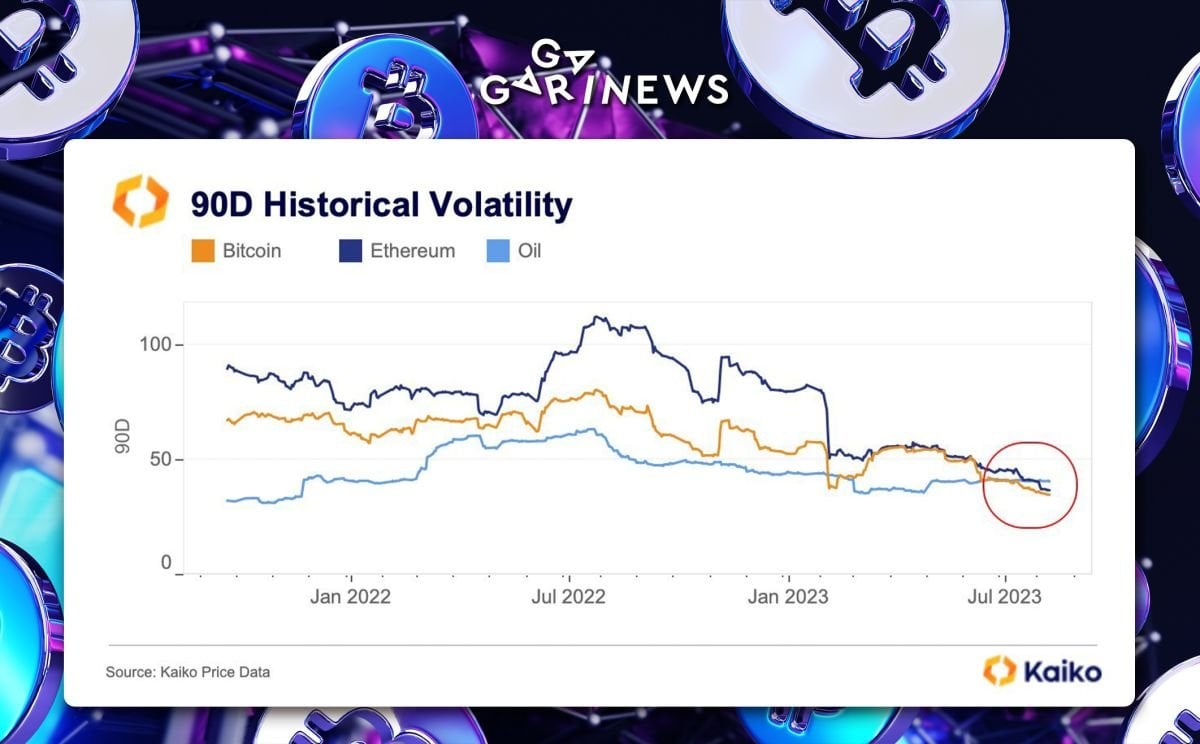

Out of the top 10 nations with the highest electricity costs, 9 are European.  According to Kaiko, BTC and ETH have recorded their lowest 90-day price volatility compared to oil in many years, a mark last reached in 2016.

Right now, Bitcoin's volatility sits at 35%, Ethereum's at 37%, while oil's is higher at 41%.

Experience tells us that after such periods of quiet , a significant move often follows. Judging by Bitcoin's recent dynamics, it appears such a shift might be kicking off.

According to Kaiko, BTC and ETH have recorded their lowest 90-day price volatility compared to oil in many years, a mark last reached in 2016.

Right now, Bitcoin's volatility sits at 35%, Ethereum's at 37%, while oil's is higher at 41%.

Experience tells us that after such periods of quiet , a significant move often follows. Judging by Bitcoin's recent dynamics, it appears such a shift might be kicking off.