KuCoin Review 2026: Everything You Need to Know

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

KuCoin

KuCoin combines low fees, deep liquidity, and a feature-rich interface for active traders. However, stricter KYC and the lack of a U.S. license limit access for some users worldwide.

GNcrypto's Verdict

KuCoin is a global exchange with low fees, deep liquidity on major pairs, and an interface that stays intuitive even with margin and futures tools. In our test, spot orders filled quickly and 100x leverage was available for advanced traders. It suits casual users and pros who want spot, futures, and staking, but strict KYC and no U.S. license limit access for some users worldwide.

- Low trading fees

- Broad asset and product offering

- Advanced tools for active trading

- Not fully available or licensed in key markets

- Lengthy verification steps for new users

On this page

This review examines KuCoin, one of the world’s largest and most active cryptocurrency exchanges. Founded in 2017, the platform has earned a reputation for low fees, a wide range of assets, and availability in over 200 countries.

We tested KuCoin under real trading conditions to assess its execution speed, liquidity, security, and ease of use. Our goal was to see how KuCoin performs in 2026 and whether it remains a top choice for active traders.

From spot and futures trading to staking and passive income tools, here’s how KuCoin compares to the top exchanges on the market.

Key Features of KuCoin

KuCoin is one of the world’s largest exchanges by trading volume. Exchange offers access to more than 700 assets across spot, margin, and futures markets, and operates in more than 200 countries, offering deep liquidity and low fees for active traders.

