Kraken vs Coinbase

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

Kraken vs Coinbase

Coinbase (4/5) is better for mainstream fiat-friendly users, and Kraken (3.6/5) will suit fee-conscious and asset-hungry spot traders.

The Bottom Line

As a result of testing two major crypto exchanges for spot trading, we can say that if you value liquidity, fiat rails and a big listed U.S. brand, Coinbase is usually the easier pick. If you care more about fees and a broader asset list while staying on a reputable, long-running venue, Kraken is often the better fit.

- Kraken: lower, more competitive trading fees

- Kraken: broader asset list and global reach

- Coinbase: top-tier liquidity and fiat access

- Coinbase: beginner-friendly, regulation-first brand

- Kraken: lower liquidity and volume

- Kraken: fiat rails less strong

- Coinbase: higher trading fees overall

- Coinbase: slightly narrower asset selection

On this page

We have tested both exchanges and, in our opinion, Coinbase comes out slightly ahead overall thanks to stronger liquidity, excellent fiat access, and a very polished, regulation-first UX. However, Kraken fights back with better fee scores, more listed assets, and very strong security and transparency credentials.

Kraken vs Coinbase at a Glance

| Category | Kraken | Coinbase | Winner |

|---|---|---|---|

| Overall GNcrypto rating | 3.6 / 5 | 4 / 5 | Coinbase (overall) |

| Daily spot turnover (approx.) | ≈$1.5B | ≈$3B | Coinbase |

| Tradable assets (spot) | 562 | 475 | Kraken |

| Liquidity & volume rating | 3.5 | 5 | Coinbase |

| Fees & total cost rating | 3 | 2 | Kraken |

| Asset selection rating | 4 | 4 | Draw |

| Tools & order controls | 4 | 4 | Draw |

| Fiat access & minimum trade size | 4 | 5 | Coinbase |

| Reliability & transparency rating | 4.5 | 4 | Kraken |

Kraken vs Coinbase – Which Should You Choose?

If you’re a beginner or first-time buyer

Choose: Coinbase

Very clean interface, strong fiat on/off ramps, and deep liquidity on majors make it easier to get comfortable with your first BTC, ETH or blue-chip altcoin purchases. It feels closer to a traditional fintech app than a “pro trader terminal.”

If you’re an active, fee-sensitive spot trader

Choose: Kraken (Kraken Pro)

The maker–taker schedule on Kraken Pro is generally more competitive than Coinbase’s base tiers. If you place many trades, use limit orders and care about your effective cost per trade, Kraken tends to be kinder to your P&L over time.

If you mainly want a curated list of majors

Choose: Coinbase

You don’t necessarily need 500+ assets – you just want reliable access to the big names. Coinbase gives you that, wrapped in a regulation-first, public-company package.

If you want maximum asset variety and global reach

Choose: Kraken

With more listed assets and broad country coverage, Kraken is better suited if you like exploring a wide range of spot markets from one account.

Kraken vs. Coinbase: Quick Overview of Both Exchanges

When people search “Kraken vs Coinbase”, they’re usually asking which one is safer, more established, and better suited for everyday spot trading. We have done the research about these well-established platforms.

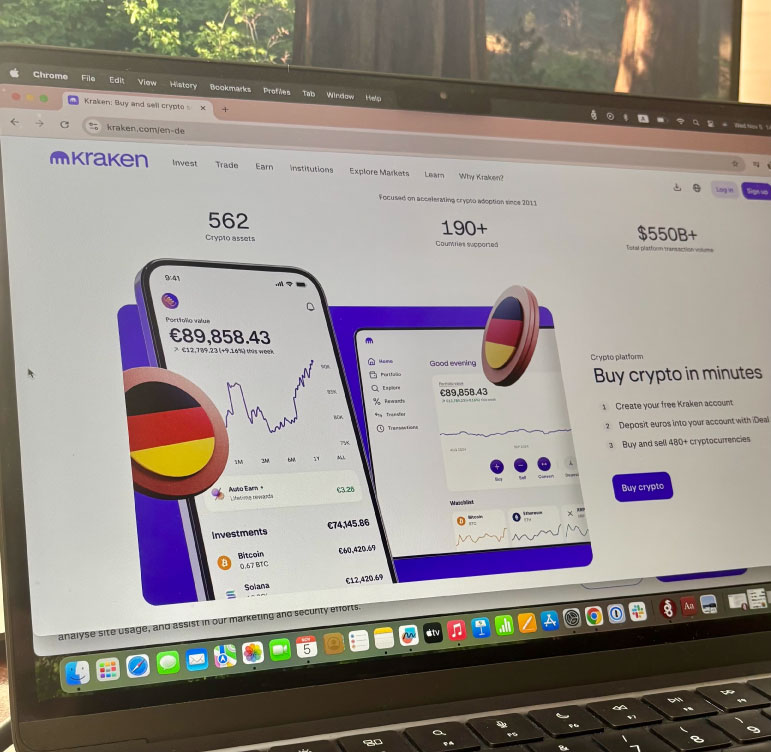

Kraken was founded in July 2011 in the U.S., making it one of the longest-running crypto exchanges. It’s available in 190+ countries and has built a reputation for strong security, regulatory compliance and a broad asset lineup. Kraken has more years in operation than Coinbase and an excellent reliability & transparency score plus a 90% third-party security rating.