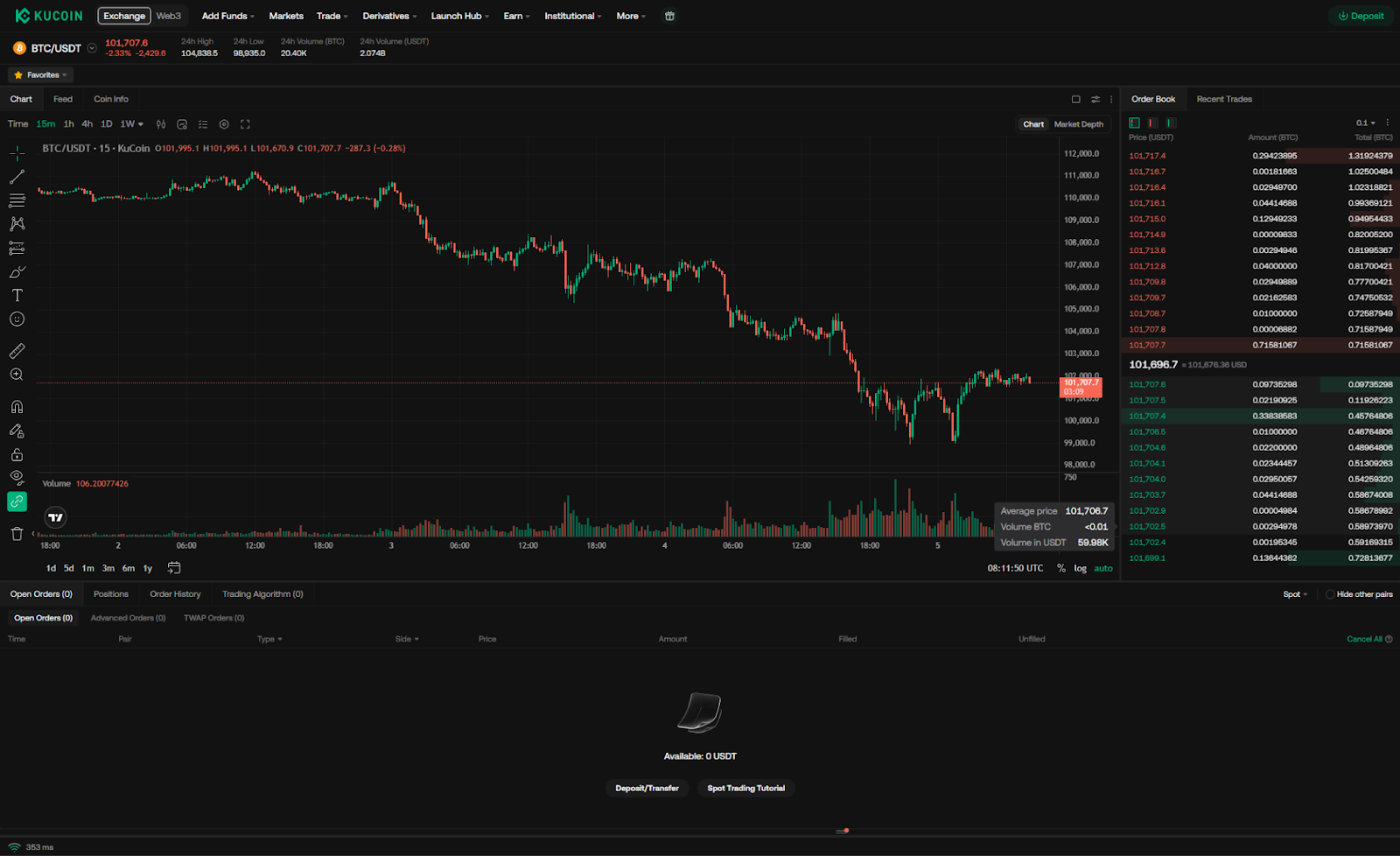

In our KuCoin exchange review, trading was fast and stable. Orders executed reliably, and spreads on major pairs stayed tight even during peak hours. The interface combines straightforward navigation with professional features such as TradingView charts and multiple order types.

KuCoin remains a solid option for traders who value liquidity, speed, and low costs, though it primarily serves an international audience outside the U.S.

KuCoin – Pros and Cons

The exchange consistently ranks among the top ten by daily spot trading volume, with billions in turnover across more than 700 listed assets. KuCoin’s futures platform offers up to 100x leverage, and its ecosystem includes staking, lending, and trading bots designed for advanced users.

While the exchange stands out for its low fees and wide asset selection, it continues to face challenges with U.S. licensing and user onboarding. Here’s a breakdown of KuCoin’s main strengths and weaknesses.

Strengths:

- Low trading fees starting at 0.1%

- Over 700 supported assets

- Futures trading with up to 100x leverage

- KCS token bonuses and fee discounts

- Built-in trading bots and mobile apps

Weaknesses:

- No operating license in the United States

- Complex onboarding and verification for new users

- Limited customer support

- Security breach in 2020 (since resolved with full reimbursement)

Who KuCoin Is Best For

KuCoin is best for traders who want low fees, advanced order types, and access to both margin and futures markets. Built-in trading bots make it easy to launch automated strategies, even for mid-level users.

Because of current licensing limits, U.S. residents can’t use the full platform – but for global traders, KuCoin remains a popular choice.

It is also appealing to long-term investors seeking returns through staking, lending, and yield programs linked to the KCS token.

GNcrypto’s Overall KuCoin Rating

| Criteria | Rating (out of 5) |

|---|---|

| Liquidity & Volume | 4.5 |

| Fees & Cost to Trade | 5 |

| Asset Selection & Tools | 4.5 |

| Reliability & Transparency | 3.5 |

| Security | 4 |

| Customer Support | 3 |

KuCoin stands out for its low fees and strong liquidity. The platform combines spot, margin, and futures markets with staking, lending, and automated trading tools.

So, is KuCoin a good exchange? Yes – for experienced traders outside the U.S., it remains one of the most capable and cost-efficient platforms available.

Methodology – Why You Should Trust Us

We use a weighted, category-based model, collect standardized data from each platform (open data + hands-on testing), and convert that into a 1.0–5.0 star score in 0.1 increments.

Our team opened a KuCoin account, completed verification, and placed live trades to evaluate the platform’s performance. We measured execution speed, analyzed trading fees, and reviewed the interface and user experience.

All results in this review are based on firsthand testing and public data. GNcrypto works independently and receives no compensation for exchange reviews or listings. This material is for informational purposes only and should not be taken as financial advice.

How We Collect Data

– Public data: fee schedules, supported assets, proof-of-reserves statements, and official status pages.

– First-hand testing: we placed real trades, measured execution speed and slippage, and reviewed the interface and platform tools.

We do not assess solvency or make guarantees about financial stability. Our ratings reflect the quality of user experience rather than institutional soundness.

Categories & Weights

- Liquidity & Volume – 25%

- Fees & Total Cost to Trade – 25%

- Asset Selection & Trading Pairs – 15%

- Execution Quality (Market Quality) – 10%

- Tools & Order Controls – 10%

- Fiat Access & Minimum Trade Size – 5%

- Reliability & Transparency – 10%

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.