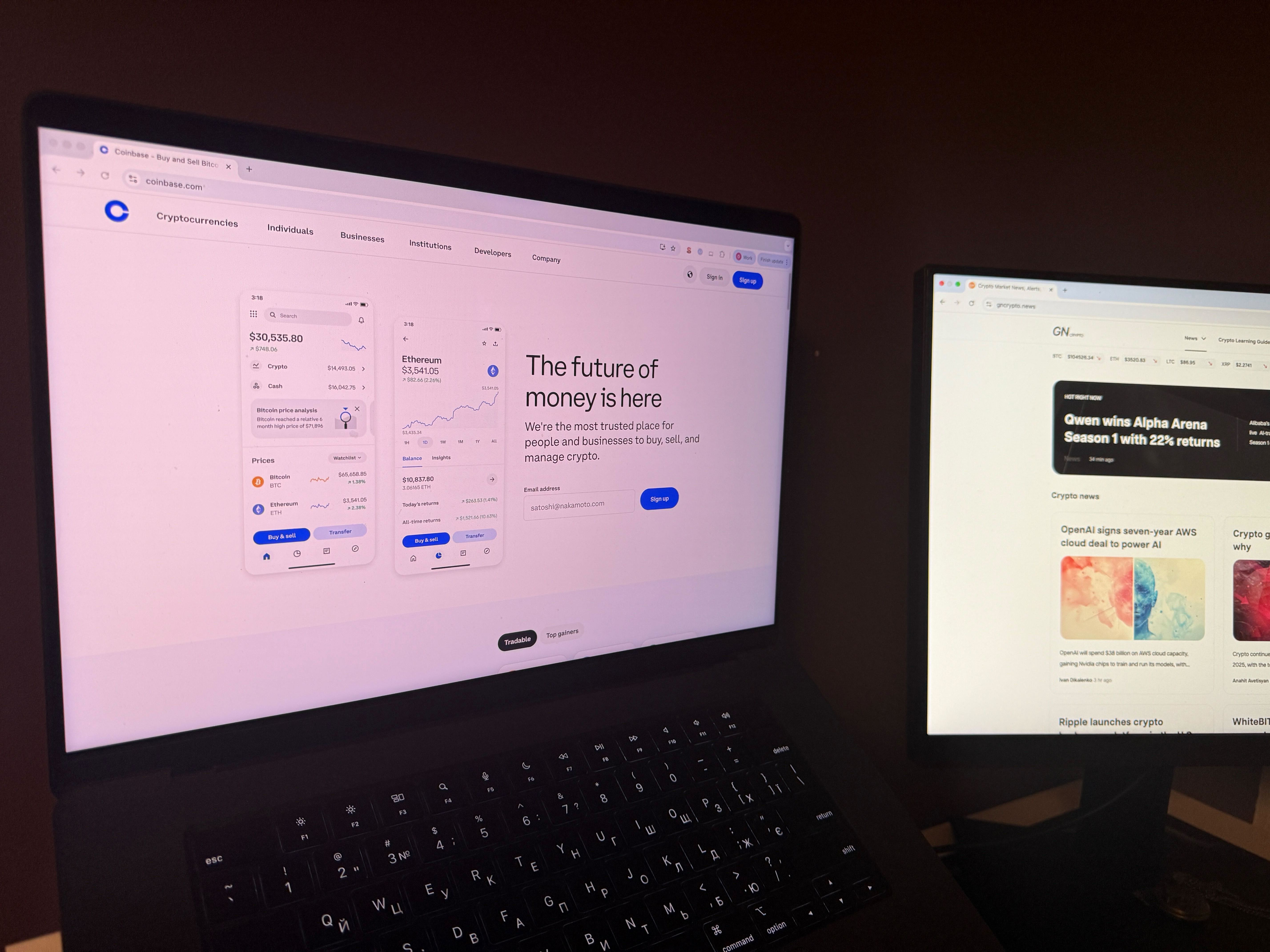

Coinbase is a regulated, U.S.-listed exchange geared toward users who want strong fiat rails and a trustworthy, mainstream brand. Positioned as a comfortable entry point into BTC, ETH and other leading assets rather than a “thousands of microcaps” exchange. Coinbase wins on mainstream reputation and liquidity, thanks to its public listing, very high liquidity rating, and strong fiat rails.

Key Features and Trading Experience Compared

Our team had look at “Coinbase vs Kraken” from a day-to-day spot trading perspective: interface, order types, and how it feels to place trades.

From our Kraken trading experience this exchange offers good usability for both beginners and experienced traders. You can choose either of the two modes: Standard and Pro. They offer simple and advanced layouts with more interface elements for traders. Pro version should be more attractive to repeat spot traders.

Coinbase follows the same suit with simple and advanced mode options. In our testing, they stood out for fast, intuitive order entry for spot trades and top-tier spot liquidity on majors, helping even small retail orders clear quickly at fair prices. The trade-off: buying “the easy way” comes at a higher effective cost than lean, fee-first venues, which power users will feel.

Our Verdict:

We would call it a draw – Coinbase for simplicity and liquidity, Kraken Pro for fee-aware active spot traders.

Supported Assets and Market Access

Coinbase or Kraken, which offers more trade assets? The numbers matter. Let’s do some crypto math.

Kraken lists 562 tradable assets and offers availability in 190+ countries with licenses and registrations in major jurisdictions like the U.S., Canada, Cyprus and the EEA. GNcrypto scores Kraken 4/5 for “Asset Selection & Trading Pairs,” reflecting this broad portfolio.

Coinbase works with 475 tradable assets, with good breadth for a U.S. platform but not at “thousands of altcoins” level. We gave it 4/5 for Asset Selection & Trading Pairs – solid coverage of major and mid-cap coins, but with a more conservative listing policy than some offshore venues.

Our Verdict:

Kraken wins on breadth; Coinbase is strong but slightly narrower. Kraken clearly lists more assets in absolute terms (562 vs 475) and serves a very wide geographic footprint.

Fees and Pricing

Every spot trader should be aware of how much it really costs to trade. In order to find out Kraken fees vs Coinbase, we made $200 trades on each platform to see effective trading costs, maker-taker tiers, and the pain of instant buys.

Standard Kraken charges a $1 fee on instant trading/conversions, which can be relatively expensive for small tickets. Kraken Pro switches to a volume-based maker-taker model with no fixed per-trade fee: the more you trade, the less you pay, and maker orders are cheaper than taker orders. GNcrypto rates Kraken 3/5 on “Fees & Total Cost to Trade,” – we would say that althoug it’s not the cheapest platform, its overall structure is reasonably competitive, especially for Pro users.

If you go to Coinbase at low volumes, and especially when using instant buy, the effective cost is higher than fee-first exchanges. Even in Advanced Trade, base maker/taker tiers start around 0.40%/0.60%, which fee-sensitive spot traders will feel. This is where Coinbase, in our opinion, falls short. As a result, Coinbase scores 2/5 on “Fees & Total Cost to Trade,” the lowest of its major categories in GNcrypto’s rating.

Our Verdict:

We can say, that if you’re comparing “Kraken vs Coinbase fees”, this is where the differences really show up. Kraken wins on cost as Coinbase is clearly more expensive for most spot trading styles.

How We Tested Coinbase vs Kraken

We evaluated both exchanges using the same GNcrypto methodology, which is why a Coinbase vs Kraken comparison is consistent.

GNcrypto employs a standardized rating framework with 7 major categories: liquidity & volume, fees & total cost, asset selection & trading pairs, execution quality, tools & order controls, fiat access & minimum trade size, reliability & transparency.

Scores are normalized into a 1.0–5.0 star rating in 0.1-point steps, and then rolled into an overall rating (3.6 for Kraken, 4.0 for Coinbase).For both exchanges we looked at public data: fee schedules, supported pairs/asset lists, status pages, proof-of-reserves and security documentation, regulatory filings. And then we evaluated it against our first-hand testing, which included: opening accounts, completing KYC, funding balances and placing spot trades.

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.